Roth IRA contribution limits for 2024 over 50 offer a powerful tool for retirement planning, especially for those approaching their golden years. These limits allow individuals aged 50 and above to contribute an additional amount beyond the standard contribution limit, accelerating their savings and maximizing their retirement nest egg.

This catch-up provision provides a significant advantage, helping older individuals make up for lost time and potentially reach their financial goals sooner.

The Roth IRA, known for its tax-free withdrawals in retirement, is a popular choice for individuals looking to secure their financial future. Understanding the contribution limits and how catch-up contributions work is crucial for making informed decisions about your retirement savings strategy.

Contents List

- 1 Roth IRA Contribution Limits for 2024

- 2 Catch-Up Contributions for Individuals Over 50: Roth IRA Contribution Limits For 2024 Over 50

- 3 Eligibility Requirements and Income Limits

- 4 Tax Implications of Roth IRA Contributions and Withdrawals

- 5 Strategies for Maximizing Roth IRA Contributions

- 6 Key Considerations for Individuals Over 50

- 7 Resources and Further Information

- 8 Epilogue

- 9 FAQ Corner

Roth IRA Contribution Limits for 2024

A Roth IRA is a retirement savings account that offers tax advantages. Contributions to a Roth IRA are made with after-tax dollars, meaning you’ve already paid taxes on the money. This allows you to withdraw your earnings and principal tax-free in retirement.The Roth IRA contribution limit for 2024 is the maximum amount you can contribute to your Roth IRA in a given year.

Don’t miss the deadline! Find out about the penalties for not filing an extension by October 2024 so you can plan ahead.

This limit is set by the IRS and is subject to change each year.

Plan your retirement savings strategy with the 401k contribution limits for 2024 by age.

