Tax calculator for estimated taxes in October 2024 is a valuable tool for individuals and businesses alike. As the tax year draws to a close, it’s crucial to ensure you’ve paid the correct amount of taxes. This calculator simplifies the process of estimating your tax liability, helping you avoid penalties and prepare for filing season.

By accurately calculating your estimated taxes, you can gain peace of mind knowing you’re meeting your financial obligations.

This guide will delve into the intricacies of estimated taxes, exploring the key factors that influence calculations and providing a comprehensive overview of the tax calculator’s features. We’ll also discuss how to find a reliable tax calculator, navigate the steps involved in using it, and understand the various payment options available.

Contents List

Understanding Estimated Taxes

Estimated taxes are payments you make throughout the year to cover your tax liability. They are designed to ensure that you pay your taxes as you earn or receive income, rather than having a large tax bill at the end of the year.Estimated taxes are crucial because they help you avoid penalties for underpayment.

Even if you work part-time, you can still contribute to an IRA. The IRA contribution limits for 2024 for part-time workers can help you plan your retirement savings.

The IRS requires taxpayers to pay their tax liability throughout the year, not just at the end of the year. Failure to do so can result in penalties.

When Estimated Tax Payments are Required

Estimated tax payments are typically required for individuals who have income that is not subject to withholding, such as:

- Self-employed individuals

- Independent contractors

- Individuals with significant investment income

- Individuals who receive income from sources other than wages, such as royalties or dividends

In addition to the above, individuals may also be required to make estimated tax payments if they anticipate owing more taxes than were withheld from their wages. This could occur if:

- They have a significant change in their income, such as a promotion or a new job

- They experience a significant increase in their deductions or credits

- They have a large capital gain, such as from selling a house or stocks

“If you anticipate owing more taxes than were withheld from your wages, you should make estimated tax payments to avoid penalties.”

Small businesses have unique tax obligations. The tax calculator for small businesses in October 2024 can help you estimate your tax liability.

Importance of Paying Estimated Taxes in October 2024

October 2024 is the fourth and final estimated tax payment deadline for the tax year 2024. This means that if you are required to make estimated tax payments, you must make your final payment by October 15, 2024, to avoid penalties.

For example, if you are self-employed and your income is higher than expected, you may need to make estimated tax payments to ensure you are paying your taxes throughout the year. This will help you avoid penalties for underpayment at the end of the tax year.

Factors Affecting Estimated Tax Calculations

Your estimated tax payments are based on your expected income, deductions, and credits for the tax year. Understanding these factors is crucial for accurately calculating your estimated taxes and avoiding penalties.

If you’re self-employed, you’ll need to file your own taxes. The tax calculator for self-employed individuals in October 2024 can help you estimate your tax liability.

Income

Changes in your income can significantly impact your estimated tax liability. Here are some key factors:

- Wages and Salaries:If you expect a raise or bonus, your income will increase, leading to higher tax payments. Similarly, a decrease in income will result in lower tax liability.

- Self-Employment Income:For self-employed individuals, income fluctuations are common. If you anticipate a significant increase in business revenue, you’ll likely need to adjust your estimated tax payments accordingly.

- Investment Income:Fluctuations in the stock market or interest rates can affect your investment income. If your investments generate more income than expected, you’ll likely owe more in taxes.

Deductions

Deductions reduce your taxable income, thereby lowering your tax liability. Changes in your deductions can affect your estimated tax payments.

Understanding tax brackets is crucial for planning your finances. The tax bracket thresholds for 2024 have been updated, so it’s a good idea to review them to see how your income might be affected.

- Standard Deduction vs. Itemized Deductions:The standard deduction is a fixed amount that you can claim on your tax return. Itemized deductions are specific expenses that you can deduct, such as mortgage interest, charitable donations, and medical expenses. If you anticipate significant changes in your itemized deductions, you may need to adjust your estimated tax payments.

It’s always a good idea to estimate your tax liability. The tax bracket calculator for 2024 can help you get a rough idea of your tax obligations.

- Homeownership Deductions:Changes in your mortgage interest, property taxes, or home improvement expenses can affect your homeownership deductions.

- Business Expenses:Self-employed individuals can deduct various business expenses. If you expect a significant increase in your business expenses, you may be able to lower your estimated tax payments.

Credits

Tax credits directly reduce your tax liability. Changes in your eligibility for certain credits can affect your estimated tax payments.

- Child Tax Credit:The Child Tax Credit is a credit for each qualifying child. If you expect a change in your family situation, such as the birth of a child or a child turning 17, your eligibility for the Child Tax Credit could change.

