IRS regulations

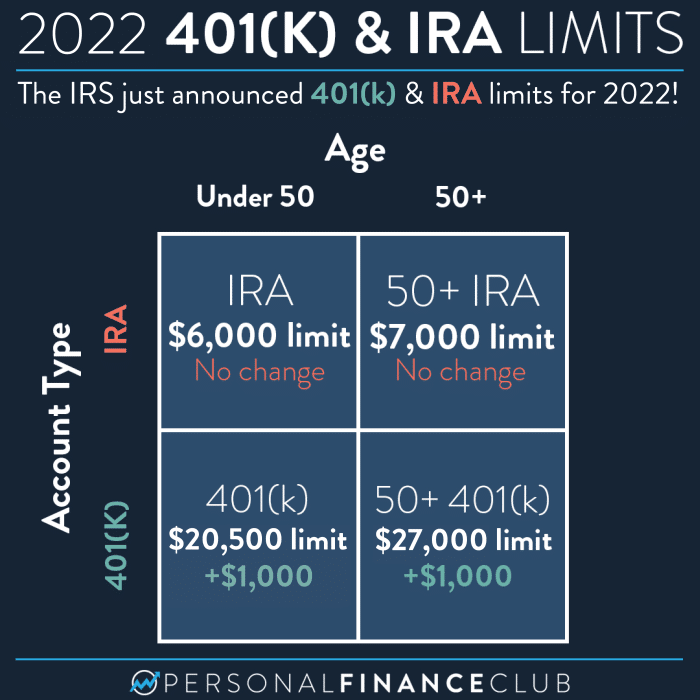

Variable Annuity Contribution Limits 2024: What You Need to Know

Variable Annuity Contribution Limits 2024: Navigating the landscape of variable annuities in 2024 requires a clear understanding of contribution limits. ...

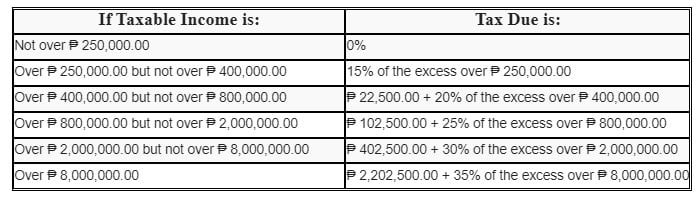

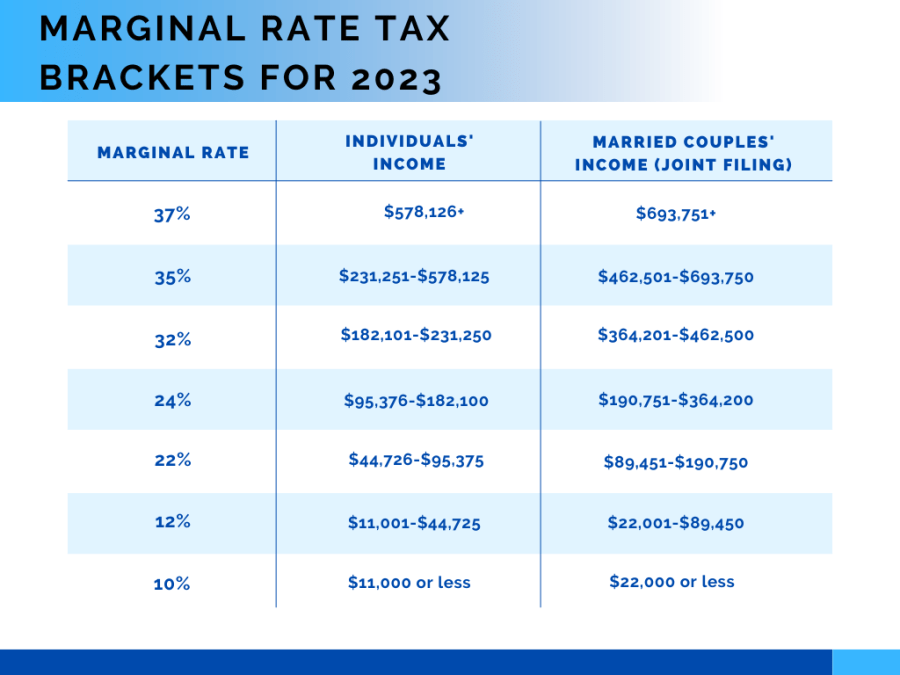

Annuity Is Taxable Or Not 2024: A Guide to Understanding Tax Implications

Annuity Is Taxable Or Not 2024: A Guide to Understanding Tax Implications – Annuities are a popular retirement savings tool, ...

