Tax Deadline 2023 is fast approaching, and it’s time to get your financial affairs in order. Whether you’re a seasoned filer or a first-timer, navigating the complexities of tax season can be daunting. This comprehensive guide provides everything you need to know about filing your taxes accurately and on time, from understanding the basics to exploring tax planning strategies and avoiding common pitfalls.

We’ll delve into the different filing methods available, including online filing, mail filing, and tax preparation services, outlining the advantages and disadvantages of each. We’ll also cover essential tax forms and documents, important tax credits and deductions, and common tax filing mistakes to watch out for.

Furthermore, we’ll explore proactive tax planning strategies to minimize your tax liability and maximize your savings, including charitable contributions, retirement contributions, and investment adjustments.

Contents List

- 1 Tax Deadline Overview

- 2 2. Filing Methods and Options

- 3 Tax Forms and Documents

- 4 Tax Credits and Deductions

- 5 5. Tax Planning Strategies

- 6 6. Common Tax Filing Mistakes

- 7 Tax Audit Considerations: Tax Deadline 2023

- 8 8. Penalties for Late Filing or Non-Payment

- 8.1 Penalties for Late Filing or Non-Payment

- 8.2 Calculating Penalties

- 8.3 Exceptions to Penalties

- 8.4 Table of Penalties for Late Filing or Non-Payment

- 8.5 Blog Post: Avoiding Late Filing and Payment Penalties

- 8.6 Sample Letter Requesting Waiver of Late Filing Penalties

- 8.7 Flow Chart for Calculating Penalties for Late Filing or Non-Payment

- 9 Resources and Support for Taxpayers

- 10 Impact of Tax Law Changes

- 11 Tax Filing Tips for Specific Groups

- 12 Future Tax Outlook

- 13 Closure

- 14 FAQ Summary

Tax Deadline Overview

The tax deadline is the date by which you must file your tax return with the Internal Revenue Service (IRS) and pay any taxes owed. The deadline can vary depending on whether you are filing federal or state taxes, and whether you are an individual or a business.

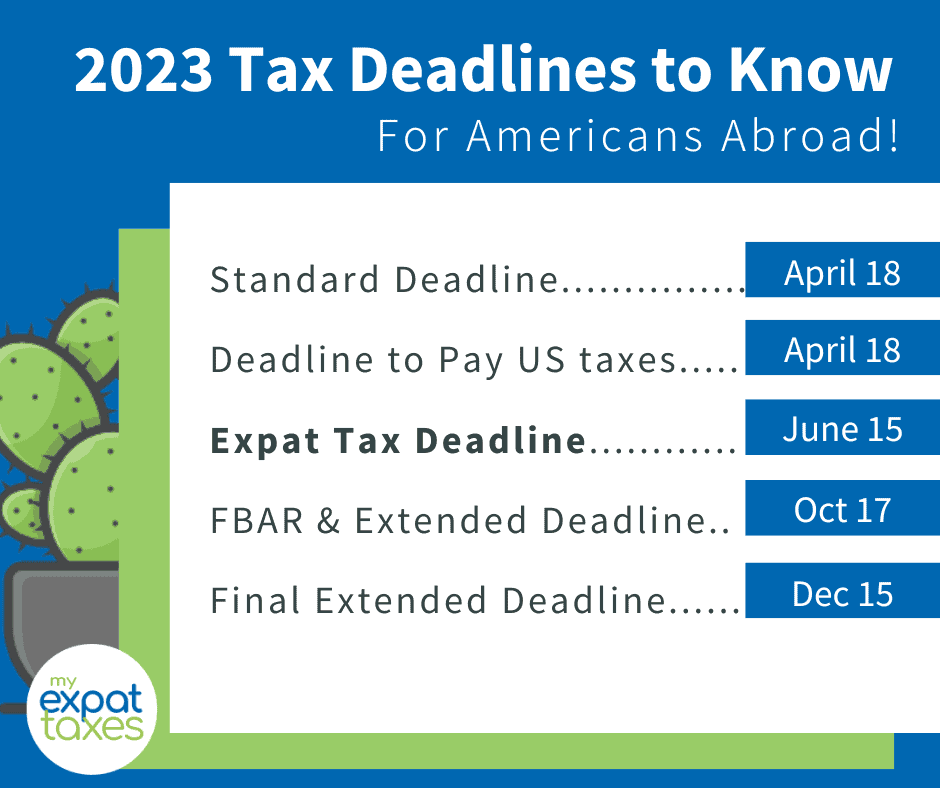

Federal Tax Deadline

The federal tax deadline for most individuals and businesses is April 18, 2023. This is because April 15th, 2023, falls on a Saturday, and the following Monday, April 17th, is Emancipation Day, a federal holiday in Washington, D.C. The deadline for filing your tax return is moved to the next business day.

State Tax Deadlines

State tax deadlines vary by state. However, many states follow the federal tax deadline. You can find your state’s tax deadline on the website of your state’s tax agency.

Extensions

You can request an extension to file your federal tax return. This will give you an additional six months to file your return. However, it will not give you an extension to pay any taxes owed. You must still pay any taxes owed by the original tax deadline.

To request an extension, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Exceptions

There are some exceptions to the tax deadlines. For example, if you are a member of the military serving outside of the United States, you may have an extended deadline to file your tax return.

Key Dates

Here is a list of key dates for the 2023 tax season:

- January 31, 2023: Deadline for employers to file Form W-2, Wage and Tax Statement, and Form 1099-NEC, Nonemployee Compensation, with their employees.

