Roth IRA contribution limits for 2024 for married couples are a crucial aspect of retirement planning. Understanding these limits and how they impact your eligibility can help you maximize your savings and secure a comfortable future. Married couples can contribute a combined amount to their individual Roth IRAs, but income limits may apply.

The potential benefits of Roth IRA contributions include tax-free withdrawals in retirement, making them a valuable tool for many couples.

In 2024, married couples can contribute up to $6,500 each to their Roth IRAs, for a total of $13,000. However, these contributions may be phased out for couples with higher modified adjusted gross incomes (MAGI). The phase-out range for married couples filing jointly starts at $153,000 and ends at $228,000 in 2024.

If your MAGI falls within this range, your contribution limit may be reduced. It’s important to consult with a financial advisor to determine your eligibility and contribution limits.

Contents List

Roth IRA Contribution Limits for 2024

The Roth IRA is a popular retirement savings vehicle that allows you to contribute after-tax dollars and potentially withdraw your earnings tax-free in retirement. For married couples filing jointly in 2024, there are certain contribution limits and income restrictions to be aware of.

The amount you can contribute to your 401(k) depends on your age. If you’re younger, you can contribute less than someone older. Check out 401k contribution limits for 2024 by age to learn more about how much you can contribute based on your age.

Contribution Limits

The maximum amount a married couple can contribute to Roth IRAs in 2024 is $12,500. This means each spouse can contribute up to $12,500 to their own individual Roth IRA, for a total of $25,000 for the couple.

Are you looking to maximize your Roth IRA contributions? This year, you can contribute up to $7,000 if you’re under 50. Want to learn more? Check out How much can I contribute to my Roth IRA in 2024 and get started on your retirement savings.

