Tax brackets for single filers in 2024 are a critical aspect of personal finance, influencing the amount of income tax you owe. Understanding these brackets is crucial for maximizing your tax savings and ensuring you pay the right amount.

The Internal Revenue Service (IRS) establishes these brackets, which determine the tax rate applied to different income levels. Each bracket represents a range of taxable income, with a corresponding tax rate. The higher your income, the higher the tax bracket you fall into, and the greater the percentage of your income that goes towards taxes.

Contents List

Overview of Tax Brackets

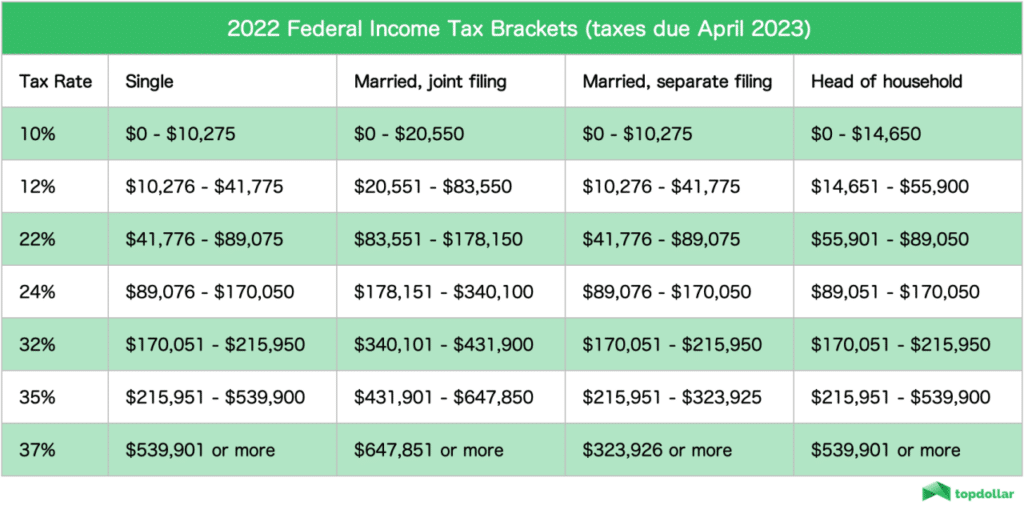

The tax bracket system in the United States is a progressive system, meaning that the more you earn, the higher the percentage of your income you pay in taxes. The system is designed to ensure that higher earners contribute a larger share of their income to support government services.For single filers in 2024, there are seven different tax brackets, each with a corresponding income range and tax rate.

These brackets determine the amount of federal income tax you will owe based on your taxable income.

Tax Brackets for Single Filers in 2024

The following table Artikels the income ranges and tax rates for each tax bracket for single filers in 2024:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 10% | $0

|

10% |

| 12% | $10,751

|

12% |

| 22% | $43,001

Southern California experienced a sudden jolt early this morning when an earthquake struck near Ontario. The quake, which registered as a moderate tremor, shook parts of the region and caused some minor damage. For more information on the earthquake and its impact, visit Early morning Ontario earthquake shakes parts of Southern California.

|

22% |

| 24% | $109,251

The latest college football rankings are out, and there’s been some shuffling at the top. Alabama dropped a spot after their recent loss, while Big Ten teams are making a strong showing. To see the full rankings and learn more about the movement, visit College Football Rankings: Alabama falls, Big Ten teams stack top.

|

24% |

| 32% | $192,151

Michigan football had a close call against Washington, but they ultimately emerged victorious. The game highlighted some key areas for improvement, and the Wolverines will need to address them moving forward. For a look at what Michigan learned from the game, visit Michigan football: What we learned vs. Washington: ‘Don’t let this.

|

32% |

| 35% | $577,101

|

35% |

| 37% | $1,000,001+ | 37% |

Important Note:These tax brackets and rates are subject to change based on future legislation. It is always advisable to consult with a tax professional for the most up-to-date information.

The Dallas Cowboys and Pittsburgh Steelers are set to clash in a highly anticipated matchup. If you’re looking for live updates, scoring information, and ways to watch the game, look no further! You can find all the details you need at Cowboys vs.

Steelers score today: Live updates, how to watch.