- April 18, 2023: Deadline for most individuals and businesses to file their federal income tax returns and pay any taxes owed.

- October 16, 2023: Deadline for individuals to make estimated tax payments for the fourth quarter of 2023.

2. Filing Methods and Options

In 2023, taxpayers have several options for filing their taxes, each with its own advantages and disadvantages. Choosing the best method depends on individual circumstances, such as tax complexity, time constraints, and comfort level with technology.

2.1. Online Filing

Online filing has become increasingly popular due to its convenience, speed, and potential cost savings. Taxpayers can use various tax software programs to prepare and file their returns electronically.

- Popular tax software options include TurboTax, H&R Block, and TaxAct. These programs offer different features and price points to suit various needs.

- Setting up an account typically involves providing basic personal information, such as name, Social Security number, and address.

- Taxpayers then enter their tax information, including income, deductions, and credits, into the software. The software guides users through the process and helps calculate their tax liability.

- Once the return is completed, taxpayers can electronically file it with the IRS through the software.

Online filing offers several advantages:

- Convenience:Taxpayers can file their returns from anywhere with an internet connection, eliminating the need to visit a tax preparer or mail forms.

- Speed:Electronic filing typically results in faster processing and refunds compared to mail filing.

- Accuracy:Tax software programs can help identify potential errors and ensure accuracy in calculations.

- Cost savings:Online filing is often more affordable than using a tax preparer, especially for simple returns.

- Tax deductions and credits:Many tax software programs offer features that help taxpayers identify and claim eligible deductions and credits, maximizing potential tax savings.

However, online filing also has some disadvantages:

- Technical issues:Taxpayers may encounter technical problems with the software or internet connectivity, delaying the filing process.

- Security concerns:Sharing sensitive financial information online raises security concerns. It is important to choose reputable software programs with strong security measures.

- Internet access:Online filing requires reliable internet access, which may not be available to all taxpayers.

- Complex tax situations:Taxpayers with complex tax situations may need professional assistance from a tax preparer, as online software may not be able to handle all their needs.

2.2. Mail Filing

For taxpayers who prefer a more traditional approach or lack internet access, mail filing remains an option.

- The IRS website provides access to all necessary tax forms and instructions.

- Taxpayers can download and print the forms or request them by mail.

- After filling out the forms and calculating their taxes, taxpayers must mail them to the appropriate IRS address.

Mail filing offers some advantages:

- Control:Taxpayers have greater control over the filing process, as they can review the forms thoroughly before submission.

- Tax preparer assistance:Taxpayers can choose to use a tax preparer to assist with form completion, even when filing by mail.

However, mail filing also has drawbacks:

- Errors:Filling out forms manually increases the potential for errors, which could lead to delays or penalties.

- Processing time:Mail filing typically takes longer to process than online filing, resulting in a longer wait for refunds.

- Lost or damaged mail:Mailing tax forms carries the risk of lost or damaged mail, potentially delaying processing or requiring resubmission.

2.3. Tax Preparation Services

For taxpayers who want professional assistance with their taxes, various tax preparation services are available.

- Taxpayers can choose to work with a tax preparer in person, online, or through a phone consultation.

- Tax preparers offer different levels of expertise and services.

- Certified Public Accountants (CPAs)are licensed professionals who can provide a wide range of tax services, including tax planning, preparation, and representation.

- Enrolled Agents (EAs)are licensed by the IRS to represent taxpayers before the agency.

- Tax preparersare individuals who prepare tax returns but may not have the same level of expertise as CPAs or EAs.

Using tax preparation services offers several benefits:

- Expertise:Tax preparers have specialized knowledge of tax laws and regulations, helping taxpayers maximize their deductions and credits.

- Complex tax situations:Tax preparers can assist with complex tax situations, such as business income, investment income, or international taxes.

- Potential tax savings:By taking advantage of all eligible deductions and credits, tax preparers can help taxpayers save money on their taxes.

- Personalized guidance:Tax preparers can provide personalized guidance and support throughout the filing process.

However, using tax preparation services also has some drawbacks:

- Cost:Tax preparation services can be expensive, especially for complex returns.

- Personal information:Taxpayers must share their personal financial information with a third party, raising privacy concerns.

- Reputable preparer:It is crucial to choose a reputable and qualified tax preparer to avoid errors and fraud.

2.4. Comparison Table, Tax Deadline 2023

| Filing Method | Advantages | Disadvantages | Cost | Convenience | Complexity ||—|—|—|—|—|—|| Online Filing | Convenient, fast, accurate, potentially cost-effective, tax deductions and credits | Technical issues, security concerns, requires internet access, may not handle complex situations | Low to moderate | High | Low to moderate || Mail Filing | Greater control, potential for tax preparer assistance | Potential for errors, slower processing, risk of lost mail | Low | Moderate | Moderate || Tax Preparation Services | Expertise, assistance with complex situations, potential tax savings, personalized guidance | Higher cost, sharing personal information, importance of choosing a reputable preparer | Moderate to high | Moderate to high | Low to high |

