tax benefits

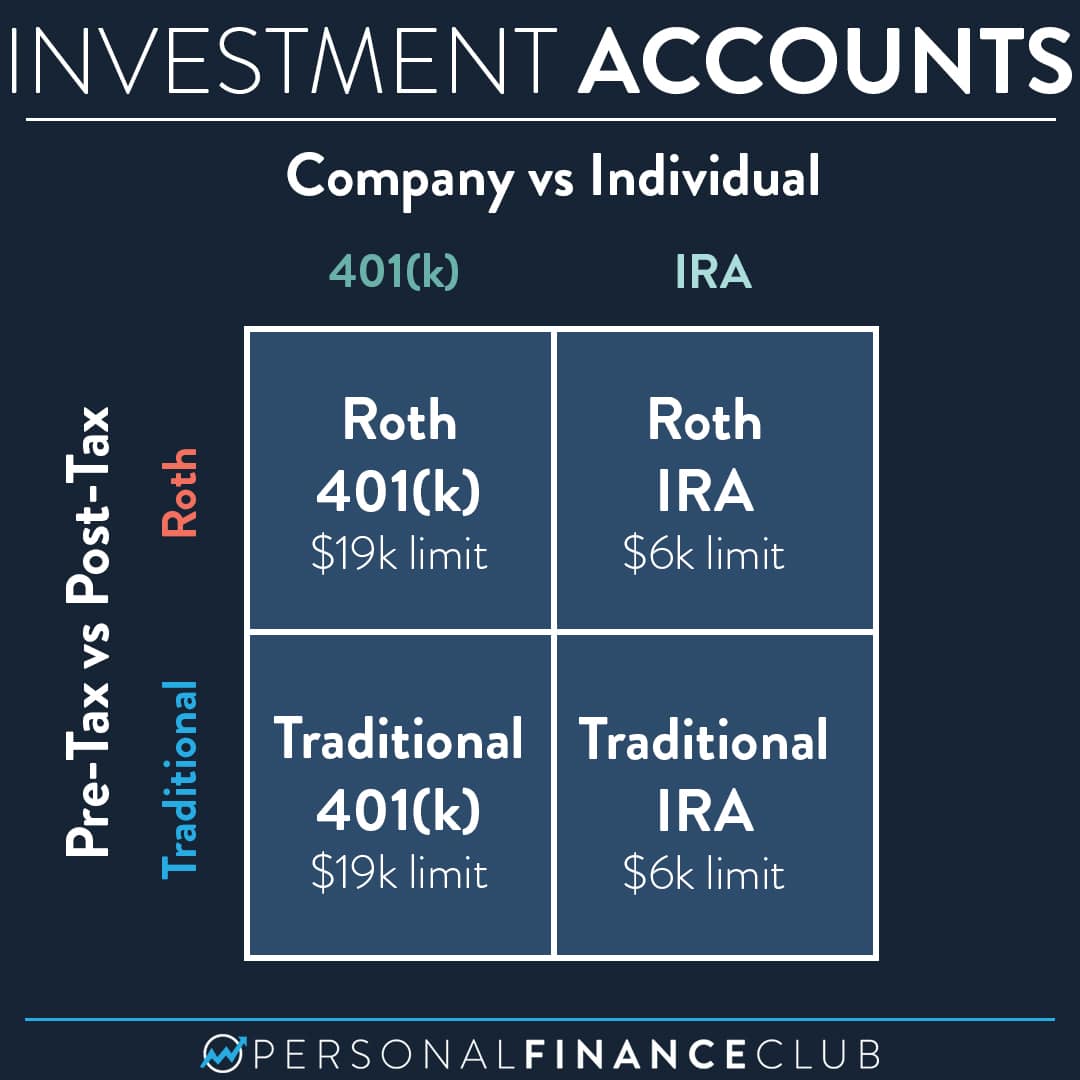

Traditional vs. Roth IRA in 2024: Which is Right for You?

