Tax rates for each tax bracket in 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The federal income tax system in the United States relies on a progressive tax structure, where individuals and households are taxed at different rates depending on their income level.

This system utilizes tax brackets, which are ranges of income that are subject to a specific tax rate. This guide delves into the intricacies of tax brackets in 2024, exploring how they influence tax liability and providing insights into potential tax planning strategies.

Understanding the nuances of tax brackets is crucial for individuals and families alike. By comprehending the tax rates associated with each bracket, taxpayers can gain valuable insights into their financial obligations and make informed decisions about their financial planning.

This guide provides a comprehensive overview of the 2024 federal income tax brackets, highlighting any changes from previous years and exploring factors that can impact tax liability beyond income.

Contents List

2024 Federal Income Tax Brackets: Tax Rates For Each Tax Bracket In 2024

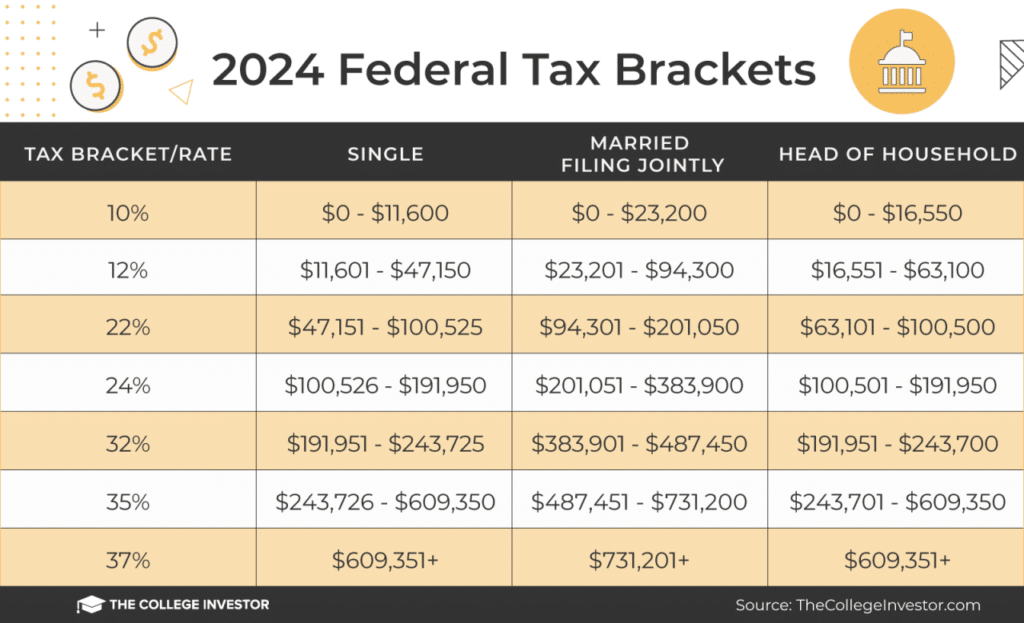

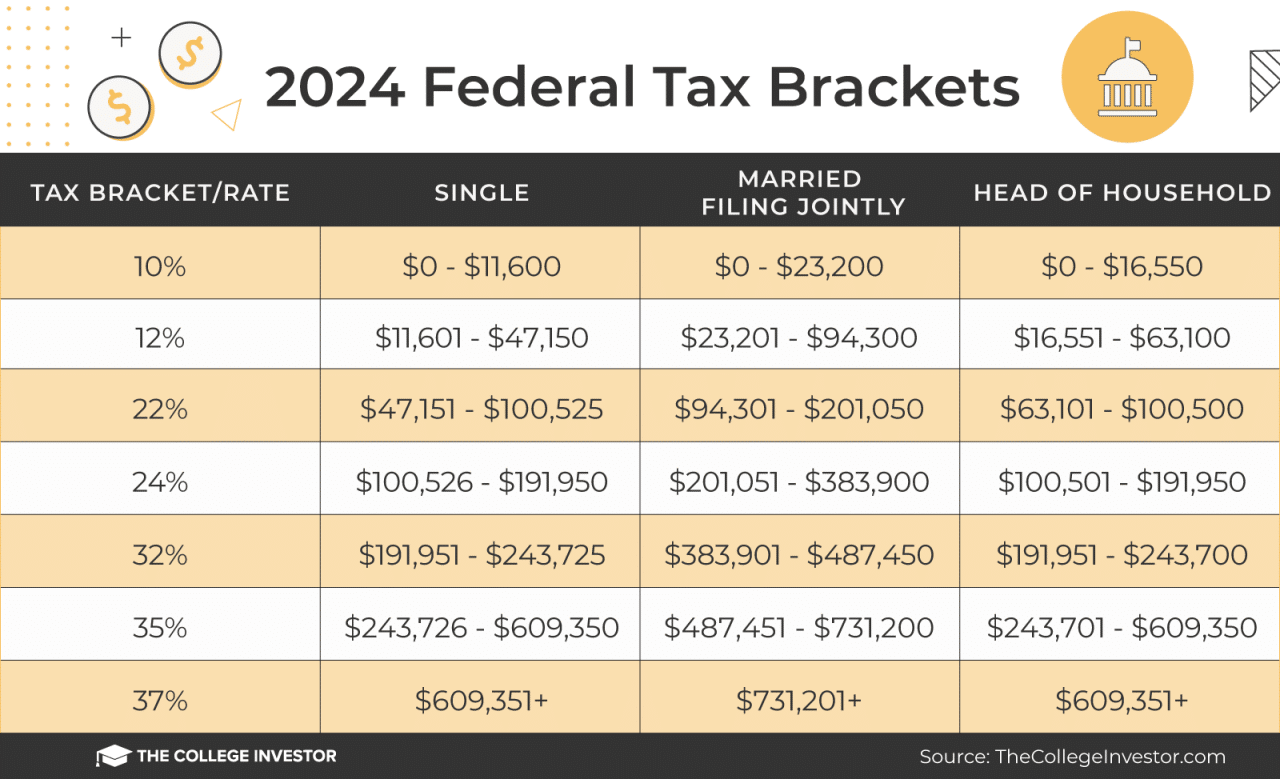

The 2024 federal income tax brackets are determined by the Internal Revenue Service (IRS) and are used to calculate the amount of income tax owed by individuals and households. These brackets are based on your filing status, taxable income, and the corresponding tax rate for each bracket.

Tragically, TikTok star Taylor Rousseau Grigg passed away at the young age of 25. You can read more about this sad news in the article. Our thoughts are with her family and friends during this difficult time.

2024 Federal Income Tax Brackets

The 2024 federal income tax brackets and rates are as follows:

| Income Range | Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|---|

| $0

The tax brackets for single filers in 2024 have been released, so take a look to see how they might affect your tax obligations. It’s a good idea to review your financial situation and plan accordingly.

|

10% | $0

|

$0

The New York Giants pulled off a convincing win against the Seattle Seahawks. Check out the instant analysis to get a deeper look into the game and what contributed to the Giants’ success.

|

| $10,951

The college football landscape is shifting! Alabama’s reign is being challenged as Big Ten teams are dominating the rankings. You can see the latest shakeup in the College Football Rankings. It’s going to be a thrilling season!

