Tax Deductions

Immediate Annuity Tax Deductible: Retirement Planning

Immediate Annuity Tax Deductible – Immediate Annuities Tax Deductible: A retirement income strategy that allows for tax advantages, Immediate Annuities ...

Pet Tax Deductions 2022: Claiming Expenses for Your Furry Friend

Pet Tax Deductions 2022 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is ...

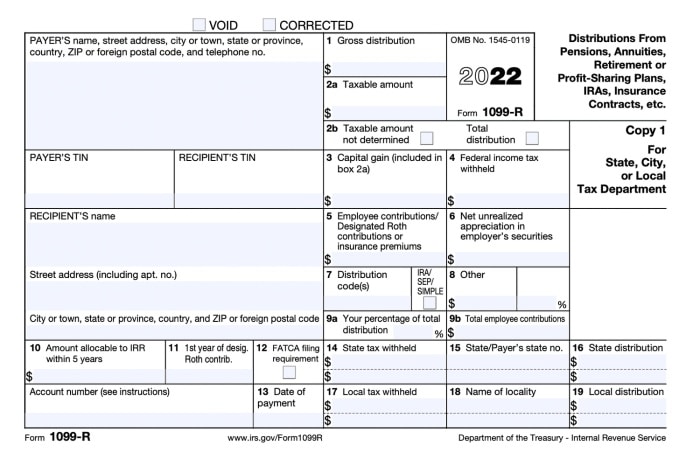

Annuity 1099 2024: Tax Guide for Your Retirement Income

Annuity 1099 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich ...

Tax Deductions for October 2024 Filing: Save Money on Your Taxes

Tax deductions for October 2024 tax filing can be a powerful tool for both individuals and businesses to reduce their ...

October 2024 Tax Deadline for Freelancers: A Guide

October 2024 tax deadline for freelancers is fast approaching, and it’s crucial to understand your obligations and navigate the filing ...

Tax planning tips for October 2024: Optimize Your Finances

Tax planning tips for October 2024: Optimize Your Finances. As the year winds down, it’s crucial to strategize and make ...

Tax Deductions for October 2024: What You Need to Know

What are the tax deductions for October 2024 sets the stage for this informative exploration, guiding you through the landscape ...

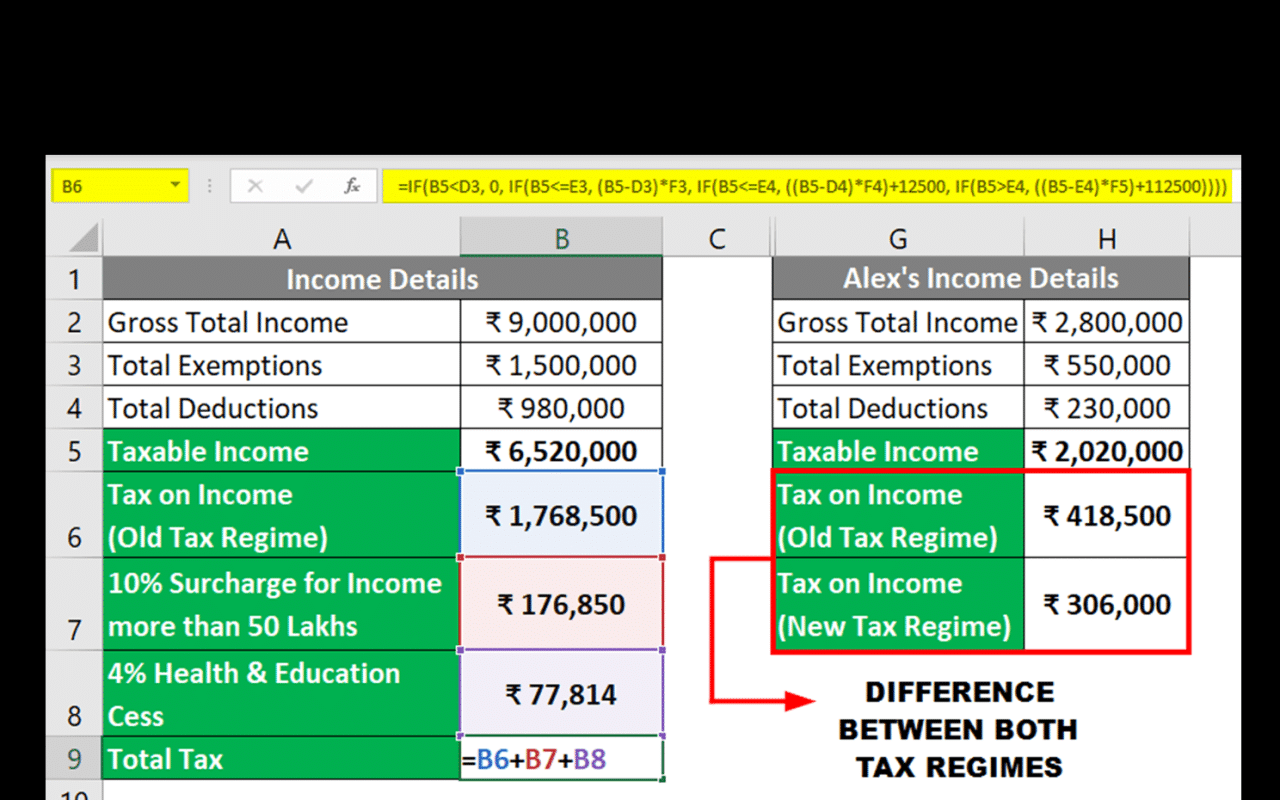

How to Calculate Income Tax in October 2024

How to calculate income tax in October 2024 – Navigating the complexities of income tax can feel overwhelming, especially when ...

How much income tax will I owe in October 2024?

How much income tax will I owe in October 2024? This question likely crosses many minds as the year progresses. ...

What are the 2024 Tax Implications for Small Business Owners?

What are the 2024 tax implications for small business owners sets the stage for this enthralling narrative, offering readers a ...