financial planning

Immediate Annuity Tax Calculator: Understanding Your Retirement Income

The Immediate Annuity Tax Calculator takes center stage, providing a clear understanding of the tax implications associated with immediate annuities, ...

Immediate Annuity Tax Deductible: Retirement Planning

Immediate Annuity Tax Deductible – Immediate Annuities Tax Deductible: A retirement income strategy that allows for tax advantages, Immediate Annuities ...

What Is Immediate Annuities: Guaranteed Income for Life

What Is Immediate Annuities are a type of financial product that provides a guaranteed stream of income for life. Unlike ...

T Rowe Price Immediate Annuity: A Retirement Income Solution

T Rowe Price Immediate Annuity offers a way to turn your savings into a guaranteed stream of income for retirement. ...

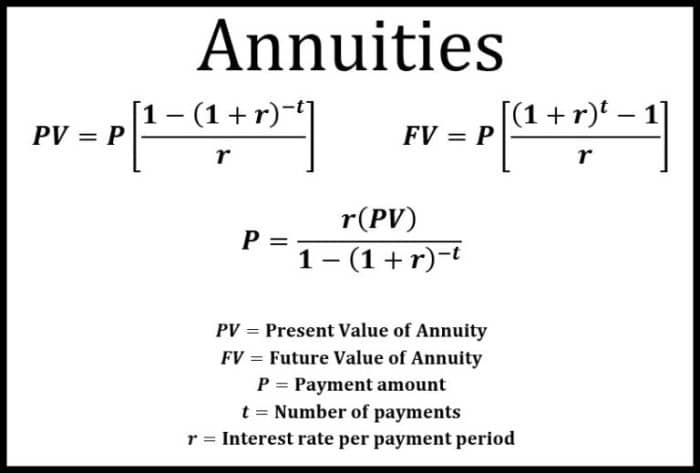

Immediate Annuity Tables: A Guide to Retirement Income

Immediate Annuity Tables provide a roadmap for understanding how these financial instruments can help you secure a steady stream of ...

Is Immediate Annuity: A Retirement Income Option

Is Immediate Annuity a retirement income option that offers a guaranteed stream of payments for life? It’s a financial tool ...

Is Immediate Annuity Income Taxable: Understanding the Rules

Is Immediate Annuity Income Taxable? This question is a common concern for individuals seeking guaranteed income streams in retirement. Immediate ...

Is An Immediate Annuity A Fixed Annuity?

Is An Immediate Annuity A Fixed Annuity? This question often arises when considering retirement income options, as both immediate and ...

Immediate Annuity Taxation Under 59 1/2: Early Withdrawal Implications

Immediate Annuity Taxation Under 59 1/2 explores the complexities of withdrawing funds from an immediate annuity before reaching the age ...