Tax bracket changes for 2024 vs 2023: What to expect. As we approach the new year, it’s essential to understand how tax brackets might shift and how those changes could impact your finances. The upcoming tax year holds potential adjustments to income levels and tax rates, influencing your tax liability and potentially necessitating adjustments to your financial strategies.

This guide explores the projected tax bracket changes for 2024, delving into the factors driving these shifts, and examining the potential implications for different income groups. We’ll also discuss strategies for tax planning in light of these anticipated changes, empowering you to navigate the tax landscape effectively.

Contents List

Understanding Tax Bracket Changes

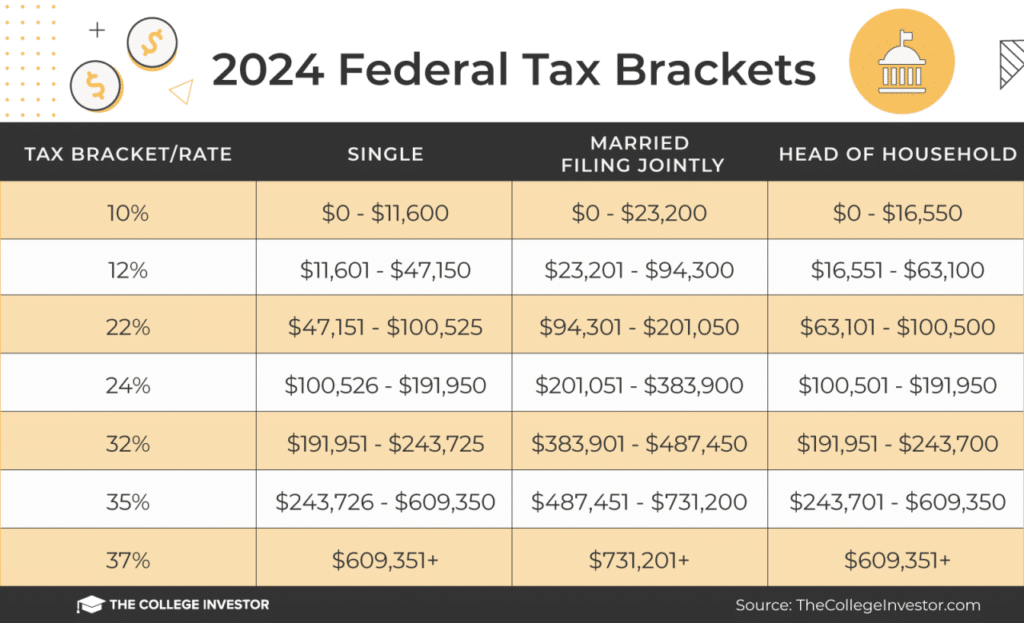

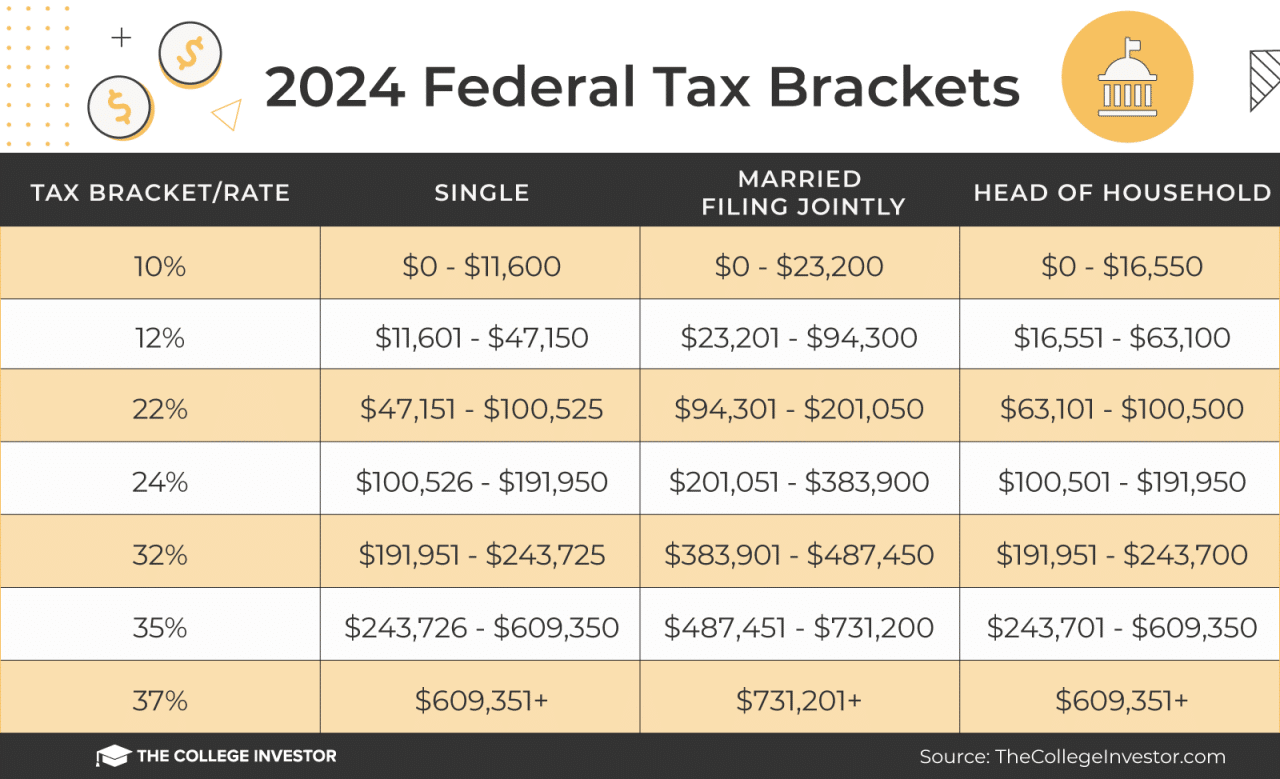

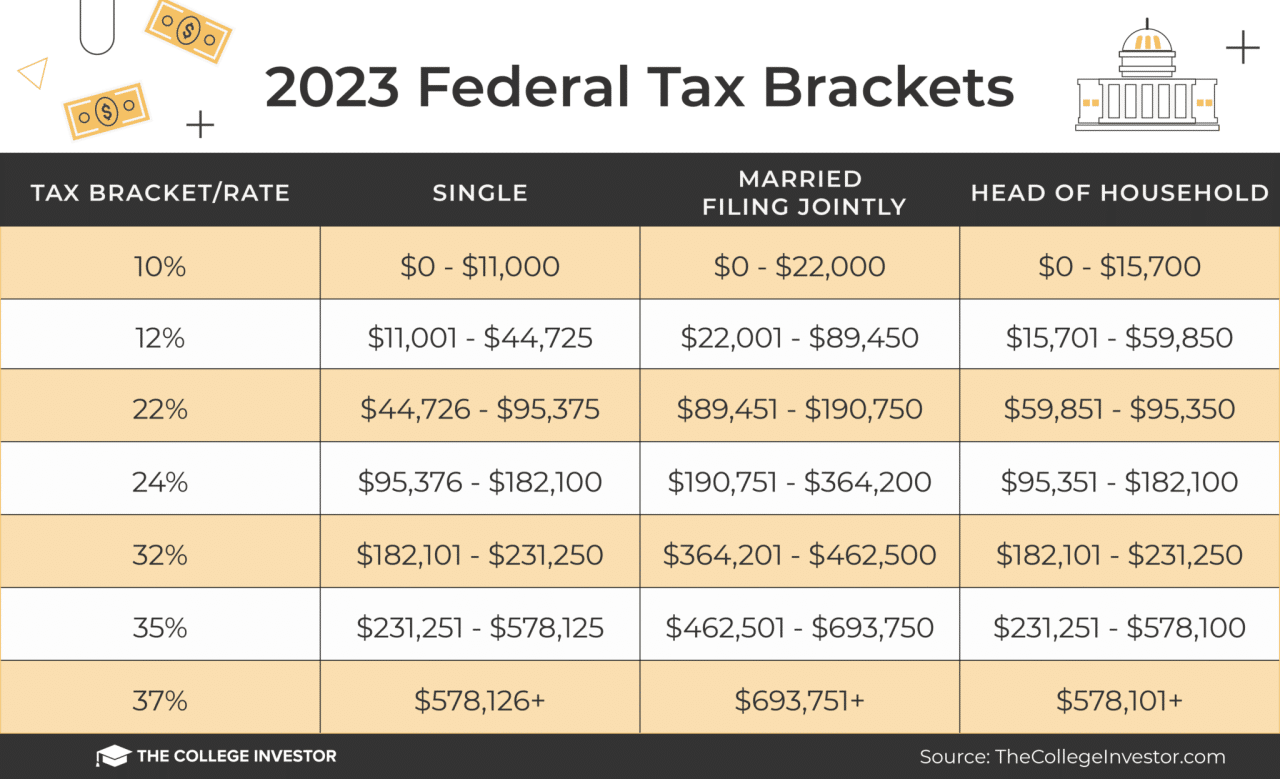

Tax brackets are the different income levels that determine how much income tax you pay. Understanding how these brackets change from year to year is crucial for both individuals and businesses, as it directly impacts your tax liability. Comparing the tax brackets between 2023 and 2024 allows you to assess how these changes might affect your income tax obligations and plan accordingly.

