Series 7 Variable Annuity 2024 presents a complex financial instrument designed to provide retirement income and potential growth. This guide explores the intricate workings of these annuities, delving into their investment options, risk profiles, and the various benefits they offer.

Tax implications are a crucial aspect of annuity investments. Is Annuity Exempt From Tax 2024 sheds light on the tax treatment of annuities and the potential tax benefits they may offer.

Variable annuities offer a unique blend of investment flexibility and guaranteed income features, making them an attractive option for individuals seeking to diversify their portfolios and secure their financial future. This guide will provide insights into the key aspects of Series 7 Variable Annuities, helping you navigate the complexities of this investment vehicle and make informed decisions.

Contents List

- 1 Introduction to Series 7 Variable Annuities

- 2 Investment Options in Series 7 Variable Annuities: Series 7 Variable Annuity 2024

- 3 Understanding the Risks of Series 7 Variable Annuities

- 4 Death Benefits and Living Benefits

- 5 Fees and Expenses Associated with Series 7 Variable Annuities

- 6 Tax Considerations for Series 7 Variable Annuities

- 7 Series 7 Variable Annuities in 2024

- 8 End of Discussion

- 9 Essential Questionnaire

Introduction to Series 7 Variable Annuities

Series 7 Variable Annuities are a type of insurance product that combines the guaranteed features of traditional annuities with the potential for growth offered by the stock market. These annuities allow investors to allocate their premiums to a variety of investment options, such as mutual funds, ETFs, and other securities, which can fluctuate in value based on market performance.

This unique combination of features aims to provide investors with a potentially higher return than traditional annuities while offering some protection against market downturns.

When considering annuities, it’s important to understand the various options available. Annuity Joint Life Option 2024 explores the joint life option, which provides income for multiple individuals.

Key Features of Series 7 Variable Annuities

Series 7 Variable Annuities offer a variety of features designed to meet the specific needs of individual investors. These features include:

- Investment Options:Series 7 Variable Annuities provide a wide range of investment options, allowing investors to customize their portfolio based on their risk tolerance and investment goals. These options typically include a variety of mutual funds, ETFs, and other securities that are carefully selected and managed by the insurance company.

- Death Benefits:Series 7 Variable Annuities often include death benefit options that guarantee a minimum payout to beneficiaries upon the death of the annuitant. These benefits can provide financial security for loved ones and ensure that their financial needs are met, even if the investment performance of the annuity is not favorable.

- Living Benefits:Series 7 Variable Annuities may also offer living benefits, which provide income guarantees or other financial protection during the annuitant’s lifetime. These benefits can be particularly valuable for individuals concerned about outliving their savings or experiencing unexpected financial challenges in retirement.

When making investment decisions, comparing different options is essential. Variable Annuity Vs Mutual Fund 2024 provides a comprehensive comparison of variable annuities and mutual funds, highlighting their similarities and differences.

Common living benefits include guaranteed minimum income, guaranteed minimum withdrawal benefits, and death benefit riders.

Advantages and Disadvantages of Series 7 Variable Annuities

Series 7 Variable Annuities offer both potential advantages and disadvantages, and it’s essential to carefully consider these factors before making an investment decision.

- Advantages:

- Potential for Higher Returns:The ability to invest in a variety of market-linked options can lead to potentially higher returns compared to traditional annuities.

- Tax-Deferred Growth:Earnings on investments within a Series 7 Variable Annuity are generally tax-deferred, meaning that taxes are not paid until withdrawals are made.

- Protection Against Market Downturns:Series 7 Variable Annuities may offer some protection against market downturns through features like guaranteed minimum income or death benefit riders.

- Flexibility:Investors have a degree of control over their investment choices within the annuity, allowing them to tailor their portfolio to their individual needs and risk tolerance.

- Disadvantages:

- Market Risk:Investment options within a Series 7 Variable Annuity are subject to market risk, which means that the value of the annuity can fluctuate based on the performance of the underlying investments.

- Fees and Expenses:Series 7 Variable Annuities typically have higher fees and expenses than traditional annuities, which can impact the overall return on investment.

- Complexity:Understanding the features and risks of a Series 7 Variable Annuity can be complex, requiring careful research and potentially professional financial advice.

- Surrender Charges:Most Series 7 Variable Annuities have surrender charges, which are penalties assessed if you withdraw money from the annuity before a certain period. These charges can significantly impact the overall return on investment, especially if you need to access your funds early.

Investment Options in Series 7 Variable Annuities: Series 7 Variable Annuity 2024

Series 7 Variable Annuities offer a wide range of investment options, allowing investors to tailor their portfolio to their specific risk tolerance and investment goals. These options typically fall into two categories: sub-accounts and separate accounts.

