Taxes Due October is a time when many individuals and businesses face important financial obligations. Whether it’s property taxes, quarterly estimated taxes, or other tax liabilities, understanding your responsibilities and meeting deadlines is crucial. This guide provides a comprehensive overview of everything you need to know about taxes due in October, from key deadlines to payment options and potential consequences of late payment.

October often marks a significant period for tax-related activities, encompassing various types of taxes and deadlines. It’s a time when individuals and businesses need to be mindful of their tax obligations, ensuring timely payment and proper filing to avoid penalties.

This guide aims to demystify the complexities of taxes due in October, offering practical insights and valuable resources to help you navigate this crucial period effectively.

Contents List

- 1 Taxes Due in October: Everything You Need to Know

- 2 Key Dates and Deadlines

- 3 3. Filing Methods and Options

- 4 4. Payment Methods and Options

- 5 Tax Extensions and Penalties: Taxes Due October

- 6 Tax Preparation Tips and Resources

- 7 7. Common Tax Issues in October

- 8 Tax Planning for the Future

- 9 Tax Laws and Regulations

- 10 State and Local Taxes

- 11 Tax Deductions and Credits

- 12 Tax Audit and Investigations

- 13 Tax Relief Programs and Assistance

- 14 Tax Scams and Fraud

- 15 Concluding Remarks

- 16 Query Resolution

Taxes Due in October: Everything You Need to Know

October is a crucial month for tax obligations, as various taxes are due, impacting individuals and businesses alike. These taxes play a significant role in funding essential public services, ensuring the smooth operation of government programs, and contributing to the overall economic well-being of the nation.

Understanding the types of taxes due in October, their deadlines, and the potential consequences of late payment is essential for responsible financial management.

Significance of October Taxes

October marks a significant period for tax obligations, as several taxes are due, impacting both individuals and businesses. These taxes contribute to the funding of vital public services, such as healthcare, education, infrastructure, and social safety nets.

Types of Taxes Due in October

Here is a table outlining the various types of taxes typically due in October:

| Tax Name | Description | Who is Responsible for Paying | Deadline for Payment |

|---|---|---|---|

| Estimated Income Tax Payments | Quarterly payments made by individuals and businesses to account for income tax liability throughout the year. | Individuals and businesses with self-employment income, independent contractors, and those with fluctuating income. | 15th of October (for the third quarter). |

| Property Taxes | Annual taxes levied on real estate, including residential and commercial properties. | Property owners. | Varies by jurisdiction, but often falls in October. |

| Sales Tax | Tax collected by businesses on the sale of goods and services, remitted to the government. | Businesses selling goods and services. | Varies by jurisdiction, but often has monthly or quarterly deadlines falling in October. |

| Franchise Tax | Tax levied on corporations and other business entities for the privilege of doing business in a specific state. | Corporations and other business entities. | Varies by state, but often has annual deadlines falling in October. |

Consequences of Late Payment

Failing to meet tax deadlines can have serious consequences, including:

- Penalties and interest charges: Late payments often incur penalties and interest charges, increasing the overall tax burden.

- Legal actions and potential lawsuits: In extreme cases, late tax payments can lead to legal actions and lawsuits, potentially resulting in fines and even imprisonment.

- Impact on credit score and future borrowing: Late tax payments can negatively impact credit scores, making it harder to secure loans or credit cards in the future.

- Potential for tax liens and property seizure: The government may place a tax lien on property, restricting its sale or transfer until the debt is settled. In severe cases, property seizure may occur.

“Late payment penalties can be substantial, and the longer you delay, the higher the penalties become. It’s crucial to prioritize tax payments and avoid unnecessary financial strain.”

IRS Taxpayer Advocate Service

Tips for Avoiding Late Payments

Here are some practical tips to help individuals and businesses avoid late tax payments:

- Setting reminders and deadlines: Utilize calendars, reminders, or tax preparation software to track deadlines and avoid missing payments.