Tax brackets can change from year to year. The tax bracket changes for 2024 vs 2023 highlight the differences in how your income is taxed.

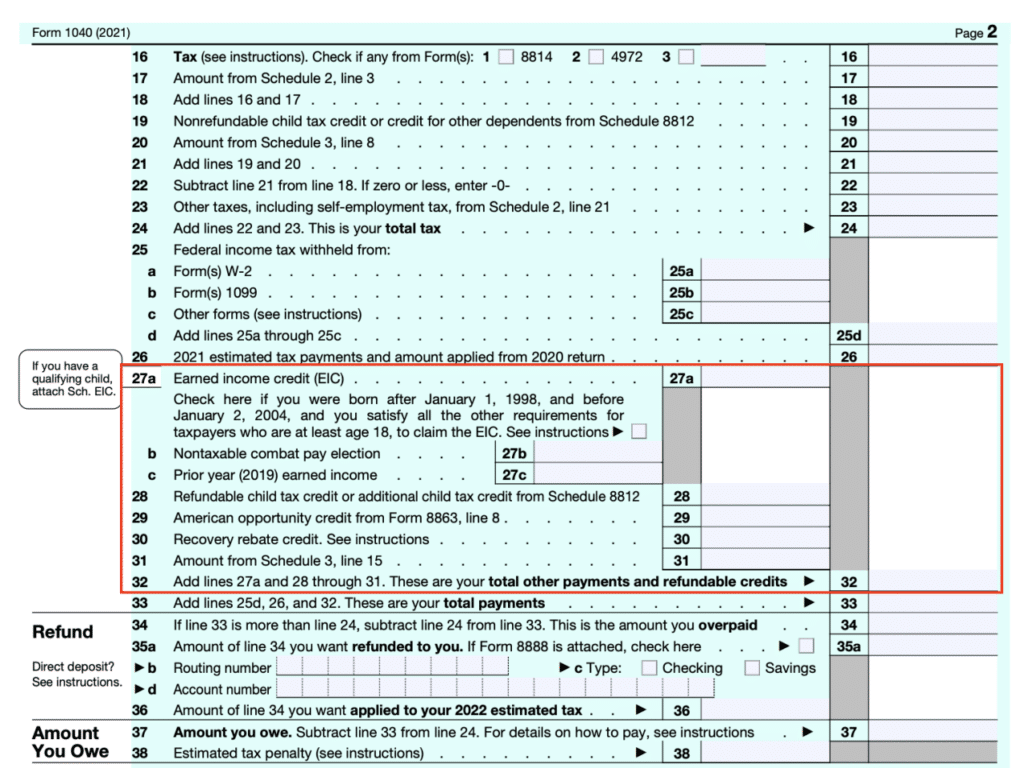

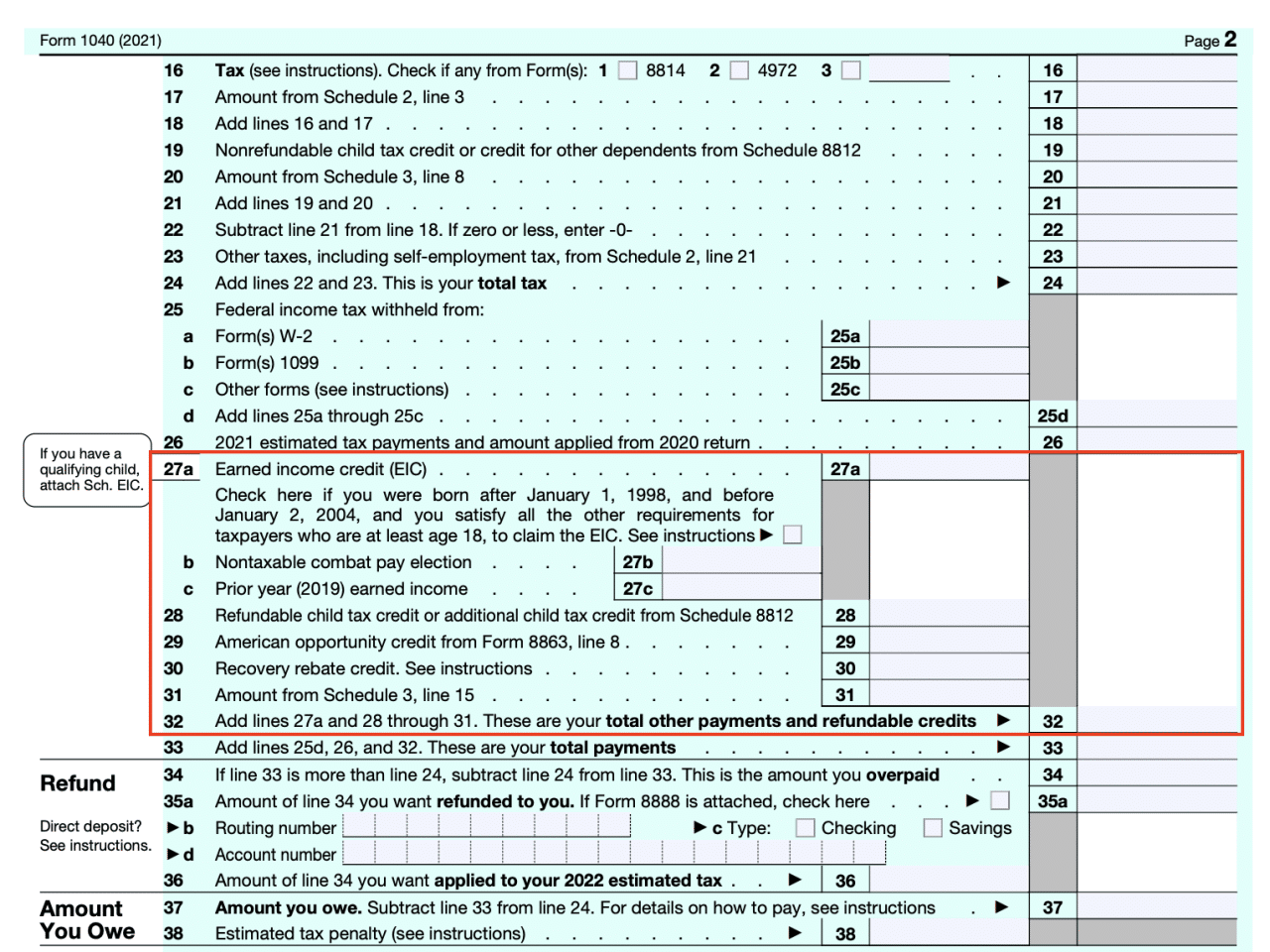

- Earned Income Tax Credit (EITC):The EITC is a tax credit for low-to-moderate-income working individuals and families. If you expect a change in your income or family situation, your eligibility for the EITC could change.

- Other Credits:There are various other tax credits available, such as the Premium Tax Credit for health insurance premiums. Changes in your eligibility for these credits can affect your estimated tax payments.

Examples of How Factors Can Impact Tax Liability

Example 1: Increased Income:Suppose you received a promotion with a significant salary increase. Your income would increase, leading to a higher tax liability. You would need to adjust your estimated tax payments to reflect this change.

Tax rates vary depending on your income level. The tax rates for each tax bracket in 2024 outline the percentage of your income that will be taxed.

Example 2: Deductions for Home Improvement:If you make significant home improvements, you may be able to deduct some of the expenses on your tax return. This would reduce your taxable income and lower your tax liability.

The W9 form is used to report your tax information to the IRS. There are some changes and updates to the W9 form in October 2024. Make sure you’re using the latest version by visiting the W9 Form October 2024 changes and updates page.

Example 3: Eligibility for Child Tax Credit:If you have a new baby, you will be eligible for the Child Tax Credit. This credit would reduce your tax liability and may result in a tax refund.

