catch-up contributions

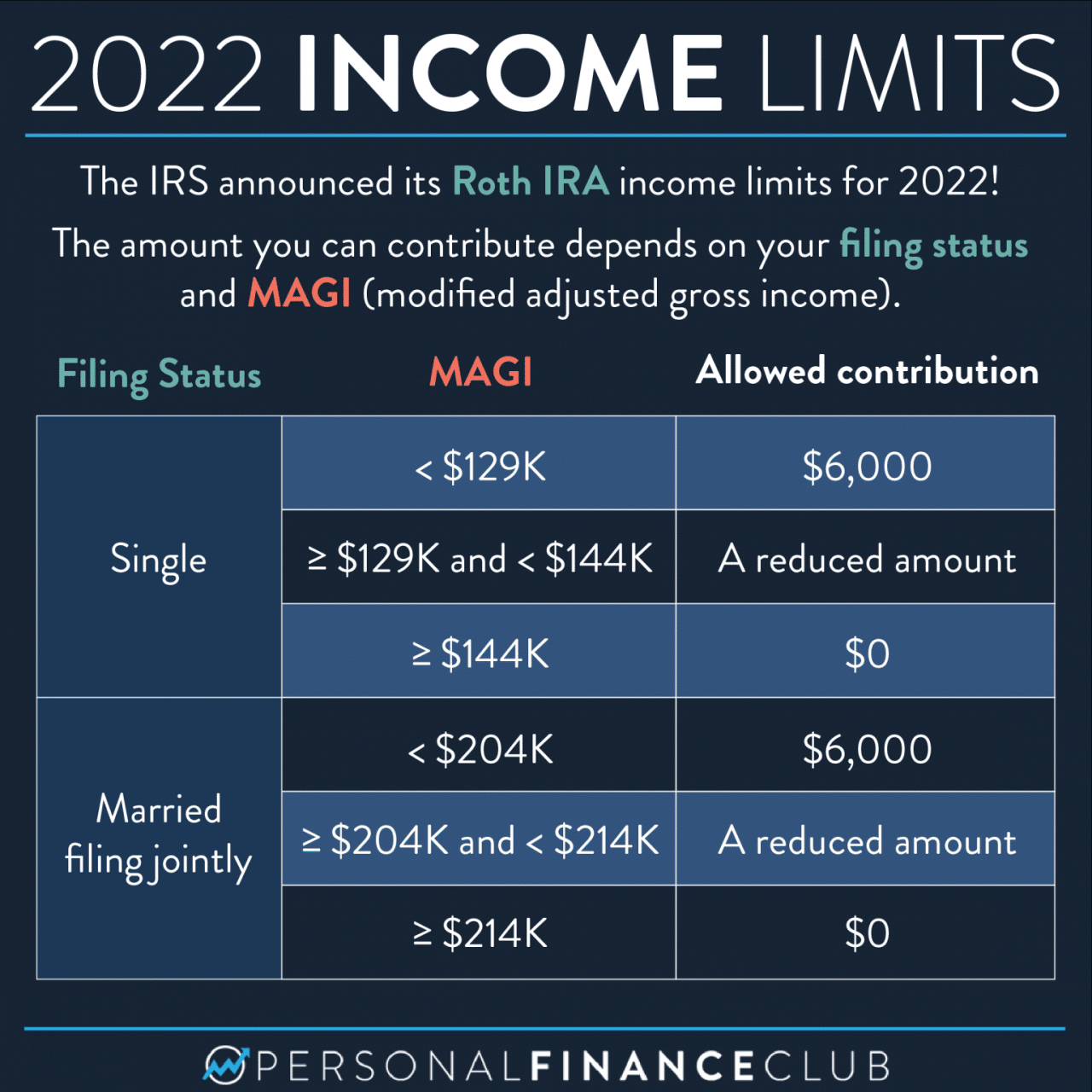

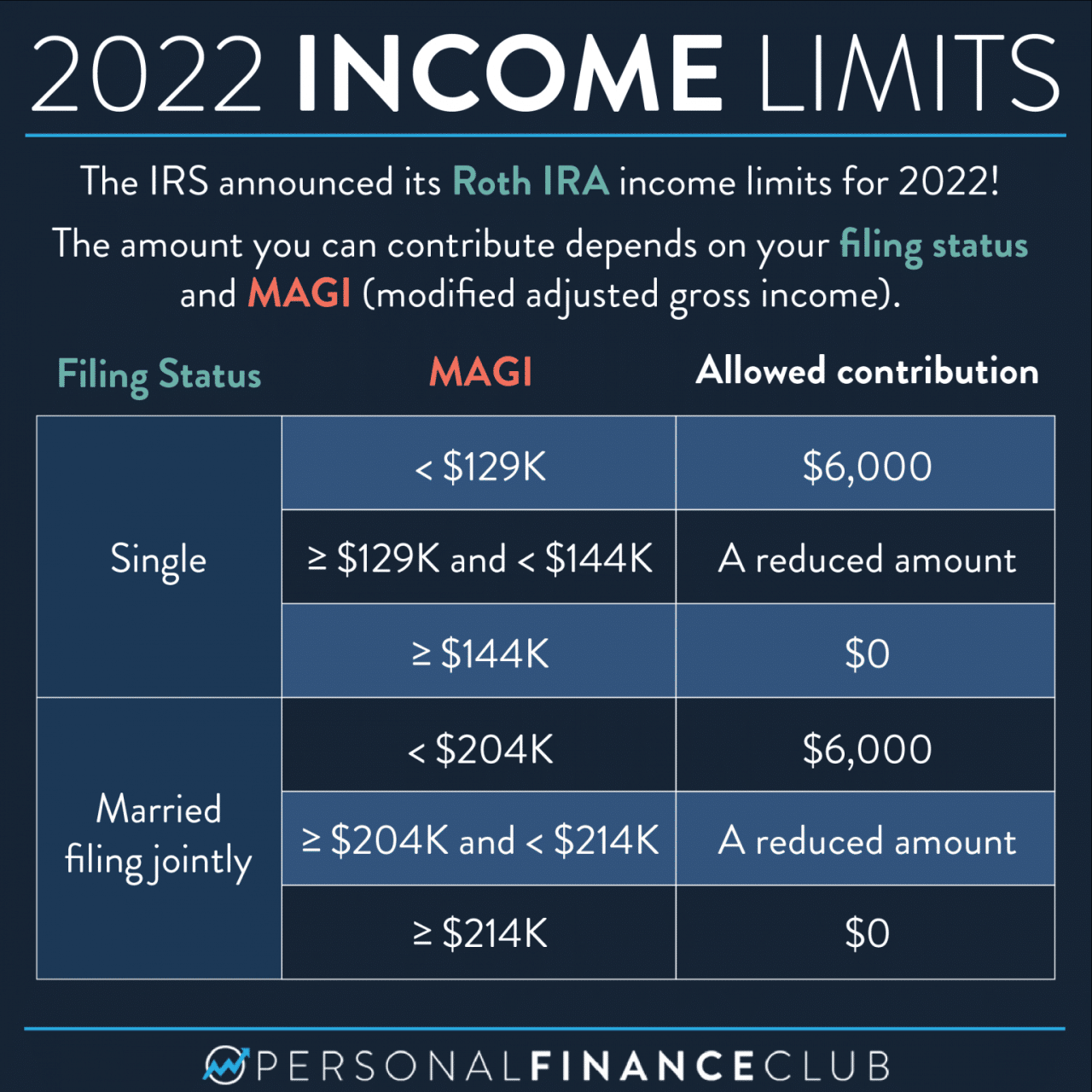

Roth IRA Catch-Up Contributions: 2024 Limits Explained

Is there a catch-up contribution limit for Roth IRAs in 2024? The answer is yes, and it’s a valuable tool ...