Sub-Accounts

Sub-accounts are investment options offered by the insurance company itself. They are typically mutual funds, ETFs, or other securities that have been carefully selected and managed by the insurance company’s investment professionals. Sub-accounts provide investors with a diversified portfolio and potentially lower expenses compared to separate accounts.

However, investors have limited control over the specific investments within sub-accounts.

If you’re considering a variable annuity, it’s essential to understand the licensing requirements. Variable Annuity License 2024 provides information on the necessary qualifications for financial professionals.

Separate Accounts

Separate accounts allow investors to invest in a broader range of securities, including individual stocks, bonds, and other assets. These accounts offer greater flexibility and control over investment choices but also carry a higher level of risk. Investors are responsible for managing their own separate accounts and must have a more sophisticated understanding of investment strategies.

Variable annuities can offer a blend of growth potential and income security. Variable Annuity Fidelity 2024 explores the features and considerations associated with this type of investment.

Categorizing Investment Options by Risk and Return

Investment options within a Series 7 Variable Annuity can be categorized based on their risk levels and potential returns. Generally, higher-risk investments have the potential for higher returns but also carry a greater risk of loss. Conversely, lower-risk investments typically offer lower potential returns but are considered safer.

For individuals looking to understand the basics of annuities, Annuity Meaning In English 2024 provides a clear and concise definition of annuities.

Here’s a general overview of different risk categories:

- Conservative:Conservative investment options, such as money market funds, short-term bonds, and fixed-income securities, are designed to preserve capital and provide a steady stream of income. These options typically offer lower potential returns but are less volatile and carry a lower risk of loss.

- Moderate:Moderate investment options, such as diversified stock funds, balanced funds, and a combination of stocks and bonds, aim to balance growth potential with risk management. These options offer a moderate level of risk and potential return.

- Aggressive:Aggressive investment options, such as growth stocks, emerging market funds, and sector-specific funds, are designed for investors seeking higher potential returns but are also subject to greater volatility and risk of loss.

Understanding the Risks of Series 7 Variable Annuities

Series 7 Variable Annuities are subject to market risk, meaning that the value of the annuity can fluctuate based on the performance of the underlying investments. This risk is inherent to any investment that is tied to the stock market, and it’s important to understand the potential for loss of principal before investing in a Series 7 Variable Annuity.

Market Risk

Market risk refers to the possibility that the value of investments within a Series 7 Variable Annuity may decline due to factors such as economic downturns, interest rate changes, inflation, or geopolitical events. This risk can impact the overall value of the annuity and potentially reduce the amount of money available for withdrawals or payouts.

Potential for Loss of Principal

Due to market risk, there is always the potential for loss of principal when investing in a Series 7 Variable Annuity. This means that the value of your investment could fall below the amount you originally invested, and you may not recover your initial investment if the market performs poorly.

Annuities are a complex financial product, and understanding their different types is essential. Annuity Is Series 2024 delves into the various types of annuities available and their unique characteristics.

The extent of potential loss depends on the specific investment options chosen, the overall market conditions, and the duration of the investment.

Risks Associated with Specific Investment Options

Different investment options within a Series 7 Variable Annuity carry varying levels of risk. For example, stocks are generally considered higher-risk investments than bonds, while investments in emerging markets or specific sectors may be even more volatile. It’s crucial to carefully consider the risks associated with each investment option before making a decision.

The annuity industry is constantly evolving, creating opportunities for professionals. Annuity Jobs 2024 explores the career paths available in this growing field.

Death Benefits and Living Benefits

Series 7 Variable Annuities often offer a range of death benefit options and living benefits designed to provide financial protection for both the annuitant and their beneficiaries. These benefits can enhance the overall value of the annuity and provide peace of mind.

One of the key features of annuities is their potential for guaranteed income. Is Annuity Guaranteed 2024 provides insights into the guarantees offered by different types of annuities.

Death Benefit Options

Death benefit options in Series 7 Variable Annuities typically provide a guaranteed minimum payout to beneficiaries upon the death of the annuitant. These benefits can ensure that loved ones receive a specific amount of money, regardless of the performance of the annuity’s underlying investments.

Common death benefit options include:

- Guaranteed Death Benefit:This option guarantees a minimum payout equal to the original investment amount, regardless of the current value of the annuity. It provides a safety net for beneficiaries, ensuring that they receive at least their initial investment.

- Enhanced Death Benefit:This option may provide a payout greater than the original investment amount, depending on the performance of the annuity’s underlying investments. It offers the potential for a larger payout to beneficiaries but also carries a higher cost.