A Roth IRA is a great way to save for retirement. The maximum Roth IRA contribution in 2024 is a good starting point for your savings plan.

Finding a Reliable Tax Calculator: Tax Calculator For Estimated Taxes In October 2024

When it comes to calculating your estimated taxes, accuracy is paramount. A reliable tax calculator can be a valuable tool, helping you determine your tax liability and avoid penalties. However, not all tax calculators are created equal. It’s essential to choose one that is trustworthy and provides accurate results.

Factors to Consider When Choosing a Tax Calculator

Several factors contribute to a tax calculator’s reliability. It’s crucial to consider these aspects when making your choice.

If you’re over 50, you can contribute more to your 401k. The maximum 401k contribution for 2024 for over 50 is higher than for younger individuals.

- Accuracy and Up-to-Date Information:Ensure the calculator uses the latest tax laws and regulations. Look for updates and notifications regarding changes in tax codes or policies.

- Comprehensive Coverage:A reliable calculator should cover all relevant deductions, credits, and income sources. It should also account for different filing statuses and tax brackets.

- User-Friendly Interface:The calculator should be easy to navigate and understand. Clear instructions, helpful prompts, and intuitive design are essential for a smooth user experience.

- Security and Privacy:Opt for calculators hosted on secure websites that protect your personal and financial information. Look for indicators like SSL certificates (https://) and privacy policies.

- Customer Support:Choose a calculator with readily available customer support. This can be helpful if you encounter issues or have questions about the calculations.