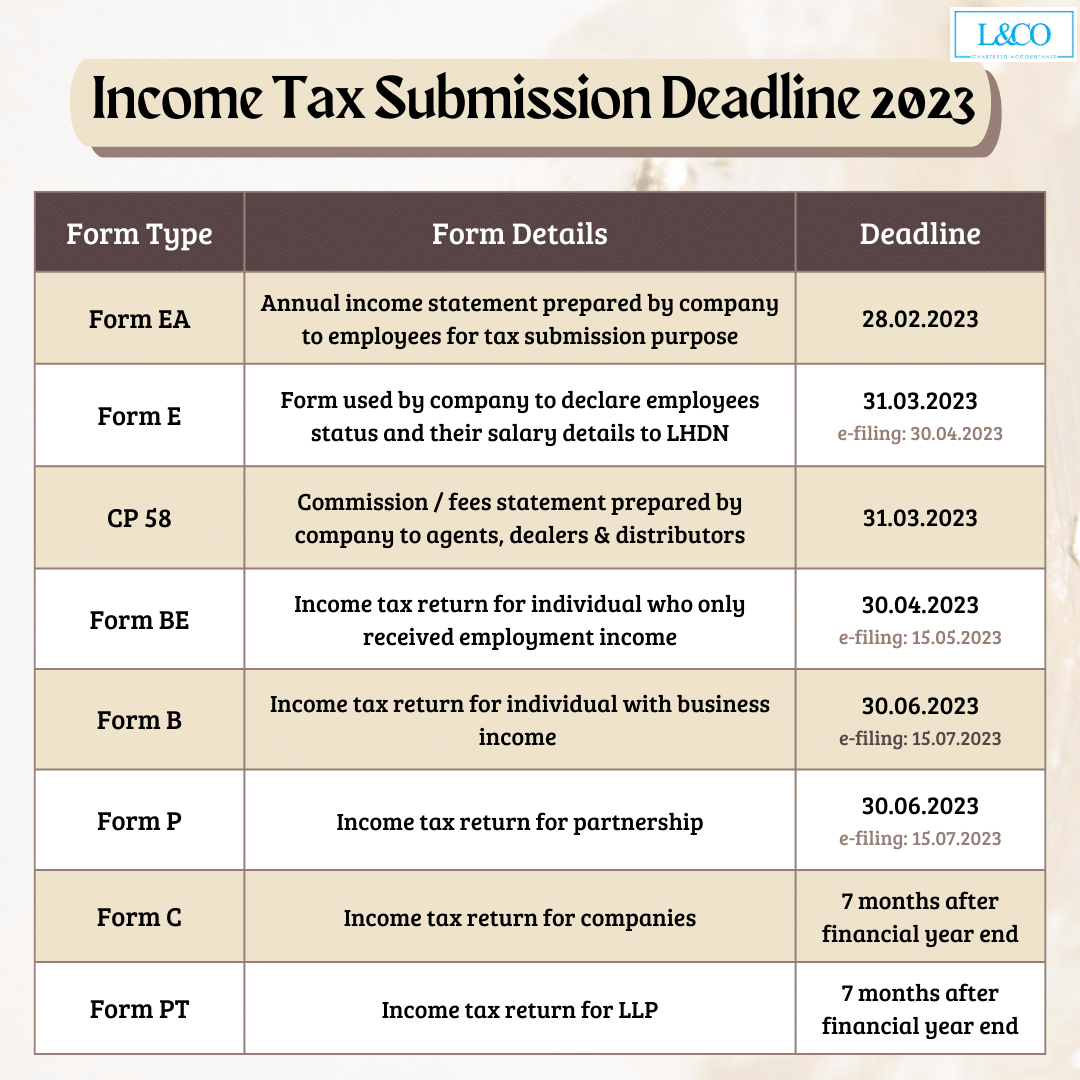

Tax Forms and Documents

Filing your taxes requires a collection of essential forms and documents that provide the IRS with the necessary information to calculate your tax liability. These forms and documents are used to report your income, deductions, and credits, allowing the IRS to determine the amount of taxes you owe or the refund you are eligible for.

Form 1040

The Form 1040 is the primary tax form used by most individuals to file their federal income tax return. It serves as the central document where you report your income, deductions, and credits. You can choose from various versions of Form 1040 depending on your circumstances:* Form 1040-EZ:This simplified form is available for taxpayers with straightforward income and deductions.

Form 1040-SR

This form is designed for seniors and allows for simplified reporting of certain income and deductions.

Form 1040-NR

This form is used by non-resident aliens.

Form 1040 is used to calculate your tax liability, which is the amount of taxes you owe to the IRS.

W-2 Form

The W-2 form, also known as the Wage and Tax Statement, is issued by your employer and summarizes your income and withholdings for the year. It is essential for reporting your earned income, including wages, salaries, tips, and bonuses.

The W-2 form is used to report your wages and withholdings for the year.

1099 Forms

forms are used to report various types of income, such as interest, dividends, and payments for services. There are several different 1099 forms, each designed for a specific type of income:* 1099-INT:Used to report interest income from sources like savings accounts and bonds.

1099-DIV

Used to report dividends from stocks and mutual funds.

1099-NEC

Used to report income from self-employment, independent contracting, and other non-employee compensation.

1099-MISC

Used to report miscellaneous income, including royalties, prizes, and certain types of payments.

1099 forms are used to report income other than wages, such as interest, dividends, and payments for services.

Tax Credits and Deductions

Tax credits and deductions are valuable tools that can help reduce your tax liability. They offer financial relief by either directly reducing your tax bill (credits) or lowering your taxable income (deductions).

Tax Credits for Individuals and Families

Tax credits directly reduce the amount of taxes you owe. These credits can be claimed by individuals and families who meet certain eligibility criteria.

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children. For example, in 2023, a single filer with three qualifying children and an adjusted gross income (AGI) of $53,057 could receive a maximum credit of $6,935.