Income Limits, Roth IRA contribution limits for 2024 for married couples

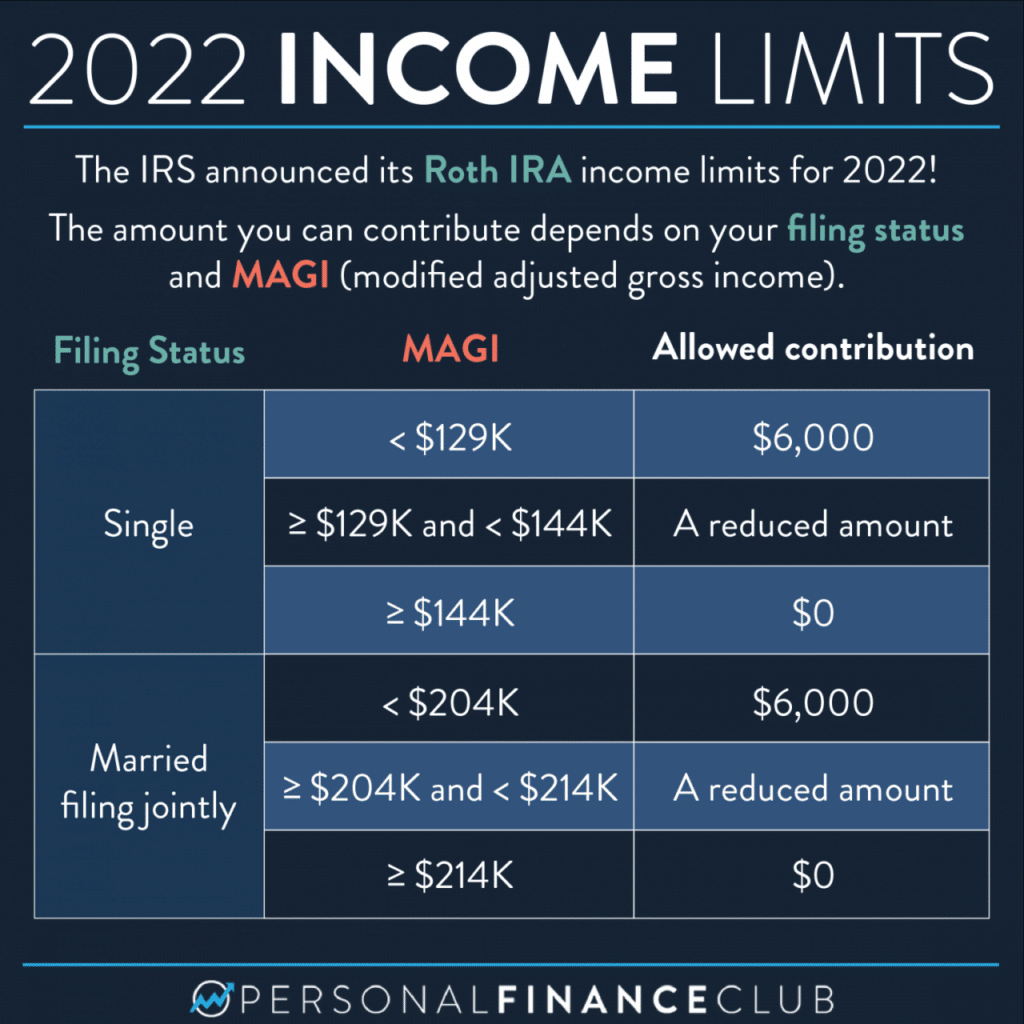

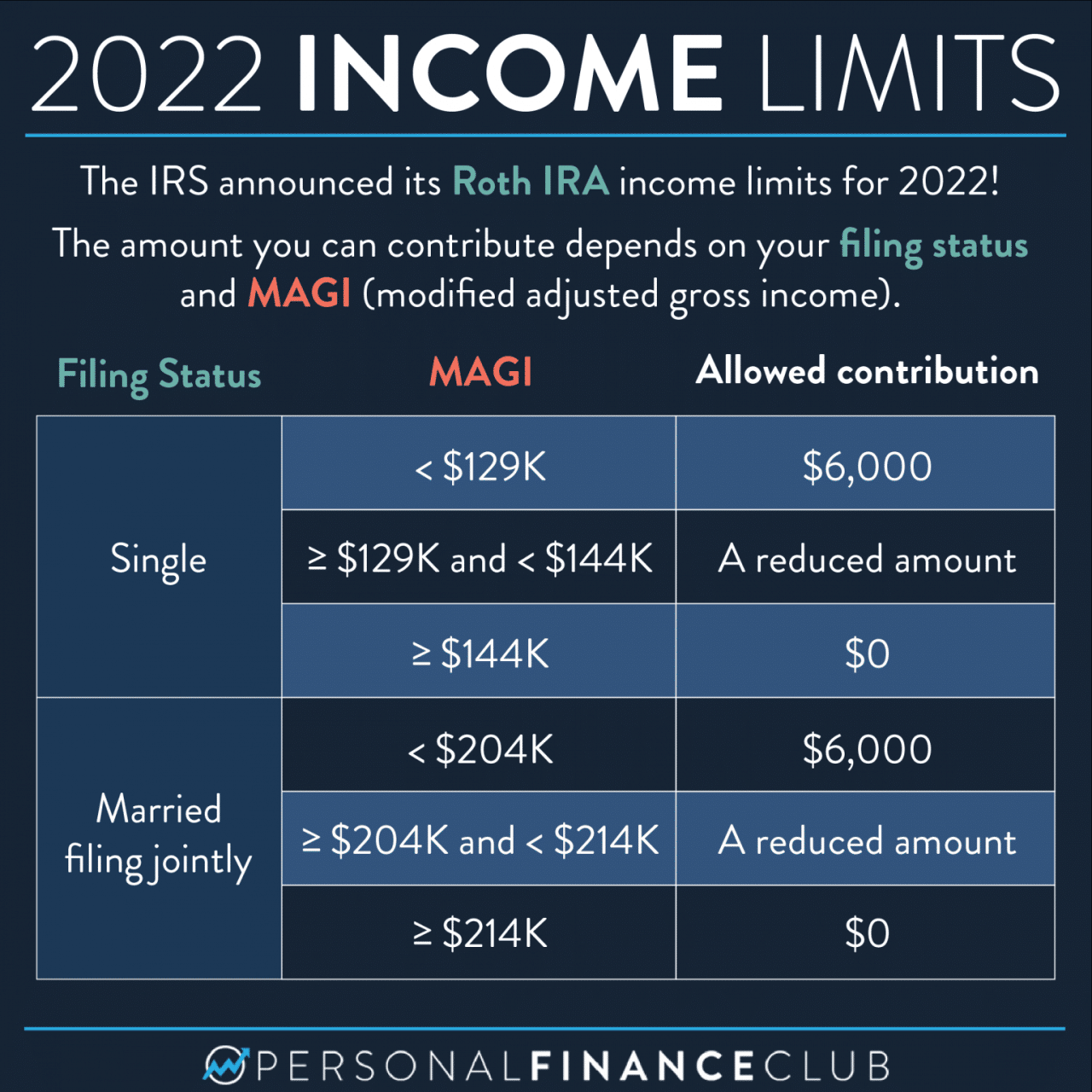

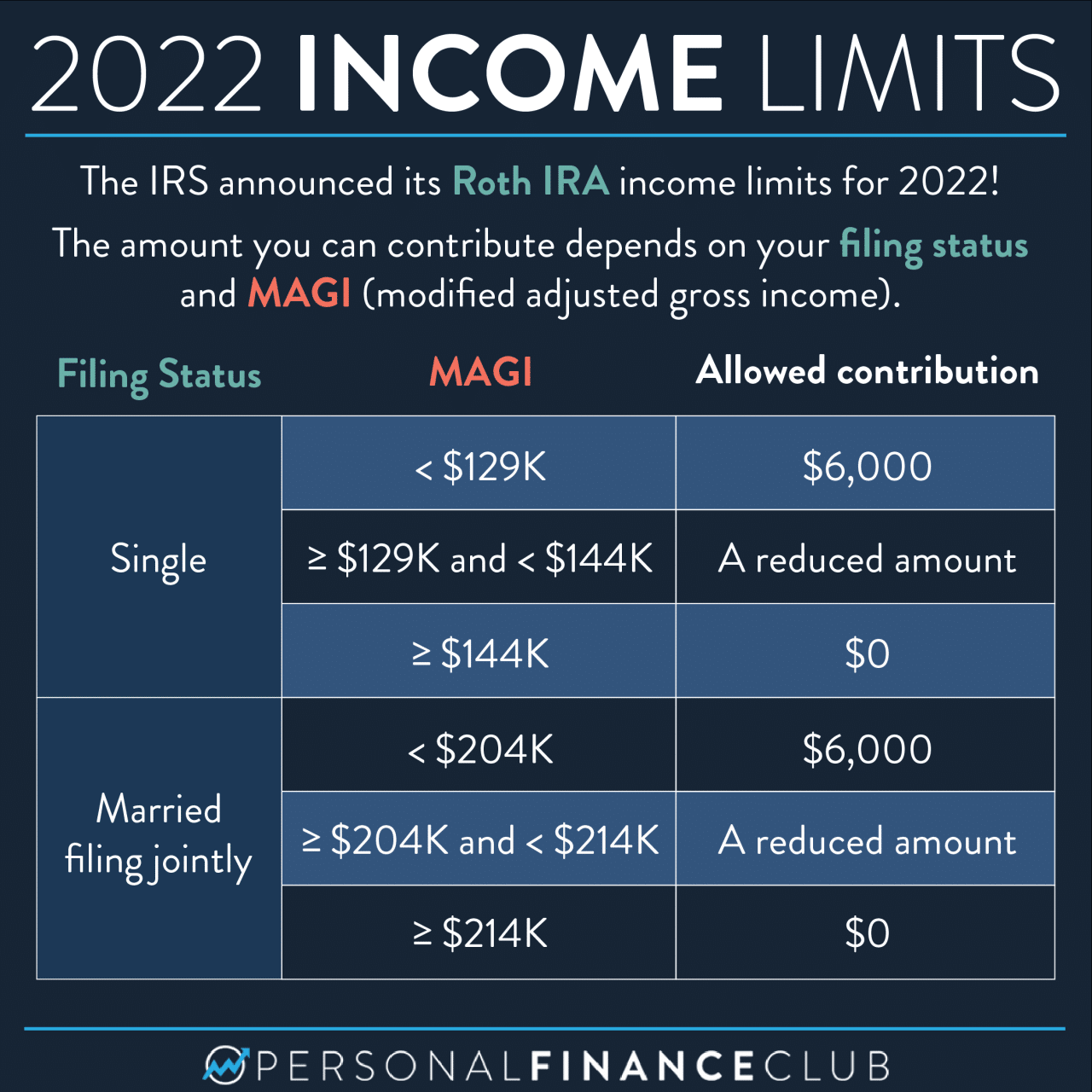

It’s important to note that there are income limits for Roth IRA contributions. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be able to contribute to a Roth IRA or your contributions may be limited.

Moving can be expensive, but the IRS offers a mileage rate for moving expenses. This rate is updated every year, so make sure you’re using the correct one. Check out October 2024 mileage rate for moving expenses to learn more about how to deduct your moving expenses.

For 2024, the income limits for married couples filing jointly are:

- Phase-out begins:$228,000

- Phase-out ends:$248,000

If your MAGI falls within this phase-out range, your contribution limit will be reduced. For example, if your MAGI is $238,000, you will be able to contribute a reduced amount to your Roth IRA.

Want to see where your income falls in the tax brackets? You can use a tax bracket calculator to get a better idea of your tax liability. Check out 2024 tax bracket calculator for different income levels and see where your income falls.