Is it better to contribute to a traditional or Roth IRA in 2024? This question is a common dilemma for ...

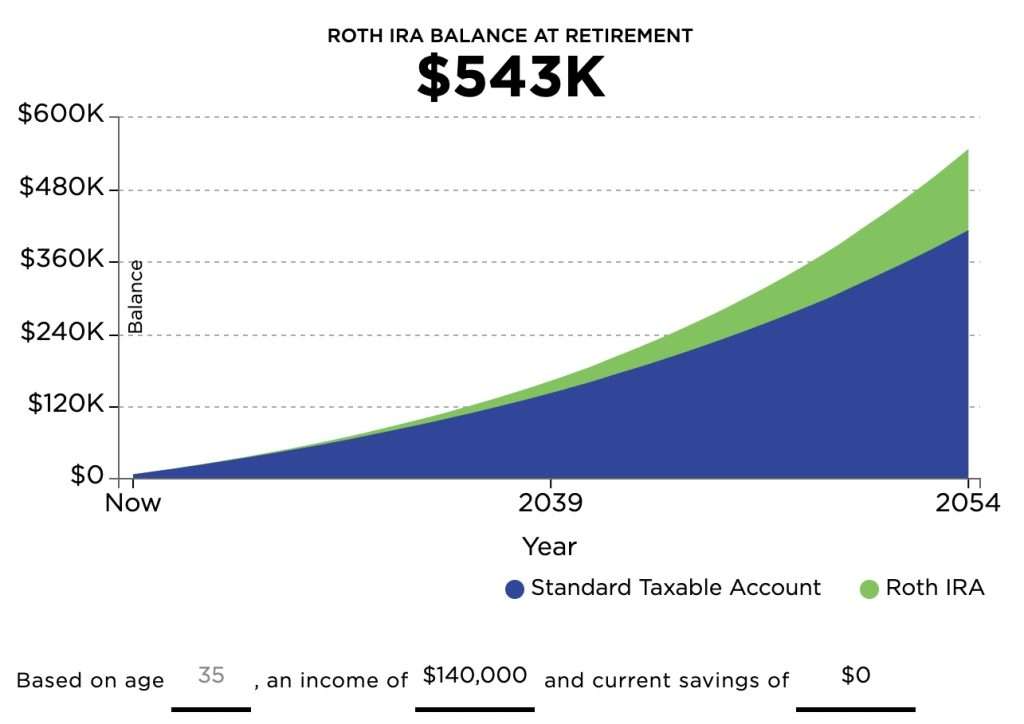

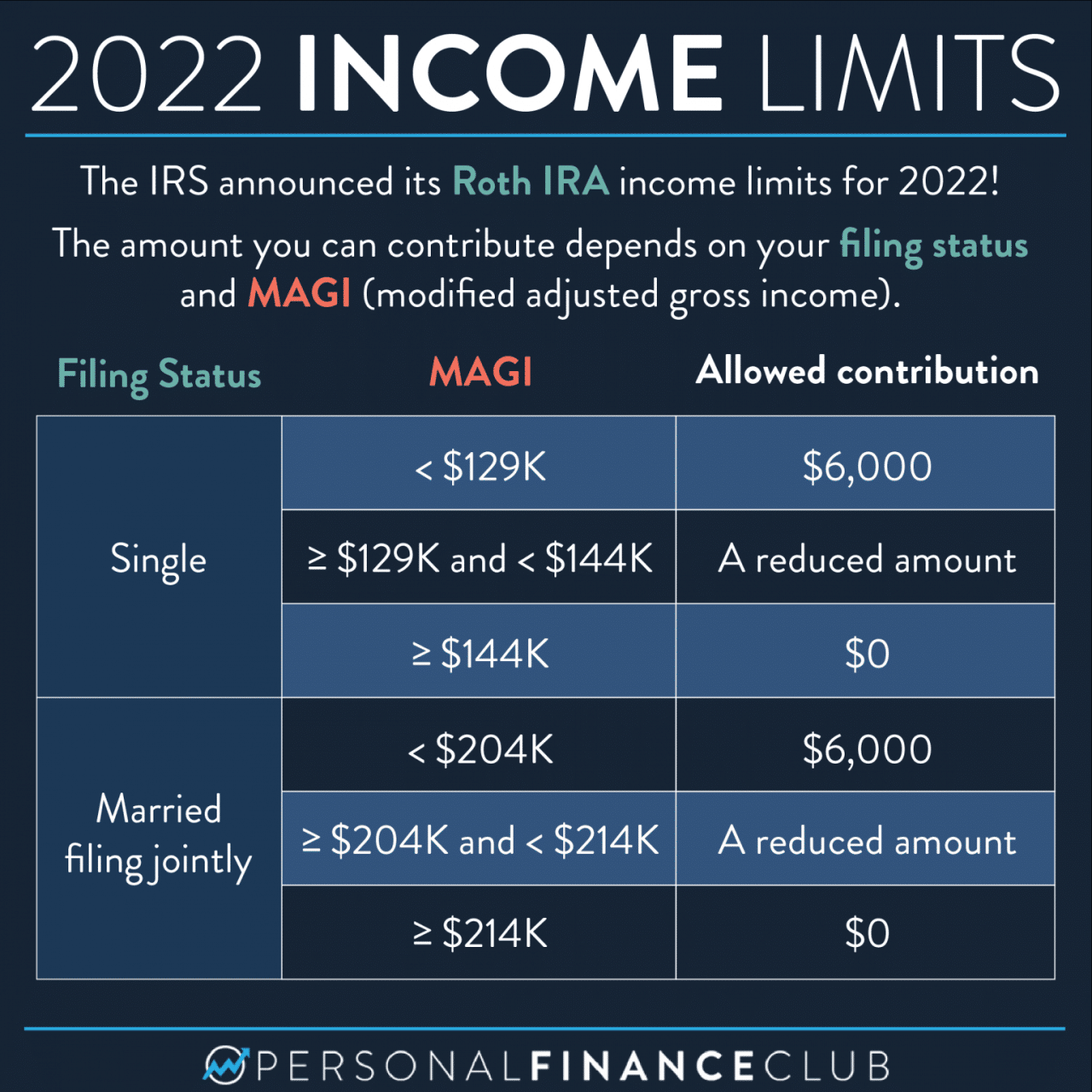

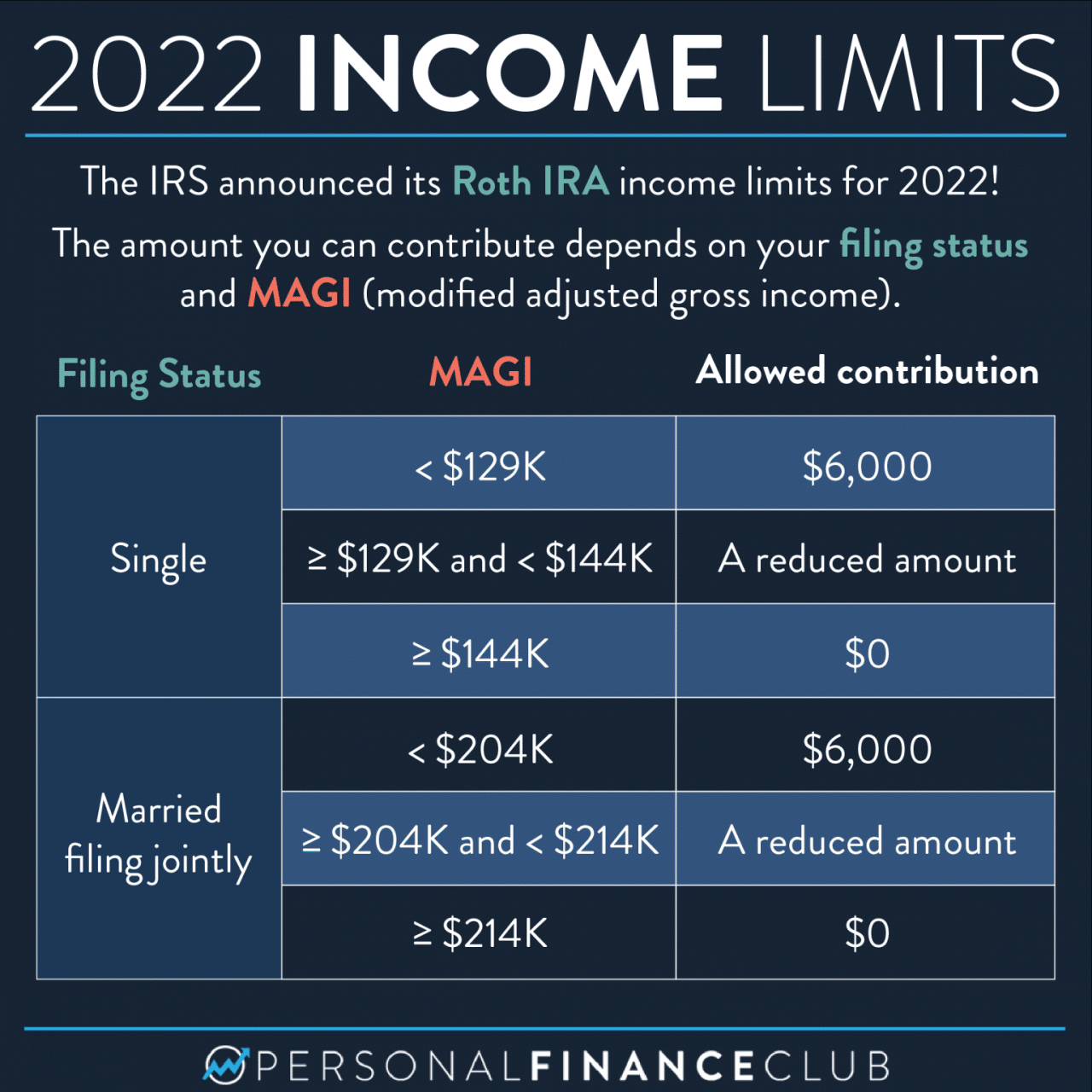