- Child Tax Credit (CTC): The CTC provides a credit for each qualifying child under the age of 17. In 2023, the credit amount is $2,000 per qualifying child. However, the amount of the credit that is refundable (meaning you can receive a portion of the credit even if you don’t owe taxes) is capped at $1,500.

- Premium Tax Credit (PTC): The PTC helps individuals and families afford health insurance through the Affordable Care Act’s marketplaces. The amount of the credit depends on your income, household size, and the cost of health insurance plans in your area.

- American Opportunity Tax Credit (AOTC): The AOTC is available to eligible students enrolled at least half-time in a qualified educational institution. The credit is worth up to $2,500 per student and can be claimed for the first four years of post-secondary education.

Tax Deductions for Individuals and Families

Tax deductions lower your taxable income, which in turn reduces your tax liability. Here are some common tax deductions:

- Standard Deduction: This deduction is a fixed amount that can be claimed instead of itemizing deductions. The standard deduction amount varies based on your filing status.

- Itemized Deductions: If you choose to itemize your deductions, you can deduct certain expenses that exceed the standard deduction. Common itemized deductions include:

- Homeownership Expenses: This includes mortgage interest, property taxes, and insurance premiums.

- Medical Expenses: You can deduct medical expenses exceeding 7.5% of your adjusted gross income (AGI).

- State and Local Taxes (SALT): The 2017 Tax Cuts and Jobs Act limited the deduction for state and local taxes to $10,000 per household.

- Charitable Contributions: You can deduct cash contributions up to 60% of your AGI and non-cash contributions up to 30% of your AGI.

- Student Loan Interest Deduction: You can deduct up to $2,500 in interest paid on student loans.

- Child and Dependent Care Credit: This credit helps offset the costs of childcare for qualifying dependents. The amount of the credit depends on your income and the amount of care expenses.

Tax Credits and Deductions for Businesses

Tax credits and deductions are also available to businesses. These benefits can help reduce a business’s tax liability and encourage investment and growth.

- Research and Development (R&D) Tax Credit: This credit is available to businesses that conduct qualifying research activities. The credit amount is based on the amount of qualified research expenses incurred.

- Work Opportunity Tax Credit (WOTC): This credit is available to businesses that hire individuals from certain target groups, such as veterans, long-term unemployed individuals, and ex-felons. The amount of the credit varies depending on the target group and the number of hours worked.

- Small Business Deduction: This deduction is available to small businesses with annual gross receipts of less than $5 million. The deduction amount is 20% of the first $250,000 of qualified business income.

5. Tax Planning Strategies

Proactive tax planning is essential for individuals and families seeking to minimize their tax liability and maximize their financial well-being. By strategically managing income, expenses, and investments, you can optimize your tax situation and potentially save a significant amount of money over time.

Charitable Contributions

Charitable contributions are a great way to support causes you care about while also reducing your tax burden. There are various types of charitable contributions, each with its own tax implications. * Cash Contributions:These are the most common type of charitable contribution.

You can deduct cash contributions up to 60% of your Adjusted Gross Income (AGI).

Donating Appreciated Assets

Donating appreciated assets, such as stocks or real estate, can provide significant tax benefits. You can deduct the fair market value of the asset at the time of the donation, potentially avoiding capital gains tax.

Volunteer Services

You can also deduct the value of your time spent volunteering for certain organizations. This deduction is limited to out-of-pocket expenses related to your volunteer work. Examples of Common Charitable Organizations:

American Red Cross

Provides humanitarian aid and disaster relief worldwide.

United Way

Supports a wide range of local community programs.

Habitat for Humanity

Builds affordable homes for low-income families. Claiming Charitable Contribution Deductions:To claim a charitable contribution deduction on your tax return, you must keep detailed records of your donations. This includes the name of the organization, the date of the donation, and the amount donated.

You can use Form 1040 Schedule A to claim these deductions.

Retirement Contributions

Retirement savings plans offer significant tax advantages, allowing you to grow your savings tax-deferred or tax-free. Here are some popular retirement savings plans:* 401(k) Plans:Offered by employers, 401(k) plans allow you to contribute pre-tax dollars to your retirement account. Your contributions are not taxed until you withdraw them in retirement.

Traditional IRA

Individuals can contribute to a Traditional IRA, regardless of employment status. Contributions are tax-deductible, and earnings grow tax-deferred.

Roth IRA

Contributions to a Roth IRA are made with after-tax dollars, but withdrawals in retirement are tax-free. Table Comparing Retirement Savings Plans:| Plan Type | Contribution Limit (2023) | Tax-Deductible? | Tax-Free Withdrawals? | Other Features ||—|—|—|—|—|| 401(k) | $22,500 (or $30,000 for those 50 and older) | Yes | No | Employer matching contributions, potential for loan options || Traditional IRA | $6,500 (or $7,500 for those 50 and older) | Yes | No | May be eligible for a tax deduction even if you have a 401(k) || Roth IRA | $6,500 (or $7,500 for those 50 and older) | No | Yes | Contributions are not tax-deductible, but withdrawals in retirement are tax-free | Early Retirement Planning:Starting early with retirement savings can provide significant tax benefits.

The longer your money grows tax-deferred, the more it can compound, leading to a larger nest egg.

Investment Adjustments

Strategic investment planning can minimize your tax liability and enhance your overall returns.* Tax-Loss Harvesting:This strategy involves selling losing investments to offset capital gains and reduce your overall tax burden.