Important Note:The income limits for Roth IRA contributions are subject to change each year. It’s essential to consult with a financial advisor or refer to the latest IRS guidelines for the most up-to-date information.

Planning for retirement can be a little tricky, but knowing your 401(k) contribution limits can help. If you’re over 50, you can contribute more than someone younger. Take a look at What are the 401k limits for 2024 for over 50 and see how much you can contribute.

Understanding Roth IRA Contributions: Roth IRA Contribution Limits For 2024 For Married Couples

For married couples, contributing to a Roth IRA can be a smart financial strategy, offering various advantages that can help them build wealth and secure their future.

Tax laws are always changing, and 2024 is no exception. Make sure you’re up to date on the latest changes that could impact your taxes. Check out Tax changes impacting the October 2024 deadline to learn more.

Tax Benefits of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This results in tax-free withdrawals in retirement, allowing you to enjoy your savings without any tax obligations.

Students have a bit more time to file their taxes than most. The October 15, 2024, deadline gives you a little extra breathing room. Check out October 2024 tax deadline for students to learn more about what you need to know.

- Tax-free growth:Earnings on your Roth IRA investments grow tax-free, meaning you won’t have to pay taxes on any capital gains or dividends generated within the account. This allows your money to compound faster, leading to potentially higher returns over time.

Saving for retirement? If you’re over 50, you can contribute a little extra to your Roth IRA. This year, you can contribute up to $7,500. Learn more about the Roth IRA contribution limits for 2024 over 50 and start planning your financial future.

- Tax-free withdrawals in retirement:When you withdraw your contributions and earnings in retirement, they are completely tax-free. This is a significant advantage, especially if you expect to be in a higher tax bracket during retirement.

Comparison with Traditional IRA Contributions

While Roth IRA contributions offer tax-free withdrawals in retirement, traditional IRA contributions are made with pre-tax dollars. This means you get a tax deduction for your contributions, but you’ll have to pay taxes on withdrawals in retirement.

If you’re filing as head of household, you’ll need to know the tax brackets for 2024. These brackets can help you estimate your tax liability. Check out Tax brackets for head of household in 2024 to learn more about how these brackets work.

- Traditional IRA contributions offer a tax deduction:You can deduct your traditional IRA contributions from your taxable income, reducing your current tax liability. This can be beneficial if you’re in a higher tax bracket now but expect to be in a lower tax bracket in retirement.

If you’re married and filing separately, you’ll need to know the tax brackets for 2024. These brackets can help you estimate your tax liability. Check out Tax brackets for married filing separately in 2024 to learn more about how these brackets work.

- Traditional IRA withdrawals are taxed in retirement:When you withdraw your contributions and earnings from a traditional IRA in retirement, they are taxed as ordinary income. This means you’ll have to pay taxes on the withdrawals, which could be significant if you’re in a higher tax bracket in retirement.

Retirees have a bit more time to file their taxes than most. The October 15, 2024, deadline gives you a little extra breathing room. Check out October 2024 tax deadline for retirees to learn more about what you need to know.

“The best choice between a Roth IRA and a traditional IRA depends on your individual circumstances, including your current and projected tax bracket, your income level, and your risk tolerance.”

If you’re self-employed, you have until October 15, 2024, to file your taxes. That’s right, you can get an automatic extension by filing for it with the IRS. Check out this article to learn more about the tax extension deadline October 2024 for self-employed individuals and what you need to know.

Planning for Retirement with Roth IRAs

Retirement planning is an essential aspect of financial security, and Roth IRAs can play a crucial role in building a comfortable future. Married couples, especially, can leverage Roth IRAs to maximize their retirement savings and enjoy tax-free withdrawals in retirement.

The standard deduction is the amount you can deduct from your taxable income. This amount can help reduce your tax liability. Check out How much is the standard deduction in 2024 to learn more about how to claim this deduction.

Strategies for Maximizing Roth IRA Contributions

Maximizing Roth IRA contributions for married couples involves strategic planning and careful consideration of their financial circumstances.

Understanding tax brackets is important for everyone. The thresholds for 2024 have been updated. Check out Tax bracket thresholds for 2024 to learn more about how these thresholds work.

- Contribute the Maximum Amount:Both spouses should contribute the maximum allowable amount to their Roth IRAs, which for 2024 is $7,500 per person. This ensures they are taking full advantage of the tax benefits and maximizing their retirement savings potential.

- Coordinate Contributions:Couples should coordinate their contributions based on their individual income levels. For example, if one spouse earns significantly more than the other, they may contribute the full amount while the other spouse contributes a lesser amount, based on their income.