- Maintaining accurate financial records: Keep detailed records of income, expenses, and tax deductions to ensure accurate tax calculations and timely filing.

- Planning ahead and budgeting for tax obligations: Allocate funds throughout the year to cover anticipated tax liabilities, avoiding surprises and financial stress.

- Utilizing tax preparation software or professional services: Consider using tax preparation software or hiring a tax professional to ensure accurate calculations, efficient filing, and compliance with tax regulations.

“Proactive tax planning and effective budgeting are essential for avoiding late payments and minimizing tax liabilities. Consult with a financial expert to develop a personalized strategy for managing your tax obligations.”

Certified Financial Planner (CFP)

Key Dates and Deadlines

October is a crucial month for tax obligations in many jurisdictions. Understanding the key dates and deadlines for various tax types is essential to avoid penalties and ensure compliance.

Tax Deadlines in October

Here’s a comprehensive calendar of important tax deadlines in October, categorized by tax type:

| Date | Tax Type | Description |

|---|---|---|

| October 15th | Estimated Income Tax Payments | The IRS requires quarterly estimated income tax payments from individuals and businesses. The fourth and final payment for the year is typically due on October 15th. |

| October 15th | Property Tax | Property tax deadlines vary by state and locality. In some jurisdictions, the October 15th deadline applies for property taxes. |

| October 31st | Sales Tax | Sales tax filing deadlines also vary by state. Some states require monthly filings, while others have quarterly or even annual deadlines. In certain states, October 31st may be the filing deadline for sales tax. |

| October 31st | Payroll Tax | Payroll tax deadlines are generally monthly or quarterly, depending on the employer’s size and payroll frequency. In some cases, October 31st could be a payroll tax deadline. |

Note: These are general deadlines, and specific dates may vary based on your location, tax type, and individual circumstances. Consult with a tax professional or your state’s revenue agency for accurate information.

3. Filing Methods and Options

There are several ways to file your taxes in October, each with its own advantages and disadvantages. Understanding these options will help you choose the best method for your specific needs and circumstances.

Thinking about buying a house? The Mortgage Rates October 2023 are still fluctuating, so it’s important to do your research and find the best deal. There are many resources available to help you understand the current market and make informed decisions.

3.1 Tax Filing Methods

The most common methods for filing taxes include:

- Electronic Filing (e-filing)

- Paper Filing

- Tax Preparation Services

3.1.1 Electronic Filing (e-filing)

Electronic filing, or e-filing, is the most convenient and efficient way to file your taxes. It involves using tax preparation software or online filing services to prepare and submit your tax return electronically to the IRS. E-filing offers several advantages, including:

- Speed: E-filed returns are typically processed faster than paper returns, with refunds often being issued within a few weeks.

- Accuracy: Tax preparation software and online filing services often include built-in error-checking features, reducing the risk of errors in your tax return.

- Convenience: E-filing eliminates the need to print, sign, and mail paper forms, saving time and effort.

3.1.2 Paper Filing

Paper filing involves completing tax forms by hand and mailing them to the IRS. While it may seem like a straightforward process, paper filing has some disadvantages:

- Potential for Errors: Handwritten tax forms are prone to errors, which can lead to delays in processing or even penalties.

- Delays: Paper returns typically take longer to process than e-filed returns, potentially delaying your refund.

- Need for Physical Copies: Paper filing requires physical copies of tax forms, documents, and supporting materials, which can be inconvenient and time-consuming to gather.

3.1.3 Tax Preparation Services

Tax preparation services offer professional assistance with preparing and filing your taxes. These services can be provided by various tax professionals, including:

- Certified Public Accountants (CPAs): CPAs are licensed professionals who can provide a wide range of tax services, including tax preparation, tax planning, and tax representation.

- Enrolled Agents (EAs): EAs are federally licensed tax professionals who specialize in representing taxpayers before the IRS.

- Tax Preparers: Tax preparers are individuals who prepare tax returns but may not have the same qualifications or licensing as CPAs or EAs.

