retirement planning

IRS 401k Contribution Limit for 2024: What You Need to Know

IRS 401k contribution limit for 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story ...

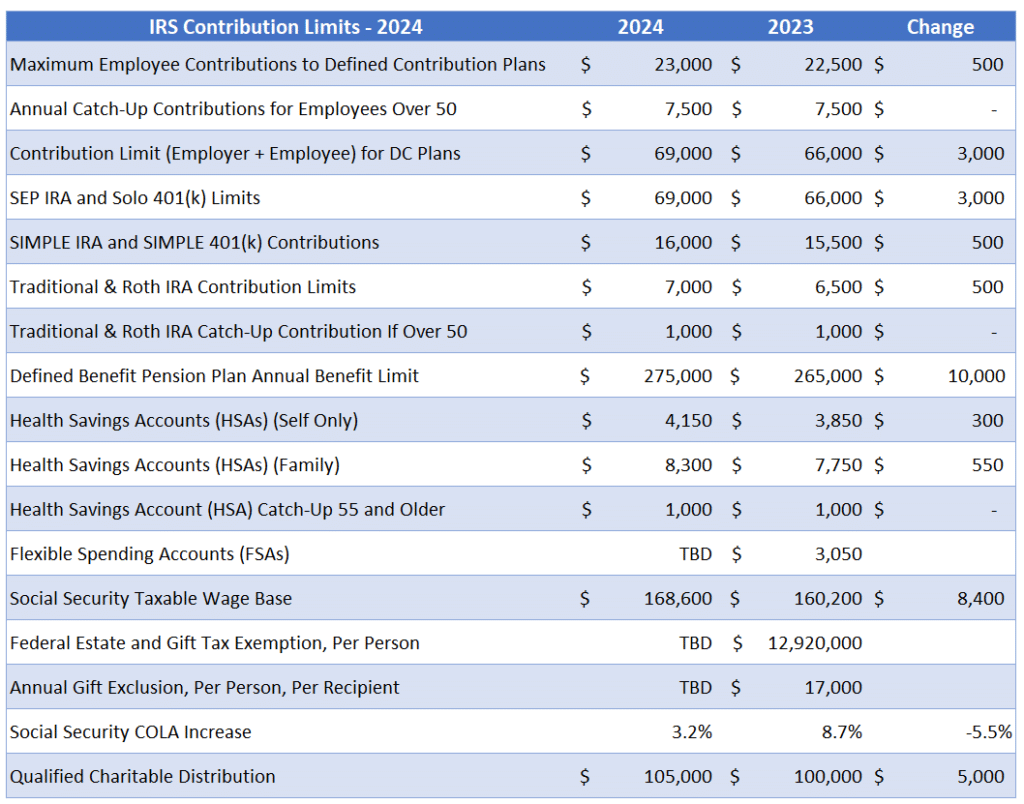

401k Contribution Limit Increase for 2024: A Boost to Your Retirement Savings

401k contribution limit increase for 2024 signifies a significant opportunity to enhance your retirement savings. The new limit, a substantial ...

2024 401k Contribution Limits: Catch-Up for Over 50s

2024 401k contribution limits for employees over 50 present a unique opportunity to accelerate retirement savings. These “catch-up” contributions allow ...