Is Annuity Payments Taxable in 2024?

Is Annuity Payments Taxable 2024 – Is Annuity Payments Taxable in 2024? This question is crucial for anyone considering annuities ...

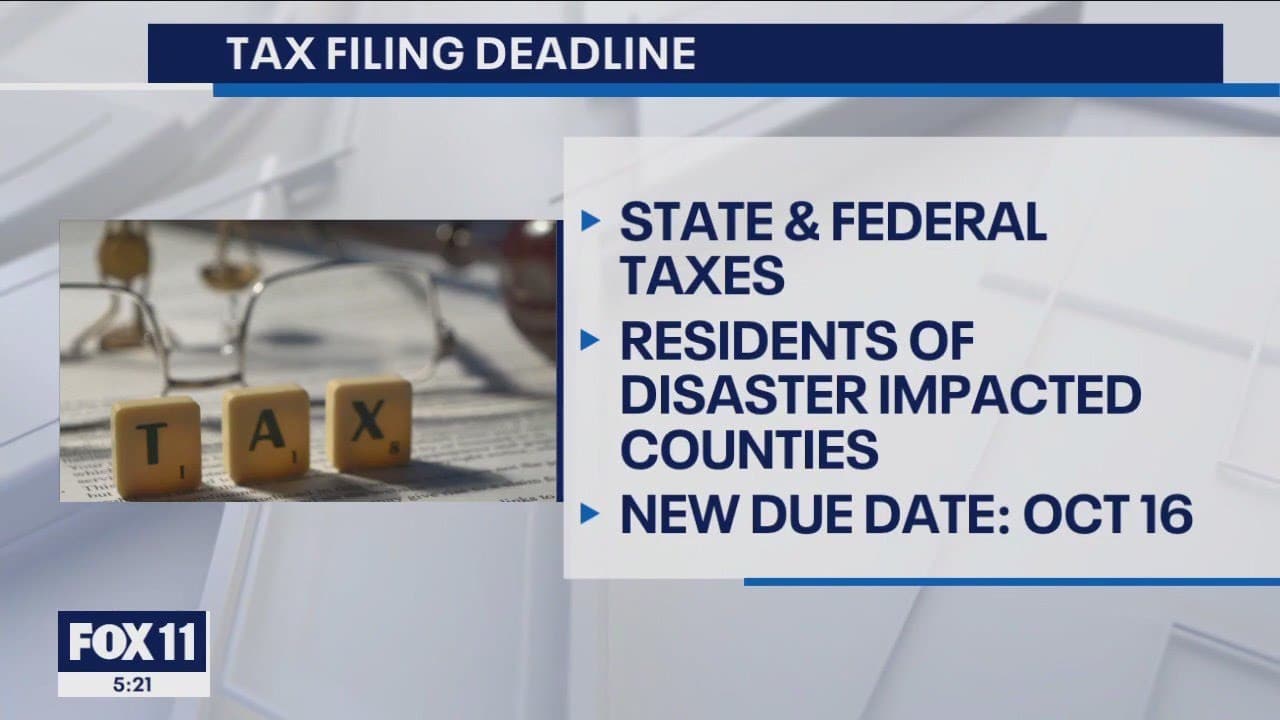

Tax Extension Deadline October 2024 for Partnerships

Tax extension deadline October 2024 for partnerships: A crucial date for businesses operating as partnerships, this deadline offers a lifeline ...

W9 Form October 2024 for Trusts: A Guide for Understanding Requirements

W9 Form October 2024 for trusts is a critical document for trusts seeking to engage in financial transactions. This form ...

October 2024 Mileage Rate for Business Use

October 2024 Mileage Rate for Business Use is a crucial factor for anyone using their personal vehicle for work-related purposes. ...