Tax preparation services can provide valuable assistance, especially for complex tax situations or individuals who are unfamiliar with tax laws. However, it’s important to choose a reputable and qualified tax professional to ensure accurate and reliable tax preparation.

3.2 Advantages and Disadvantages of Filing Methods

The following table compares and contrasts the advantages and disadvantages of different filing methods:

| Method | Cost | Time | Accuracy | Convenience | Security |

|---|---|---|---|---|---|

| E-filing | Low to moderate (software or online service fees) | Fast (preparation and filing) | High (built-in error-checking features) | High (convenient and accessible) | High (secure online platforms) |

| Paper Filing | Low (postage costs) | Slow (preparation and processing) | Moderate (prone to errors) | Low (requires physical copies and mailing) | Moderate (potential for loss or theft) |

| Tax Preparation Services | Moderate to high (tax preparation fees) | Variable (depends on complexity) | High (professional expertise) | High (convenience and professional guidance) | Variable (depends on the tax professional) |

3.3 Filing Method Flowcharts

Here are flowcharts illustrating the steps involved in each filing method:

3.3.1 E-filing Flowchart

* Gather necessary information: Collect all relevant documents and information, such as income statements, tax forms, and supporting documentation.

Prepare tax forms

Use tax preparation software or an online filing service to complete your tax forms electronically.

File taxes

Submit your completed tax return electronically through the software or online service.

Track the status of your filing

Use the software or online service to track the progress of your tax return and receive updates on its status.

3.3.2 Paper Filing Flowchart

* Gather necessary information: Collect all relevant documents and information, such as income statements, tax forms, and supporting documentation.

Prepare tax forms

Complete your tax forms by hand using the provided instructions.

File taxes

Mail your completed tax forms and supporting documents to the IRS address specified on the forms.

Track the status of your filing

Use the IRS website or contact the IRS directly to track the status of your tax return.

3.3.3 Tax Preparation Services Flowchart

* Gather necessary information: Provide all relevant documents and information to your tax professional.

Prepare tax forms

Your tax professional will prepare your tax forms based on your information.

File taxes

Your tax professional will file your tax return on your behalf, either electronically or by mail.

Track the status of your filing

Your tax professional will keep you updated on the status of your tax return and provide any necessary communication with the IRS.

4. Payment Methods and Options

Paying your taxes on time is crucial to avoid penalties. Fortunately, there are various payment methods available to accommodate your needs and preferences. This section will Artikel the common methods, their processing times, fees, and potential advantages and disadvantages.

Specific Payment Methods

The accepted payment methods for taxes due in October 2023 can vary depending on the specific tax authority or jurisdiction. However, some common methods include:

- Online Payment: Many tax authorities offer secure online payment portals. You can often pay using a debit card, credit card, or electronic bank transfer. Some platforms might accept popular online payment processors like PayPal or Stripe, though this is not always the case.

October is a beautiful month with crisp air and changing leaves. Keep track of your schedule with the October 2023 Calendar. It’s also a great time to start thinking about your financial goals. If you’re looking to save, you might want to consider checking out the CD Rates October 2023 and the Best CD Rates October 2023.

- Mail-in Payment: You can send a check or money order to the designated address provided by the tax authority. Ensure you include your tax identification number and the relevant tax year on the payment.

- In-Person Payment: Some tax authorities allow you to pay in person at designated locations, such as government offices or designated banks. You might need to check the specific payment options and locations available.

Payment Method Implications

Each payment method has its own processing time, potential fees, and associated advantages and disadvantages. Let’s explore these in detail:

Processing Times

- Online Payment: Online payments are typically processed quickly, often within a few business days. The exact processing time can vary depending on the payment processor and the tax authority.

- Mail-in Payment: Mail-in payments can take longer to process, usually around 7-10 business days, depending on the postal service. Ensure you mail your payment well in advance of the deadline to avoid late penalties.

- In-Person Payment: In-person payments are typically processed immediately. However, you need to visit a designated location during their operating hours.