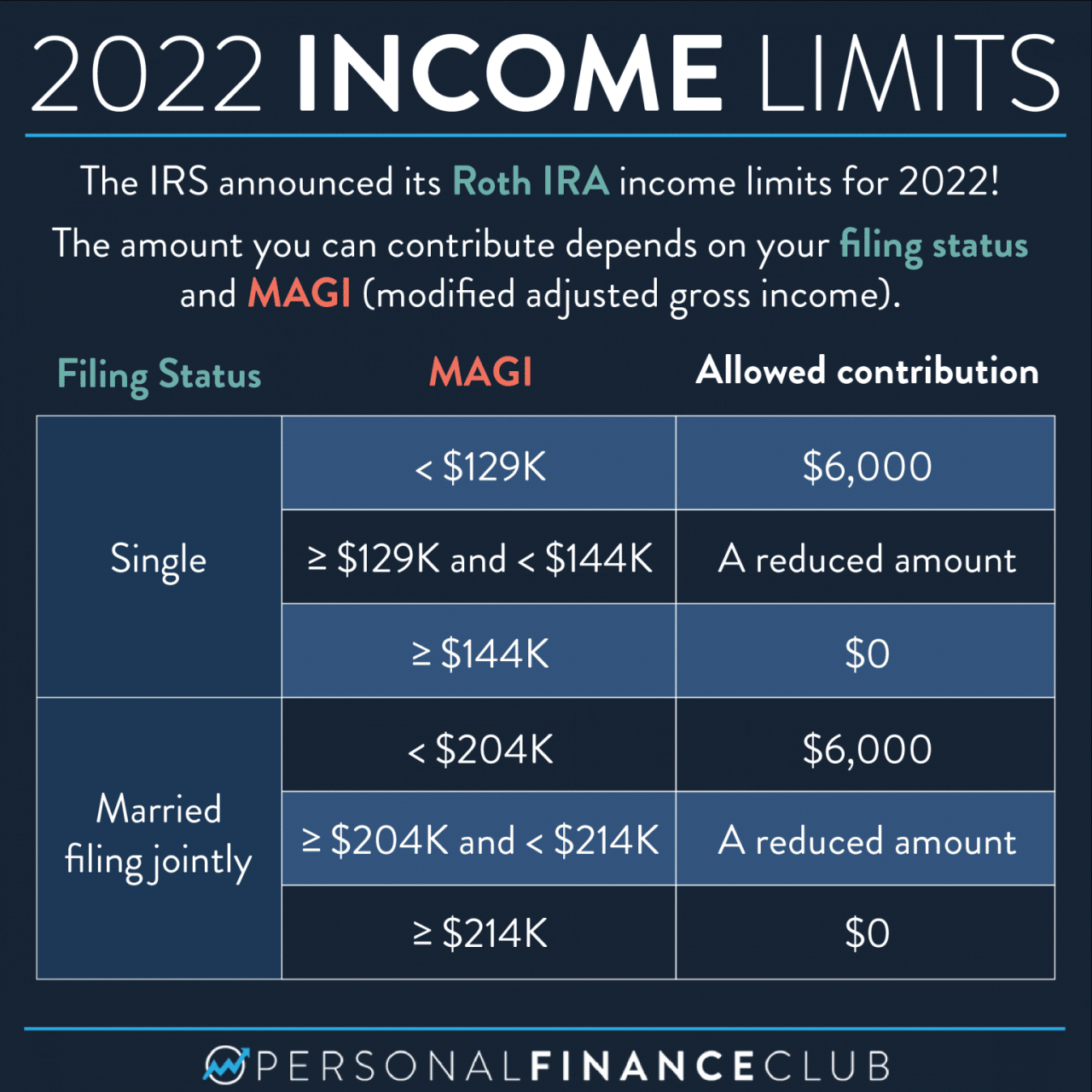

Roth IRA Contribution Limits & Retirement Planning in 2024

Roth IRA contribution limits and retirement planning in 2024 are crucial topics for anyone seeking to secure their financial future. ...

Roth IRA Contribution Limit for Self-Employed in 2024

The Roth IRA contribution limit for self-employed individuals in 2024 presents a unique opportunity to save for retirement while potentially ...

Tax Credits Available in October 2024: A Guide to Potential Savings

Tax credits available in October 2024 represent a valuable opportunity for individuals and businesses to potentially reduce their tax liability. ...