Capital Gains and Losses

The tax treatment of capital gains and losses depends on the holding period. Short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains are taxed at lower rates.

Tax-Efficient Portfolios

Consider investing in assets with lower tax implications, such as municipal bonds, which offer tax-free interest income.

Other Strategies

There are various other tax planning strategies that can benefit individuals and families.* Homeownership Deductions:Mortgage interest and property taxes are often deductible on your federal income tax return.

Education Tax Credits

The American Opportunity Tax Credit and the Lifetime Learning Credit can help offset the cost of education expenses.

Dependent Care Expenses

If you pay for childcare expenses, you may be eligible for the Child Tax Credit or the Dependent Care Credit.

“Proactive tax planning can save you a significant amount of money in the long run. By taking the time to understand your tax situation and exploring available strategies, you can minimize your tax liability and maximize your financial well-being.”

Tax Expert

6. Common Tax Filing Mistakes

Tax season can be a stressful time, and it’s easy to make mistakes when you’re trying to navigate the complex world of taxes. Even experienced taxpayers can fall victim to common errors, which can lead to penalties, audits, and even a delay in receiving your refund.

This guide will help you identify some of the most frequent tax filing mistakes and offer actionable advice to avoid them.

Incorrect Deductions

Claiming deductions you’re not entitled to is a common mistake. It’s important to understand the rules and requirements for each deduction and ensure you have the necessary documentation to support your claims.

- Home Office Deduction:This deduction is often claimed incorrectly. You must meet specific requirements, such as using the space exclusively for business purposes and having a regular place of business.

- Charitable Donations:Donors must have a written acknowledgment from the charity for any donation exceeding $250. This acknowledgment should include the name of the charity, the date of the donation, and the amount donated.

- Medical Expenses:You can only deduct medical expenses exceeding 7.5% of your Adjusted Gross Income (AGI).

- Child Tax Credit:You must meet certain income and filing status requirements to claim the Child Tax Credit.

- Student Loan Interest:You can only deduct interest on student loans up to $2,500 per year.

Missing Forms

Failing to include all the necessary tax forms can lead to errors and delays.

- Form 1099-NEC:This form reports non-employee compensation, such as payments made to independent contractors.

- Form 1099-INT:This form reports interest income earned from banks and other financial institutions.

- Form 1099-DIV:This form reports dividend income earned from stocks and other investments.

- Form W-2G:This form reports gambling winnings.

- Form 1095-A:This form provides information about your health insurance coverage through the Marketplace.

Calculation Mistakes

Simple math errors can have a significant impact on your tax liability.

- Incorrectly Calculating Deductions:Make sure you’re using the correct formulas and applying the deduction limits.

- Mistakes in Calculating Credits:Many tax credits have income limitations or phase-out rules.

- Incorrectly Reporting Income:Double-check your income figures from all sources.

Filing Status Errors

Choosing the wrong filing status can affect your tax liability and eligibility for certain deductions and credits.

- Married Filing Separately:This filing status is often chosen for strategic reasons, but it can result in higher taxes.

- Head of Household:You must meet specific requirements to qualify for this filing status, such as having a qualifying child.

Tax Audit Considerations: Tax Deadline 2023

It’s important to understand that while not everyone gets audited, certain factors can increase your chances of being selected. Knowing these triggers can help you minimize your risk and prepare if you’re chosen for an audit.

Common Triggers for a Tax Audit

Understanding the common triggers for a tax audit can help you proactively minimize your risk and prepare for potential scrutiny.

- Large Deductions:Claiming unusually high deductions for expenses like business travel or charitable donations can raise red flags. For example, a small business owner claiming a significant portion of their home expenses as a business deduction might attract attention.

- Inconsistent Reporting:Reporting income or expenses differently on various tax forms or between years can be a cause for concern. For instance, a taxpayer reporting a large amount of income on their Form 1040 but claiming very little on their Schedule C might trigger an audit.

- Red Flags in Tax Returns:Unusual or inconsistent entries, such as claiming a deduction for a non-existent expense, can immediately flag your return for review. A taxpayer claiming a deduction for a nonexistent medical expense is a prime example.

- Industry-Specific Audits:Certain industries, such as real estate or construction, are more likely to be audited due to the complexity of their deductions and expenses. For example, a real estate agent claiming deductions for travel and entertainment expenses might face closer scrutiny.

- High-Income Individuals:Individuals with high incomes are more likely to be audited, as the IRS may suspect underreporting or errors in complex tax situations. A taxpayer earning over $200,000 annually, for instance, might face a higher audit probability.

If you’re selected for a tax audit, don’t panic! It’s crucial to understand the process and how to respond effectively.

- Gather Documents:The first step is to gather all relevant financial records, including bank statements, receipts, invoices, and any supporting documentation for your deductions and credits. This will help you quickly provide the auditor with the necessary information.

- Communicate with the Auditor:Be polite and professional when communicating with the auditor. Respond to their requests promptly and clearly. Keep detailed records of all communications, including dates, times, and the content of conversations.

- Potential Outcomes:The outcome of an audit can vary. The auditor may find no errors, leading to no changes in your tax liability. Alternatively, they might find errors and issue a notice of proposed adjustment, which may require you to pay additional taxes, penalties, and interest.

You have the right to appeal this decision if you disagree.

Preparing for a Tax Audit

Being prepared can help you navigate the audit process smoothly. Here’s a checklist of key actions to take:

- Organize Financial Records:Gather and organize all relevant financial documents, including bank statements, receipts, invoices, and supporting documentation for deductions and credits.