Fees and Penalties

- Online Payment: Some online payment platforms might charge a small transaction fee, depending on the payment processor and the tax authority.

- Mail-in Payment: There are usually no fees associated with mail-in payments, but late payments can incur penalties.

- In-Person Payment: In-person payments typically do not involve fees, but late payments can attract penalties.

Advantages and Disadvantages

| Payment Method | Processing Time | Fees | Advantages | Disadvantages |

|---|---|---|---|---|

| Online Payment | Fast (usually within a few business days) | Possible transaction fees | Convenient, secure, quick processing | May require internet access, potential transaction fees |

| Mail-in Payment | Slower (7-10 business days) | Typically no fees | No internet access required, no transaction fees | Longer processing time, potential for delays in mail delivery |

| In-Person Payment | Immediate | Typically no fees | Immediate processing, no reliance on internet or mail | Requires visiting a designated location during operating hours |

Tax Extensions and Penalties: Taxes Due October

If you can’t file your taxes by the October deadline, you may be able to request an extension. However, it’s crucial to understand that an extension only gives you more time to file, not to pay. You’ll still be responsible for paying your taxes by the original deadline, even if you file an extension.

Requesting a Tax Extension

A tax extension allows you to delay filing your tax return but not the payment of taxes. You can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. You can file Form 4868 online, by mail, or by fax.

The IRS generally grants automatic extensions for up to six months.

- File Form 4868: This form can be filed online, by mail, or by fax.

- Deadline: You must file Form 4868 by the original tax filing deadline, which is October 15th for most taxpayers.

- Payment: While you have extra time to file, you still need to pay your taxes by the original deadline.

If you can’t pay by the original deadline, you can request a payment plan.

Penalties for Late Filing and Late Payment

The IRS imposes penalties for late filing and late payment of taxes. These penalties can be significant, so it’s important to understand the rules and how to avoid them.

- Late Filing Penalty: If you fail to file your tax return by the deadline, you’ll be subject to a penalty of 0.5% of the unpaid tax each month or part of a month that the return is late. The penalty is capped at 25% of your unpaid tax.

- Late Payment Penalty: If you fail to pay your taxes by the deadline, you’ll be subject to a penalty of 0.5% of the unpaid tax each month or part of a month that the payment is late. The penalty is capped at 25% of your unpaid tax.

Penalties for Different Tax Types and Payment Methods

Penalties for late filing and late payment vary depending on the type of tax and the payment method. For example, the penalty for late payment of estimated taxes is different from the penalty for late payment of income taxes.

- Estimated Taxes: If you fail to pay your estimated taxes by the due date, you’ll be subject to a penalty. The penalty is calculated on the underpayment of estimated taxes for each quarter.

- Income Taxes: The penalty for late payment of income taxes is calculated on the unpaid tax for the entire year.

Looking to get a new car? October is a great time to check out the October 2023 Lease Deals. There are some great deals available, so it’s a good time to compare options and find the best deal for you.

And if you’re looking for the best deals, check out the Best Lease Deals October 2023.

It’s important to note that the IRS may waive penalties in certain situations, such as if you can demonstrate reasonable cause for the late filing or late payment.

Tax Preparation Tips and Resources

October is a crucial month for taxpayers as it’s a time to finalize tax preparation before the annual deadline. Whether you’re self-employed, a freelancer, or a salaried individual, getting a head start on your taxes in October can help you avoid stress and potential penalties.

Tax Preparation Tips (October Specific)

October provides a valuable window to prepare for your tax obligations, ensuring a smoother filing process and minimizing potential issues.

- Tip: Start gathering tax documents early. October is a good time to begin organizing receipts, W-2s, and other relevant paperwork to avoid last-minute stress.

- Tip: Review your income and expenses. Take this opportunity to analyze your income sources and deductible expenses, ensuring accuracy and maximizing potential tax savings.