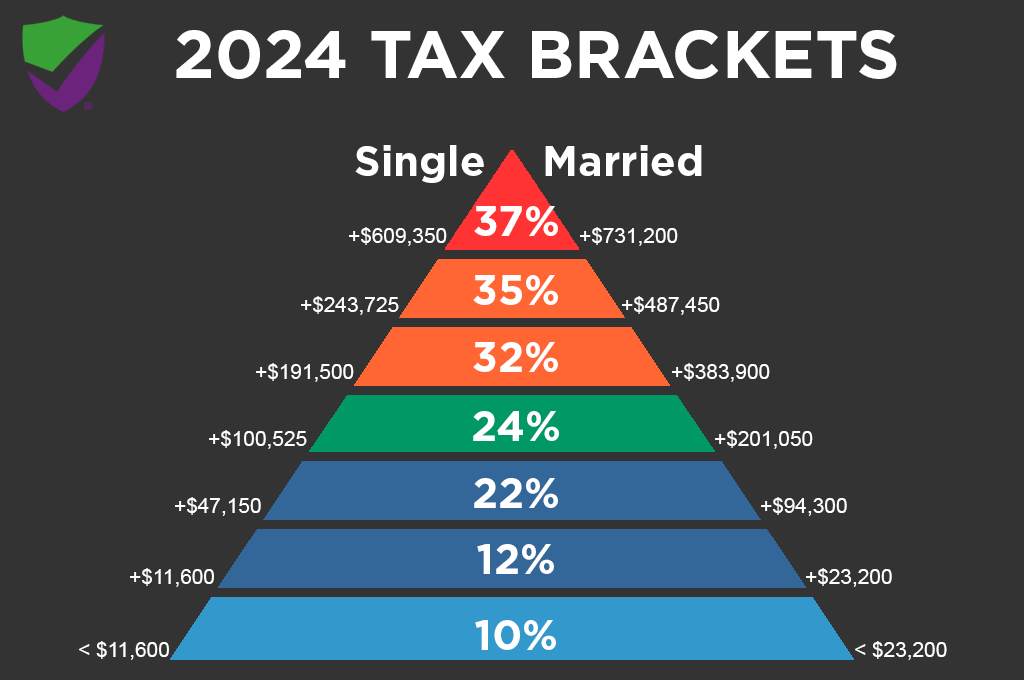

How Do 2024 Tax Brackets Affect Retirement Savings?

How do the 2024 tax brackets affect my retirement savings? This question is on the minds of many as they ...

