tax deduction

Amazinggoodwilldonationreceipt 2024: Your Guide to Tax Benefits

Amazinggoodwilldonationreceipt 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in ...

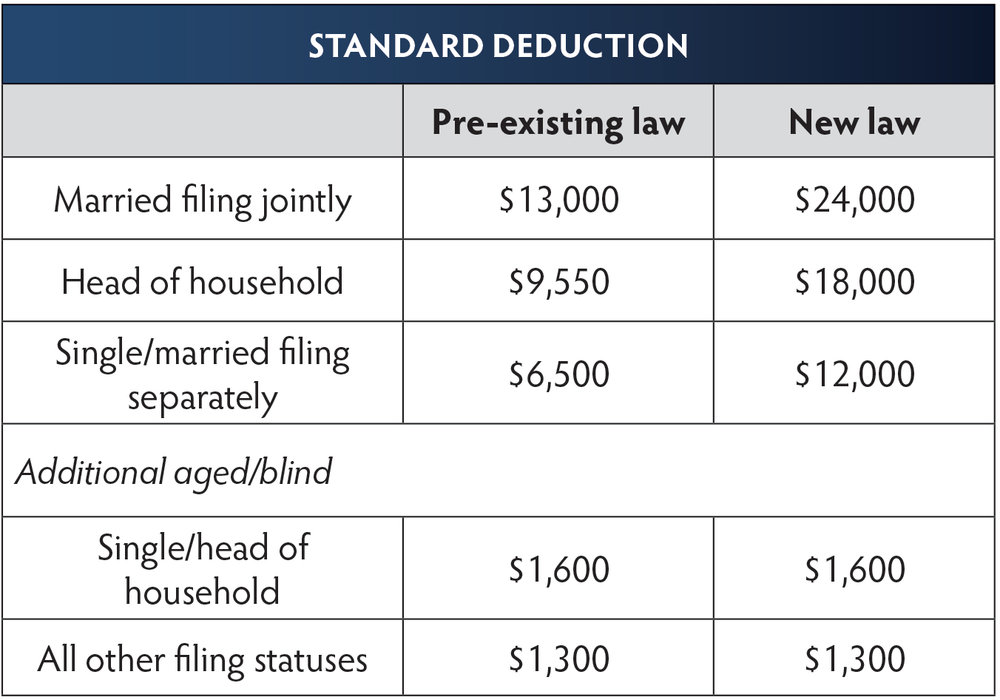

Standard Deduction for Students in 2024: A Guide

Standard deduction for students in 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story ...

Standard Deduction Amount for 2024 Tax Year: Your Guide

Standard deduction amount for 2024 tax year is a crucial factor in determining your tax liability. This deduction allows you ...