2024 Tax Bracket Changes: Tax Brackets For Single Filers In 2024

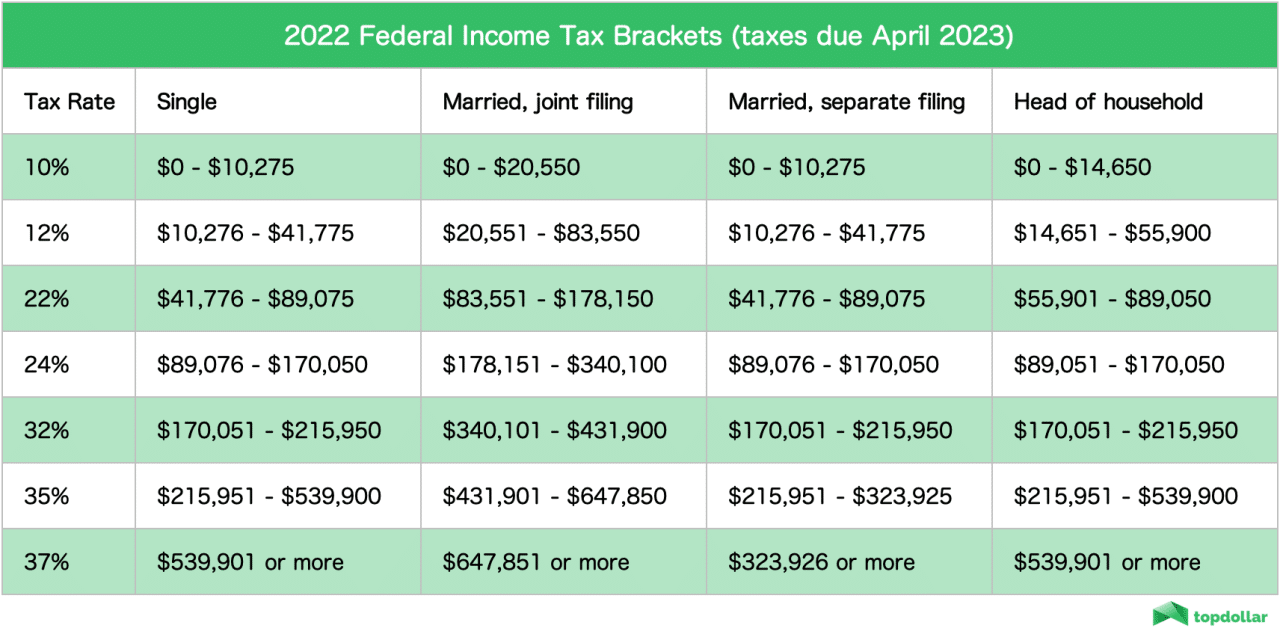

The 2024 tax year brings about a few significant changes to the tax brackets for single filers, affecting how much income tax you’ll pay. These changes aim to adjust the tax burden based on income levels and may impact your overall tax liability.

The Arizona Cardinals pulled off a stunning upset against the San Francisco 49ers, rallying to win in a thrilling game. The Cardinals’ offense came alive, and their defense made crucial stops. For a look at the highlights, analysis, and key moments, visit Cardinals vs.

49ers highlights, analysis: Arizona rallies to stun S.F..

Changes to Tax Brackets

The following table presents the tax brackets for single filers in 2024 and compares them to the 2023 tax brackets:

| Tax Bracket | 2024 Tax Rate | 2024 Income Range | 2023 Tax Rate | 2023 Income Range |

|---|---|---|---|---|

| 10% | 10% | $0

The New York Giants secured a convincing victory over the Seattle Seahawks, winning 29-20. The Giants’ offense was clicking, while their defense made key stops. For an in-depth analysis of the game and the key takeaways, head over to Instant Analysis: Giants defeat Seahawks, 29-20.

|

10% | $0

|

| 12% | 12% | $10,751

|

12% | $10,951

The Chicago Bears dominated the Carolina Panthers this week, improving their record to 3-2. The Bears’ offense was firing on all cylinders, while their defense was stifling the Panthers’ attack. For a quick recap of the game and the key moments, head over to Rapid Recap: Bears improve to 3-2 with rout of Panthers.

|

| 22% | 22% | $43,001

|

22% | $46,276

|

| 24% | 24% | $107,351

|

24% | $101,751

The Houston Texans pulled off a big upset against the Buffalo Bills, winning 23-20. The Texans’ defense played a key role in the victory, while their offense made just enough plays to secure the win. For the final score, key stats, and highlights, check out Texans 23, Bills 20 | Final score, stats to know + game highlights.

|

| 32% | 32% | $192,151

|

32% | $192,151

|

| 35% | 35% | $577,051

|

35% | $577,051

|

| 37% | 37% | $693,751+ | 37% | $693,751+ |

As you can see, the 2024 tax brackets have been slightly adjusted compared to the 2023 brackets. The income thresholds for each tax bracket have been modified, with some thresholds increasing and others decreasing.

Impact of Changes

The changes to the tax brackets could potentially impact single filers in various ways:

Higher earners

Individuals earning above the previous income thresholds for the 22%, 24%, and 32% tax brackets may see a slight increase in their tax liability.

Lower earners

Those earning within the lower income brackets may experience a slight decrease in their tax liability.