Contribution Limit for 2024

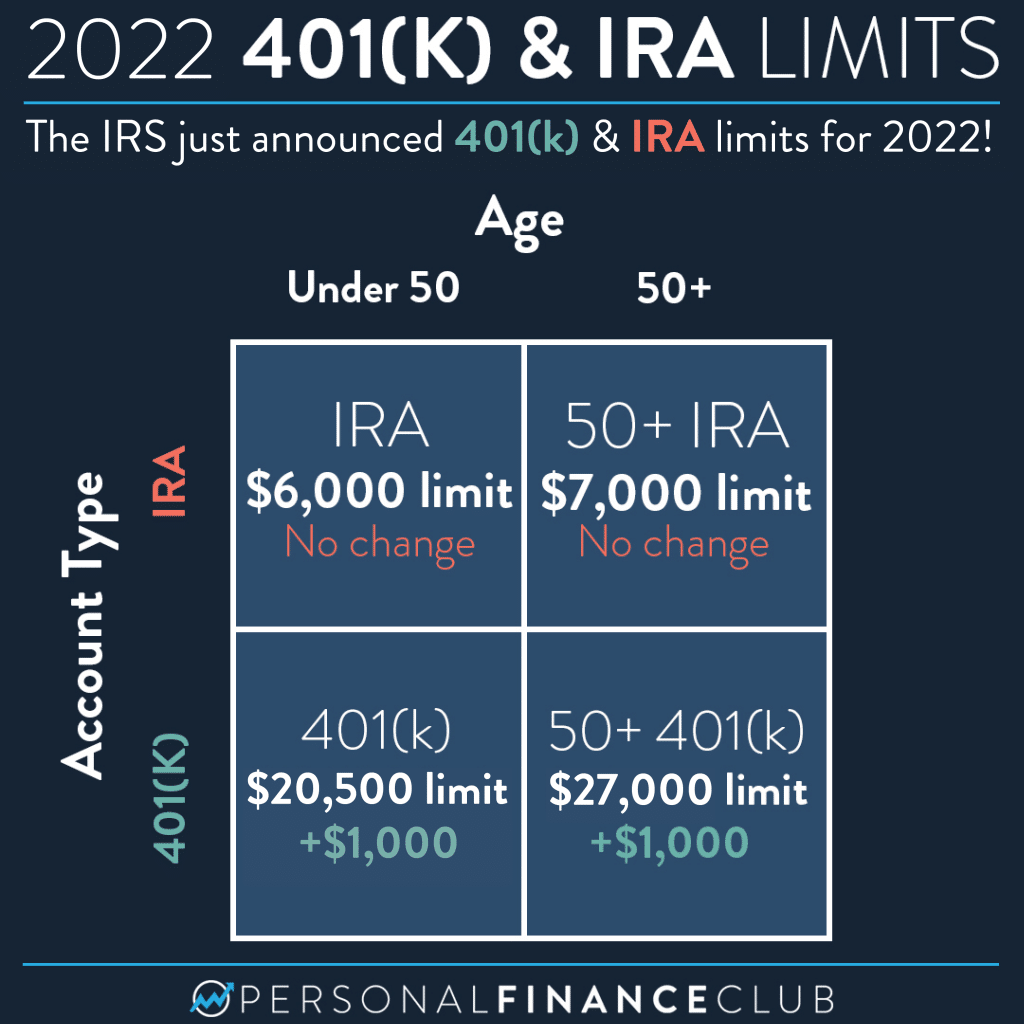

The Roth IRA contribution limit for 2024 for individuals under age 50 is $6,500.

Catch-Up Contributions for Individuals Over 50: Roth IRA Contribution Limits For 2024 Over 50

For individuals over 50, there’s an extra contribution amount you can add to your Roth IRA to help you catch up on retirement savings. This catch-up contribution allows older individuals to contribute more to their Roth IRAs, potentially accelerating their retirement savings journey.

Catch-Up Contribution Rationale

The rationale behind allowing catch-up contributions for individuals over 50 is to help them make up for lost time in saving for retirement. As individuals age, they often have fewer years to save, making it more difficult to accumulate a sufficient retirement nest egg.

Want to contribute even more to your 401k? Check out the catch-up contribution limits for 2024.

Catch-up contributions aim to address this challenge by providing older individuals with an opportunity to contribute more and potentially bridge the gap in their retirement savings.

It’s tax season and you might be wondering how to claim the standard deduction. Learn about the standard deduction for your 2024 taxes and see if you qualify.

Catch-Up Contribution Amount in 2024

The additional contribution amount allowed for individuals over 50 in 2024 is $1,000. This means that individuals over 50 can contribute an extra $1,000 to their Roth IRA in 2024, in addition to the regular contribution limit.

Wondering how much you can contribute to your IRA? The IRA contribution limits for 2024 vary depending on your age.

Total Maximum Contribution for Individuals Over 50 in 2024, Roth IRA contribution limits for 2024 over 50

To calculate the total maximum contribution allowed for individuals over 50 in 2024, we simply add the regular contribution limit to the catch-up contribution amount.

Total Maximum Contribution = Regular Contribution Limit + Catch-Up Contribution Amount

Total Maximum Contribution = $6,500 + $1,000 = $7,500

If you’re considering a Roth IRA, check the income limits for Roth IRA contributions in 2024 to see if you qualify.

Therefore, the total maximum contribution allowed for individuals over 50 in 2024 is $7,500.