- Return of Premium Death Benefit:This option guarantees a payout equal to the total premiums paid into the annuity, regardless of the current value of the annuity. It provides a way to recover the premium payments made over time.

Living Benefits

Living benefits in Series 7 Variable Annuities provide financial protection during the annuitant’s lifetime. These benefits can be valuable for individuals concerned about outliving their savings or experiencing unexpected financial challenges in retirement. Common living benefits include:

- Guaranteed Minimum Income:This benefit guarantees a minimum income stream for life, regardless of the performance of the annuity’s underlying investments. It provides a steady source of income in retirement, even if the market experiences downturns.

- Guaranteed Minimum Withdrawal Benefits (GMWB):This benefit allows the annuitant to withdraw a certain percentage of the annuity’s value each year, regardless of the performance of the underlying investments. It provides flexibility and peace of mind, ensuring that a portion of the investment remains available for withdrawals.

- Death Benefit Riders:These riders can enhance the death benefit payout, providing a larger amount of money to beneficiaries upon the annuitant’s death. They can be particularly valuable for individuals with significant financial obligations or dependents.

Potential Benefits and Limitations of Death and Living Benefits

Death and living benefits can provide valuable financial protection, but it’s important to understand their potential benefits and limitations. These benefits typically come with additional costs, which can impact the overall return on investment. Additionally, the specific terms and conditions of these benefits can vary significantly depending on the insurance company and the annuity contract.

Fees and Expenses Associated with Series 7 Variable Annuities

Series 7 Variable Annuities typically have a variety of fees and expenses associated with them, which can impact the overall return on investment. It’s crucial to carefully consider these fees before making an investment decision.

Types of Fees

The fees associated with Series 7 Variable Annuities can be categorized into several different types:

- Annual Fees:These fees are charged annually, regardless of the performance of the annuity’s underlying investments. They typically cover the costs of managing the annuity and providing its various features.

- Surrender Charges:These charges are assessed if you withdraw money from the annuity before a certain period. They are designed to discourage early withdrawals and can significantly impact the overall return on investment, especially if you need to access your funds early.

Annuity owners are looking for ways to secure their financial future, and Annuity Owner Is 2024 provides insights into the current market. Understanding the nuances of annuities is essential for making informed decisions.

- Expense Ratios:These fees are charged by the underlying investment options, such as mutual funds or ETFs, within the annuity. They cover the costs of managing the investments and typically range from 0.5% to 2% per year.

- Mortality and Expense Risk Charges:These charges are typically included in the annual fees and are designed to cover the costs of providing the annuity’s death benefit and other guaranteed features.

Examples of Specific Fees

Here are some examples of specific fees that may be associated with Series 7 Variable Annuities:

- Annual Administrative Fee:This fee is typically charged as a percentage of the annuity’s value and covers the costs of managing the annuity account.

- Surrender Charge:This charge may be assessed as a percentage of the withdrawal amount and is typically highest in the early years of the annuity. The charge gradually decreases over time.

- Expense Ratio:This fee is charged by the underlying mutual fund or ETF and typically ranges from 0.5% to 2% per year.

Impact of Fees on Returns

Fees and expenses can significantly impact the overall return on investment for a Series 7 Variable Annuity. The higher the fees, the lower the potential return. It’s important to compare the fees charged by different insurance companies and annuity contracts to ensure that you are choosing an option with reasonable fees that align with your investment goals.

Tax Considerations for Series 7 Variable Annuities

Series 7 Variable Annuities have specific tax implications that investors should understand before making an investment decision. The tax treatment of withdrawals and distributions from a Series 7 Variable Annuity can impact the overall return on investment.

Calculating the interest earned on an annuity is crucial for understanding its overall performance. Calculating Annuity Interest 2024 offers a guide to understanding how annuity interest is calculated.

Tax Implications of Investing

Earnings on investments within a Series 7 Variable Annuity are generally tax-deferred, meaning that taxes are not paid until withdrawals are made. This tax deferral can provide a significant tax advantage, as earnings can grow tax-free for a longer period.

However, withdrawals from the annuity are typically taxed as ordinary income, which can result in a higher tax rate compared to other investment options.

Tax Treatment of Withdrawals and Distributions

Withdrawals from a Series 7 Variable Annuity are generally taxed as ordinary income. This means that they are subject to the same tax rates as your salary or wages. The specific tax treatment of withdrawals can vary depending on the type of withdrawal, the age of the annuitant, and the length of time the annuity has been held.

It’s important to consult with a tax advisor to understand the specific tax implications of your situation.