Standard deduction

The Jacksonville Jaguars pulled off a thrilling victory against the Indianapolis Colts in Week 5, winning 37-34. The game was a back-and-forth affair, with both teams trading blows throughout the contest. You can read all about the exciting game and the key moments in the Game Report, 2024 Week 5: Jaguars 37, Colts 34.

The standard deduction for single filers in 2024 is $13,850, which is an increase from $13,850 in 2023. This increase in the standard deduction could offset some of the potential tax increases for higher earners.It is crucial to consult with a tax professional to understand how these changes might affect your individual tax situation.

Robert Lewandowski was on fire in Barcelona’s latest match, scoring a hat trick in the first half alone. His impressive performance helped Barcelona secure a commanding victory. To see the highlights and read more about Lewandowski’s stellar performance, visit First-half hat trick for Lewandowski as Barcelona top ahead of.

They can help you analyze your income and deductions and determine the best strategies to minimize your tax liability.

Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. Understanding the available options and their eligibility criteria can help you maximize your savings.

Tax Credits

Tax credits directly reduce the amount of tax you owe. They are often more valuable than deductions, as they provide a dollar-for-dollar reduction in your tax liability.

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children you have. For example, a single filer with no children earning $20,000 or less could receive up to $1,000 in tax credits.

The Washington Commanders put up a strong performance against the Cleveland Browns, winning 34-13. The Commanders’ offense was efficient, while their defense held the Browns in check. For the full score, stats, and a recap of the game, check out Commanders 34, Browns 13 | Final Score, Stats & Game Recap.

- Child Tax Credit:This credit provides a tax break for families with children. For 2024, the credit is worth up to $2,000 per child under the age of 17. This credit is partially refundable, meaning you can receive some of it back even if you don’t owe any taxes.

For example, if you have two children and owe $1,000 in taxes, you can receive $2,000 in credits, resulting in a refund of $1,000.

- American Opportunity Tax Credit:This credit is available to students pursuing higher education. It is worth up to $2,500 per eligible student, with the amount gradually decreasing as income rises. For example, a single filer with an adjusted gross income of $80,000 or less could receive up to $2,500 in credits for their eligible student.

- Premium Tax Credit:This credit helps offset the cost of health insurance purchased through the Affordable Care Act marketplace. The amount of the credit depends on your income and the cost of your health insurance plan. For example, a single filer with an income of $40,000 could receive a credit of $1,000 to help cover their health insurance premiums.

Tax Deductions

Tax deductions reduce your taxable income, thereby lowering your tax liability.

The Miami Dolphins just finished a tough game, and the postgame press conference is providing some interesting insights. Coaches and players are sharing their thoughts on the game’s key moments and what’s next for the team. For a look at the postgame quotes, visit Miami Dolphins Postgame Quotes 10/6.

- Standard Deduction:This deduction is available to all taxpayers and is a fixed amount based on your filing status. For 2024, the standard deduction for single filers is $13,850. For example, if your taxable income is $50,000, your taxable income would be reduced to $36,150 after claiming the standard deduction.

- Itemized Deductions:These deductions allow you to deduct certain expenses from your taxable income. Some common itemized deductions include:

- Home Mortgage Interest:This deduction allows you to deduct the interest paid on your home mortgage. For example, if you pay $10,000 in mortgage interest, you can deduct this amount from your taxable income.

The Ravens and Bengals faced off in a hard-fought battle this week, and the postgame press conferences were full of insights. Coaches and players shared their thoughts on the game’s key moments and what’s ahead for both teams. To see the full postgame notes and quotes, visit Postgame Notes and Quotes: Ravens at Bengals.

- State and Local Taxes (SALT):This deduction allows you to deduct up to $10,000 in state and local taxes, including property taxes, income taxes, and sales taxes. For example, if you pay $12,000 in state and local taxes, you can deduct $10,000 from your taxable income.

Looking for a way to watch the Las Vegas Raiders take on the Denver Broncos this week? You’re in luck! The game will be broadcast on national television, and there are several ways to catch the action, including streaming options.

For all the details on how to watch, check out How to watch the Las Vegas Raiders vs. Denver Broncos NFL game.

- Medical Expenses:This deduction allows you to deduct medical expenses exceeding 7.5% of your adjusted gross income. For example, if your adjusted gross income is $50,000, you can deduct medical expenses exceeding $3,750.

- Charitable Contributions:This deduction allows you to deduct contributions made to eligible charities. The amount you can deduct depends on the type of charity and the amount of your contribution. For example, if you donate $5,000 to a qualified charity, you can deduct this amount from your taxable income.

Tragic news has emerged about Taylor Rousseau Grigg, a popular TikTok star who has passed away at the age of 25. Grigg was known for her engaging content and her positive energy. To learn more about Grigg and her impact on the platform, visit TikTok star Taylor Rousseau Grigg dead at 25.