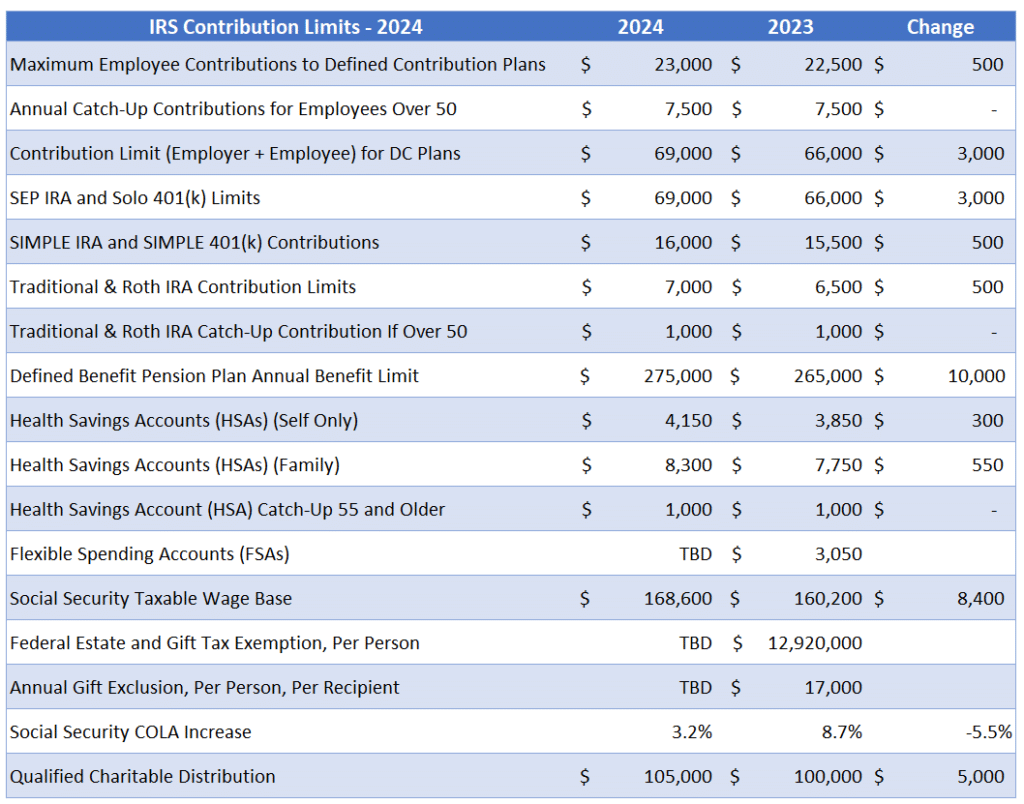

401k Contribution Limit 2024 & Catch-Up Contributions

401k contribution limit 2024 and catch-up contributions are essential for maximizing retirement savings. In 2024, the maximum amount you can ...

2024 401k Contribution Limits: Catch-Up for Over 50s

2024 401k contribution limits for employees over 50 present a unique opportunity to accelerate retirement savings. These “catch-up” contributions allow ...

Roth IRA Contribution Limits for 2024 Over 50: Catch-Up Contributions Explained

Roth IRA contribution limits for 2024 over 50 offer a powerful tool for retirement planning, especially for those approaching their ...

Roth IRA Contribution Limit for Over 50s in 2024

How much can I contribute to a Roth IRA in 2024 if I am over 50? If you’re over 50, ...

401k Contribution Limits for 2024: Catch-Up Contributions Explained

401k contribution limits for 2024 for catch-up contributions – The 401(k) contribution limits for 2024, including catch-up contributions, are crucial ...

401k Contribution Limit for 2024: Over 50 Catch-Up

401k Contribution Limit for 2024 for over 50: If you’re over 50, you have a chance to supercharge your retirement ...

401k Contribution Limits for 2024: Over 50

401k contribution limits for 2024 for over 50 offer a valuable opportunity to boost retirement savings. This year, those aged ...

Maximum 401k Contribution 2024: Catch-Up Rules Explained

Maximum 401k contribution 2024 with catch-up allows those 50 and over to significantly boost their retirement savings. This strategy empowers ...