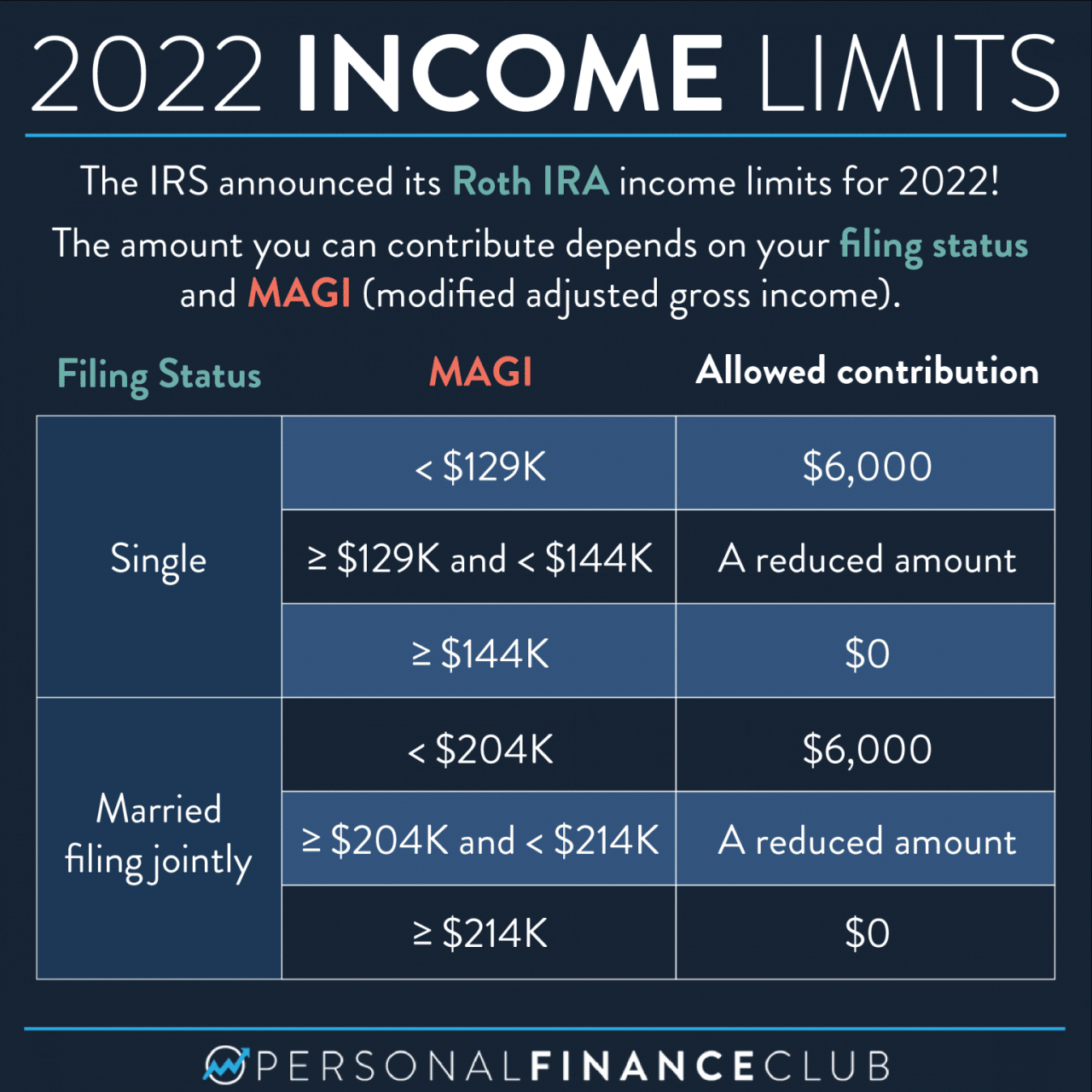

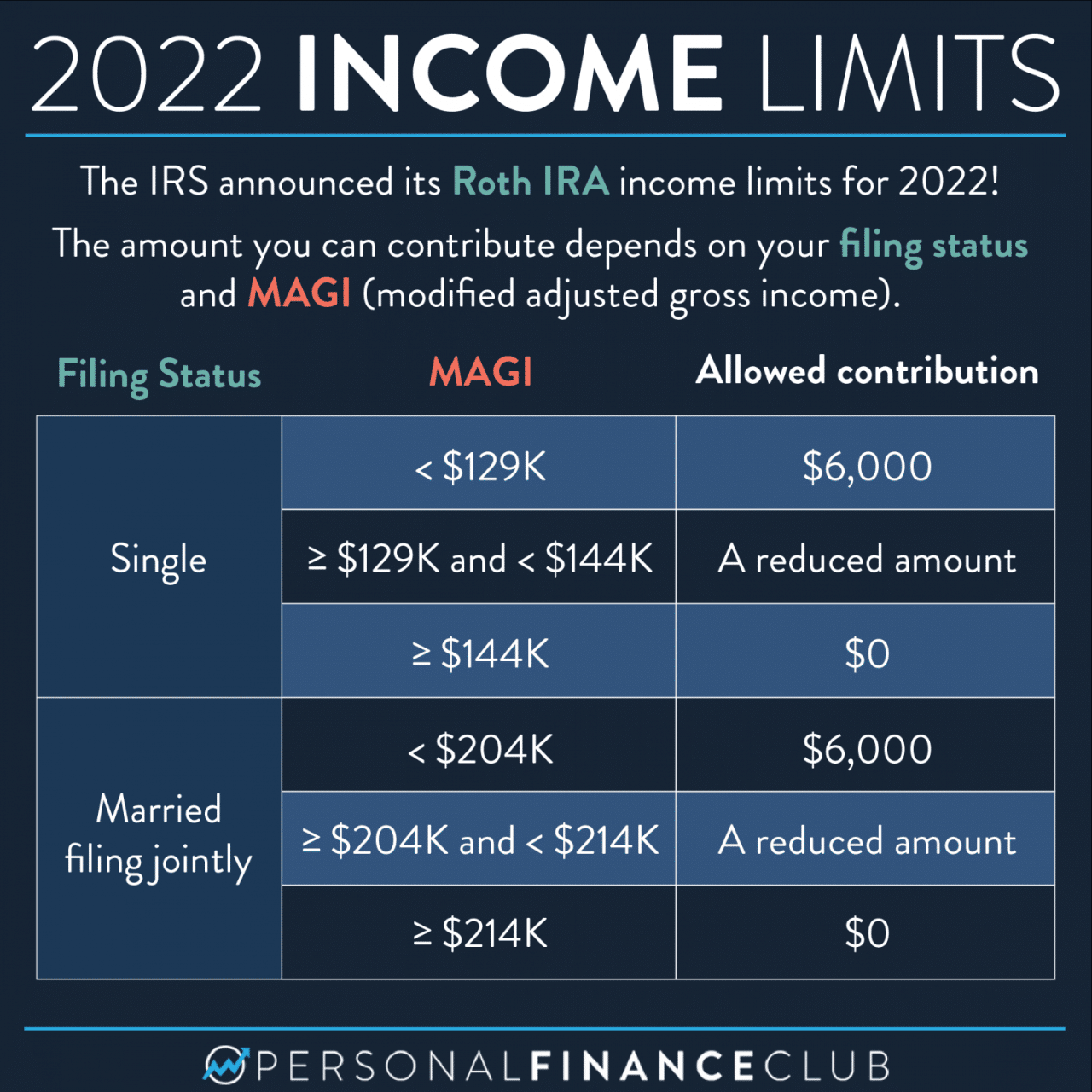

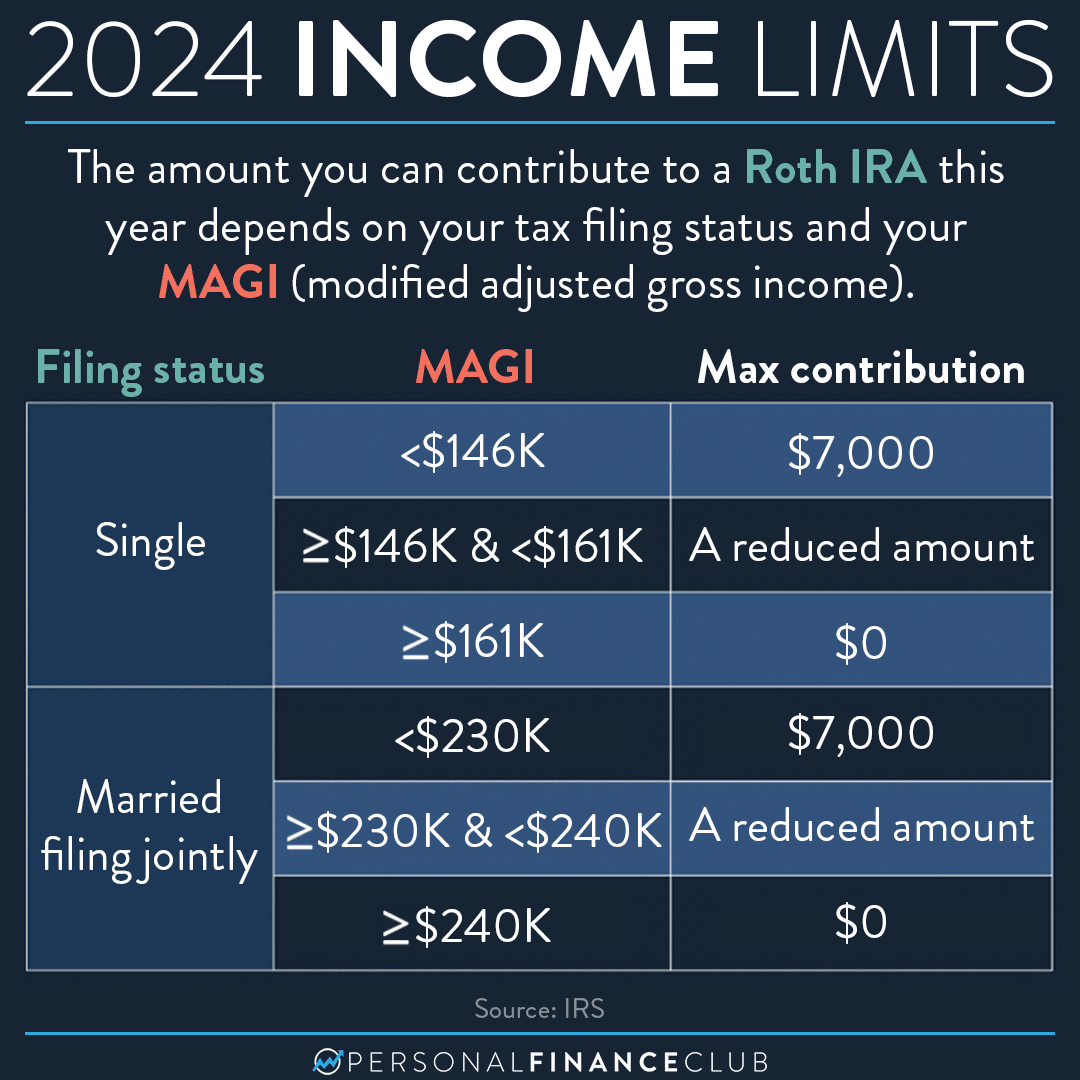

Roth IRA Contribution Limit 2024 for Divorced Individuals

Roth IRA contribution limit 2024 for divorced individuals – Navigating retirement planning after a divorce can be complex, especially when ...

Roth IRA Contribution Limits for 2024 Over 50: Catch-Up Contributions Explained

Roth IRA contribution limits for 2024 over 50 offer a powerful tool for retirement planning, especially for those approaching their ...

