retirement planning

Immediate Annuity Taxation Under 59 1/2: Early Withdrawal Implications

Immediate Annuity Taxation Under 59 1/2 explores the complexities of withdrawing funds from an immediate annuity before reaching the age ...

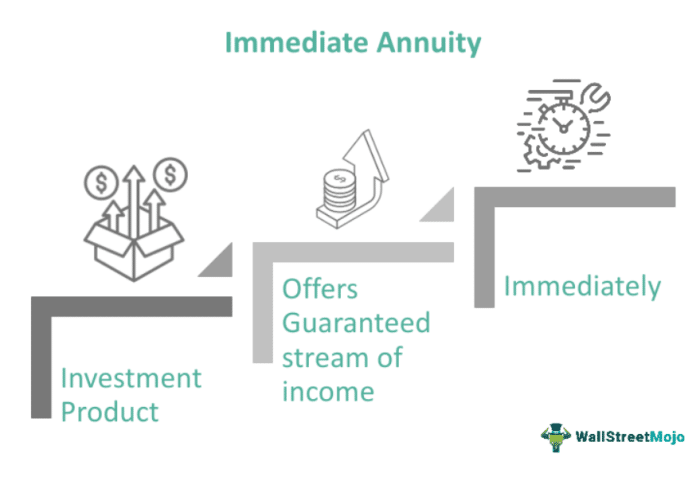

Immediate Annuity Taxation: Understanding the Tax Implications

Immediate Annuity Taxation is a critical aspect of retirement planning, as it directly impacts the amount of income you receive ...

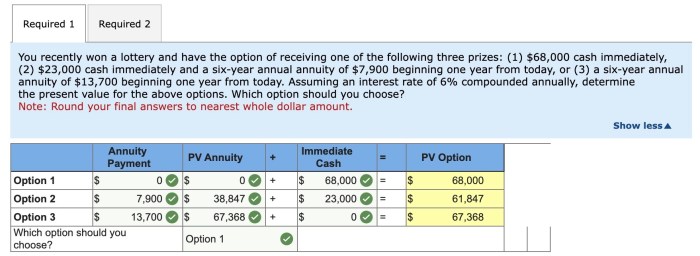

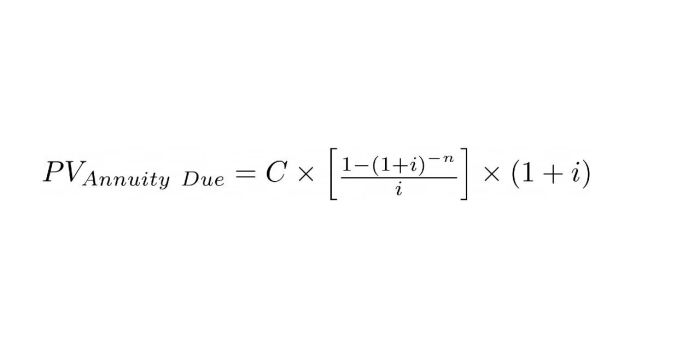

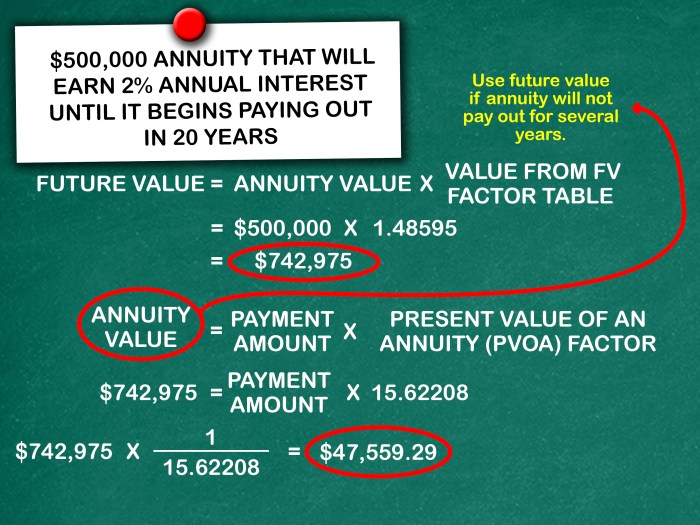

Immediate Annuity Example Problems With Solutions

Immediate Annuity Example Problems With Solutions delves into the intricacies of immediate annuities, providing practical examples and solutions to help ...

Immediate Annuity Singapore: Secure Your Retirement Income

Immediate Annuity Singapore offers a unique way to secure a guaranteed income stream throughout retirement. These annuities provide a steady ...

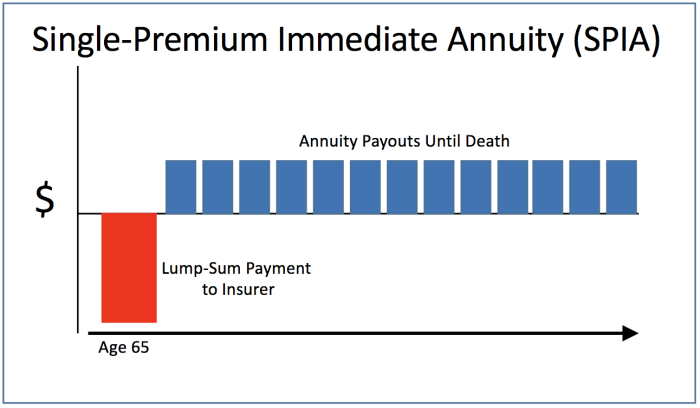

Immediate Annuity Rate: Your Guide to Retirement Income

Immediate Annuity Rate, a financial tool that can provide a steady stream of income during retirement, is a powerful option ...

Immediate Annuity Schemes In India: A Guide to Guaranteed Income

Immediate Annuity Schemes In India are gaining popularity as a way to secure a steady income stream during retirement. These ...

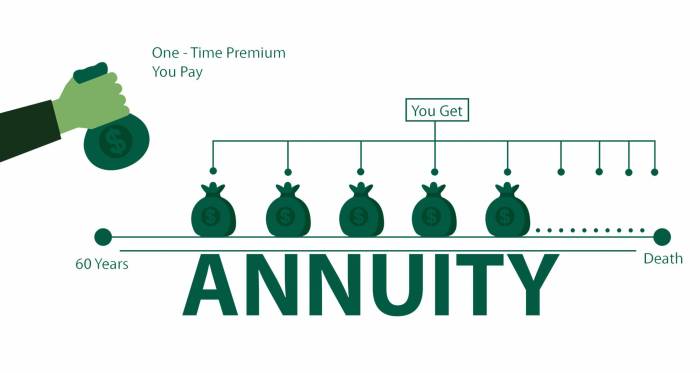

Immediate Annuity Returns: A Guide to Guaranteed Income

Immediate Annuity Returns offer a way to convert a lump sum of money into a steady stream of income for ...

Immediate Annuity Rates In India: A Comprehensive Guide

Immediate Annuity Rates In India offer a unique way to secure a steady income stream during retirement. These annuities, which ...