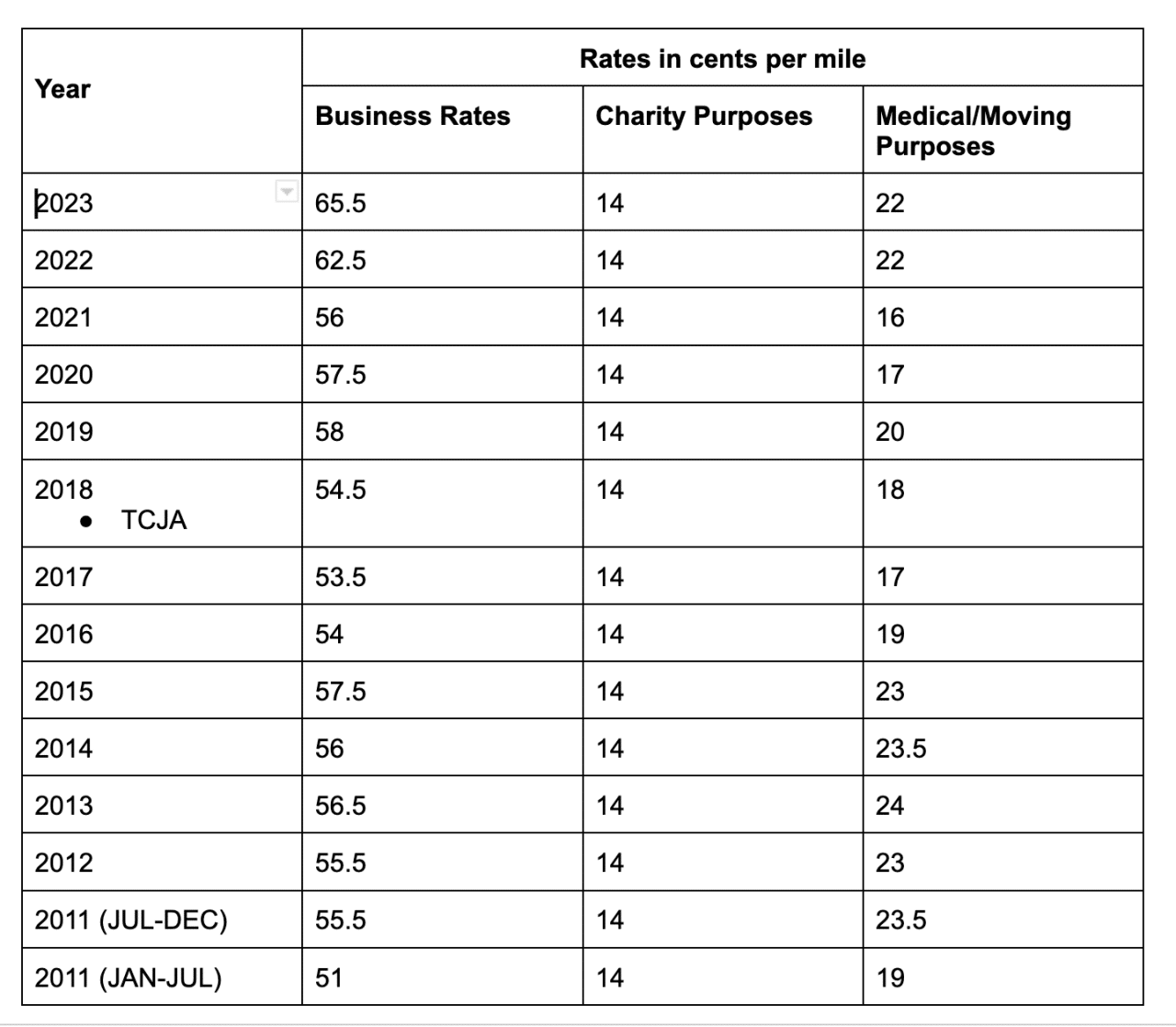

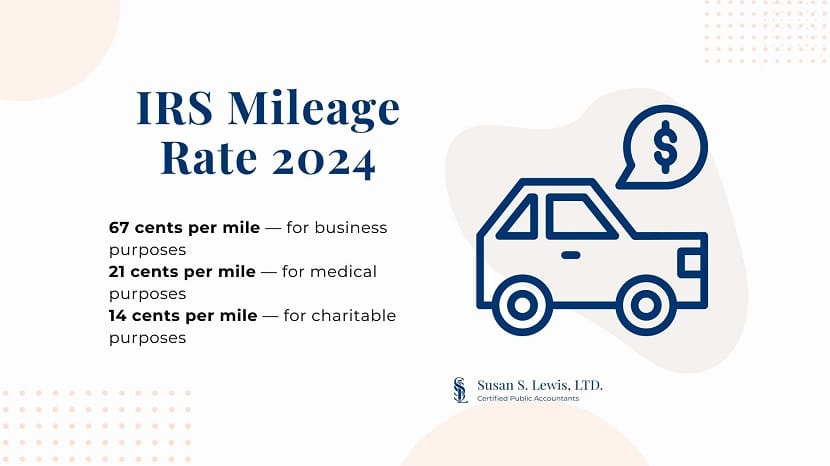

Where can I find the mileage rate for October 2024?

Where can I find the mileage rate for October 2024? This question is crucial for anyone seeking reimbursement for business ...

Mileage Rate Calculation for October 2024

How is the mileage rate calculated for October 2024? Understanding how mileage rates are determined is crucial for individuals and ...

Reputable Car Donation Charities 2024: Giving Back Through Your Vehicle

Reputable Car Donation Charities 2024 offer a unique opportunity to turn your old car into a powerful force for good. ...

Npr Car Donation 2024: Support NPR Through Vehicle Donation

Npr Car Donation 2024 offers a unique way to support National Public Radio (NPR) while decluttering your garage. This program ...

Car Donation Near Me 2024: Give Your Vehicle a Second Life

Car Donation Near Me 2024: Thinking about donating your car? It’s a great way to give back to your community ...