IRS

Standard Deduction Amount for 2024 Tax Year: Your Guide

Standard deduction amount for 2024 tax year is a crucial factor in determining your tax liability. This deduction allows you ...

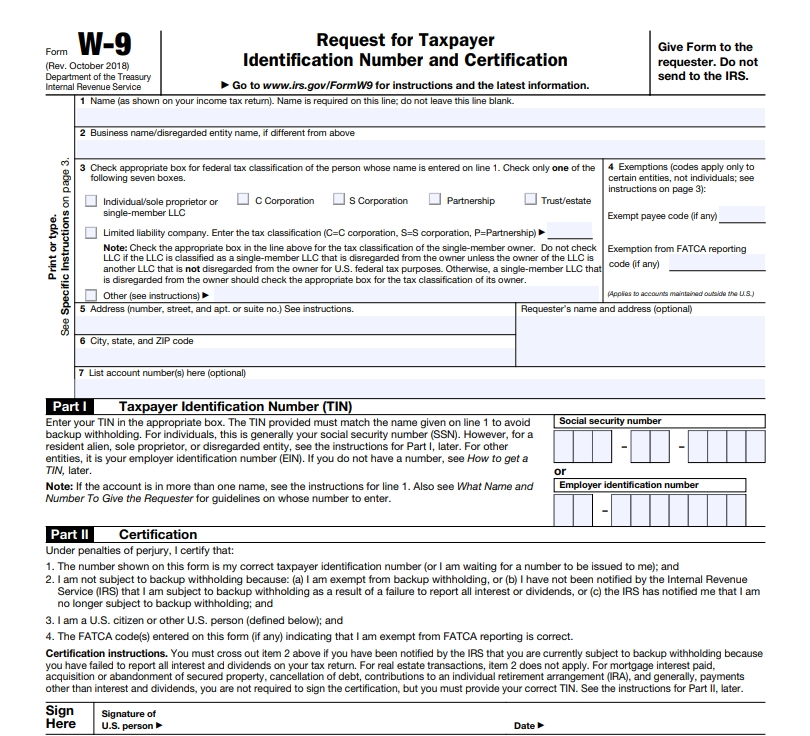

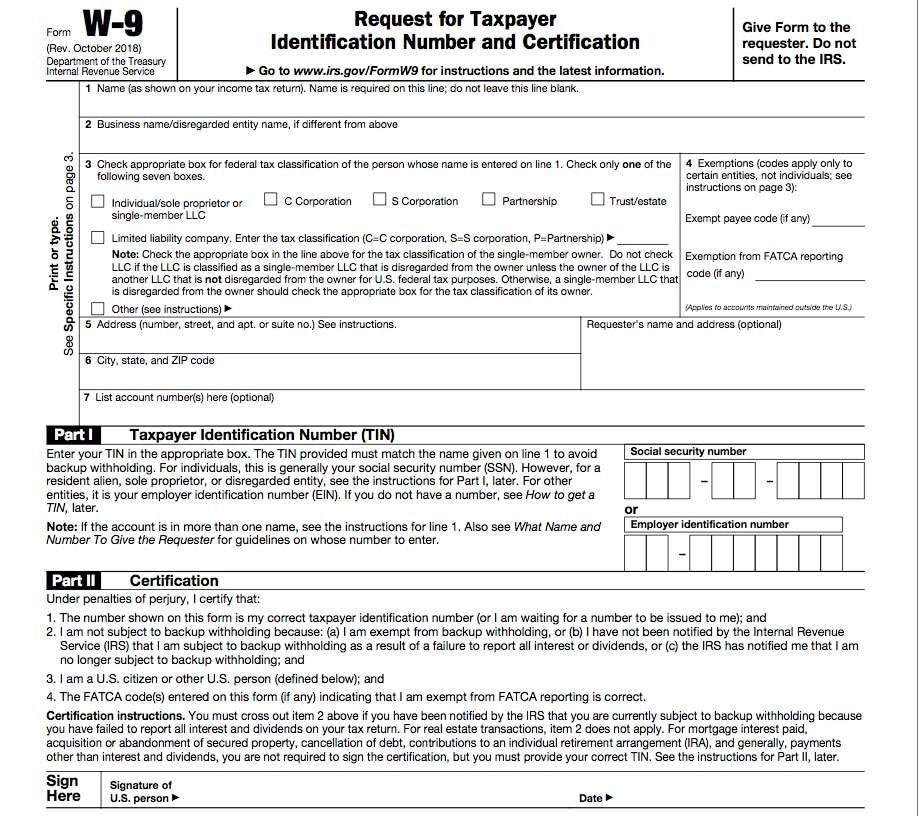

W9 Form October 2024: Non-Profit Organization Guide

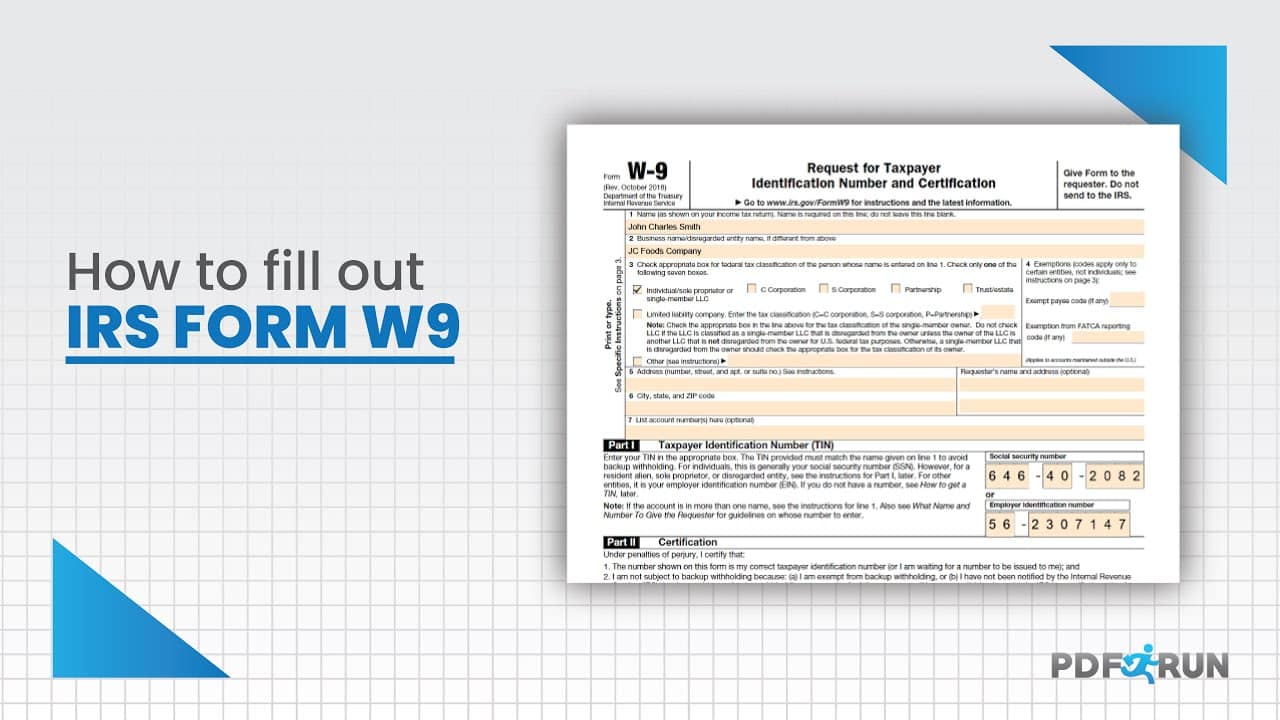

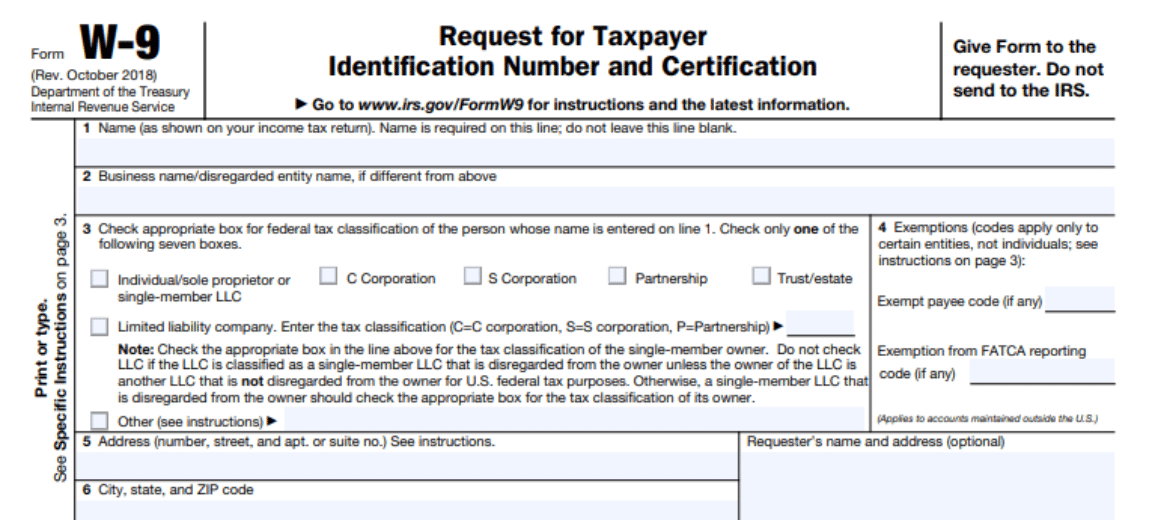

W9 Form October 2024 for non-profit organizations is an essential document that helps ensure proper tax reporting and compliance. This ...

W9 Form October 2024 for Corporations: A Guide

W9 Form October 2024 for corporations sets the stage for this enthralling narrative, offering readers a glimpse into a story ...

How to fill out W9 Form for October 2024: A Comprehensive Guide

How to fill out W9 Form for October 2024: A Comprehensive Guide Navigating the world of taxes can be daunting, ...

W9 Form October 2024 for Freelancers: A Guide to Compliance

W9 Form October 2024 for freelancers is a crucial document for independent contractors, ensuring smooth tax reporting and payment. As ...

W9 Form October 2024 Changes and Updates

W9 Form October 2024 changes and updates are here, bringing new requirements and adjustments for individuals and businesses alike. The ...

W9 Form October 2024 Deadline: Filing Requirements and Tips

The W9 Form October 2024 deadline for filing is approaching, and understanding the requirements is crucial for individuals and businesses ...

W9 Form October 2024 Requirements for Businesses

W9 Form October 2024 requirements for businesses are crucial for ensuring accurate tax reporting and compliance. The W9 Form serves ...

