business taxes

Tax Implications of Starting a Business in October 2024

What are the tax implications of starting a business in October 2024? Embarking on a new business venture is an ...

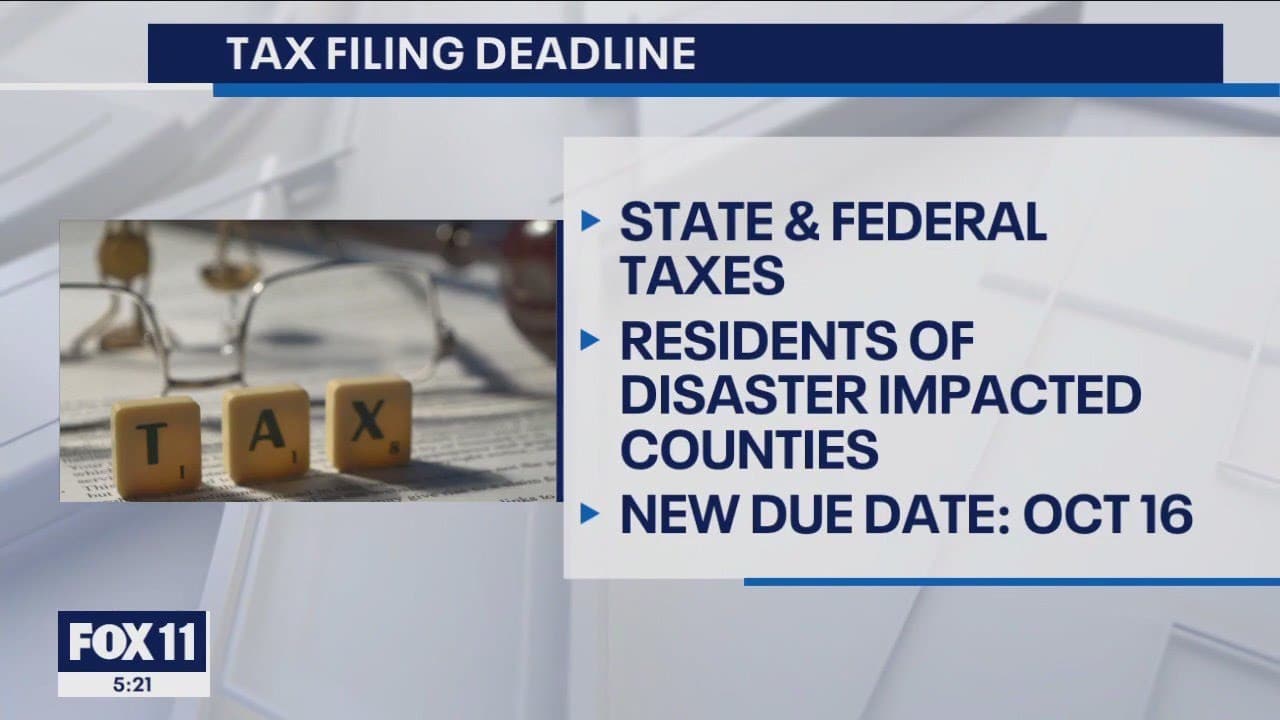

Tax Extension Deadline October 2024 for Partnerships

Tax extension deadline October 2024 for partnerships: A crucial date for businesses operating as partnerships, this deadline offers a lifeline ...

Extension Tax Deadline October 2024 for Businesses: A Guide

Extension Tax Deadline October 2024 for Businesses: The October 2024 tax deadline extension offers a lifeline to businesses grappling with ...

Tax Changes Impacting the October 2024 Deadline

Tax Changes Impacting the October 2024 Deadline are a significant event for both individuals and businesses. The upcoming changes bring ...

October 2024 Tax Deadline for Businesses: A Guide

October 2024 tax deadline for businesses is fast approaching, and it’s crucial for business owners to be prepared. This deadline ...