- Tip: Explore tax credits and deductions. October is an ideal time to research available tax credits and deductions that might apply to your specific situation, such as those for education, childcare, or homeownership.

- Tip: Consider using tax preparation software. Tax preparation software can simplify the filing process, guide you through deductions, and potentially identify overlooked credits. Many software options offer free versions for basic filing, making it an accessible choice.

- Tip: Consult a tax professional. If you have a complex financial situation or need guidance on specific tax matters, consider consulting a qualified tax professional. Their expertise can help you navigate tax laws and maximize your tax benefits.

Valuable Tax Resources (October Availability)

October presents an opportunity to leverage resources that can help you prepare your taxes effectively.

- Resource: IRS Free File Program. The IRS Free File Program offers free tax preparation software for eligible taxpayers. This program is typically available from January to April, but some providers may offer it earlier in October.

- Resource: IRS Taxpayer Advocate Service. The Taxpayer Advocate Service (TAS) provides assistance to taxpayers facing difficulties with the IRS. If you’re facing challenges with your tax obligations, TAS can help resolve issues and advocate on your behalf.

- Resource: Tax-related publications and guides. The IRS publishes numerous publications and guides covering various tax topics, providing comprehensive information on tax laws, deductions, and credits. October is a good time to review these resources and gain a better understanding of your tax obligations.

7. Common Tax Issues in October

October is a crucial month for tax planning and compliance, as it marks the deadline for several important tax obligations. Understanding common tax issues in October can help individuals and businesses avoid penalties and ensure they are in compliance with tax laws.

Quarterly Estimated Tax Payments

Quarterly estimated tax payments are required for individuals and businesses who expect to owe taxes but are not subject to withholding. These payments are due on April 15, June 15, September 15, and January 15 of the following year. Failing to make these payments on time can result in penalties.

- Underpayment: This occurs when you don’t pay enough in estimated taxes throughout the year. If you owe more than $1,000 in taxes, you may be penalized for underpayment.

- Failure to file: This happens when you don’t file your estimated tax payments by the due date. The penalty for failing to file is typically 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25%.

- Changes in income or deductions: If your income or deductions change significantly throughout the year, you may need to adjust your estimated tax payments to avoid underpayment penalties.

- Make estimated tax payments on time: Plan ahead and make your payments by the due date to avoid penalties.

- Adjust withholdings: If your income or deductions have changed, you may need to adjust your withholdings from your paycheck to ensure you are paying enough taxes throughout the year.

- File an amended return: If you underpaid your estimated taxes, you can file an amended return to pay the remaining balance.

Property Taxes

Property taxes are levied by local governments on real estate. They are typically due in installments throughout the year, with a major payment often due in October.

- Changes in property value: If the assessed value of your property increases, your property taxes may also increase.

- Late payment penalties: If you fail to pay your property taxes by the due date, you may be subject to late payment penalties.

- Appeal property assessments: If you believe your property is overvalued, you can appeal the assessment to potentially reduce your property taxes.

- Explore tax exemptions: Some states offer property tax exemptions for certain individuals or groups, such as seniors, veterans, or homeowners with disabilities.

- Set up a payment plan: If you are unable to pay your property taxes in full by the due date, you may be able to set up a payment plan with your local government.

Retirement Contributions

Retirement contributions are an important part of long-term financial planning. October is a good time to review your retirement contributions and make sure you are on track to meet your savings goals.

- Missing contribution deadlines: Missing contribution deadlines for retirement accounts, such as 401(k)s or IRAs, can result in missed opportunities for tax benefits.

- Exceeding contribution limits: If you contribute more than the annual limit to your retirement account, you may be subject to penalties.

- Make contributions on time: Set up automatic contributions to your retirement accounts to ensure you are making regular contributions.

- Understand contribution limits: Familiarize yourself with the annual contribution limits for your retirement accounts to avoid exceeding them.

- Consult with a financial advisor: A financial advisor can help you develop a retirement savings plan that meets your individual needs.

