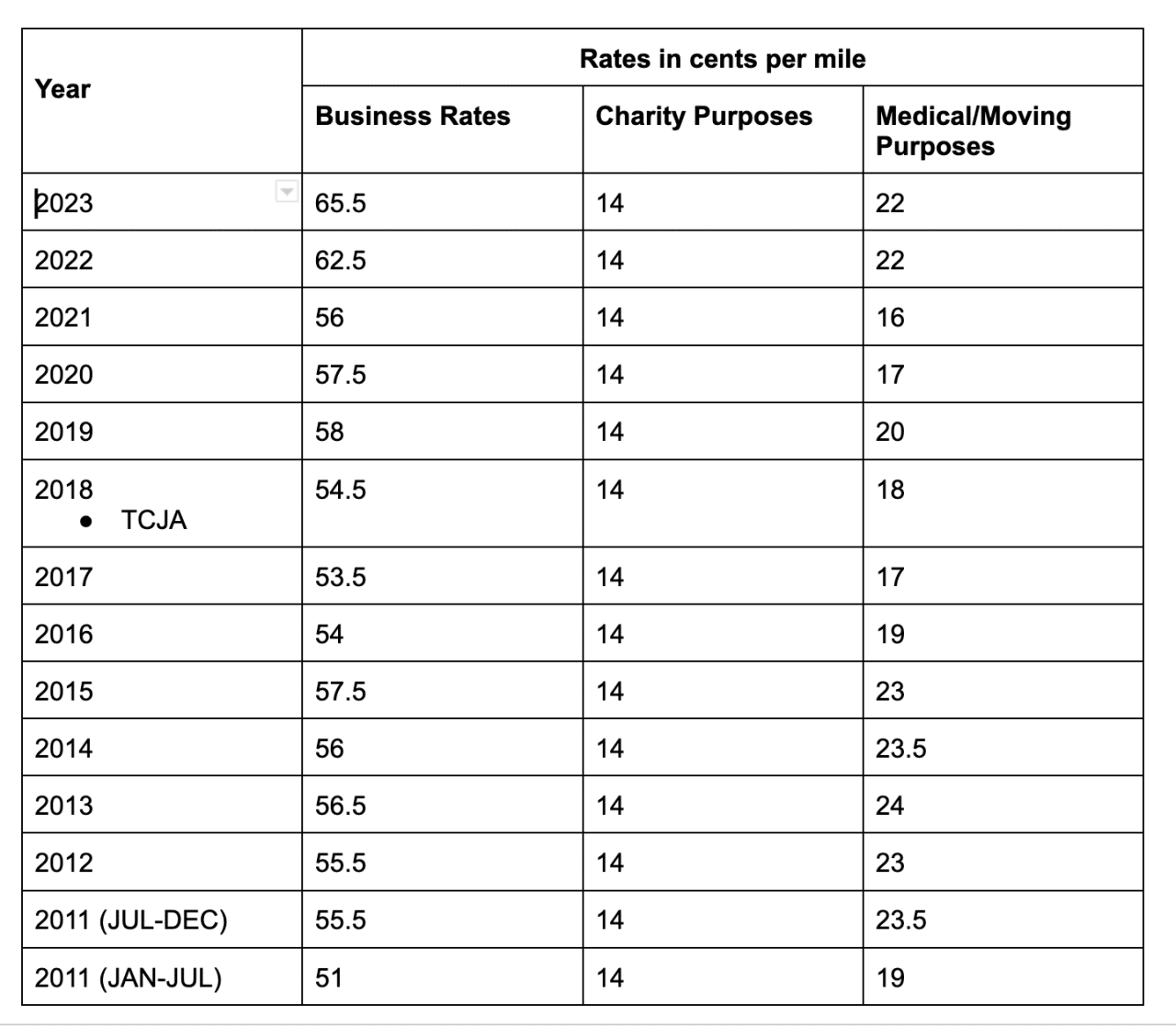

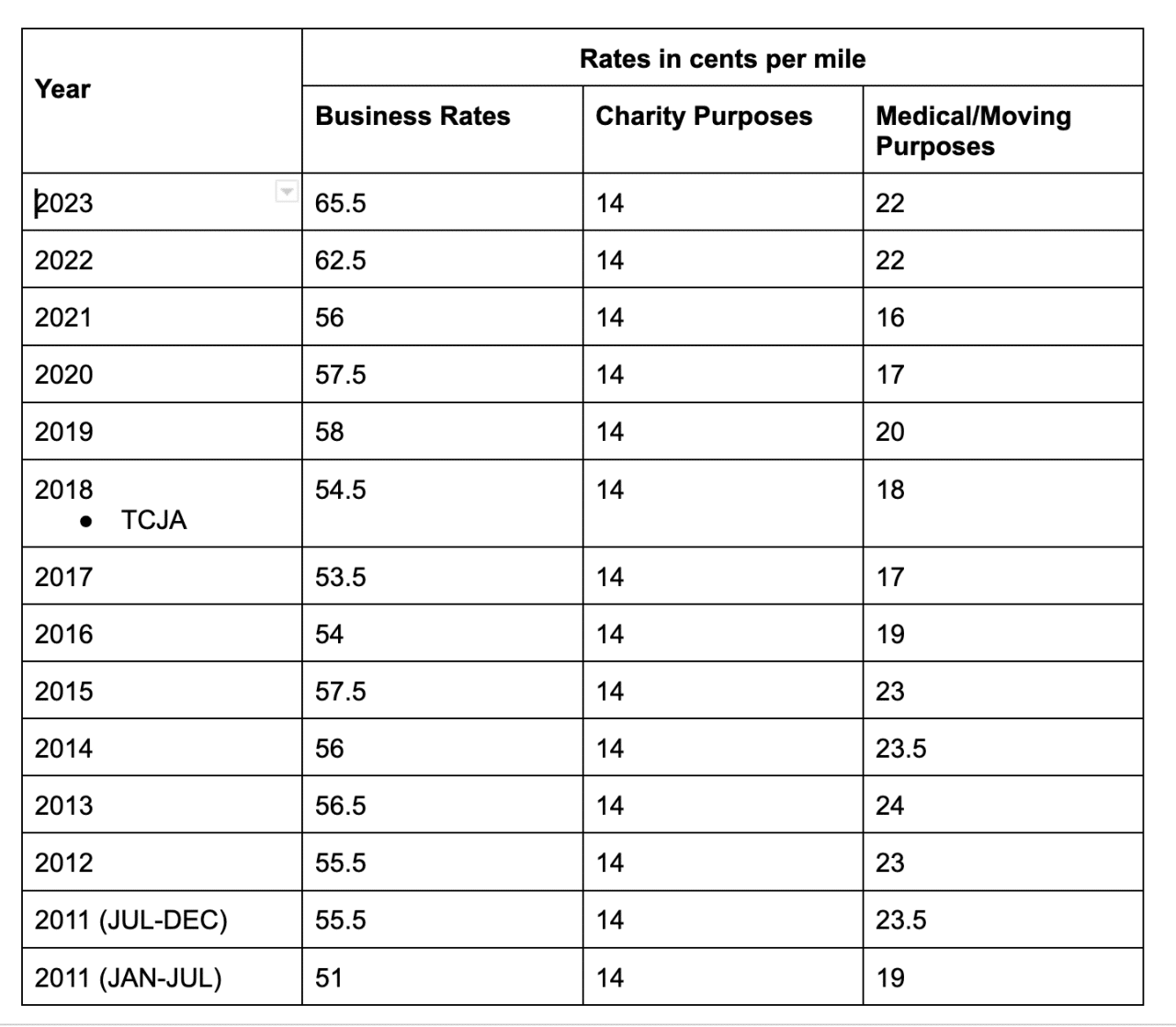

business expenses

October 2024 Mileage Rate Changes: What You Need to Know

October 2024 mileage rate changes are on the horizon, and understanding their implications is crucial for businesses and individuals alike. ...

Is the Mileage Rate Changing in October 2024?

Is the mileage rate changing in October 2024? This question has become a pressing concern for businesses and individuals alike, ...

