Tax Planning

Immediate Annuity Required Minimum Distributions: Planning for Retirement Income

Immediate Annuity Required Minimum Distributions (RMDs) are a crucial aspect of retirement planning, particularly for those seeking guaranteed income streams ...

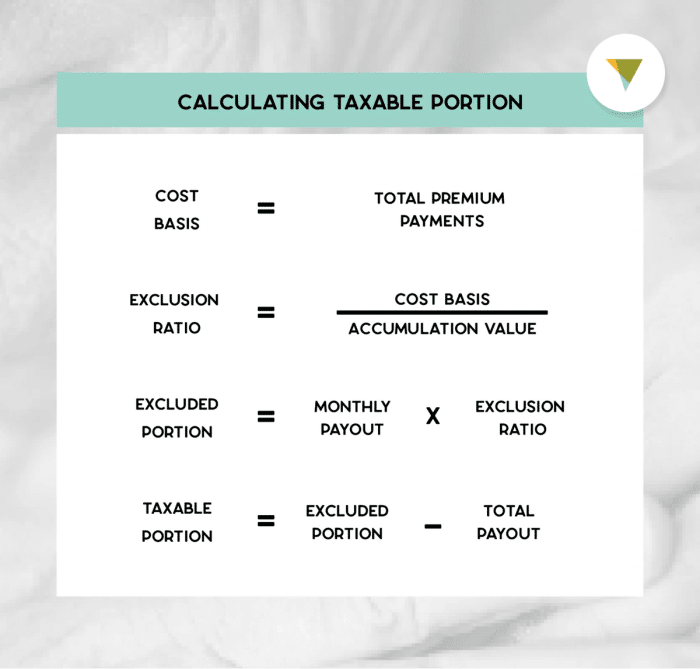

Immediate Annuity Exclusion Ratio Calculator: Understanding Your Taxable Income

Immediate Annuity Exclusion Ratio Calculator is a powerful tool that helps individuals understand the tax implications of receiving annuity payments. ...

Qualified Variable Annuity Taxation 2024: A Comprehensive Guide

Qualified Variable Annuity Taxation 2024: Navigating the complexities of this financial instrument can be daunting, but understanding the tax implications ...

Estate Planning Attorney 2024: Your Guide to Peace of Mind

Estate Planning Attorney 2024 takes center stage as a crucial aspect of safeguarding your future and the well-being of your ...

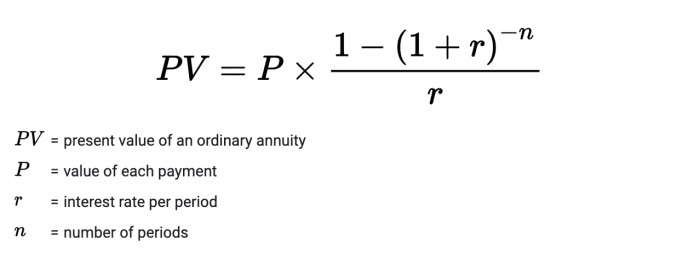

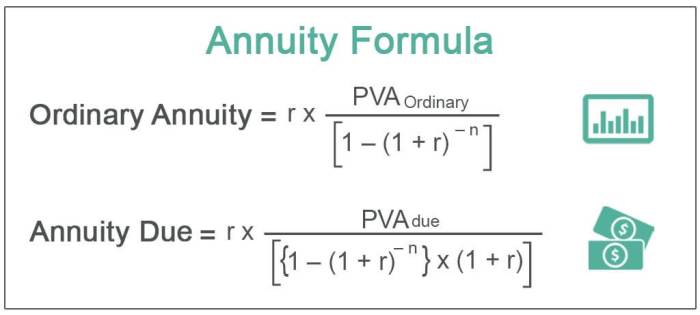

Calculating Taxable Annuity Income 2024: A Guide

Calculating Taxable Annuity Income 2024: A Guide is essential for understanding how your annuity payments will be taxed. Annuities are ...

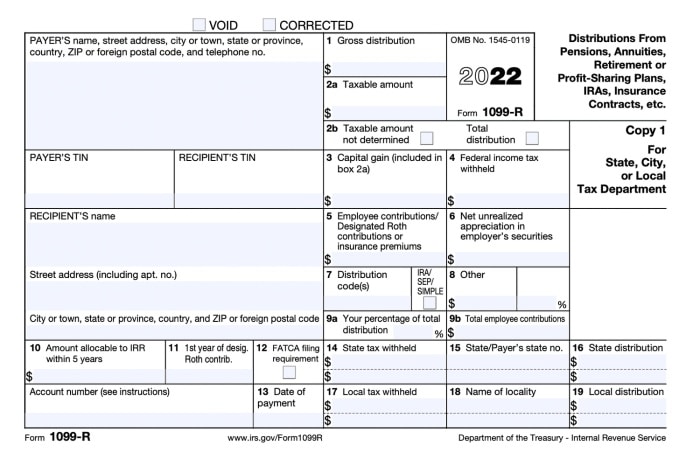

Annuity 1099 2024: Tax Guide for Your Retirement Income

Annuity 1099 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich ...

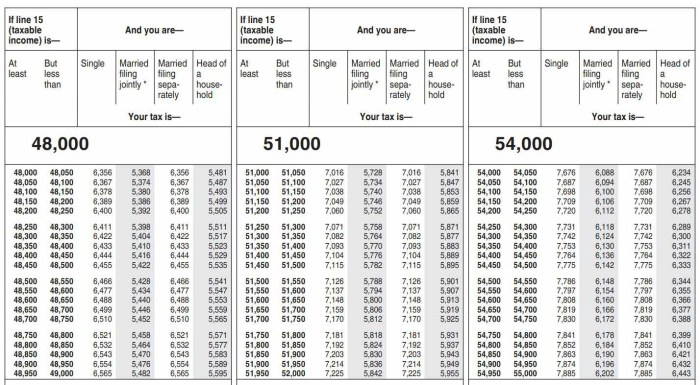

IRS Tax Deadline October 2024: What You Need to Know

IRS Tax Deadline October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that ...

Taxes Due October: A Comprehensive Guide

Taxes Due October: A time of year when many individuals and businesses find themselves facing a flurry of tax obligations. ...

Taxes Due October: A Guide to Planning and Filing

Taxes Due October: Navigating the complexities of October tax deadlines can feel daunting, but with the right information and strategies, ...

When Are Taxes Due In October: Key Deadlines and Planning Tips

When Are Taxes Due In October is a question that often arises as the year winds down. October marks a ...