Charitable Donations

Charitable donations are a great way to support worthy causes and reduce your tax liability. However, there are important rules and regulations to follow when making charitable donations.

- Improper recordkeeping: Failing to keep accurate records of your charitable donations can make it difficult to claim deductions on your tax return.

- Exceeding donation limits: You can only deduct a certain percentage of your adjusted gross income for charitable donations.

- Keep detailed records of donations: Keep receipts, canceled checks, or other documentation that proves your donations.

- Understand donation limits: Familiarize yourself with the donation limits for your tax situation.

- Seek professional advice: If you are making significant charitable donations, it’s a good idea to consult with a tax professional to ensure you are complying with all applicable rules and regulations.

Year-End Tax Planning

October is a good time to start planning for your year-end taxes. By taking proactive steps now, you can reduce your tax liability and ensure you are prepared for tax season.

- Failure to plan ahead: Waiting until the last minute to plan for your taxes can lead to missed opportunities for deductions and credits.

- Missed opportunities for deductions: There are many different deductions and credits available to taxpayers, but you need to know about them to take advantage of them.

- Review tax situation early: Gather your tax documents and review your income and expenses to identify potential deductions and credits.

- Consider strategies for reducing tax liability: Explore different tax planning strategies, such as making tax-advantaged investments or increasing your charitable donations.

- Consult with a tax professional: A tax professional can help you develop a tax plan that minimizes your tax liability.

| Tax Issue | Potential Causes | Solutions |

|---|---|---|

| Quarterly estimated tax payments | Underpayment, failure to file, changes in income or deductions | Make estimated tax payments on time, adjust withholdings, file an amended return |

| Property taxes | Changes in property value, late payment penalties | Appeal property assessments, explore tax exemptions, set up a payment plan |

| Retirement contributions | Missing contribution deadlines, exceeding contribution limits | Make contributions on time, understand contribution limits, consult with a financial advisor |

| Charitable donations | Improper recordkeeping, exceeding donation limits | Keep detailed records of donations, understand donation limits, seek professional advice |

| Year-end tax planning | Failure to plan ahead, missed opportunities for deductions | Review tax situation early, consider strategies for reducing tax liability, consult with a tax professional |

Tax Planning for the Future

Proactive tax planning is essential for minimizing your tax liability and maximizing your financial well-being. By strategically planning your finances throughout the year, you can significantly reduce your tax burden in future October periods and achieve your financial goals more effectively.

Tax Planning Strategies

Effective tax planning involves taking steps throughout the year to minimize your tax liability. Here are some strategies to consider:

Maximize Deductions and Credits

Deductions and credits directly reduce your taxable income or tax liability, resulting in significant savings.

- Contribute to Retirement Accounts:Contributions to traditional IRAs and 401(k)s are tax-deductible, lowering your taxable income.

- Utilize Tax-Advantaged Accounts:Consider using health savings accounts (HSAs) for medical expenses and 529 plans for education expenses.

- Claim Homeownership Deductions:Mortgage interest, property taxes, and insurance premiums can be deducted.

- Explore Charitable Giving:Charitable contributions can be deducted, potentially reducing your tax burden.

Optimize Income and Expenses

Adjusting your income and expenses can impact your tax bracket and overall tax liability.

- Consider Income Timing:Delaying income or accelerating expenses can help you shift income into a lower tax bracket.

- Evaluate Investment Strategies:Invest in tax-efficient vehicles like index funds and ETFs to minimize capital gains taxes.

- Take Advantage of Tax Breaks:Explore deductions and credits specific to your occupation, such as deductions for business expenses or credits for education expenses.

Seek Professional Advice

Consulting with a tax professional can provide valuable insights and guidance tailored to your individual circumstances.

- Tax Planning Consultation:A tax professional can help you develop a comprehensive tax plan to minimize your tax liability.

- Investment Advice:A financial advisor can help you create a diversified investment portfolio that considers tax implications.

- Estate Planning:A tax professional can assist you with estate planning strategies to minimize estate taxes.