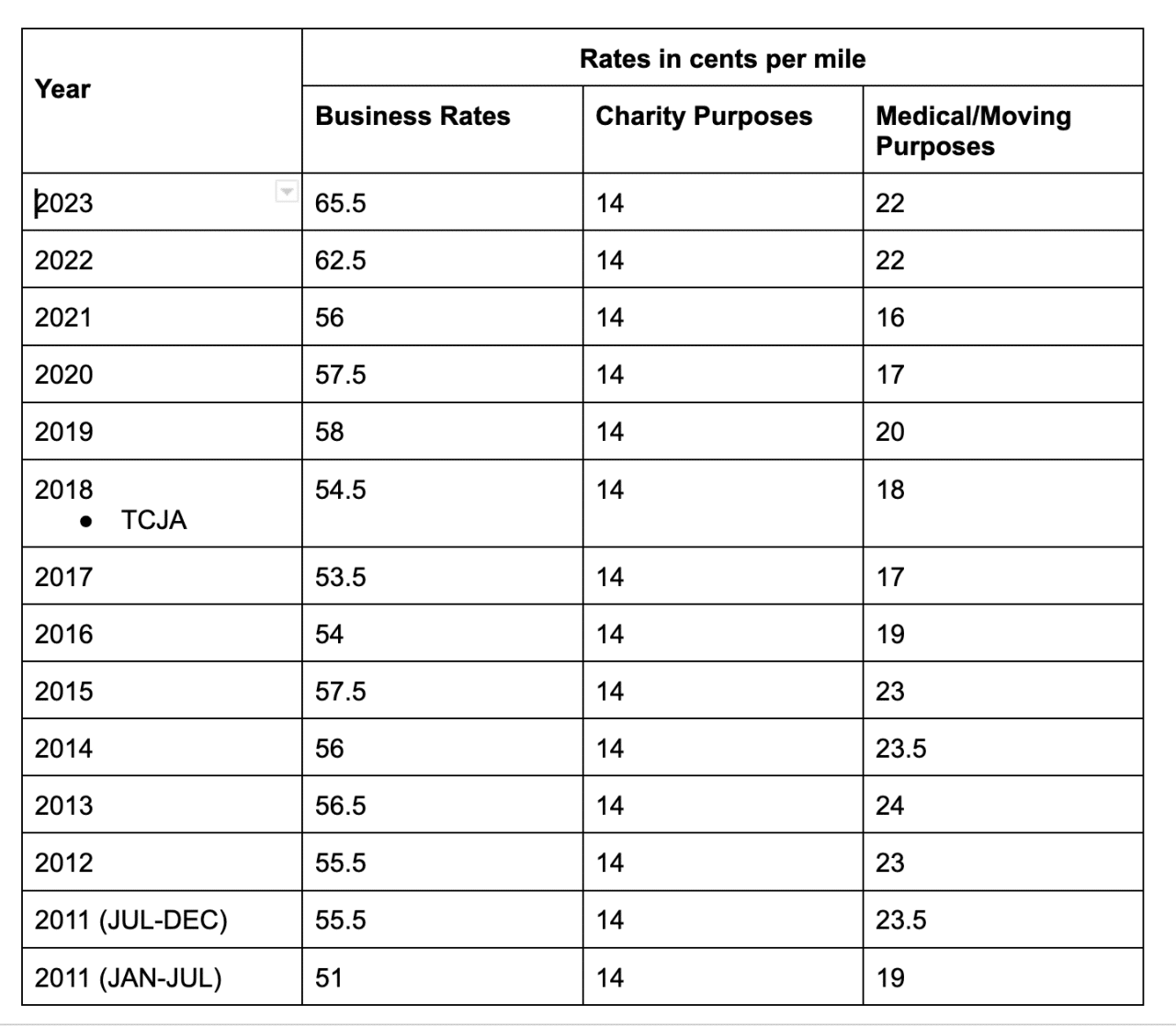

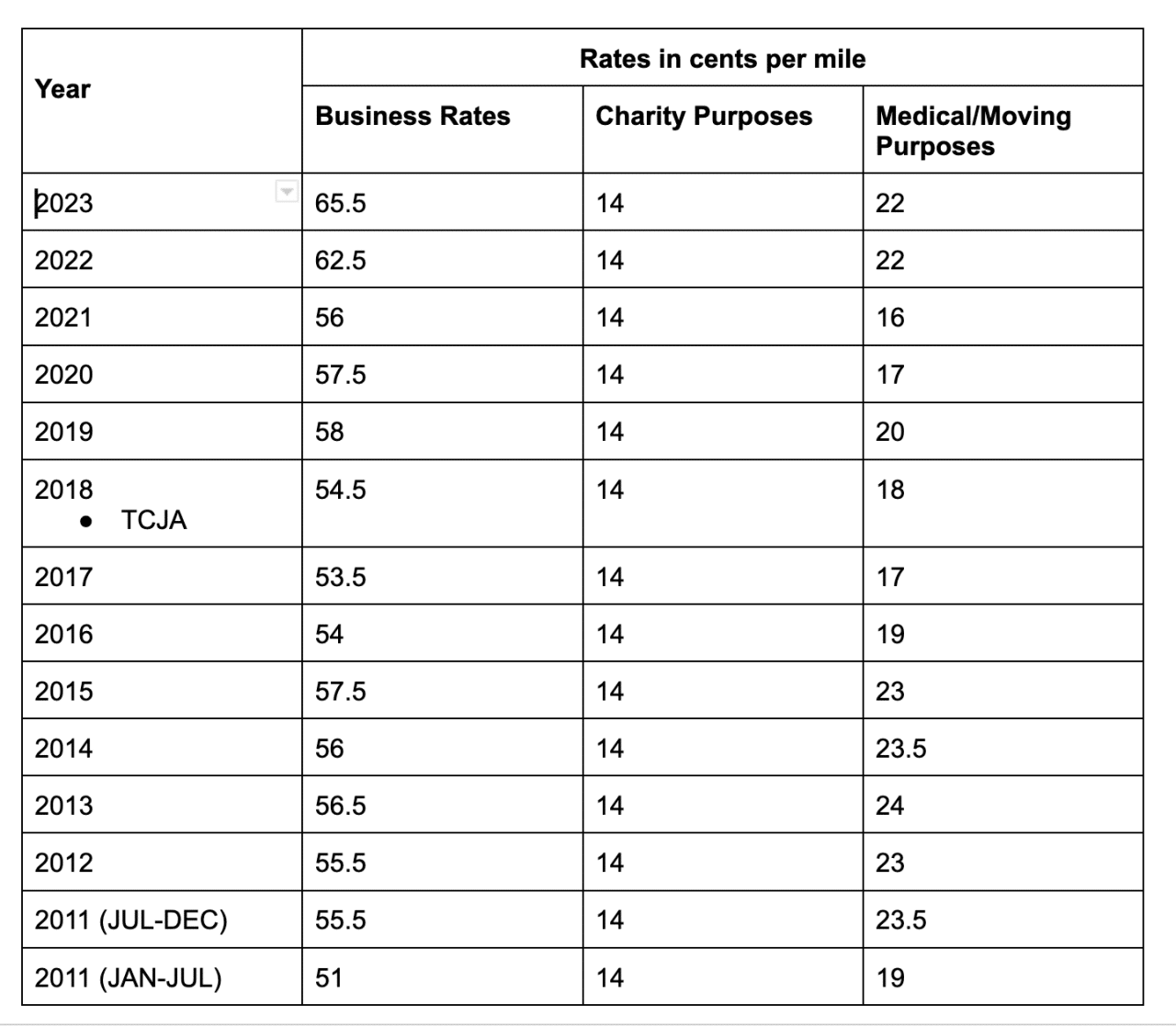

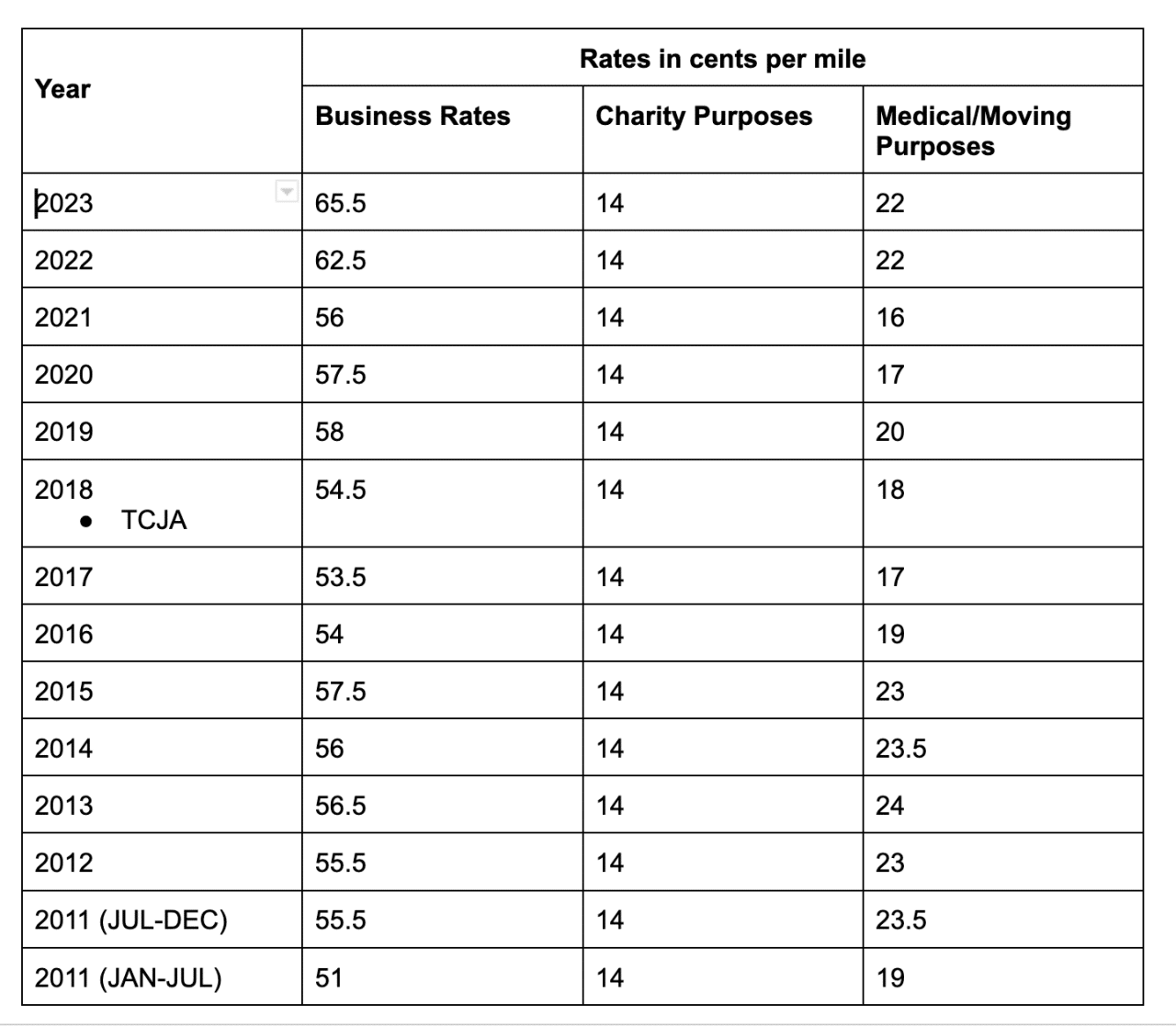

October 2024 Mileage Rate for Business Use

October 2024 Mileage Rate for Business Use is a crucial factor for anyone using their personal vehicle for work-related purposes. ...

Mileage Rate for October 2024: What You Need to Know