- Home Mortgage Interest:This deduction allows you to deduct the interest paid on your home mortgage. For example, if you pay $10,000 in mortgage interest, you can deduct this amount from your taxable income.

Comparing Tax Credits and Deductions

| Feature | Tax Credits | Tax Deductions |

|---|---|---|

| Impact on Tax Liability | Directly reduces tax owed | Reduces taxable income |

| Value | Dollar-for-dollar reduction | Reduces tax liability based on your tax bracket |

| Eligibility | Specific criteria based on income, dependents, etc. | Based on expenses, income, or other factors |

| Example | A $1,000 tax credit reduces your tax liability by $1,000 | A $1,000 deduction reduces your taxable income by $1,000, resulting in a tax savings based on your tax bracket |

Resources for Tax Information

Navigating the complex world of taxes can be challenging, but there are numerous resources available to help you understand your obligations and maximize your tax benefits. From official government websites to tax preparation services, you have access to a wealth of information and support.

Official Government Resources, Tax brackets for single filers in 2024

Official government websites are the most reliable source for accurate and up-to-date tax information. They provide comprehensive guidance on tax laws, regulations, forms, and deadlines.

- Internal Revenue Service (IRS):The IRS website (www.irs.gov) is your primary source for all things tax-related. It offers a vast library of publications, forms, instructions, and FAQs. You can also find information on tax credits, deductions, and other tax-saving strategies.

- State Tax Agencies:Each state has its own tax agency that administers state income tax. Visit your state’s tax agency website for information on state-specific tax rules, forms, and deadlines. For example, the California Franchise Tax Board website (www.ftb.ca.gov) provides comprehensive information on California state taxes.

Tax Preparation Services

Tax preparation services offer assistance with filing your taxes, ensuring accuracy and maximizing your deductions.

- Free Tax Preparation Services:The IRS offers free tax preparation services for low- and moderate-income taxpayers through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. These programs provide free assistance from IRS-certified volunteers.

- Paid Tax Preparation Services:Paid tax preparation services offer professional assistance with filing your taxes. These services can be helpful if you have a complex tax situation or need expert guidance. Consider researching and comparing different services to find one that fits your needs and budget.

Seeking Professional Tax Advice

While online resources and tax preparation services can be helpful, it’s crucial to seek professional tax advice from a qualified tax professional if you have a complex tax situation or require personalized guidance.

- Certified Public Accountants (CPAs):CPAs are licensed professionals who have extensive knowledge of tax laws and regulations. They can provide comprehensive tax advice, prepare your tax returns, and represent you before the IRS.

- Enrolled Agents (EAs):EAs are federally licensed tax professionals who specialize in tax preparation and representation. They can represent taxpayers before the IRS and are authorized to prepare tax returns.

- Tax Attorneys:Tax attorneys are lawyers who specialize in tax law. They can provide legal advice on tax matters and represent you in tax-related legal disputes.

Tax Information Resources

| Resource | Key Features |

|---|---|

| IRS Website (www.irs.gov) | Comprehensive tax information, publications, forms, instructions, and FAQs. |

| State Tax Agency Websites | State-specific tax rules, forms, and deadlines. |

| Volunteer Income Tax Assistance (VITA) | Free tax preparation services for low- and moderate-income taxpayers. |

| Tax Counseling for the Elderly (TCE) | Free tax preparation services for seniors. |

| Paid Tax Preparation Services | Professional assistance with filing taxes. |

| Certified Public Accountants (CPAs) | Comprehensive tax advice, tax return preparation, and IRS representation. |

| Enrolled Agents (EAs) | Tax preparation, representation before the IRS. |

| Tax Attorneys | Legal advice on tax matters, representation in tax-related legal disputes. |

Last Word

Navigating the complexities of tax brackets can be challenging, but understanding them is vital for financial planning. By familiarizing yourself with the tax brackets for single filers in 2024, you can make informed decisions about your income, deductions, and credits to optimize your tax liability and achieve your financial goals.

Remember, seeking professional tax advice from a qualified accountant or tax advisor can provide personalized guidance and ensure you’re maximizing your tax benefits.

General Inquiries

What happens if my income falls within multiple tax brackets?

You only pay the tax rate associated with the bracket that your income falls into. You do not pay the higher tax rate for the entire income, just the portion that falls within that higher bracket.

Are there any deductions or credits that can reduce my tax liability?

Yes, there are many deductions and credits available for single filers. These can include deductions for mortgage interest, charitable contributions, and student loan interest, as well as credits for child tax credit, earned income tax credit, and education credits.

How do I know if I need to file an amended tax return?

If you believe you made an error on your original tax return or if your circumstances have changed, you may need to file an amended return. You can file an amended return using Form 1040-X.