Popular and Trusted Tax Calculators

Several reputable tax calculators are available online. Here are a few examples:

- TurboTax:A popular online tax preparation service, TurboTax offers a free tax calculator that allows you to estimate your tax liability. It is known for its user-friendly interface and comprehensive coverage.

- H&R Block:Another well-known tax preparation company, H&R Block provides a free online tax calculator. It offers a wide range of features, including personalized tax advice and a step-by-step guide.

- TaxAct:TaxAct is a popular online tax software that offers a free tax calculator. It is known for its accuracy and affordability.

- IRS Tax Withholding Estimator:The Internal Revenue Service (IRS) provides a free online tool called the Tax Withholding Estimator. This tool helps you determine the correct amount of taxes to withhold from your paycheck. It is a reliable source for accurate tax calculations.

Using a Tax Calculator

Tax calculators are helpful tools for estimating your tax liability. They use your financial information to calculate your estimated taxes and provide insights into your tax situation.

Understanding the Process of Using a Tax Calculator

Tax calculators work by gathering your financial information and using it to calculate your estimated tax liability. This involves several steps, including:

- Choosing a Reliable Tax Calculator:Select a reputable tax calculator from a trusted source, ensuring it is designed for the current tax year. Consider factors like ease of use, features, and user reviews.

- Providing Your Personal Information:Input your personal details, including your name, address, Social Security number, and filing status.

- Entering Income Information:Provide details about your income sources, including wages, salaries, self-employment income, and investment income. You may need to specify your income type, amount, and withholding information.

- Specifying Deductions and Credits:Enter any deductions or credits you anticipate claiming on your tax return, such as the standard deduction, itemized deductions, or credits for education or child care. These deductions and credits can significantly reduce your tax liability.

- Estimating Other Taxable Income:If applicable, provide details about other taxable income, such as interest income, dividends, or capital gains. This information is crucial for calculating your overall tax liability.

- Calculating Your Estimated Taxes:Once you have entered all the necessary information, the tax calculator will calculate your estimated tax liability based on the current tax laws and rates. This calculation includes your income, deductions, and credits.

- Reviewing and Adjusting Your Information:Carefully review the calculated results. If necessary, adjust your information to reflect any changes or inaccuracies. For example, if you anticipate a significant increase in income, you may need to adjust your deductions or credits accordingly.

- Saving or Printing Your Results:Save or print your results for future reference. The calculated results can help you plan your tax payments and avoid penalties.

Illustrative Example: Using a Tax Calculator

Let’s assume you are a single filer with an annual income of $70,000 from your job. You are eligible for the standard deduction and have no other deductions or credits. You can use a tax calculator to estimate your tax liability.

- Choose a Tax Calculator:Select a reputable tax calculator from a trusted source, like the IRS website or a financial institution’s website.

- Provide Personal Information:Enter your name, address, Social Security number, and filing status as “single.”

- Enter Income Information:Input your income of $70,000 from your job. Specify your income type as “wages” or “salary.”

- Specify Deductions and Credits:Select the standard deduction option for your filing status.

- Estimate Other Taxable Income:If you have any other taxable income, enter it accordingly. However, in this example, we assume you have no other taxable income.

- Calculate Estimated Taxes:The tax calculator will use your information to calculate your estimated tax liability, taking into account your income, deductions, and credits.

- Review and Adjust Information:Review the calculated results. If any information needs adjustments, make the necessary changes.

- Save or Print Results:Save or print your results for future reference. You can use this information to plan your tax payments and avoid penalties.

Tax Payment Options

Paying your estimated taxes in October 2024 is crucial to avoid penalties. You have several options for making these payments, each with its own advantages and disadvantages.

Payment Methods

The IRS offers a variety of ways to pay your estimated taxes. Understanding the different payment methods available can help you choose the most convenient and efficient option for you.

Independent contractors are required to provide a W9 form to their clients. The W9 Form October 2024 for independent contractors details the specific information you need to include.

- Online Payment:This is the most convenient option, allowing you to make payments directly from your bank account using the IRS’s online payment system. You can pay through the IRS website or through a third-party payment processor like Pay1040 or other tax software providers.

This method is typically free and allows for quick and secure payments.

- Electronic Funds Withdrawal:This option is similar to online payments, but you can make payments directly from your bank account when filing your tax return electronically through tax preparation software or through the IRS Free File program. It’s convenient and efficient, and you can be sure your payment will be processed promptly.

If you’re a single parent or someone who provides more than half of the support for a qualifying dependent, you might be eligible for the head of household filing status. This can lead to lower tax liability. Check out the standard deduction for head of household in 2024 to see if you qualify.