- Review Past Returns:Review your tax returns from previous years to ensure consistency in reporting and identify any potential areas of concern.

- Understand the Process:Familiarize yourself with the audit process, including your rights and responsibilities as a taxpayer.

- Prepare for an Interview:If required, prepare for a potential interview with the auditor. This includes understanding the questions they may ask and having your supporting documentation ready.

- Keep Detailed Notes:Maintain detailed notes of all communications with the auditor, including dates, times, and the content of conversations. This will provide a clear record of the audit process.

- Maintain a Professional Demeanor:Throughout the audit process, maintain a calm and professional demeanor. This will help you communicate effectively with the auditor and ensure a fair and transparent process.

8. Penalties for Late Filing or Non-Payment

The IRS imposes penalties for late filing or non-payment of taxes. These penalties can significantly increase your tax liability, so it’s crucial to understand them and take steps to avoid them.

Penalties for Late Filing or Non-Payment

Late filing and non-payment penalties are designed to encourage timely tax compliance. Understanding these penalties can help you avoid them.

- Late Filing Penalty:This penalty applies when you file your tax return after the deadline. The penalty is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

The penalty is calculated on the amount of tax due after subtracting any payments made, including estimated taxes.

- Late Payment Penalty:This penalty applies when you don’t pay your taxes by the due date. The penalty is generally 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax.

- Failure to Pay Penalty:This penalty applies when you don’t pay enough tax by the due date, even if you file on time. The penalty is generally 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax.

Calculating Penalties

The penalties for late filing or non-payment are calculated based on the following formula:

Penalty = (Unpaid Tax) x (Penalty Rate) x (Number of Months or Parts of Months Late)

For example, if you owe $1,000 in taxes and file your return two months late, the late filing penalty would be calculated as follows:

Penalty = ($1,000) x (0.05) x (2) = $100

Exceptions to Penalties

There are some exceptions to the late filing and late payment penalties, including:

- Reasonable Cause Relief:The IRS may waive penalties if you can demonstrate that you had a reasonable cause for filing late or paying late. This could include circumstances such as a serious illness, a natural disaster, or a delay caused by the IRS.

- Hardship Waivers:The IRS may waive penalties if you can demonstrate that paying the penalty would cause you significant financial hardship.

Table of Penalties for Late Filing or Non-Payment

The following table summarizes the penalties for late filing or non-payment:

| Penalty Type | Description | Calculation | Exceptions |

|---|---|---|---|

| Late Filing Penalty | Penalty for filing your tax return after the deadline. | 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. | Reasonable cause relief, hardship waivers. |

| Late Payment Penalty | Penalty for not paying your taxes by the due date. | 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax. | Reasonable cause relief, hardship waivers. |

| Failure to Pay Penalty | Penalty for not paying enough tax by the due date, even if you file on time. | 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax. | Reasonable cause relief, hardship waivers. |

Blog Post: Avoiding Late Filing and Payment Penalties

Late filing and payment penalties can add a significant amount to your tax bill. Here’s what you need to know to avoid them.The IRS imposes penalties for late filing and late payment of taxes. The late filing penalty is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

The late payment penalty is generally 0.5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax.However, there are some exceptions to these penalties.

For example, the IRS may waive penalties if you can demonstrate that you had a reasonable cause for filing late or paying late, such as a serious illness, a natural disaster, or a delay caused by the IRS.To avoid these penalties, it’s essential to file your tax return and pay your taxes by the deadline.

If you know you won’t be able to meet the deadline, consider filing for an extension. This will give you more time to file your return, but it won’t give you more time to pay your taxes.

Sample Letter Requesting Waiver of Late Filing Penalties

[Your Name][Your Address][Your Phone Number][Your Email Address][Date]Internal Revenue Service[Address] Subject: Request for Waiver of Late Filing PenaltiesDear Sir/Madam,This letter is to request a waiver of late filing penalties for my tax return for the [Tax Year]. I understand that my return was filed late on [Date].[Explain the reason for the late filing.

Be specific and provide supporting documentation, such as a doctor’s note, a copy of a death certificate, or a letter from your employer.]I am committed to timely filing my taxes in the future and have taken steps to ensure that this will not happen again.I request that you consider waiving the late filing penalties in this case.

I am confident that I have a valid reason for the late filing and that I have taken steps to prevent this from happening again.Thank you for your time and consideration.Sincerely,[Your Signature][Your Typed Name]

Flow Chart for Calculating Penalties for Late Filing or Non-Payment

[Flow Chart Description][Image Description]

Resources and Support for Taxpayers

Navigating the tax system can be complex, but numerous resources are available to help taxpayers understand their obligations and ensure accurate filing. Whether you prefer online tools, government websites, or professional guidance, you have options to streamline the tax process and avoid potential pitfalls.

Government Websites

Government websites offer comprehensive information about tax laws, filing procedures, and available resources. These websites serve as primary sources for tax-related information and provide access to important tools and services.

- IRS Website:The official IRS website, https://www.irs.gov/ , is a valuable resource for taxpayers. It offers detailed information on tax laws, forms, and deadlines. The website also features helpful tools like the “Taxpayer Advocate Service,” which assists taxpayers facing problems with the IRS.

This service helps resolve tax issues and provides advocacy for taxpayers who are struggling to navigate the IRS system. The “Where’s My Refund?” tool allows taxpayers to track the status of their tax refunds.