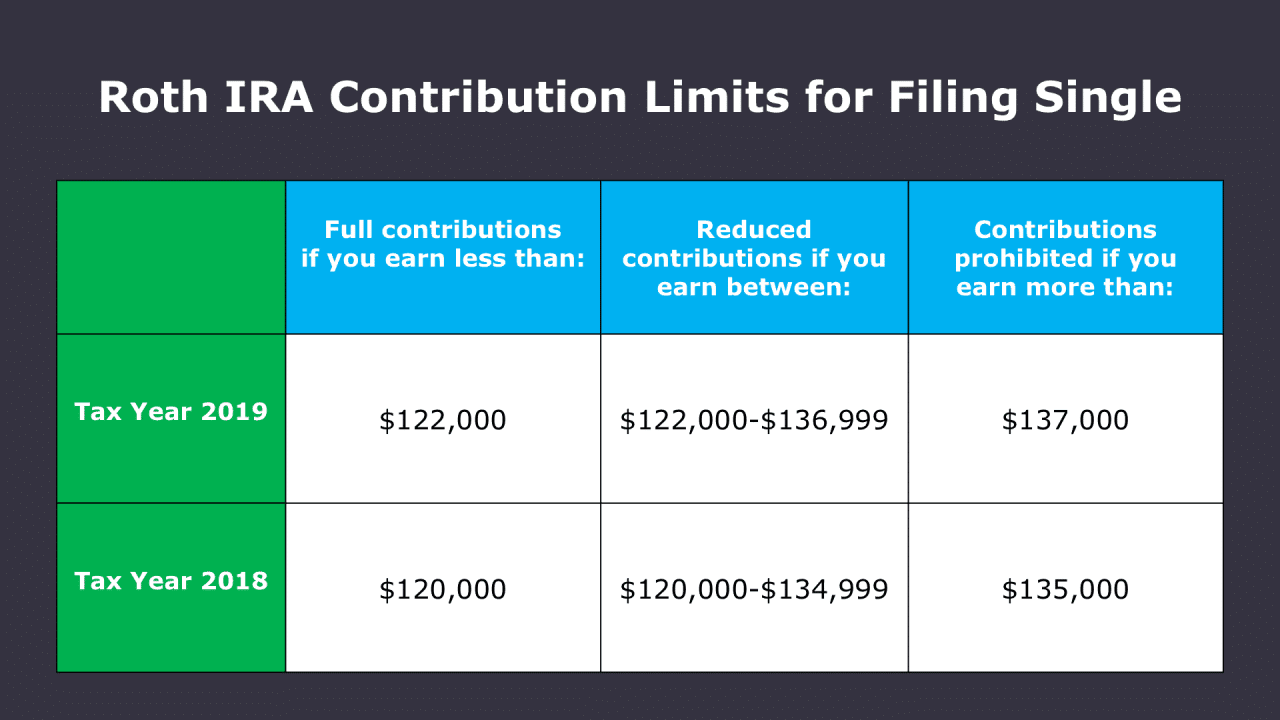

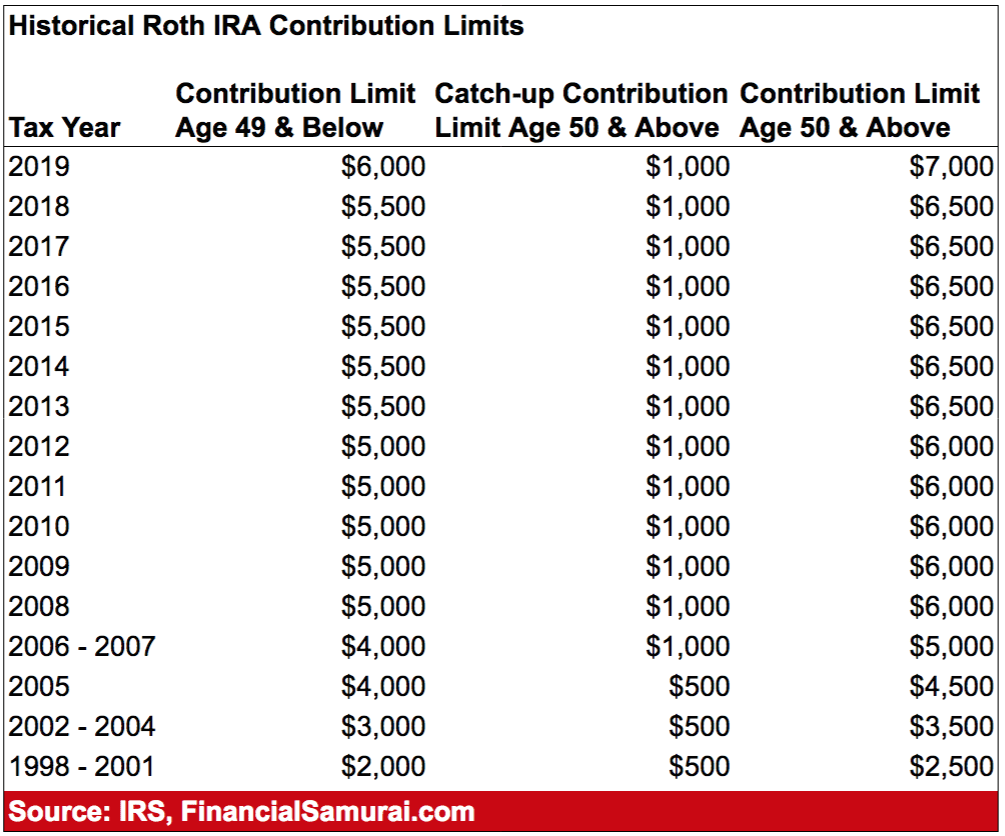

Roth IRA Contribution Limit 2024 vs 2023: Whats Changed?

Roth IRA contribution limit 2024 vs 2023: Planning for retirement involves understanding the rules and limits that govern your savings. ...

Roth IRA Catch-Up Contributions: 2024 Limits Explained

Is there a catch-up contribution limit for Roth IRAs in 2024? The answer is yes, and it’s a valuable tool ...

401k Contribution Limits for 2024: Small Business Owners

401k contribution limits for 2024 for small business owners are a critical aspect of retirement planning, offering significant tax advantages ...

