contribution limit

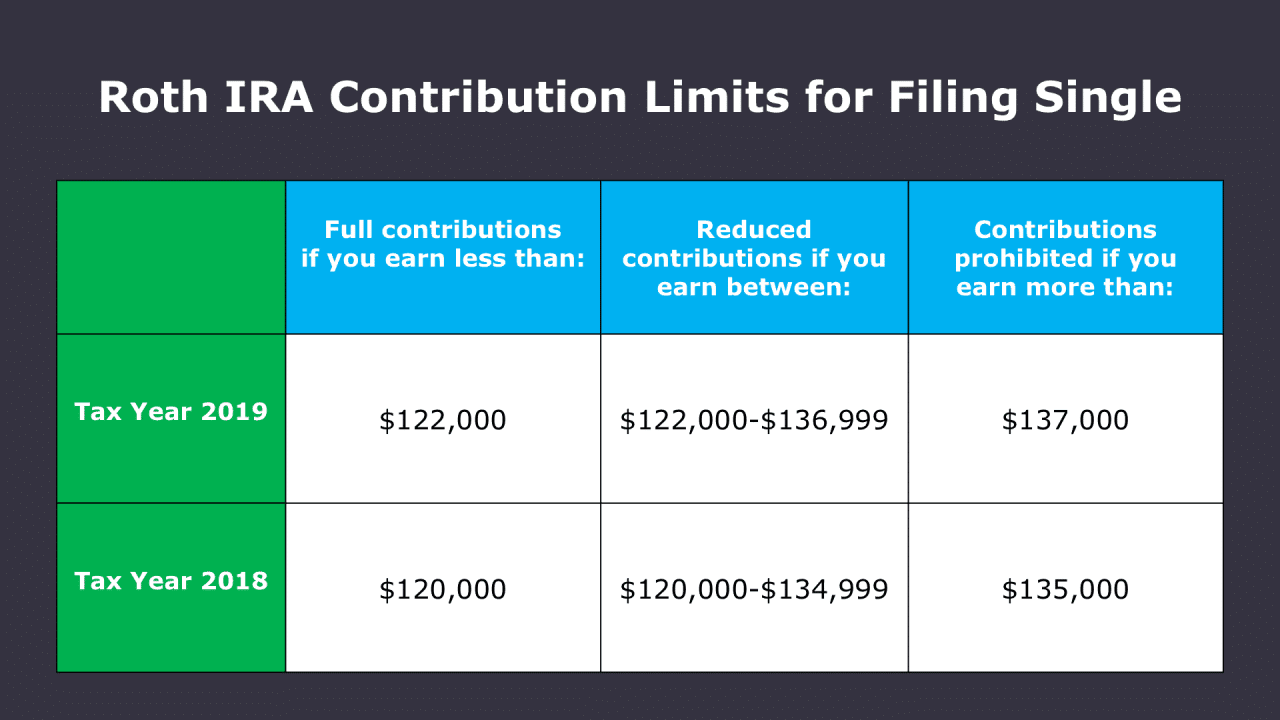

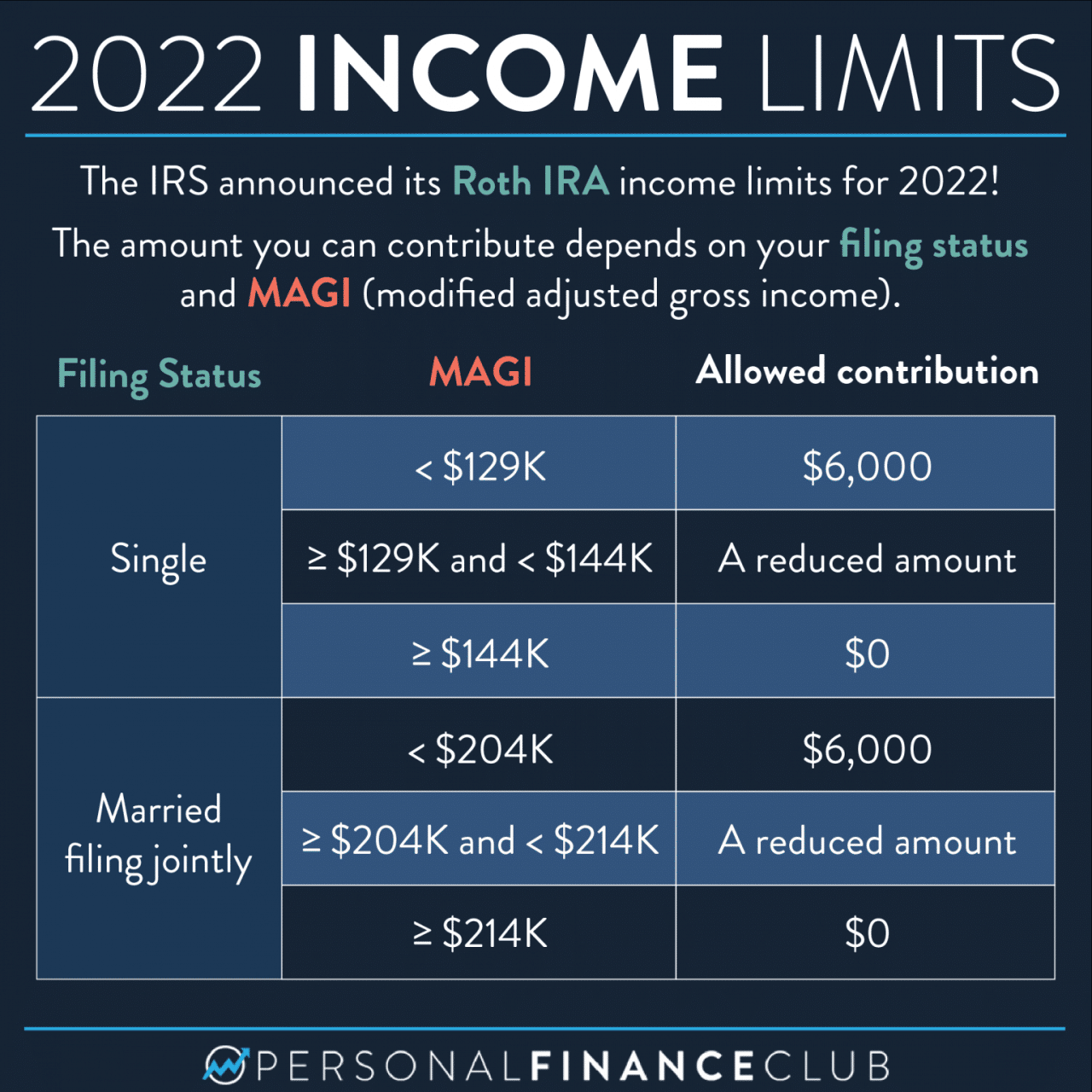

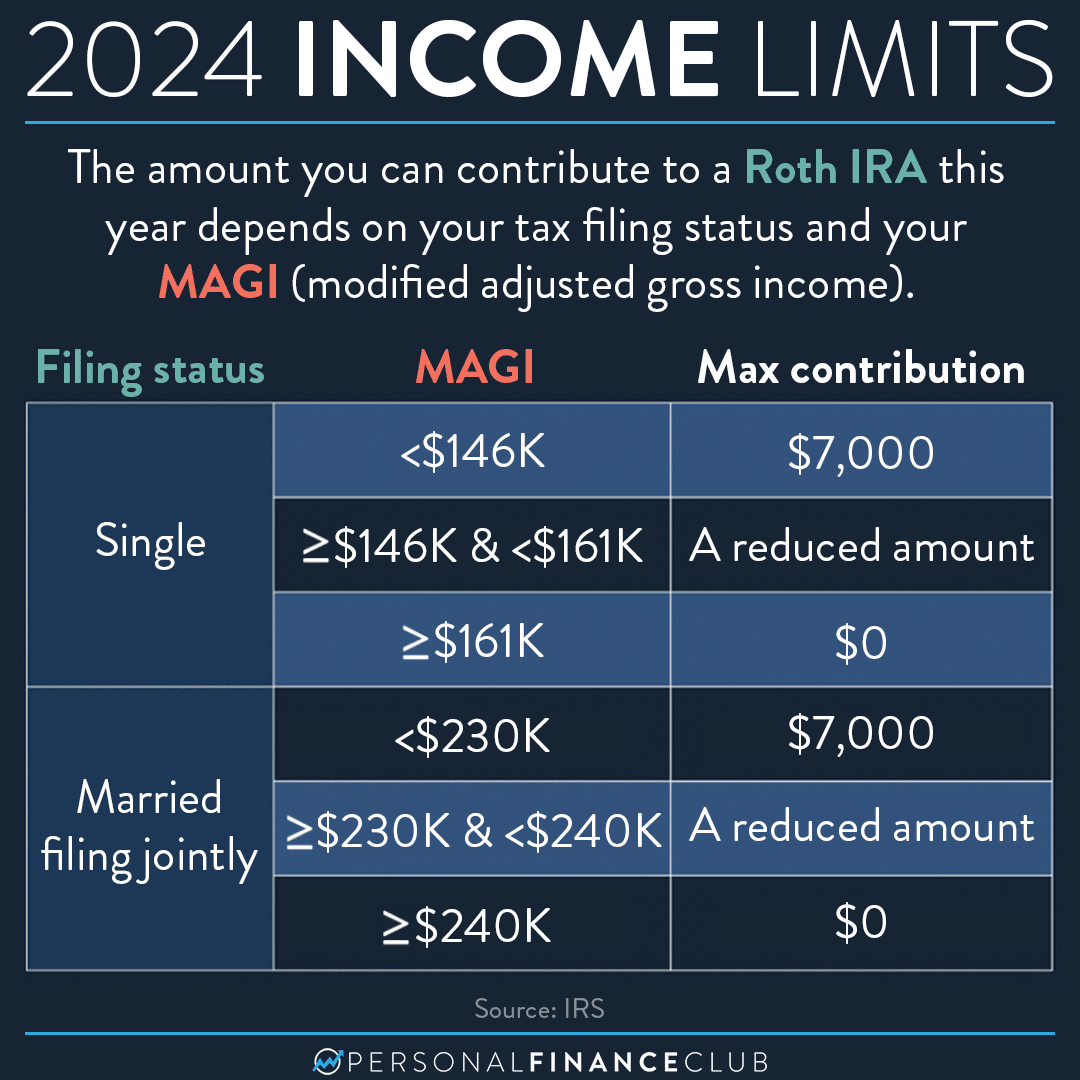

Roth IRA Contribution Limit Penalty in 2024

Roth IRA contribution limit penalty for exceeding the limit in 2024 is a crucial topic for those seeking tax advantages ...