|

12% | $10,951

|

$21,901

Ready for some NFL action? The Las Vegas Raiders are taking on the Denver Broncos, and you can catch all the excitement by checking out how to watch the game. Let’s see who comes out on top!

|

$46,276

|

22% | $46,276

If you’re a qualifying widow(er), the tax brackets for 2024 will be different for you. It’s important to understand these specific brackets to ensure you’re filing correctly.

|

$82,551

The Green Bay Packers pulled off a victory against the Los Angeles Rams thanks to some crucial turnovers. Read the recap to relive the highlights and see how the Packers secured the win.

|

$101,751

|

24% | $101,751

|

$172,751

Are you curious about the tax brackets for 2024 in the United States? You can find a comprehensive overview of the tax brackets for 2024 in this article. It’s a good idea to stay informed about these changes, especially as they can affect your finances.

|

| $192,151

If you’re married filing separately, you’ll want to be aware of the tax brackets for married filing separately in 2024. These brackets can be different from other filing statuses, so it’s important to understand how they apply to your situation.

|

32% | $192,151

|

$344,301

Wondering how your tax bill might change next year? Check out the latest news on tax bracket changes for 2024. It’s always a good idea to stay informed about these changes, especially as they can impact your finances.

|

$578,126

|

35% | $578,126

|

$688,601

The Seahawks put up a good fight, but ultimately fell short in their Week 5 matchup. Check out the Rapid Reactions to get a deeper dive into what went down in the game. There’s always next week!

|

| $1,000,001+ | 37% | $1,000,001+ | $1,500,001+ |

Note:These income ranges are subject to change based on adjustments made by the IRS in the future. It is important to consult with a tax professional for personalized advice and to ensure you are using the most up-to-date information.

Want to hear what the Miami Dolphins had to say after their game? Check out the postgame quotes for insights into their performance and what they’re looking ahead to. It’s always interesting to hear directly from the players and coaches!

Tax Planning Strategies

Tax planning is an essential part of managing your finances and ensuring that you pay the least amount of taxes legally possible. By taking a proactive approach to tax planning, you can potentially save money and maximize your financial well-being.

