tax savings

Apply For Marriage Allowance: A Guide to Tax Savings

Apply For Marriage Allowance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is ...

Tax Deductions for October 2024 Filing: Save Money on Your Taxes

Tax deductions for October 2024 tax filing can be a powerful tool for both individuals and businesses to reduce their ...

Tax Deductions for October 2024: What You Need to Know

What are the tax deductions for October 2024 sets the stage for this informative exploration, guiding you through the landscape ...

Tax Credits Available in October 2024: A Guide to Potential Savings

Tax credits available in October 2024 represent a valuable opportunity for individuals and businesses to potentially reduce their tax liability. ...

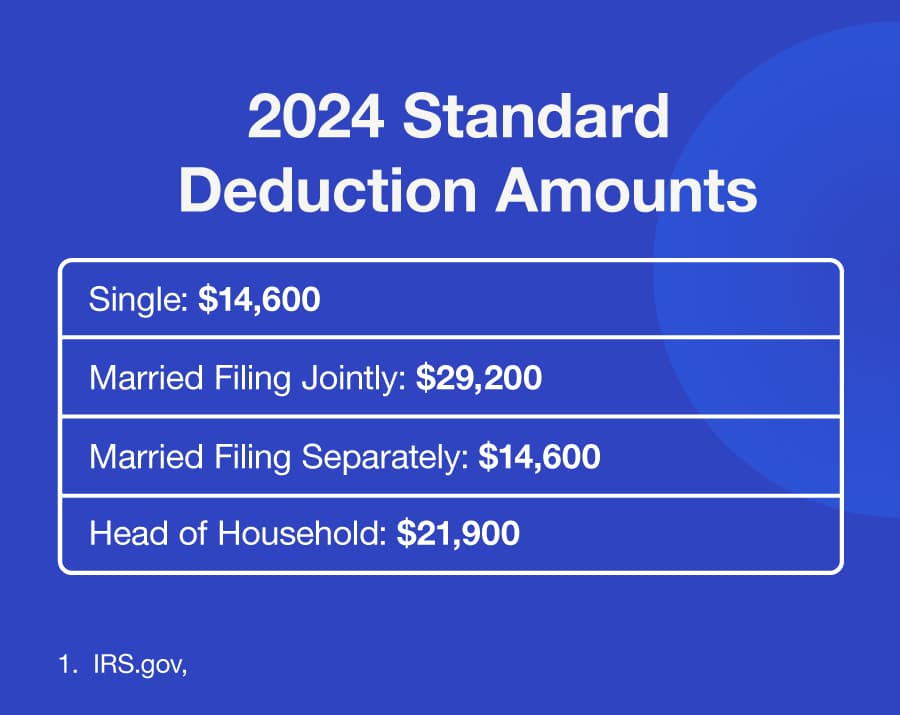

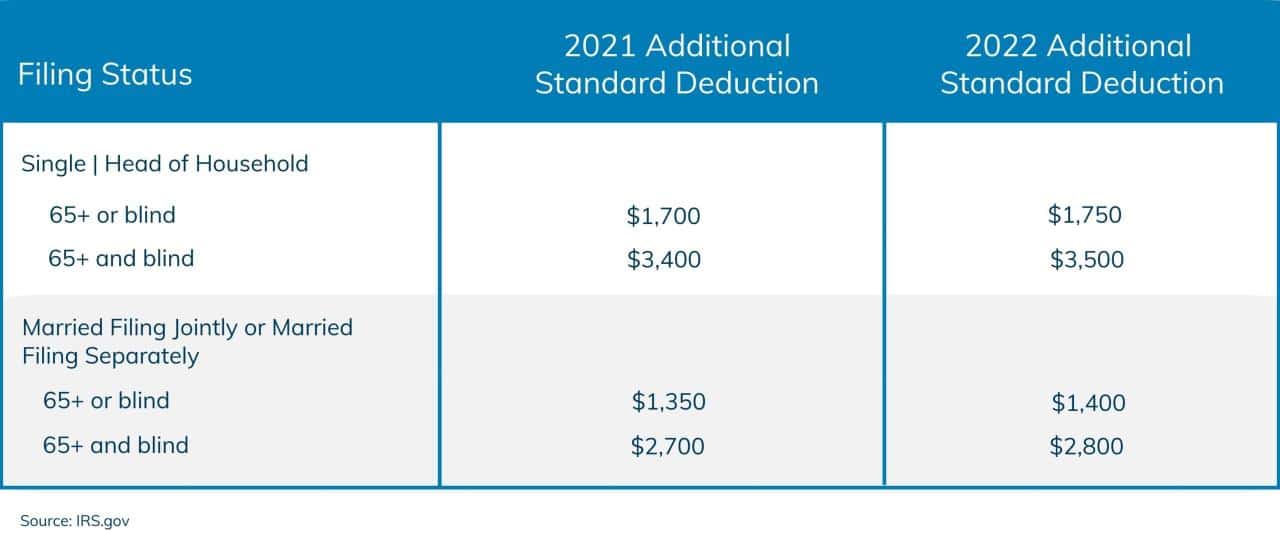

What is the 2024 Standard Deduction for Married Filing Jointly?

What is the 2024 standard deduction for married filing jointly? This question is crucial for married couples looking to navigate ...

Claim Your 2024 Standard Deduction: A Guide

How to claim the standard deduction on my 2024 taxes is a question many taxpayers have. The standard deduction is ...