Eligibility Requirements and Income Limits

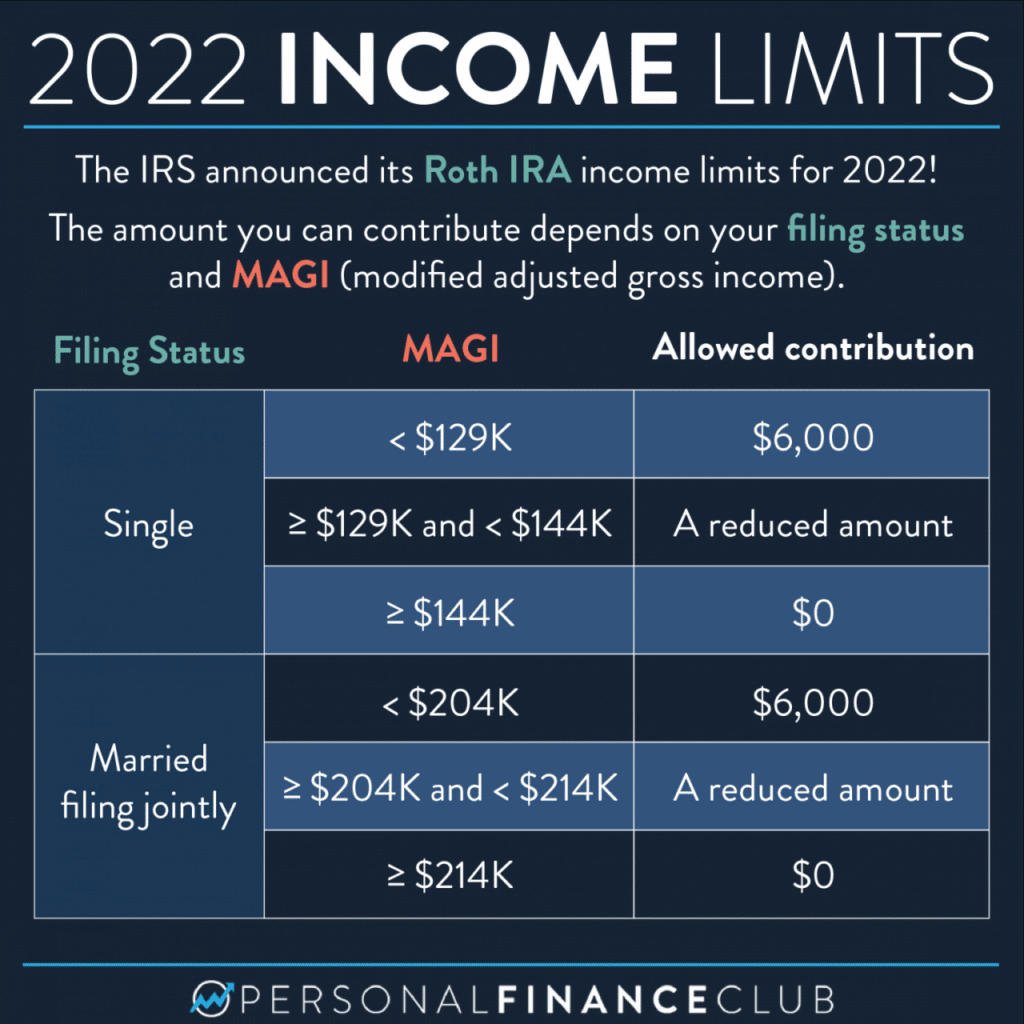

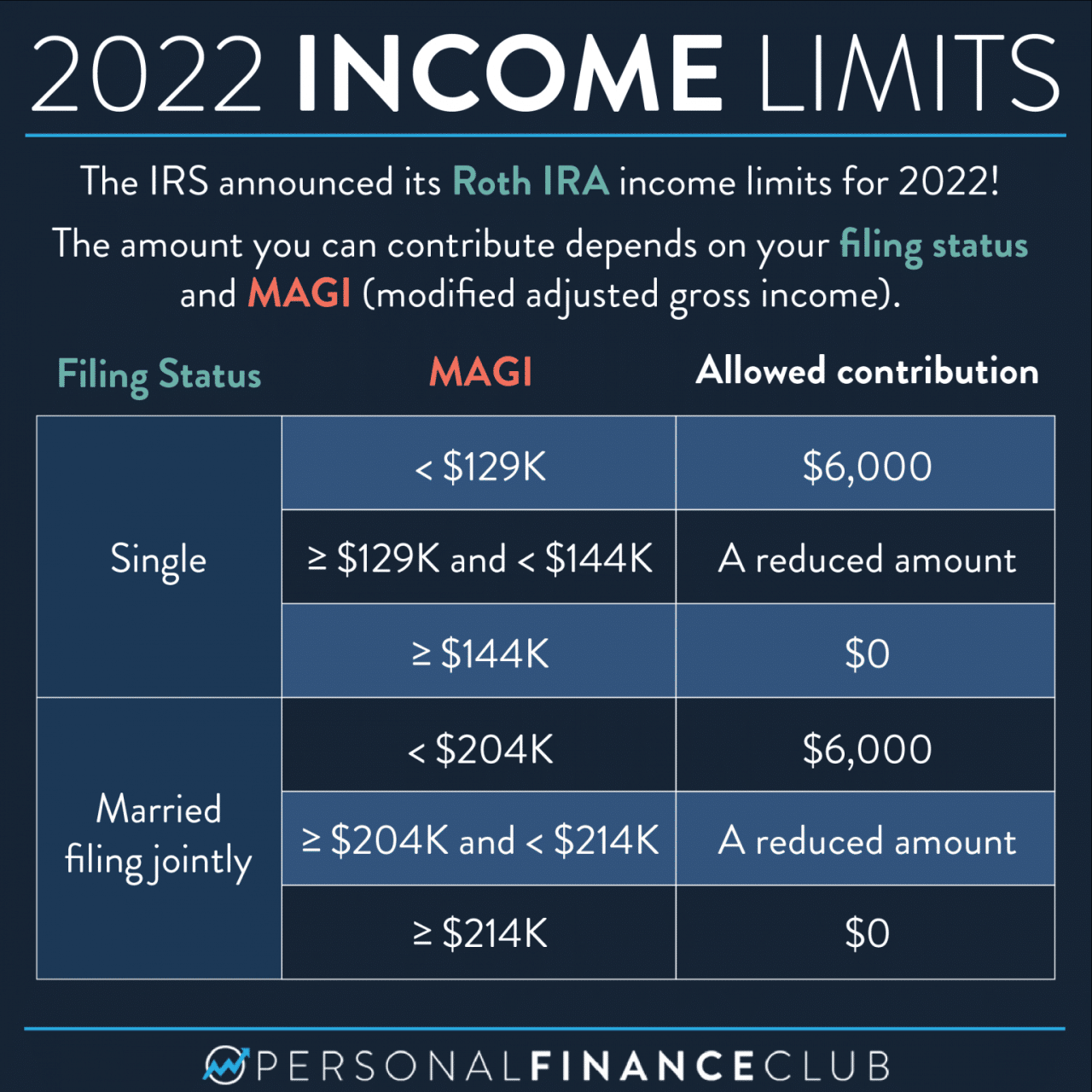

While anyone can open a Roth IRA, not everyone can contribute to one. There are income limits for contributing to a Roth IRA, and if your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute the full amount or may not be eligible to contribute at all.

If you’re a trustee, you’ll need to fill out a W9 form to report your tax information. You can find the latest information about the W9 form for trusts in October 2024 online.

Income Limitations for Roth IRA Contributions in 2024

The IRS sets income limits for Roth IRA contributions each year. If your income is above these limits, you may not be able to contribute to a Roth IRA or may only be able to contribute a reduced amount. Here are the income limits for 2024:

| Filing Status | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| Phase-Out Begins | $153,000 | $228,000 | $189,000 |

| Phase-Out Ends | $168,000 | $246,000 | $214,000 |

For example, if you are single and your MAGI is $160,000 in 2024, you will not be able to contribute the full $7,500 to a Roth IRA. Instead, you will be able to contribute a reduced amount.