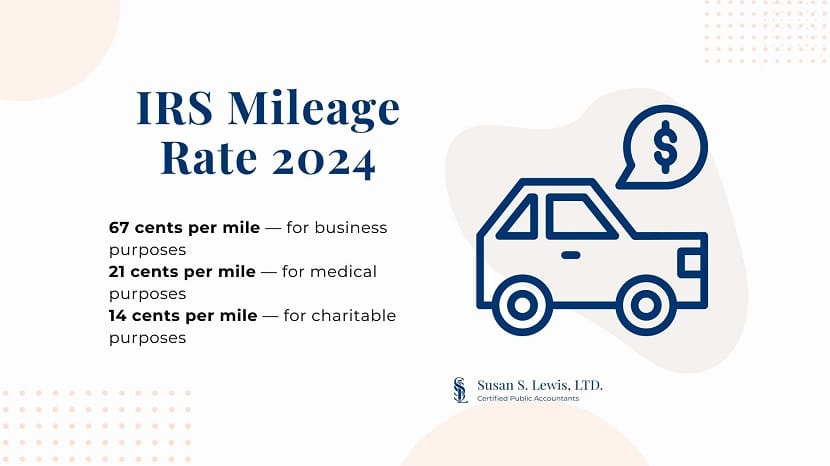

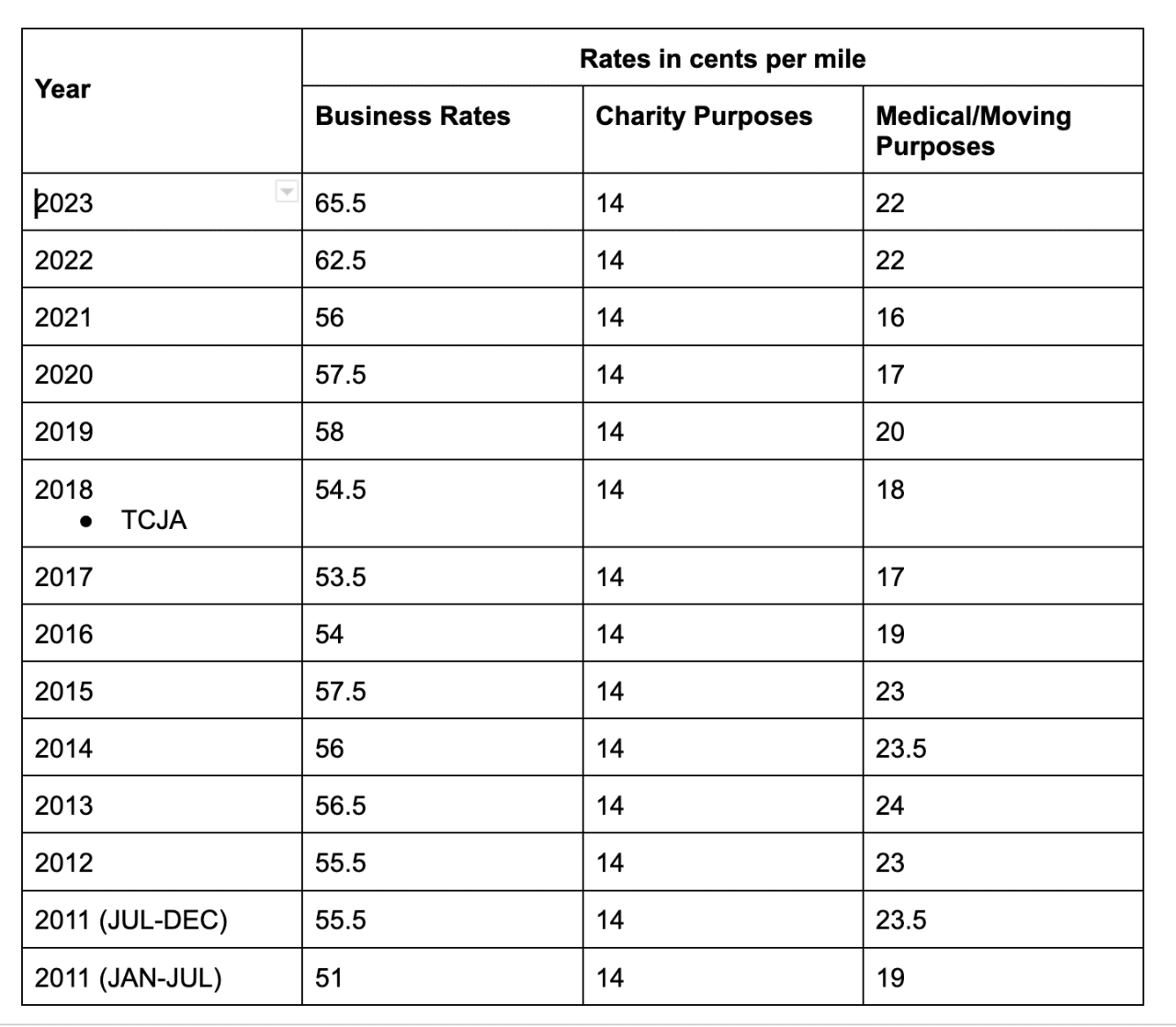

Mileage Rate Calculation for October 2024

How is the mileage rate calculated for October 2024? Understanding how mileage rates are determined is crucial for individuals and ...

October 2024 Mileage Rate for Driving to Work

October 2024 mileage rate for driving to work is a critical factor for individuals who commute to their workplaces. Understanding ...