Tax preparation tips for the October 2024 deadline are crucial for individuals and businesses alike. This deadline marks the final opportunity to file your taxes and avoid potential penalties. Understanding the implications of missing this deadline and navigating the complexities of tax preparation can be daunting.

This guide aims to provide clear and concise information to help you prepare for this important tax obligation.

The October 2024 deadline signifies the culmination of a year’s worth of financial activities. It’s a time to gather necessary documents, explore available deductions and credits, and choose the most suitable filing method. This guide will provide a roadmap for a successful tax preparation journey, ensuring you understand the intricacies of tax filing and minimize your tax liability.

Contents List

Gathering Necessary Documents

Having the right documents is crucial for accurate tax preparation. Missing information can lead to delays, errors, and even penalties.

The tax brackets for 2024 in the United States have been updated. If you’re curious about the specific brackets and rates, you can find detailed information in this article on tax brackets for 2024 in the United States.

Organizing and Verifying Documents

Organizing your documents before you begin filing is essential for a smooth and efficient process. This helps ensure you have all the necessary information and reduces the risk of missing important details. Start by creating a dedicated folder for your tax documents and systematically placing each document within it.

The tax brackets for single filers in 2024 are set to change, impacting how much you’ll owe in taxes. To see the specific brackets and rates, check out this article on the 2024 tax brackets for single filers.

- Check for completeness:Review each document to ensure it includes all the necessary information. For example, pay stubs should include your name, Social Security number, earnings, and withholdings.

- Verify accuracy:Double-check the information on each document for any errors or discrepancies. This is especially important for documents with sensitive financial information.

- Look for missing information:If you are missing any documents, reach out to the relevant source to obtain them as soon as possible. This may include contacting your employer, financial institutions, or other relevant parties.

Essential Tax Documents

Here is a checklist of essential documents you will need for filing your taxes:

- Form W-2:This form summarizes your wages and withholdings from your employer. It is essential for reporting your income and calculating your tax liability.

- Form 1099-NEC:This form reports income from independent contractors or self-employment. You will receive this form if you have earned income from freelance work, consulting, or other self-employment activities.

- Form 1099-INT:This form reports interest income from savings accounts, bonds, or other investments.

- Form 1099-DIV:This form reports dividend income from stocks, mutual funds, or other investments.

- Form 1098-T:This form reports tuition payments made to educational institutions. You may need this form if you are claiming education-related tax credits.

- Form 1098-E:This form reports student loan interest paid. You may need this form if you are claiming a deduction for student loan interest.

- Form 1098-T:This form reports tuition payments made to educational institutions. You may need this form if you are claiming education-related tax credits.

- Form 1098-E:This form reports student loan interest paid. You may need this form if you are claiming a deduction for student loan interest.

- Receipts:Keep receipts for all deductible expenses, such as medical expenses, charitable donations, and home office expenses.

- Pay stubs:Your pay stubs will show your earnings, withholdings, and other relevant information.

- Bank statements:Bank statements can be helpful for verifying your income and expenses.

- Social Security number:You will need your Social Security number to file your taxes.

- Previous year’s tax return:This will help you compare your current tax situation to the previous year.

- Any other relevant documentation:This may include documentation for any other income, deductions, or credits you are claiming.

Supporting Documentation, Tax preparation tips for the October 2024 deadline

Supporting documentation plays a vital role in validating your tax deductions and credits. This can include receipts, invoices, bank statements, and other documents that provide evidence of your expenses.

The tax brackets for 2024 are different from those in 2023, with some adjustments made. If you want to understand the changes and how they affect your taxes, you can find detailed information in this article comparing the tax bracket changes for 2024 vs 2023.

“It is always best to have supporting documentation for any deductions or credits you claim on your tax return. This can help you avoid any potential audits or penalties.”