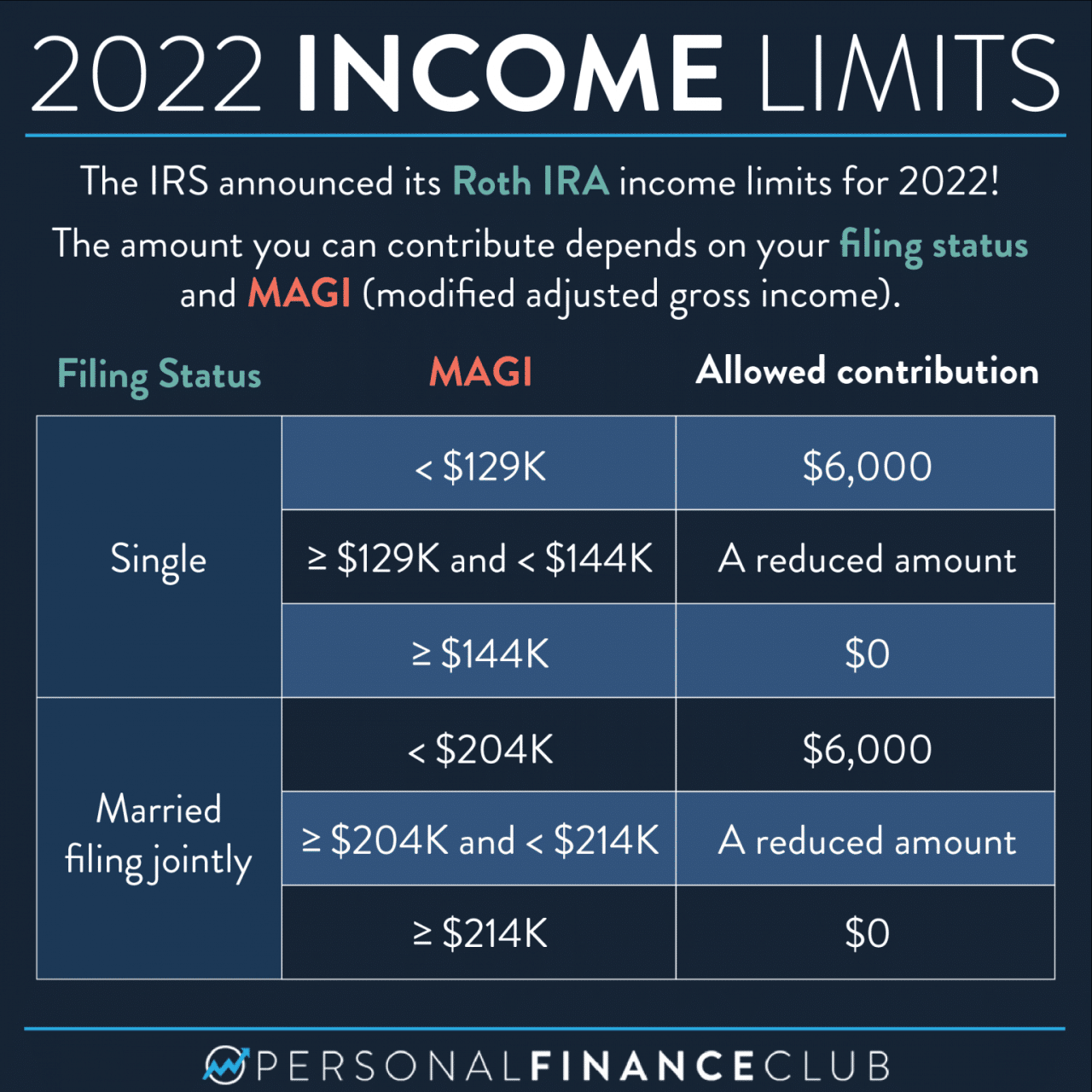

Roth IRA Contribution Limits for 2024: Married Couples

Roth IRA contribution limits for 2024 for married couples present a unique opportunity to maximize retirement savings while enjoying tax-free ...

Roth IRA Contribution Limit 2024 for Head of Household

Roth IRA contribution limit 2024 for head of household: Understanding this limit is crucial for maximizing your retirement savings. As ...

Roth IRA Limit for Married Filing Separately in 2024

What is the Roth IRA contribution limit for 2024 for married filing separately? This question is crucial for married couples ...

Roth IRA Contribution Limit for Over 50s in 2024

How much can I contribute to a Roth IRA in 2024 if I am over 50? If you’re over 50, ...