- Check or Money Order:You can send a check or money order payable to the U.S. Treasury. Make sure to include your name, address, Social Security number, tax year, and the relevant tax form number on the check or money order. Mail your payment to the address listed on the tax form or notice you received.

- Debit Card or Credit Card:You can pay your estimated taxes using a debit card or credit card through the IRS’s online payment system or through a third-party payment processor. This method might come with a processing fee, but it offers flexibility and convenience.

- Cash:You can pay your estimated taxes in cash at one of the IRS’s authorized payment locations, such as Dollar General, CVS, Walgreens, Walmart, and Kroger. This option might not be suitable for large payments, as there are limits on the amount you can pay in cash.

Self-employed individuals have different rules for retirement contributions. The 401k contribution limits for 2024 for self-employed can help you maximize your retirement savings.

Deadlines for Estimated Tax Payments in October 2024, Tax calculator for estimated taxes in October 2024

For October 2024, the deadline for paying your fourth quarter estimated taxes is January 15, 2025.

It’s important to note that this deadline falls on a Tuesday, so you won’t have to worry about weekend or holiday delays.

Partnerships are a common business structure. The W9 Form October 2024 for partnerships provides information on how partnerships should complete the form.

Tax Filing Considerations

Accurate record-keeping is essential for accurate tax filing. It helps ensure you claim all eligible deductions and credits, minimizing your tax liability. Additionally, well-organized records can simplify the tax filing process and provide evidence in case of an audit.

Families often have complex tax situations. The tax calculator for families in October 2024 can help you estimate your tax liability.

Organizing Tax Documents and Receipts

Maintaining organized tax documents and receipts is crucial for accurate tax filing. A well-structured system can streamline the tax preparation process, prevent errors, and provide readily accessible information for potential audits.

- Create a Dedicated Filing System:Designate a specific folder or location for all tax-related documents. This dedicated space can be a physical file cabinet, a digital folder on your computer, or a cloud-based storage service. Labeling each folder with the corresponding tax year is highly recommended.

- Categorize Documents:Organize your documents into relevant categories, such as income, expenses, deductions, and credits. This categorization simplifies locating specific information when preparing your tax return.

- Keep Digital and Paper Records:Store digital and paper records separately. Digital records can be organized in folders on your computer or cloud storage services. Paper records should be stored in a safe, dry place, such as a fireproof safe or filing cabinet.

- Maintain Receipts:Retain receipts for all expenses that you intend to claim as deductions on your tax return. This documentation provides evidence of your expenses and helps ensure you receive the appropriate deductions.

- Store Tax Returns:Keep copies of all filed tax returns, including the IRS confirmation, for at least three years after filing. This allows you to easily access past tax information if needed.

Preparing for Filing Taxes

Using a tax calculator provides valuable insights into your estimated tax liability. However, it’s crucial to understand that the calculator provides an estimate, and your actual tax liability may vary. After using a tax calculator, you should take the following steps to prepare for filing your taxes:

- Review the Calculator’s Results:Carefully review the tax calculator’s results, paying close attention to your estimated tax liability, potential deductions and credits, and any adjustments to your withholding.

- Gather Required Documents:Assemble all necessary tax documents, including your W-2 forms, 1099 forms, and any other relevant income and expense documentation.

- Consult with a Tax Professional:Consider consulting with a tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA), for guidance on preparing your tax return. They can help ensure you claim all eligible deductions and credits and avoid potential errors.

- File Your Taxes:File your taxes on time to avoid penalties. The IRS offers various methods for filing, including online filing, mail-in filing, and filing through a tax professional.

Last Point

Utilizing a tax calculator for estimated taxes in October 2024 empowers you to take control of your financial well-being. By accurately estimating your tax liability, you can avoid potential penalties and ensure a smoother tax filing experience. Remember to choose a reputable calculator, carefully input your information, and explore the various payment options to find the best fit for your circumstances.

With a little planning and the right tools, you can navigate the world of estimated taxes with confidence.

FAQ

What are the penalties for underpaying estimated taxes?

Penalties for underpaying estimated taxes can vary depending on the amount owed and the length of time the underpayment exists. It’s best to consult with a tax professional for specific guidance.

Can I use a tax calculator for both federal and state estimated taxes?

Many tax calculators offer both federal and state tax estimations. However, it’s important to check the calculator’s capabilities and ensure it covers your specific state’s requirements.

Is it necessary to use a tax calculator if I’m self-employed?

Yes, it’s highly recommended for self-employed individuals to use a tax calculator to estimate their tax liability. This helps avoid penalties and ensures you’re making timely payments throughout the year.