If you’re filing as head of household, it’s important to understand the tax brackets that apply to you. You can find detailed information on the tax brackets for head of household filers in 2024 here.

Tax Bracket Changes in 2024

Tax bracket changes can occur due to various factors, including inflation, economic growth, and government policies. To understand the impact of these changes, it’s important to compare the tax brackets for 2023 and 2024. This comparison can help you identify potential changes in your tax liability and adjust your financial planning accordingly.

Robert Lewandowski had a fantastic game for Barcelona, scoring a hat trick in the first half. You can find out more about the game here.

2024 Tax Bracket Projections: Tax Bracket Changes For 2024 Vs 2023

While the 2024 tax brackets are yet to be finalized, experts are predicting adjustments based on current economic conditions and political considerations. These projections are based on a combination of factors, including inflation, economic growth, and political climate.

The Jacksonville Jaguars were able to pull off a thrilling victory over the Indianapolis Colts in Week 5 of the NFL season. You can find a full report of the game here.

Factors Influencing Projections

The following factors play a significant role in shaping the anticipated tax bracket changes for 2024:

- Inflation:As inflation continues to impact the cost of living, there is a strong likelihood that the tax brackets will be adjusted to account for the erosion of purchasing power. This is a common practice to prevent taxpayers from being pushed into higher tax brackets due to inflation.

The United States has announced new tax brackets for 2024. If you’re interested in learning more about the tax brackets for 2024 in the United States , you can find the information here.

- Economic Growth:The state of the economy, particularly its growth rate, also influences tax bracket adjustments. If the economy is performing well, there might be a push for tax cuts to stimulate further growth. Conversely, a sluggish economy could lead to tax increases to boost government revenue.

If you’re a fan of the NFL, you won’t want to miss the upcoming game between the Las Vegas Raiders and the Denver Broncos. You can find out how to watch the game on your favorite streaming service or TV channel.

- Political Considerations:Tax policy is often a subject of political debate, with different parties advocating for various approaches. The political climate and the outcome of elections can significantly impact the direction of tax bracket adjustments. For example, if a party advocating for tax cuts gains power, it is likely to propose changes that reduce tax burdens.

If you’re a qualifying widow(er), you’ll want to make sure you understand the tax brackets that apply to you. You can find information on the tax brackets for qualifying widow(er)s in 2024 here.

Impact of Tax Bracket Changes

The proposed tax bracket changes for 2024 could have a significant impact on individuals and households across different income levels. The adjustments to tax brackets and standard deductions can lead to either a decrease or an increase in tax liability, depending on individual circumstances.

With the new tax brackets in effect for 2024, you may want to use a tax bracket calculator to estimate your tax liability. You can find a tax bracket calculator for 2024 here.

Impact on Different Income Groups, Tax bracket changes for 2024 vs 2023

The tax bracket changes can have a varied impact on different income groups. It’s important to understand how these changes might affect individuals in different income brackets:

- Lower-income earners: Individuals in the lower income brackets might see a slight decrease in their tax liability due to the adjustments in standard deductions and tax rates. For example, a single filer earning $25,000 might experience a small reduction in their tax burden due to the changes in the standard deduction and the first tax bracket.

An early morning earthquake in Ontario shook parts of Southern California. You can read more about the earthquake here.

- Middle-income earners: Middle-income earners might experience a mixed impact. Some might see a slight decrease in their tax liability due to the adjustments in standard deductions, while others might see an increase due to the changes in tax brackets. For example, a married couple filing jointly earning $75,000 might see a small decrease in their tax burden due to the standard deduction changes, while a single filer earning $100,000 might see a slight increase due to the adjustments in the higher tax brackets.

The IRS has announced new tax brackets for 2024. If you’re curious about what the new tax brackets are , you can find the information here.

- Higher-income earners: Individuals in the higher income brackets are likely to see a more significant impact on their tax liability. The changes in tax brackets and deductions could lead to a notable increase in their tax burden. For example, a single filer earning $500,000 might experience a substantial increase in their tax liability due to the changes in the top tax bracket.

The world of social media was saddened by the news of the passing of TikTok star Taylor Rousseau Grigg at the young age of 25. You can read more about her life and legacy here.

Strategies for Tax Planning

The anticipated tax bracket changes for 2024 present both challenges and opportunities for tax planning. By understanding these changes and implementing effective strategies, individuals and families can potentially minimize their tax liability and maximize their financial well-being.

If you’re married and filing separately, you’ll need to be aware of the tax brackets that apply to you. You can find more information on the tax brackets for married filing separately in 2024 here.