Want to see where you fall in the tax brackets for 2024? Use the tax bracket calculator to get a personalized estimate. It’s a helpful tool to get a better understanding of your tax liability.

Strategies for Individuals and Families

Tax planning strategies can be tailored to individual circumstances and goals. It’s important to consider factors like income level, family size, dependents, and investment portfolio.

Curious about how much you might owe in taxes next year? The new tax brackets for 2024 have been announced, and they’re likely to affect many taxpayers. It’s a good idea to review your income and plan accordingly.

- Maximize Deductions and Credits:Understanding available deductions and credits can significantly reduce your tax liability. Some common deductions include charitable contributions, mortgage interest, and state and local taxes. Credits, such as the Child Tax Credit or Earned Income Tax Credit, can directly reduce your tax bill.

- Contribute to Retirement Accounts:Contributions to traditional IRAs and 401(k) plans are often tax-deductible, allowing you to save for retirement while reducing your current taxable income.

- Consider Tax-Advantaged Savings Accounts:Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help you save on healthcare costs and reduce your taxable income.

- Optimize Investment Strategies:The way you invest your money can impact your tax liability. Long-term capital gains are generally taxed at lower rates than ordinary income, making it beneficial to hold investments for the long term.

- Take Advantage of Tax-Loss Harvesting:Selling losing investments to offset capital gains can help reduce your overall tax liability.

- Plan for Major Life Events:Major life events, such as marriage, divorce, birth, or death, can significantly impact your tax situation. It’s important to seek professional advice to navigate these changes effectively.

Tips for Minimizing Tax Liability

There are various strategies to minimize your tax liability within the existing tax bracket system.

The Jacksonville Jaguars took down the Indianapolis Colts in a thrilling Week 5 matchup. Read the full game report to relive all the action and see what led to the Jaguars’ victory.

- Shift Income to Lower Tax Brackets:If possible, consider spreading income across multiple tax years or deferring income to future years.

- Maximize Deductions and Credits:Thoroughly understand available deductions and credits, and claim all eligible deductions and credits.

- Utilize Tax-Advantaged Accounts:Utilize tax-advantaged savings accounts, such as 401(k)s, IRAs, and HSAs, to reduce taxable income.

- Consider Tax-Loss Harvesting:Selling losing investments to offset capital gains can reduce your overall tax liability.

- Plan for Long-Term Capital Gains:Hold investments for the long term to benefit from lower tax rates on long-term capital gains.

- Stay Informed About Tax Laws:Tax laws are constantly evolving, so it’s crucial to stay informed about changes that could impact your tax liability.

Importance of Professional Tax Advice, Tax rates for each tax bracket in 2024

Navigating the complexities of the tax system can be challenging.

- Specialized Expertise:Tax professionals possess in-depth knowledge of tax laws, regulations, and strategies. They can help you identify deductions and credits you may be eligible for and develop personalized tax plans.

- Personalized Guidance:A tax professional can provide tailored advice based on your unique financial situation and goals.

- Compliance and Audit Protection:Tax professionals can help ensure you comply with all tax regulations and minimize the risk of an audit.

- Peace of Mind:Having a tax professional on your side can provide peace of mind knowing your taxes are being handled correctly.

Closing Summary

Navigating the complexities of the tax system can be a daunting task. However, by understanding the intricacies of tax brackets, taxpayers can gain a clearer picture of their financial obligations and explore strategies to minimize their tax liability. This guide has provided a comprehensive overview of the 2024 federal income tax brackets, highlighting key changes and offering valuable insights into tax planning.

Remember, seeking professional tax advice can be invaluable in maximizing your tax efficiency and ensuring compliance with all applicable regulations.

Essential Questionnaire

What is the difference between a tax bracket and a tax rate?

A tax bracket is a range of income subject to a specific tax rate. The tax rate is the percentage of income that is taxed within that bracket. For example, if you earn $50,000 and fall within the 12% tax bracket, you will pay 12% tax on your income between $41,775 and $89,075.

How are tax brackets determined?

Tax brackets are determined by Congress through legislation. They are adjusted annually to account for inflation and other economic factors.

Do I pay the same tax rate on all of my income?

No, you pay different tax rates on different portions of your income, depending on the tax bracket you fall into. For example, if you earn $100,000, you will pay the lowest tax rate on your first $10,275, a higher rate on your income between $10,276 and $41,775, and so on.

Can I avoid paying taxes by staying below a certain income level?

No, even if your income falls below the lowest tax bracket, you may still be required to pay certain taxes, such as Social Security and Medicare taxes.