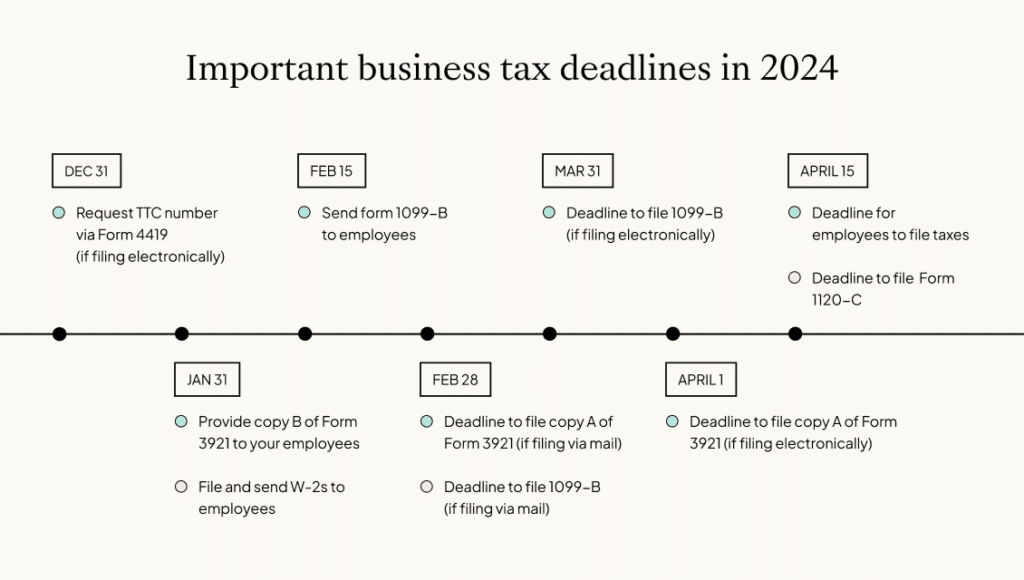

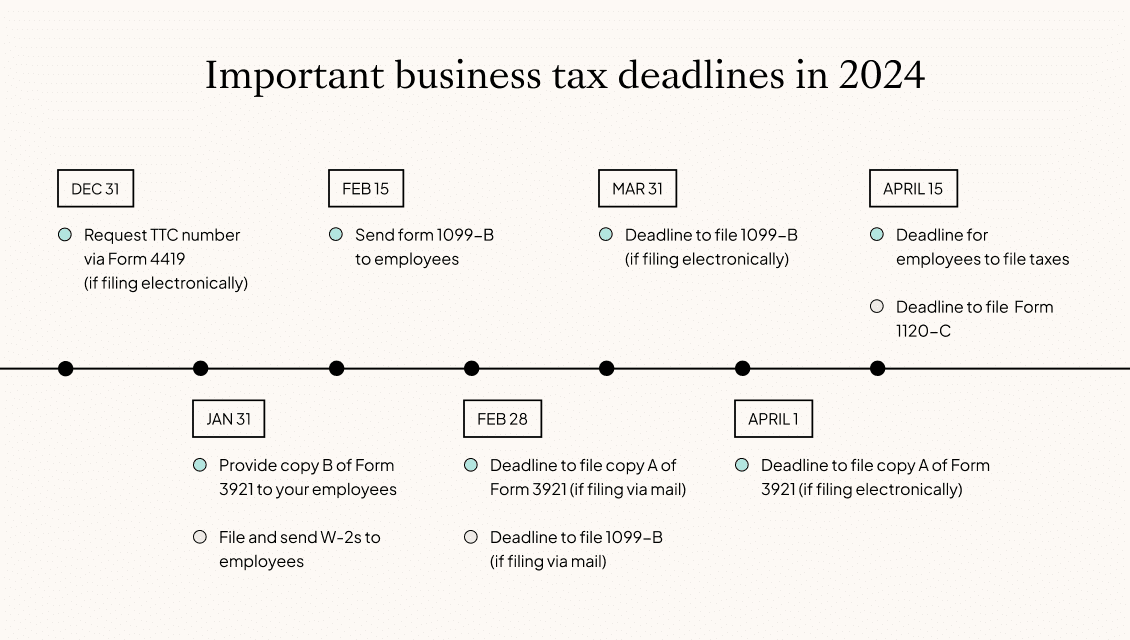

Businesses have a different tax deadline than individuals. To find out the specific deadline for businesses in October 2024, you can visit this article on the October 2024 tax deadline for businesses.

Choosing the Right Filing Method

You have your documents gathered, now it’s time to choose how you’ll submit your tax return. There are several options available, each with its own pros and cons. Understanding these differences will help you select the method best suited for your needs.

Lewandowski had an incredible performance, scoring a hat trick in the first half! Barcelona is now at the top of the table, and you can read more about this exciting match at this article on Lewandowski’s hat trick and Barcelona’s lead.

Online Filing

Online filing has become increasingly popular due to its convenience and speed. With online filing, you can complete your tax return electronically, submit it directly to the IRS, and receive your refund quickly.

The tax brackets for 2024 have been revised, with new rates and income thresholds. You can discover the updated tax brackets and learn how they affect your tax liability by reading this article on the new tax brackets for 2024.

Pros

- Convenience: You can file your taxes from the comfort of your home or on the go, using a computer, tablet, or smartphone.

- Speed: Online filing is generally faster than filing by mail, as your return is processed electronically.

- Accuracy: Tax software programs often include error-checking features to help ensure accuracy.

- Cost-effectiveness: Many online filing services offer free or low-cost options, especially for simple returns.

Cons

- Technical Requirements: You’ll need a computer or mobile device with internet access to file online.

- Security Concerns: It’s crucial to choose a reputable online filing service with strong security measures to protect your personal information.

- Complexity: Some tax situations may be too complex for online filing, requiring professional assistance.

Mail Filing

Traditional mail filing involves printing and mailing your tax return to the IRS.

Navigating the tax brackets can feel confusing, but understanding them is crucial for accurate tax filing. To get a clear explanation of how tax brackets work in 2024, read this article on understanding tax brackets for 2024.

Pros

- No Technical Requirements: You don’t need a computer or internet access to file by mail.

- Control: You have complete control over your tax return and can review it thoroughly before submitting it.