Roth IRA Contribution Limit for Self-Employed in 2024

The Roth IRA contribution limit for self-employed individuals in 2024 presents a unique opportunity to save for retirement while potentially ...

Roth IRA Contribution Limits: Penalties in 2024

Are there any penalties for exceeding the Roth IRA contribution limit in 2024? This question is on the minds of ...

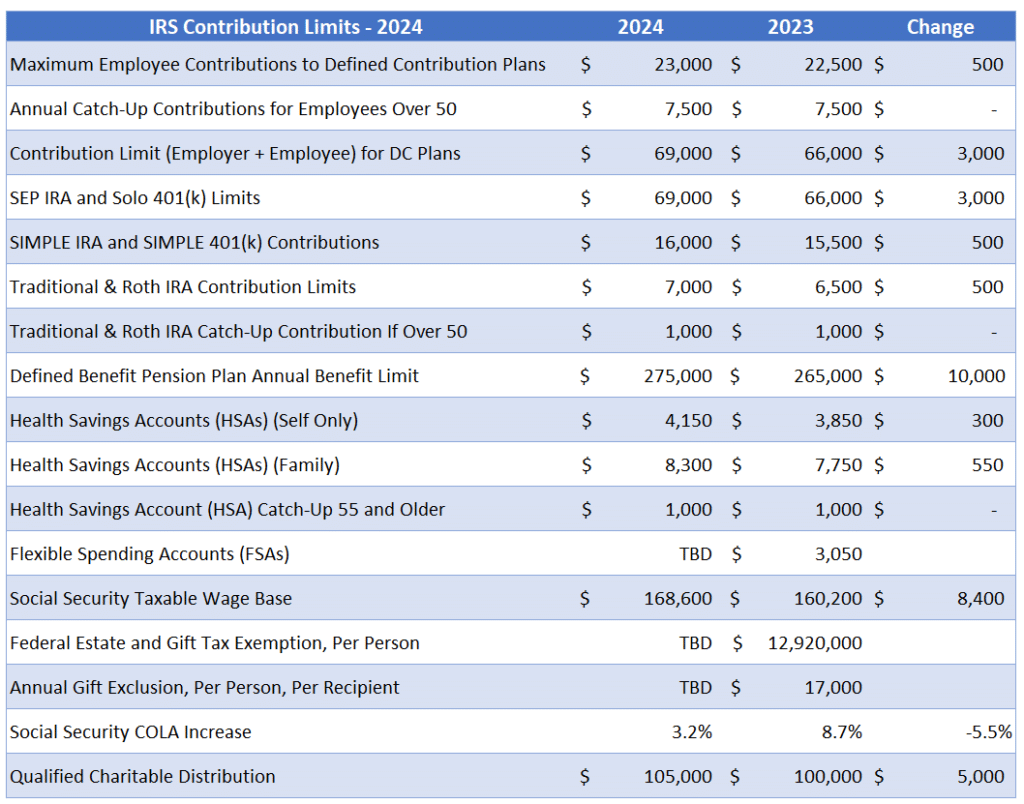

401k Contribution Limit 2024 & Catch-Up Contributions

401k contribution limit 2024 and catch-up contributions are essential for maximizing retirement savings. In 2024, the maximum amount you can ...