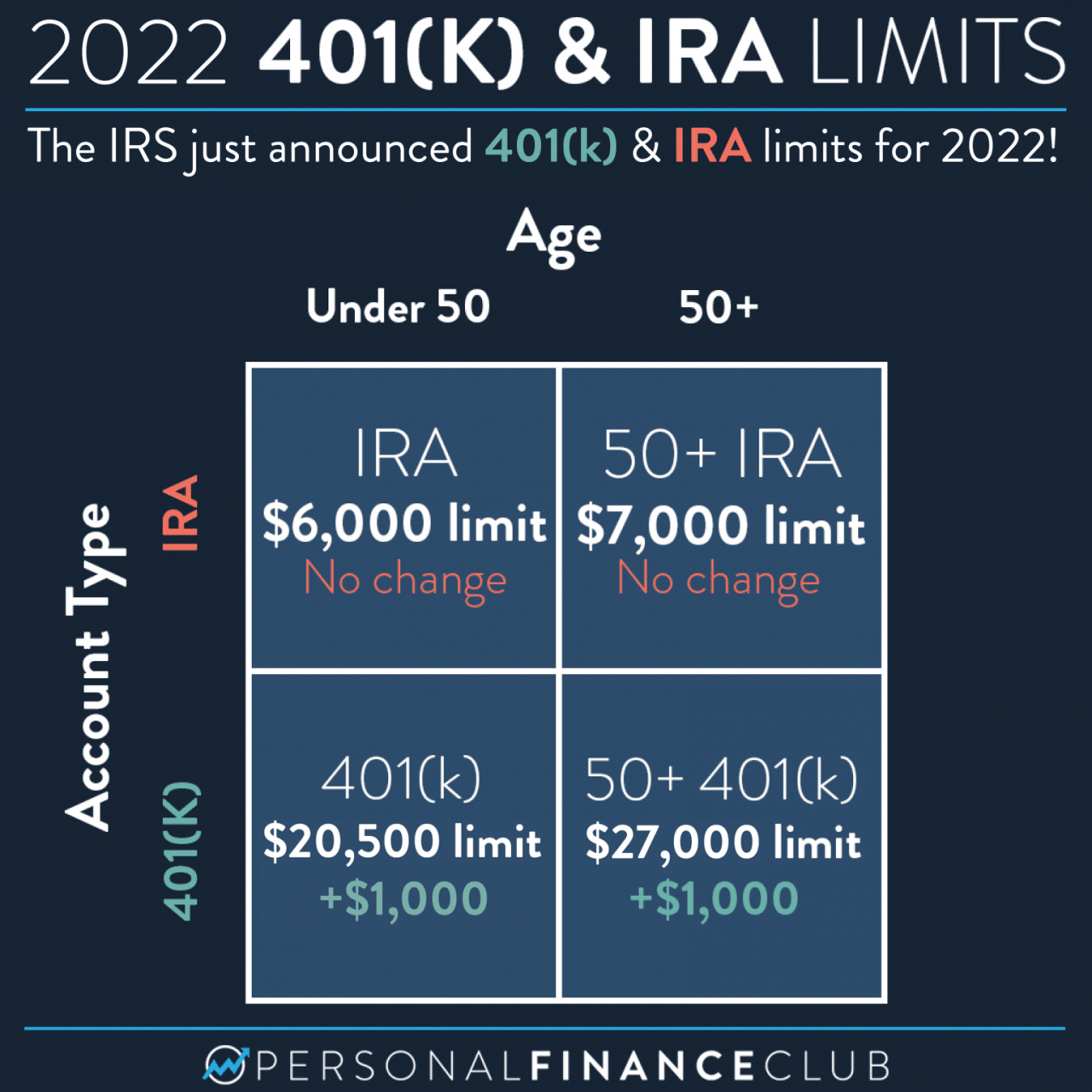

IRA Catch-Up Contributions in 2024: What You Need to Know

Is there a catch-up contribution limit for IRAs in 2024? Absolutely! If you’re 50 or older, you can contribute an ...