Cons

Professional Assistance

If your tax situation is complex or you simply prefer to have a professional handle your taxes, you can seek assistance from a tax preparer.

Curious about the highest tax bracket in 2024? It’s a significant rate that applies to the highest income earners. To find out exactly what that rate is and how it works, check out this article about the highest tax bracket in 2024.

Pros

- Expertise: Tax preparers have extensive knowledge of tax laws and can help you maximize your deductions and credits.

- Peace of Mind: A tax preparer can provide guidance and support throughout the tax filing process.

- Accuracy: Professional tax preparers are trained to ensure accuracy and minimize errors.

Cons

Planning for Future Tax Obligations: Tax Preparation Tips For The October 2024 Deadline

Proactive tax planning is crucial to minimize your tax liability and maximize your financial well-being. Year-round tax planning allows you to take advantage of tax benefits and avoid unpleasant surprises at tax time. This involves understanding your tax situation, identifying opportunities to reduce your tax burden, and making informed financial decisions throughout the year.

It’s essential to understand how tax brackets will affect your income in 2024. This article, How will tax brackets affect my 2024 income? , can provide valuable insights into how tax brackets will impact your overall income.

Strategies for Minimizing Future Tax Liability

Effective tax planning involves implementing strategies that minimize your tax liability over time. These strategies can include:

- Tax-Advantaged Investments:Explore tax-advantaged investment accounts like 401(k)s, IRAs, and 529 plans to reduce your taxable income and potentially defer or avoid taxes on investment earnings. These accounts offer tax benefits that can significantly impact your overall tax liability. For instance, contributions to a traditional IRA may be tax-deductible, reducing your taxable income in the current year.

Conversely, Roth IRA contributions are made with after-tax dollars, allowing you to withdraw earnings tax-free in retirement.

- Tax-Loss Harvesting:This strategy involves selling losing investments to offset capital gains, reducing your overall tax burden. It is a valuable tool for managing your portfolio and minimizing your tax liability. For example, if you sell a stock at a loss, you can deduct that loss from your capital gains, potentially lowering your taxable income.

If you need more time to file your taxes, you might be eligible for an extension. Learn more about the tax filing extensions for October 2024, including the requirements and how to apply, by visiting this article on tax filing extensions.

- Charitable Giving:Charitable donations can offer tax benefits, allowing you to reduce your taxable income while supporting worthy causes. You can deduct a portion of your charitable contributions on your tax return, potentially reducing your tax liability. This strategy can be particularly beneficial for high-income earners who may face higher tax brackets.

- Strategic Tax Deductions and Credits:Understanding available tax deductions and credits can help you minimize your tax liability. Deductions reduce your taxable income, while credits directly reduce your tax liability. It is important to research and identify all applicable deductions and credits to maximize your tax benefits.

For instance, if you are a homeowner, you can claim the homeownership deduction, reducing your taxable income. Similarly, if you have children, you can claim the Child Tax Credit, which directly reduces your tax liability.

Last Point

Navigating the tax landscape can be challenging, but with careful planning and preparation, you can confidently approach the October 2024 deadline. Remember, understanding the implications of the deadline, gathering essential documents, utilizing available deductions and credits, and choosing the right filing method are key steps to successful tax preparation.

If you find yourself facing complex tax situations, don’t hesitate to seek professional advice. By taking these steps, you can minimize your tax liability and ensure a smooth tax filing experience.

Commonly Asked Questions

What happens if I miss the October 2024 tax deadline?

Missing the tax deadline can result in penalties and interest charges. The penalties can vary depending on the amount of tax owed and the duration of the delay. It’s crucial to file your taxes on time or request an extension if necessary.

What are some common tax deductions for individuals?

Common tax deductions for individuals include deductions for mortgage interest, charitable contributions, state and local taxes, and medical expenses. The specific deductions available to you will depend on your individual circumstances and the tax laws in your jurisdiction.

What are the benefits of using a tax professional?

Tax professionals have expertise in tax laws and regulations. They can help you identify all eligible deductions and credits, optimize your tax strategy, and ensure your tax return is accurate and compliant. They can also assist with complex tax situations, such as business taxes or international tax issues.

Each tax bracket in 2024 has a specific tax rate that applies to income within that range. For a comprehensive overview of the tax rates for each bracket, check out this article on tax rates for each tax bracket in 2024.

The Seahawks fought hard but ultimately fell short in their Week 5 matchup. You can read a recap of the game and reactions to the loss in this article on the Seahawks’ Week 5 loss.

The tax deadline for October 2024 is a crucial date to remember. To avoid penalties, ensure you file your taxes by the deadline. You can find more information about the specific deadline and how to file your taxes in this article on the October 2024 tax deadline.

If you’re a qualifying widow(er), you may be eligible for a specific set of tax brackets. To find out more about the tax brackets for qualifying widow(er)s in 2024, you can visit this article on tax brackets for qualifying widow(er)s in 2024.

Missing the October 2024 tax deadline can result in penalties. To learn more about the potential penalties for late filing, including the amount and how to avoid them, you can read this article on tax penalties for missing the October 2024 deadline.