- State Tax Agency Websites:Each state has its own tax agency, which provides information on state-specific tax laws and filing requirements. These websites often offer resources for specific tax situations, such as filing extensions, claiming state-specific credits, and understanding state income tax deductions. For example, the California Franchise Tax Board website provides information on California tax laws, forms, and deadlines.

Tax Preparation Software

Tax preparation software offers a user-friendly way to file taxes online. These programs provide guidance throughout the tax filing process, helping taxpayers navigate deductions, credits, and other tax-related matters.

- Popular Software Options:Popular tax preparation software options include TurboTax, H&R Block, and TaxAct. These programs offer various features to suit different needs, including free filing options for simple tax returns, guidance on claiming deductions and credits, and audit support.

- Key Features:Tax preparation software typically offers features such as:

- Free Filing Options:Many software providers offer free filing options for simple tax returns, particularly for taxpayers with straightforward income and deductions.

- Tax Deductions and Credits:The software helps identify potential deductions and credits based on your individual circumstances, maximizing your tax savings.

- Audit Support:Some programs provide audit support, offering assistance in case of an IRS audit.

Financial Advisors

Financial advisors provide expert guidance on tax planning, investment strategies, and retirement planning. They can help individuals develop personalized strategies to minimize tax liability and achieve their financial goals.

- Benefits:Financial advisors can offer various benefits, including:

- Tax Planning:They help develop tax-efficient strategies for investments, retirement planning, and estate planning.

- Investment Strategies:They provide guidance on asset allocation, diversification, and investment choices to optimize returns and manage risk.

- Retirement Planning:They assist in creating a comprehensive retirement plan, considering tax implications and investment strategies.

- Choosing a Financial Advisor:When choosing a financial advisor, it’s crucial to:

- Check Credentials:Verify the advisor’s credentials and licenses, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Seek Recommendations:Ask for recommendations from trusted sources, such as friends, family, or financial professionals.

- Review Experience:Consider the advisor’s experience and expertise in areas relevant to your needs.

Contact Information

- IRS Contact Information:

- Phone:1-800-829-1040

- Email:The IRS does not provide a general email address for taxpayer inquiries. For specific inquiries, you can use the “Contact Us” section on the IRS website.

- Mailing Address:

- For Taxpayers:Internal Revenue Service, P.O. Box 7101, Ben Franklin Station, Washington, DC 20044

- For Tax Professionals:Internal Revenue Service, P.O. Box 7101, Ben Franklin Station, Washington, DC 20044

- State Tax Agency Contact Information:Contact information for state tax agencies varies by state. Refer to the relevant state tax agency website for specific contact information.

Additional Information

- Tax Filing Deadlines:The federal tax filing deadline is typically April 15th each year. State tax filing deadlines may vary.

- Tax Penalties:Penalties may apply for late filing or underpayment of taxes. The penalty for late filing is typically a percentage of the unpaid tax liability.

- Tax Assistance Programs:The IRS offers free tax preparation services through programs like the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE). These programs are available to low- and moderate-income taxpayers, as well as seniors.

Impact of Tax Law Changes

The tax landscape is constantly evolving, and 2023 is no exception. Several tax law changes have been implemented that could significantly impact your tax filing. It is essential to stay informed about these changes to ensure you are taking advantage of all available deductions and credits and avoiding potential penalties.

Changes to Deductions and Credits

The most significant changes to the tax code often involve deductions and credits. These changes can impact your taxable income and ultimately your tax liability.

- Expanded Child Tax Credit:The American Rescue Plan Act of 2021 expanded the Child Tax Credit for one year, making it fully refundable. This means that even if you owe no taxes, you could receive a payment. However, this expansion was only for 2021, and the credit has returned to its pre-pandemic levels for 2023.

This means that the credit is no longer fully refundable, and the amount of the credit has decreased for some families.

- Increased Deduction for Qualified Business Income:The Tax Cuts and Jobs Act of 2017 created a deduction for qualified business income (QBI). This deduction is capped at 20% of QBI or 20% of taxable income, whichever is less. In 2023, the deduction for QBI is still available, but the phase-out income thresholds have increased.

This means that more businesses can claim the deduction and benefit from the reduced tax liability.

Changes to Other Tax-Related Aspects

Tax law changes can also affect other aspects of your tax filing, such as the standard deduction and the alternative minimum tax (AMT).

- Increased Standard Deduction:The standard deduction is a set amount that taxpayers can claim instead of itemizing their deductions. The standard deduction is adjusted annually for inflation, and in 2023, it has increased for both single and married filers. This means that more taxpayers may find it beneficial to claim the standard deduction rather than itemizing their deductions.

- AMT Exemption Thresholds:The AMT is a separate tax system that applies to taxpayers with certain high-income deductions or credits. The AMT exemption thresholds are adjusted annually for inflation, and in 2023, they have increased. This means that fewer taxpayers will be subject to the AMT, and those who are will have a higher exemption amount.

Tax Filing Tips for Specific Groups

Filing taxes can be a complex process, but it’s especially important for certain groups to understand their unique filing considerations. This section provides tailored tips for self-employed individuals, students, and seniors.

Self-Employed Individuals

Self-employed individuals have unique tax obligations, including paying both income and self-employment taxes.

- Track income and expenses diligently:Keeping accurate records of income and expenses is crucial for self-employed individuals. This helps determine your net income and deductions.

- Claim business deductions:Self-employed individuals can claim various deductions related to their business, such as home office expenses, business travel, and professional education.