Tax Implications of Roth IRA Contributions and Withdrawals

The Roth IRA is known for its tax-advantaged features, offering potential benefits during retirement. Understanding the tax implications of Roth IRA contributions and withdrawals is crucial for maximizing its advantages.

Not sure if you can claim the standard deduction? Find out if you can claim the standard deduction in 2024.

Tax Treatment of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This means that your contributions are not tax-deductible in the year you make them. However, this leads to a significant benefit during retirement.

Tax Implications of Withdrawals from a Roth IRA in Retirement

The primary advantage of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means you won’t owe any federal income tax on the money you withdraw from your Roth IRA after you reach age 59 1/2, as long as you’ve held the account for at least five years.

This tax-free withdrawal is a significant benefit, especially for individuals who expect to be in a higher tax bracket in retirement.

If you’re under 50, the 401k contribution limit for 2024 might be different.

Comparing Roth IRA Contributions to Traditional IRA Contributions

- Roth IRA Contributions:Contributions are made with after-tax dollars, not tax-deductible, but qualified withdrawals in retirement are tax-free.

- Traditional IRA Contributions:Contributions are made with pre-tax dollars, tax-deductible, but withdrawals in retirement are taxed as ordinary income.

Strategies for Maximizing Roth IRA Contributions

Maximizing your Roth IRA contributions can be a smart move for your retirement savings. By taking advantage of the full contribution limit, you can potentially enjoy tax-free withdrawals in retirement, grow your wealth, and build a more secure financial future.

The standard deduction might be changing this year. Make sure you’re up-to-date on the latest standard deduction changes for 2024.

Understanding Contribution Limits and Income Limitations

The annual contribution limit for Roth IRAs is subject to change each year. For 2024, the maximum contribution amount is $7,000 for individuals under 50 and $7,500 for those 50 and over. However, there are income limitations to consider. For 2024, if your modified adjusted gross income (MAGI) exceeds $153,000 as a single filer or $228,000 as a married couple filing jointly, you cannot contribute to a Roth IRA.

If you’re planning on contributing to a Roth 401k, you’ll want to know the 401k contribution limits for 2024 for Roth 401k.

If your income falls within a certain range, you may only be able to contribute a partial amount. It’s important to stay informed about these limits and adjust your contribution strategy accordingly.

Key Considerations for Individuals Over 50

For individuals over 50, Roth IRA contributions offer a unique opportunity to maximize retirement savings and potentially reduce taxes in retirement. One of the most significant advantages is the availability of catch-up contributions, which allow you to contribute a larger amount to your Roth IRA each year.

It’s important to know the 401k contribution limits for 2024 based on your age.

Catch-Up Contributions

Catch-up contributions allow individuals aged 50 and over to contribute an additional amount to their Roth IRA, beyond the standard contribution limit. This extra contribution can significantly boost your retirement savings.

Maximize your retirement savings with the latest information on the maximum IRA contribution for 2024.

The 2024 catch-up contribution limit for Roth IRAs is $1,000.

This means that individuals aged 50 and over can contribute up to $7,500 in 2024 to their Roth IRA ($6,500 standard limit + $1,000 catch-up contribution).

If you’re over 50, you can contribute more to your 401k. Find out the maximum 401k contribution for 2024 for those over 50.

Benefits of Catch-Up Contributions

Catch-up contributions offer several advantages for retirement planning:

- Accelerated Savings:Catch-up contributions allow you to significantly accelerate your retirement savings. By contributing more each year, you can build a larger nest egg for retirement.

- Tax-Free Growth:Roth IRA contributions grow tax-free, and withdrawals in retirement are also tax-free. This means you can enjoy your retirement savings without having to pay taxes on the growth or withdrawals.

- Increased Flexibility:Catch-up contributions can provide greater flexibility in your retirement planning. They allow you to adjust your savings strategy based on your individual needs and circumstances.