If you’re a small business owner, you can contribute to a 401(k) plan. The contribution limits for 2024 are different for small business owners. Check out 401k contribution limits for 2024 for small business owners to learn more about how much you can contribute.

- Consider “Catch-Up” Contributions:If either spouse is 50 years or older, they can contribute an additional $1,500 per year to their Roth IRA, which allows them to catch up on their retirement savings.

Designing a Plan for Utilizing Roth IRA Contributions

Developing a comprehensive plan for utilizing Roth IRA contributions is essential for achieving retirement goals.

- Estimate Retirement Expenses:Couples should create a realistic budget for their retirement expenses, considering factors such as housing, healthcare, travel, and leisure activities. This helps determine how much they need to save.

- Set Realistic Goals:Defining clear retirement goals, such as early retirement, a specific lifestyle, or financial independence, provides a roadmap for savings and investment strategies.

- Invest Wisely:Diversifying investments within the Roth IRA, including stocks, bonds, and real estate, can help grow savings over time and mitigate risk.

- Consider Roth IRA Conversions:Couples can convert traditional IRA assets to Roth IRAs, especially if they anticipate being in a higher tax bracket in retirement. This allows them to pay taxes on the conversion amount now and enjoy tax-free withdrawals later.

Factors to Consider When Planning for Roth IRA Contributions

Married couples should carefully consider several factors when planning for Roth IRA contributions to ensure their strategy aligns with their financial goals and circumstances.

- Income Levels:Roth IRA contributions are subject to income limitations, meaning that high-income earners may not be eligible to contribute the full amount or may face limitations on tax-free withdrawals in retirement.

- Tax Bracket:Couples should consider their current and projected tax brackets. If they expect to be in a higher tax bracket in retirement, Roth IRAs may be more beneficial than traditional IRAs, as withdrawals are tax-free.

- Retirement Goals:The timeline for retirement, desired lifestyle, and specific financial goals influence the amount couples need to save and the investment strategies they employ.

- Investment Time Horizon:Roth IRAs offer long-term tax advantages, making them suitable for individuals with a longer investment time horizon, allowing them to benefit from compounding growth.

- Financial Situation:Couples should assess their overall financial situation, including debt levels, emergency funds, and other financial obligations, before committing to Roth IRA contributions.

Additional Considerations for Married Couples

When it comes to Roth IRAs, married couples have unique considerations to keep in mind. Understanding these aspects can help you maximize your retirement savings and minimize potential tax burdens.

Spousal IRA Contributions

Spousal IRA contributions allow one spouse to contribute to a Roth IRA on behalf of their non-working spouse. This is particularly beneficial if one spouse has a lower income than the other. It enables them to take advantage of the tax benefits of a Roth IRA, even if they don’t have earned income.

Tax Deductions and Credits

While Roth IRA contributions themselves are not tax-deductible, there are other tax benefits that can be relevant to married couples. For instance, if you have a high income and your spouse has a low income, you might be eligible for the Earned Income Tax Credit (EITC).

The EITC is a tax credit that can offset your tax liability and even result in a refund.

Income Limits for Roth IRA Contributions

Here’s a table outlining the income limits for Roth IRA contributions in 2024 for married couples filing jointly:

| Income Level | Contribution Limit |

|---|---|

$228,000

|

Phased-out |

| $248,000 or more | Not eligible |

Note:The contribution limit for 2024 is $7,500 per person, or $15,000 for married couples filing jointly.

Final Thoughts

Roth IRAs can be a powerful tool for married couples looking to build a secure retirement. By understanding the contribution limits, income thresholds, and tax implications, you can make informed decisions about your retirement savings strategy. It’s recommended to review your financial situation and consult with a qualified professional to create a plan that aligns with your unique goals and circumstances.

Clarifying Questions

What happens if my income exceeds the phase-out limit?

If your combined MAGI exceeds the phase-out limit, you may not be able to contribute to a Roth IRA. However, you might consider a traditional IRA instead, which allows for tax-deductible contributions.

Can I contribute to both a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year. However, your total contribution limit remains $6,500 per person.

Can I withdraw contributions from a Roth IRA before retirement?

Yes, you can withdraw your contributions from a Roth IRA at any time without penalty. However, withdrawals of earnings are subject to taxes and penalties if you withdraw them before age 59 1/2.

What are the tax implications of withdrawing earnings from a Roth IRA?

Withdrawals of earnings from a Roth IRA are tax-free in retirement. This is one of the main benefits of contributing to a Roth IRA.