Standard deduction amount for 2024 tax year is a crucial factor in determining your tax liability. This deduction allows you to reduce your taxable income by a specific amount, ultimately lowering your tax bill. Understanding how the standard deduction works and its impact on your tax return is essential for maximizing your tax savings.

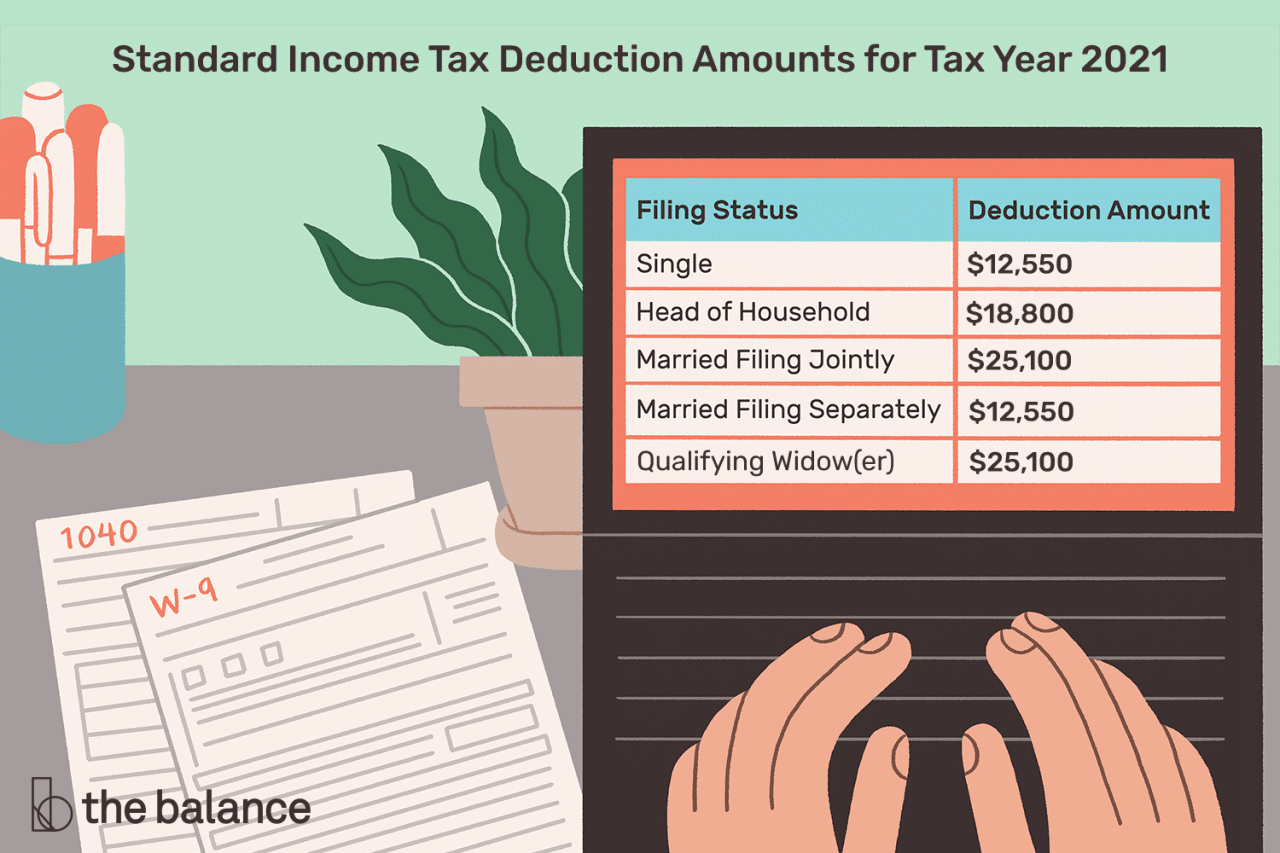

The standard deduction amount varies based on your filing status, whether you are single, married filing jointly, married filing separately, or head of household. For instance, in 2024, the standard deduction for single filers is expected to be higher than in previous years, potentially providing significant tax relief.

However, the standard deduction is not universally applicable, and certain factors, such as your age or blindness, may influence your eligibility.

Contents List

Itemized Deductions vs. Standard Deduction: Standard Deduction Amount For 2024 Tax Year

When filing your federal income tax return, you have the option to choose between taking the standard deduction or itemizing your deductions. The standard deduction is a fixed amount that you can deduct from your taxable income, while itemized deductions allow you to deduct specific expenses.

You might be surprised to learn that you can still contribute to an IRA even if you have a 401k. Can I contribute to an IRA if I have a 401k is a question many people ask.

The option that results in a lower tax liability is the one you should choose.

If you’re over 50, you can contribute more to your retirement savings. The maximum 401k contribution for 2024 for those over 50 is higher than the regular limit , allowing you to save more for your future.

Choosing Between Itemized Deductions and the Standard Deduction

The choice between itemizing and taking the standard deduction depends on your individual circumstances. To make the best decision, you need to compare the total amount of your itemized deductions to the standard deduction amount. If your itemized deductions exceed the standard deduction, you should itemize.

The W9 form is used for tax purposes and may have some changes for 2024. You can find out about any W9 Form October 2024 changes and updates on the IRS website.

However, if your itemized deductions are less than the standard deduction, you should take the standard deduction.

There’s a lot of talk about changes to the mileage rate, but for October 2024, it’s still the same. You can find out more about the current rate and any potential changes on the IRS website. Is the mileage rate changing in October 2024?

