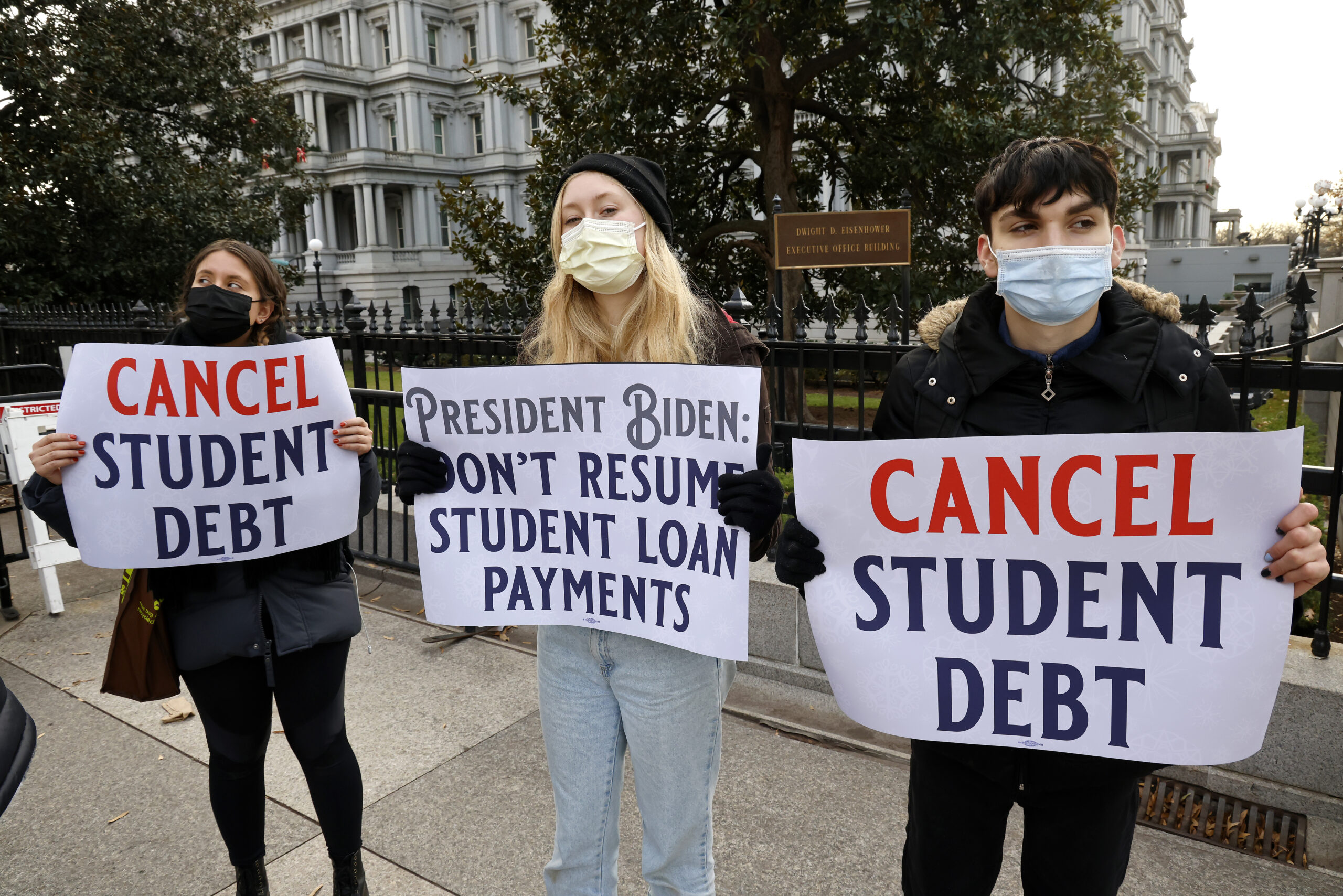

Studentaid Gov Debt Relief offers a lifeline to borrowers struggling with student loan debt. This program, designed to ease the financial burden of education, provides forgiveness for eligible loans, potentially impacting borrowers’ financial well-being and future planning. Understanding the eligibility criteria, application process, and potential benefits is crucial for those seeking relief from student loan debt.