401k Contribution Limit 2024 for Self-Employed

401k contribution limit 2024 for self-employed, a crucial aspect of retirement planning for independent workers, sets the stage for securing ...

Roth IRA Contribution Limit 2024 for Divorced Individuals

Roth IRA contribution limit 2024 for divorced individuals – Navigating retirement planning after a divorce can be complex, especially when ...

Roth IRA Contribution Limit 2024 for Head of Household

Roth IRA contribution limit 2024 for head of household: Understanding this limit is crucial for maximizing your retirement savings. As ...

Roth IRA Limit for Married Filing Separately in 2024

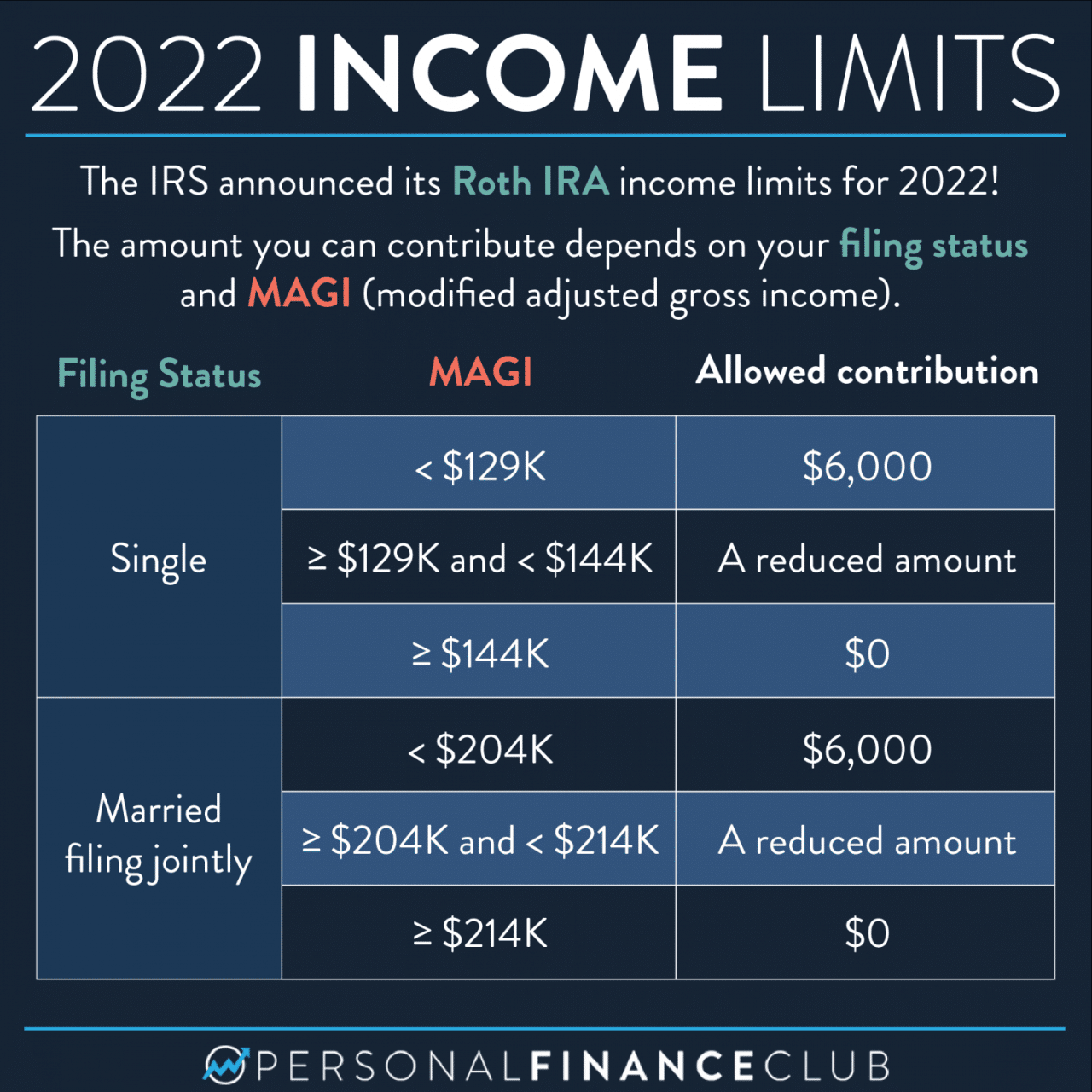

What is the Roth IRA contribution limit for 2024 for married filing separately? This question is crucial for married couples ...

401k Contribution Limit 2024: Your Guide to Retirement Savings

401k Contribution Limit 2024: Planning for retirement is a crucial aspect of financial well-being, and understanding the 401(k) contribution limit ...