- Estimate quarterly taxes:Self-employed individuals are responsible for paying estimated taxes throughout the year. This helps avoid penalties for underpayment.

- Consider a retirement plan:Self-employed individuals can take advantage of retirement plans like a Solo 401(k) or SEP IRA, which offer tax advantages.

Students

Students often have specific tax considerations, such as scholarships and education expenses.

- Claim the American Opportunity Tax Credit:This credit can help reduce your tax liability if you’re paying for qualified education expenses.

- Deduct student loan interest:You may be able to deduct up to $2,500 in interest paid on student loans.

- File as “dependent” or “independent”:Depending on your income and other factors, you may be able to file as a dependent on your parents’ return or file as an independent taxpayer.

- Understand the impact of scholarships and grants:Scholarships and grants may be taxable depending on the type and purpose.

Seniors

Seniors often have unique tax situations, including retirement income and medical expenses.

- Claim the standard deduction or itemize:Seniors may choose to claim the standard deduction or itemize deductions based on their individual circumstances.

- Understand the impact of Social Security benefits:A portion of Social Security benefits may be taxable depending on your income level.

- Deduct medical expenses:Seniors can deduct medical expenses exceeding a certain percentage of their adjusted gross income.

- Consider tax-advantaged retirement withdrawals:Seniors can withdraw funds from retirement accounts with tax-advantaged options, such as traditional IRAs or 401(k)s.

Future Tax Outlook

Predicting the future of tax policy is a complex endeavor, influenced by a myriad of factors, including evolving economic conditions and shifting political priorities. Understanding the potential changes on the horizon is crucial for taxpayers, businesses, and financial professionals alike.

This report will explore two potential policy changes and two significant economic factors that could shape the future of tax deadlines and filing requirements.

Policy Changes

Policy changes often drive significant shifts in tax deadlines and filing requirements. Here are two potential changes that could impact the tax landscape in the coming years:

- Increase in the Standard Deduction:One potential policy change is an increase in the standard deduction. This could be driven by a desire to provide tax relief to middle- and lower-income taxpayers. Increasing the standard deduction could lead to simplified tax filings for many individuals, as fewer taxpayers would need to itemize their deductions.

However, it could also result in a decrease in tax revenue for the government, potentially leading to adjustments in other tax policies or spending programs. For example, a significant increase in the standard deduction might necessitate a corresponding increase in tax rates for higher-income earners to maintain revenue neutrality.

- Expansion of the Earned Income Tax Credit (EITC):Another potential policy change is an expansion of the EITC, a tax credit for low- and moderate-income working individuals and families. Expanding the EITC could provide significant tax relief to eligible taxpayers, boosting their disposable income and stimulating economic activity.

This could potentially impact tax deadlines and filing requirements by necessitating the development of new procedures and documentation requirements to accommodate the expanded credit. For instance, taxpayers might be required to provide additional information regarding their employment status or income sources to qualify for the expanded EITC.

Economic Factors

Economic factors play a pivotal role in shaping tax policy. Here are two significant economic factors that could influence future tax deadlines and filing requirements:

- Inflation:Persistent inflation can significantly impact tax policy. In response to rising inflation, policymakers might consider adjustments to tax brackets and deductions to mitigate the impact on taxpayers’ purchasing power. For example, adjusting tax brackets to account for inflation could prevent taxpayers from being pushed into higher tax brackets due to nominal income increases.

Similarly, indexing deductions to inflation could ensure that they maintain their value over time. However, these adjustments could also lead to a decrease in tax revenue, necessitating other policy changes to offset the revenue shortfall.

- Technological Advancements:Rapid technological advancements are transforming various aspects of society, including the tax system. As businesses increasingly adopt digital technologies, the tax system may need to adapt to ensure efficient and effective tax administration. For instance, the rise of e-commerce and digital marketplaces has created challenges for tax collection and enforcement.

Governments are likely to implement new rules and regulations to address these challenges, potentially impacting tax deadlines and filing requirements. Furthermore, the increasing use of artificial intelligence (AI) and data analytics in tax administration could lead to more sophisticated audits and compliance monitoring, requiring taxpayers to be more vigilant in maintaining accurate records.

Closure

Filing your taxes can be a complex process, but with the right knowledge and resources, you can navigate it with confidence. Remember to gather all necessary documents, double-check your calculations, and seek professional assistance if needed. By understanding the intricacies of tax law and utilizing available resources, you can ensure a smooth and successful tax filing experience.

FAQ Summary

What is the tax deadline for 2023?

The tax deadline for filing your federal income taxes in 2023 is April 18, 2023. This is because April 15th falls on a Saturday, and Emancipation Day is observed on Monday, April 17th in Washington, D.C., shifting the deadline.

What are the penalties for late filing or non-payment of taxes?

Penalties for late filing or non-payment can be significant. The penalty for late filing is typically 0.5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax liability.

The penalty for late payment is 0.5% of the unpaid tax liability for each month or part of a month that the tax is late, up to a maximum of 25% of the unpaid tax liability. There may be exceptions to these penalties, such as reasonable cause relief or hardship waivers.

How can I get help with my taxes?

There are several resources available to help you with your taxes. The IRS website provides information on tax laws, filing requirements, and payment options. You can also use tax preparation software, such as TurboTax, H&R Block, and TaxAct, to file your taxes online.

If you need professional assistance, you can consult with a certified public accountant (CPA), enrolled agent (EA), or tax preparer. Additionally, there are free tax preparation services available through programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) for low- and moderate-income taxpayers.