Understanding the Personal Loan Rates available to you is essential before applying. Factors like your credit score, loan amount, and repayment term can significantly influence the interest rate you qualify for.

The program aims to alleviate the pressure of student loans, allowing individuals to focus on their financial stability and career goals. It tackles a critical issue in the education sector, addressing the growing concern of student debt and its impact on the economy.

Finding the Best Loan Rates can be challenging, but with some research and comparison, you can find options that fit your financial goals. Consider factors like your credit score, loan amount, and desired repayment term.

The program’s potential to positively influence borrowers’ lives and the overall financial landscape makes it a significant development in the realm of student loan forgiveness.

Before you head to the car dealership, it’s a good idea to know the current Auto Loan Rates. This will give you a better understanding of the financing options available and help you negotiate a fair deal.

Last Point: Studentaid Gov Debt Relief

Studentaid Gov Debt Relief represents a substantial step towards addressing the student loan crisis. By offering a path to forgiveness, the program empowers individuals to reclaim control over their financial futures. As we move forward, it’s essential to stay informed about the program’s evolution, potential changes, and the impact it has on the education sector and the economy as a whole.

Getting Pre Approval for a mortgage can strengthen your position when making an offer on a home. It demonstrates to sellers that you’re a serious buyer with financing in place.

Question & Answer Hub

What is the maximum amount of debt that can be forgiven through Studentaid Gov Debt Relief?

The housing market is constantly evolving, and it’s important to stay informed about Mortgage Interest Rates Today. These rates can fluctuate based on economic conditions, so it’s wise to monitor them closely.

The maximum amount of debt forgiveness varies depending on the specific program and eligibility criteria. It’s best to consult the program guidelines for detailed information.

If you’ve built equity in your home and are looking for ways to access it, Equity Release might be an option. This allows you to borrow against the value of your home, potentially providing funds for various needs.

How long does it take to receive forgiveness after applying for Studentaid Gov Debt Relief?

The processing time for forgiveness applications can vary. It’s advisable to check the program’s timeline and contact the relevant authorities for updates on the status of your application.

Are there any income requirements to qualify for Studentaid Gov Debt Relief?

If you’re looking to consolidate debt or cover unexpected expenses, Upgrade Personal Loans can offer competitive rates and flexible terms. Their online application process is quick and easy, making it a convenient option for many borrowers.

Yes, some programs may have income requirements for eligibility. It’s important to review the specific program guidelines to determine the income limits and any other eligibility criteria.

Buying a home is a significant financial decision, and securing a mortgage is a crucial step. House Loans can help you navigate the process, comparing different lenders and loan options to find the best fit for your needs.

Understanding current Mortgage Rates is crucial for making informed decisions about buying a home. These rates can vary depending on the type of loan, your credit score, and other factors.

If you’re considering using your home equity as collateral for a loan, it’s essential to research Home Equity Loan Interest Rates. These rates can vary significantly, so comparing offers is important.

When choosing a lender for your mortgage, it’s beneficial to explore Best Mortgage Lenders. Look for lenders with competitive rates, excellent customer service, and a strong track record.

Whether you’re looking for a personal loan, mortgage, or auto loan, finding the Best Loans for your situation requires careful consideration. Compare rates, terms, and lender reputation to make the best choice.

For those seeking to purchase a home, exploring Best Home Loans is essential. Consider factors like interest rates, loan terms, and lender reputation to find the most suitable option.

If you need a loan quickly, Fast Loans can provide a solution. However, it’s crucial to understand the terms and potential costs associated with these types of loans.

PNC Bank offers a Pnc Heloc , which can provide a flexible line of credit secured by your home’s equity. This can be a valuable option for home improvement projects or other financial needs.