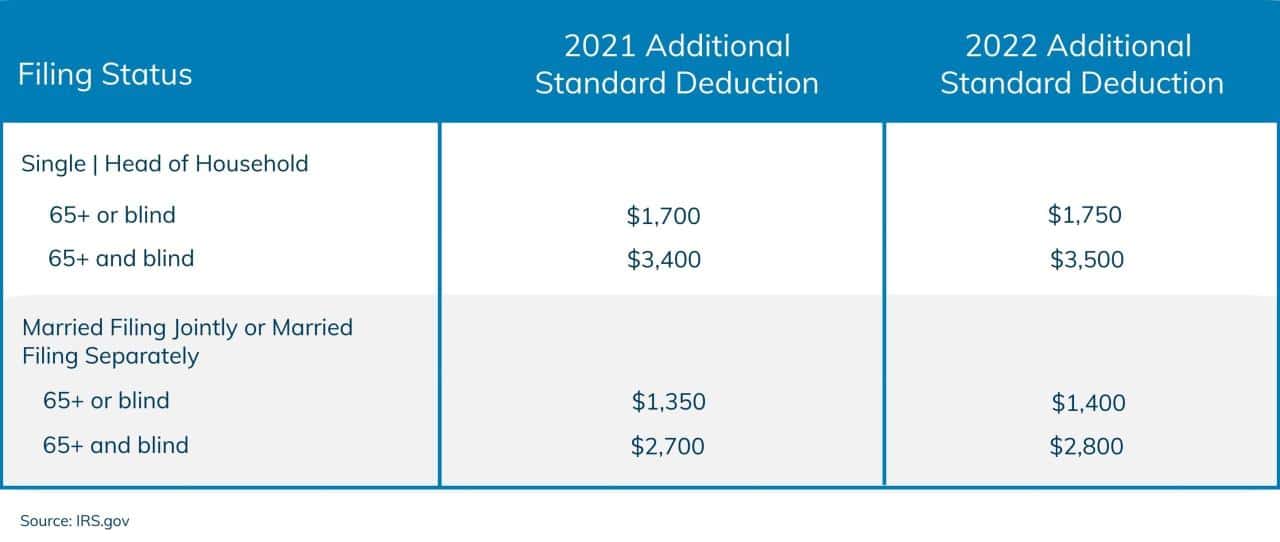

What is the 2024 Standard Deduction for Single Filers?

What is the 2024 standard deduction for single filers? This question is on the minds of many individuals as they ...

Roth IRA Contribution Limits for 2024: Married Couples

Roth IRA contribution limits for 2024 for married couples present a unique opportunity to maximize retirement savings while enjoying tax-free ...

How much can I contribute to my Roth IRA in 2024?

How much can I contribute to my Roth IRA in 2024? This question is on the minds of many Americans ...