Tax Planning Strategies for Individuals and Families

The tax bracket changes for 2024 can significantly impact your tax obligations. To optimize your tax situation, consider these strategies:

Adjusting Income and Deductions

- Income Shifting:Consider shifting income to lower tax brackets, especially for high-income earners. For example, if you are self-employed, you could defer some income to next year by delaying invoicing or taking advantage of retirement contributions.

- Maximizing Deductions:Review your eligible deductions, such as charitable contributions, medical expenses, and home mortgage interest, to ensure you claim all available benefits.

- Tax-Loss Harvesting:If you have investments that have lost value, consider selling them to offset capital gains and reduce your tax liability. This strategy is particularly effective for investors with higher incomes.

Retirement Planning

- Maximize Retirement Contributions:Contribute the maximum amount allowed to retirement accounts, such as 401(k)s and IRAs, to take advantage of tax-deferred growth. This strategy is especially beneficial for individuals in higher tax brackets.

- Roth Conversions:If you expect to be in a lower tax bracket in retirement, consider converting traditional IRA funds to a Roth IRA. This allows for tax-free withdrawals in retirement.

Estate Planning

- Gift Tax Exemption:Utilize the annual gift tax exclusion to transfer assets to family members without incurring gift taxes. The current exclusion is $17,000 per person, per year.

- Estate Planning Strategies:Review your estate plan to ensure it aligns with the latest tax laws and your financial goals. Consider strategies such as trusts and charitable giving to minimize estate taxes.

Additional Considerations

While tax bracket changes are a significant factor in tax planning, it’s essential to consider other aspects that could impact your tax liability in 2024. These include potential changes in deductions, credits, and other tax-related provisions.

Changes in Deductions and Credits

Changes in deductions and credits can significantly affect your tax liability, potentially offsetting the impact of tax bracket changes. For instance, the standard deduction amount might increase, reducing taxable income for many taxpayers. Similarly, the availability or amount of certain tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, could change.

The tax brackets for 2024 have been adjusted, so it’s important to stay up-to-date on the changes. You can learn more about the tax bracket changes for 2024 here.

Potential Challenges and Uncertainties

The 2024 tax year might present challenges and uncertainties for taxpayers.

If you’re a fan of Arkansas football, you’ll want to check out this recruiting report from Otis Kirk. You can watch the report here.

Economic Factors

Economic factors like inflation and interest rates can influence tax planning decisions. High inflation can erode the purchasing power of your tax refund, while rising interest rates could impact investment income and borrowing costs.

Legislative Changes

Congress might introduce new tax laws or modify existing ones, potentially impacting your tax liability. These changes could be related to deductions, credits, or other tax provisions.

Tax Policy Uncertainty

Tax policy uncertainty can make it difficult to plan for the future. For example, the future of certain tax breaks or the possibility of new tax proposals can create uncertainty for businesses and individuals.

With the new year approaching, many people are wondering how the new tax brackets will affect their income. You can learn more about how the tax brackets might impact you in 2024.

Technological Advancements

Technological advancements in tax preparation and filing can create both opportunities and challenges. While new tools can simplify tax filing, they can also introduce new complexities or security risks.

The Green Bay Packers were able to secure a victory over the Los Angeles Rams in a close game, with turnovers playing a key role in the outcome. You can check out a full recap of the game to see how it all went down.

It’s crucial to stay informed about potential changes in tax laws, economic conditions, and technological advancements to effectively plan for the 2024 tax year.

Closure

Navigating the complexities of tax bracket changes can be challenging, but understanding the potential shifts and planning accordingly can significantly impact your financial well-being. By staying informed and adopting proactive strategies, you can optimize your tax situation and ensure that you’re prepared for the changes ahead.

Remember to consult with a tax professional for personalized guidance and to ensure compliance with the latest tax regulations.

Query Resolution

What are the key factors influencing tax bracket changes for 2024?

Tax bracket changes are often influenced by factors like inflation, economic growth, and political considerations. Inflation can lead to adjustments in income levels to account for the erosion of purchasing power, while economic growth might influence tax rates and deductions.

Political decisions also play a role in shaping tax policy, including potential changes to tax brackets and other provisions.

Will tax brackets necessarily change in 2024?

While there are projections and discussions about potential changes, it’s not guaranteed that tax brackets will actually change in 2024. The final decision rests with lawmakers, and they may choose to maintain existing brackets or implement different adjustments.

How can I stay updated on tax bracket changes?

To stay informed about tax bracket changes and other tax-related updates, you can consult reputable sources like the IRS website, financial news outlets, and tax professional websites. It’s also beneficial to subscribe to newsletters or alerts from these sources to receive timely information.