How much is the mileage rate for October 2024? This question is crucial for businesses and individuals who rely on ...

October 2024 Mileage Reimbursement Rates: What You Need to Know

What is the mileage reimbursement rate for October 2024? This question is crucial for individuals and businesses alike, as it ...

What is the Mileage Rate for October 2024?

What is the mileage rate for October 2024? This question is top of mind for many individuals and businesses who ...

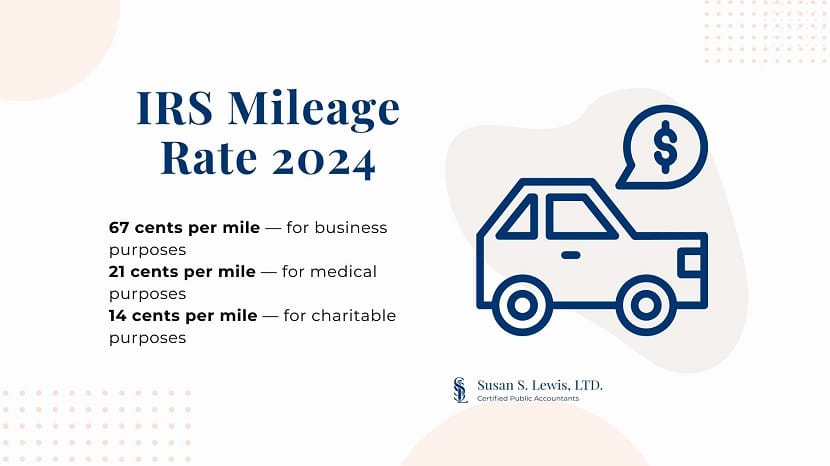

What is the IRS Mileage Rate for October 2024?

What is the IRS mileage rate for October 2024? This question is important for anyone who drives for business, medical, ...

2024 Mileage Rate: Understanding Your Driving Expenses

2024 Mileage Rate is a critical aspect for individuals and businesses seeking to accurately calculate driving expenses for tax purposes. ...