Impact on Overall Retirement Savings

Catch-up contributions can have a significant impact on your overall retirement savings. Consider this example:

Let’s say you are 55 years old and have been contributing $6,500 annually to your Roth IRA for the past 10 years. If you start contributing the maximum catch-up amount ($1,000) for the next 10 years, you will have contributed an additional $10,000 to your Roth IRA. Assuming an average annual return of 7%, this extra $10,000 will grow to approximately $19,670 in 10 years.

This example highlights the potential power of catch-up contributions. By taking advantage of this opportunity, you can significantly increase your retirement savings and enjoy greater financial security in retirement.

Resources and Further Information

The information provided here is intended to be a starting point for your Roth IRA planning. For personalized advice and assistance, it is highly recommended to consult with a qualified financial advisor or retirement planning expert.

Ready to start saving for retirement? Find out how much you can contribute to your Roth IRA in 2024.

Relevant Websites

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on Roth IRAs, including eligibility requirements, contribution limits, and tax implications. You can find detailed guidance on IRS Publication 590-A, “Contributions to Individual Retirement Arrangements (IRAs).” [https://www.irs.gov/](https://www.irs.gov/)

- United States Securities and Exchange Commission (SEC):The SEC offers resources on understanding investment options and protecting yourself from investment fraud. [https://www.sec.gov/](https://www.sec.gov/)

- Financial Industry Regulatory Authority (FINRA):FINRA provides investor education materials and tools to help you make informed decisions about your investments. [https://www.finra.org/](https://www.finra.org/)

Financial Advisor Contact Information

Finding a reputable financial advisor can be a valuable step in your retirement planning. Here are some resources to help you locate a qualified professional:

- Certified Financial Planner Board of Standards (CFP Board):The CFP Board maintains a directory of certified financial planners who meet specific ethical and competency standards. [https://www.cfp.net/](https://www.cfp.net/)

- National Association of Personal Financial Advisors (NAPFA):NAPFA is a professional organization for fee-only financial advisors who are committed to providing objective advice in their clients’ best interests. [https://www.napfa.org/](https://www.napfa.org/)

- American Institute of Certified Public Accountants (AICPA):The AICPA offers a directory of certified public accountants (CPAs) who specialize in financial planning. [https://www.aicpa.org/](https://www.aicpa.org/)

Reputable Resources

Beyond websites, there are numerous books, articles, and other resources available to help you understand Roth IRAs and retirement planning.

- The Motley Fool:This website provides investment advice, stock analysis, and personal finance information. [https://www.fool.com/](https://www.fool.com/)

- Investopedia:Investopedia offers a wide range of financial resources, including articles, tutorials, and calculators. [https://www.investopedia.com/](https://www.investopedia.com/)

- Kiplinger:Kiplinger is a well-respected source for personal finance information, including retirement planning and investing. [https://www.kiplinger.com/](https://www.kiplinger.com/)

Epilogue

Taking advantage of catch-up contributions can significantly boost your retirement savings, potentially leading to a more comfortable and secure retirement. By understanding the rules and maximizing your contributions, you can pave the way for a financially fulfilling future. Remember, seeking guidance from a financial advisor can provide personalized insights and ensure you’re making the most of your retirement savings opportunities.

FAQ Corner

Can I contribute to both a Roth IRA and a traditional IRA in the same year?

Yes, you can contribute to both a Roth IRA and a traditional IRA in the same year, but there are contribution limits for each type of account. The total contribution you make to both accounts combined cannot exceed the annual limit for either type of IRA.

What happens to my Roth IRA contributions if I withdraw them before age 59 1/2?

Withdrawals from a Roth IRA before age 59 1/2 are generally subject to taxes and a 10% penalty, unless you qualify for an exception. However, contributions can always be withdrawn tax-free and penalty-free, regardless of your age.

Are there any income limits for catch-up contributions?

There are no income limits for catch-up contributions to a Roth IRA. Anyone aged 50 or older can contribute the additional catch-up amount, regardless of their income.