Common Itemized Deductions

Itemized deductions are specific expenses that you can deduct from your taxable income. Here are some common itemized deductions:

- Medical Expenses:You can deduct medical expenses exceeding 7.5% of your adjusted gross income (AGI). This includes expenses like doctor’s visits, prescription drugs, and health insurance premiums.

- State and Local Taxes (SALT):The Tax Cuts and Jobs Act of 2017 limited the deduction for state and local taxes to $10,000 per household. This includes income taxes, property taxes, and sales taxes.

- Home Mortgage Interest:You can deduct interest paid on up to $750,000 of debt for a qualified home mortgage. This includes interest on a first and second mortgage, as well as home equity loans.

- Charitable Contributions:You can deduct cash contributions to qualified charities up to 60% of your AGI. You can also deduct the fair market value of donated items, such as clothing or furniture.

Advantages and Disadvantages

Standard Deduction

- Advantages:

- Easy to calculate and claim.

- No need to gather receipts or documentation.

- May be a better option if you don’t have many deductible expenses.

- Disadvantages:

- May not be as beneficial as itemizing if you have significant deductible expenses.

- You may miss out on valuable deductions.

Itemized Deductions

- Advantages:

- May result in a lower tax liability if your deductions exceed the standard deduction.

- Allows you to deduct specific expenses that are relevant to your situation.

- Disadvantages:

- Can be more complicated to calculate and claim.

- Requires gathering receipts and documentation for each deduction.

- May not be beneficial if your deductions are less than the standard deduction.

Standard Deduction and Tax Filing

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. It is an alternative to itemizing your deductions, which allows you to deduct specific expenses. Choosing the standard deduction simplifies the tax filing process, but it’s essential to understand how it’s reflected on tax forms and its implications for your tax liability.

The tax deadline for October 2024 is just around the corner! Make sure you’re prepared by knowing how to file your taxes. How to file taxes by the October 2024 deadline is a helpful guide.

Claiming the Standard Deduction

The standard deduction amount varies depending on your filing status, age, and whether you are blind. It is pre-determined and automatically calculated by the IRS, eliminating the need for extensive documentation. The standard deduction is claimed on your federal income tax return, Form 1040, by simply entering the appropriate amount on line 12 of the form.

If you’re self-employed, you can contribute to a SEP IRA to save for retirement. The IRA contribution limits for SEP IRA in 2024 are a good way to maximize your retirement savings.

The IRS has a table on their website that lists the standard deduction amounts for each filing status and age.

It’s important to know what tax bracket you’ll be in for 2024. Knowing the tax bracket thresholds for 2024 will help you plan your finances and make informed decisions.

Implications for Tax Preparation and Filing, Standard deduction amount for 2024 tax year

Choosing the standard deduction streamlines the tax filing process, making it easier and quicker to prepare your return. This is especially beneficial for individuals with fewer itemized deductions, as it avoids the complexities of gathering receipts and documentation for various expenses.

If you’re an independent contractor, you’ll need to fill out a W9 form. The W9 Form October 2024 for independent contractors is essential for your clients to report your income correctly.

The standard deduction amount is automatically calculated, simplifying the process of determining your taxable income. However, it’s important to remember that claiming the standard deduction means you are not deducting specific expenses that could potentially lower your taxable income further.

Tips for Accuracy and Avoiding Errors

To ensure accuracy and avoid errors when claiming the standard deduction, it is crucial to understand your filing status and eligibility criteria. The standard deduction amount is based on your filing status, age, and whether you are blind. Consult the IRS website or a tax professional to determine the correct amount for your situation.

Furthermore, double-check the accuracy of the standard deduction amount entered on your tax form. If you have any questions or doubts, seek assistance from a tax professional.

Closing Summary

The standard deduction can be a powerful tool for minimizing your tax liability, but it’s important to understand its nuances and how it interacts with other tax considerations. By carefully evaluating your options and utilizing the standard deduction strategically, you can ensure you are taking full advantage of this valuable tax benefit.

Helpful Answers

What happens if I choose the standard deduction and later find out I could have saved more with itemized deductions?

You can always choose to itemize your deductions when you file your tax return, even if you initially claimed the standard deduction.

Can I claim the standard deduction if I am self-employed?

Yes, self-employed individuals are eligible to claim the standard deduction.

Does the standard deduction affect my eligibility for other tax credits?

No, claiming the standard deduction does not impact your eligibility for other tax credits.

Need to know the standard mileage rate for business travel in October 2024? What is the standard mileage rate for October 2024? is a common question, and the answer can be found on the IRS website.

If you’re contributing to a traditional 401k, the contribution limits for 2024 are important to know. What are the 401k contribution limits for 2024 for traditional 401k is a question that comes up often.

Planning your retirement savings? The IRA contribution limits for 2024 will help you make the most of your contributions.

Married couples can contribute to IRAs, but the limits depend on their combined income. IRA contribution limits for 2024 for married couples can vary based on several factors.

The mileage rate for October 2024 is important for those who drive for business purposes. Where can I find the mileage rate for October 2024? is a question you can find the answer to on the IRS website.

If you’re a business owner, you’ll need to file your taxes by the October 2024 deadline. October 2024 tax deadline for businesses is an important date to keep in mind.

Those over 50 can contribute a little more to their IRA. IRA contribution limits for 2024 for those over 50 are higher than the regular limit.