Potential Tax Advantages and Disadvantages

Series 7 Variable Annuities can offer both potential tax advantages and disadvantages. The tax deferral of earnings can provide a significant advantage, allowing investments to grow tax-free for a longer period. However, the taxation of withdrawals as ordinary income can result in a higher tax burden compared to other investment options.

It’s important to carefully consider the tax implications of a Series 7 Variable Annuity before making an investment decision.

Series 7 Variable Annuities in 2024

The performance of Series 7 Variable Annuities in 2024 will be influenced by a variety of factors, including overall market conditions, interest rates, and regulatory changes. It’s important to stay informed about these factors and their potential impact on the annuity market.

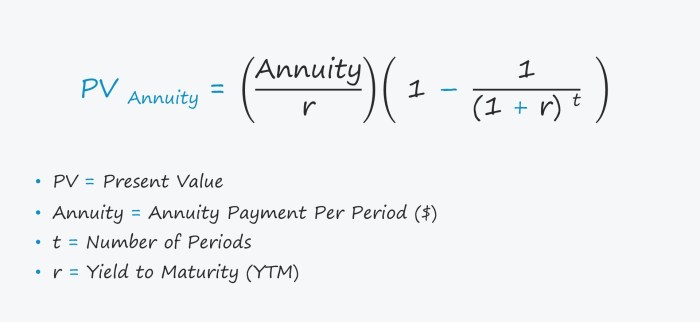

To effectively manage your annuity investments, understanding the calculation process is vital. How To Calculate Annuity Formula 2024 provides a comprehensive guide to the formulas used in annuity calculations.

Current Market Conditions

The current market conditions are characterized by elevated inflation, rising interest rates, and geopolitical uncertainty. These factors can impact the performance of the stock market and potentially affect the value of investments within Series 7 Variable Annuities. Investors should carefully consider these conditions and their potential impact on their investment decisions.

To navigate the world of annuities, it’s important to have a clear understanding of their definition and purpose. Annuity Is Definition 2024 provides a comprehensive overview of what annuities are and how they work.

Recent Changes or Developments in Regulations, Series 7 Variable Annuity 2024

The regulatory landscape surrounding Series 7 Variable Annuities is constantly evolving. Recent changes or developments in regulations can impact the features and costs associated with these annuities. It’s important to stay informed about any new regulations and their potential impact on your investment.

Retirement planning often involves considering various income streams, and variable annuities can play a role. Rmd Variable Annuity 2024 examines the role of variable annuities in retirement planning and their impact on required minimum distributions (RMDs).

Key Trends in the Variable Annuity Market

The variable annuity market is experiencing a number of key trends that could influence the performance of Series 7 Variable Annuities in 2024. These trends include:

- Increased Focus on Transparency:There is an increasing focus on transparency in the variable annuity market, with regulators pushing for greater disclosure of fees and expenses. This trend can benefit investors by providing them with more information to make informed decisions.

- Growth of Living Benefits:Living benefits, such as guaranteed minimum income and guaranteed minimum withdrawal benefits, are becoming increasingly popular among investors. This trend reflects a growing demand for financial protection during retirement.

- Competition from Other Investment Options:Series 7 Variable Annuities are facing increasing competition from other investment options, such as mutual funds, ETFs, and traditional annuities. This competition can drive innovation and potentially lead to lower fees and improved features for investors.

End of Discussion

Series 7 Variable Annuities are multifaceted financial products with a mix of potential rewards and inherent risks. Understanding the nuances of investment options, fees, and tax implications is crucial before investing. By carefully evaluating your financial goals, risk tolerance, and seeking professional guidance, you can determine if a Series 7 Variable Annuity aligns with your long-term investment strategy.

Essential Questionnaire

What are the potential tax benefits of a Series 7 Variable Annuity?

Series 7 Variable Annuities offer tax deferral on earnings, meaning you won’t pay taxes on investment gains until you withdraw them. This can be beneficial for long-term growth and tax savings.

How do I choose the right investment options within a Series 7 Variable Annuity?

Selecting investment options depends on your risk tolerance and time horizon. Consult with a financial advisor to create a portfolio that aligns with your financial goals and risk profile.

What are the surrender charges associated with Series 7 Variable Annuities?

Surrender charges are fees incurred when you withdraw money from the annuity before a specified period. These charges can vary based on the annuity contract and the length of time you’ve held it.

Are there any guarantees associated with Series 7 Variable Annuities?

When it comes to planning your retirement, understanding the ins and outs of annuities is crucial. Calculating Annuity Cash Flows 2024 offers valuable guidance on how to project your future income streams.

While Series 7 Variable Annuities offer potential growth, they don’t guarantee principal protection. The value of your investment can fluctuate based on market performance.