Tax Laws and Regulations

Tax laws and regulations are constantly evolving, and it is crucial to stay updated on any changes that may affect your tax obligations. The Internal Revenue Service (IRS) is the primary agency responsible for administering and enforcing federal tax laws in the United States.

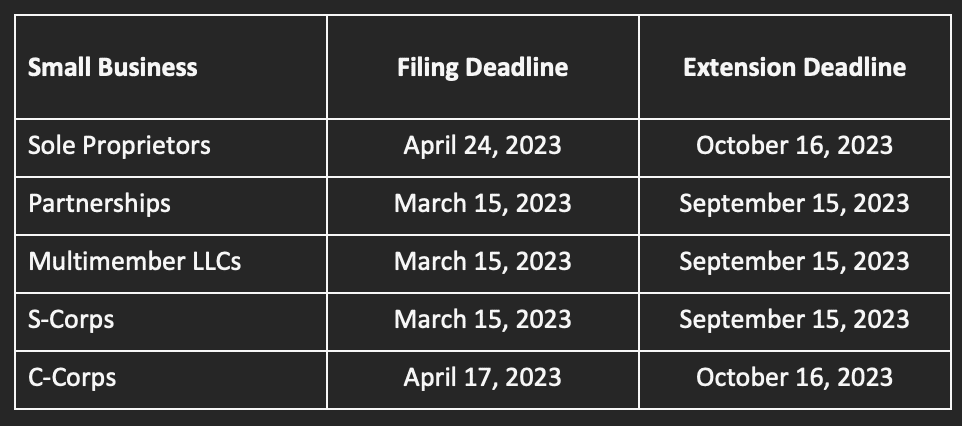

Tax Laws and Regulations Applicable in October

The tax laws and regulations that apply in October are generally the same as those that apply throughout the year. However, there are some specific deadlines and requirements that are relevant to this month. For instance, if you are self-employed or operate a small business, you may need to make estimated tax payments in October.

Additionally, October is the deadline for filing certain tax forms, such as the Form 1040-X, Amended U.S. Individual Income Tax Return.

Recent Changes to Tax Laws

The Tax Cuts and Jobs Act of 2017 (TCJA) brought about significant changes to the tax code, many of which have implications for October deadlines. For example, the TCJA increased the standard deduction for most taxpayers, which may affect your tax liability and the amount of taxes you owe.

Additionally, the TCJA made changes to the individual mandate penalty, which could impact your tax obligations if you are uninsured.

Links to Official Government Websites

For the most up-to-date information on tax laws and regulations, it is always recommended to consult official government websites. Here are some useful links:* Internal Revenue Service (IRS):[https://www.irs.gov/](https://www.irs.gov/)

Taxpayer Advocate Service (TAS)

[https://www.taxpayeradvocate.irs.gov/](https://www.taxpayeradvocate.irs.gov/)

U.S. Treasury Department

[https://www.treasury.gov/](https://www.treasury.gov/)

State and Local Taxes

State and local taxes are an important part of the overall tax system in the United States. These taxes fund essential services like education, infrastructure, and public safety at the state and local levels. While federal tax laws apply to all Americans, state and local tax laws vary significantly from one jurisdiction to another.

State Income Taxes

State income taxes are levied on the income of individuals and businesses within a particular state. The tax rates and exemptions can vary significantly across states. Some states have no income tax, while others have progressive tax systems with higher rates for higher earners.

For example, California has a progressive income tax system with rates ranging from 1% to 13.3%, while Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming have no income tax.

State Sales Taxes

State sales taxes are levied on the sale of goods and services within a particular state. These taxes are typically collected by retailers and remitted to the state government. The sales tax rate can vary across states and even within a state, depending on the type of goods or services being purchased.

For example, the standard sales tax rate in California is 7.25%, but some cities and counties impose additional local sales taxes, resulting in a total sales tax rate of 10% or more in some areas.

Property Taxes

Property taxes are levied on the value of real estate, such as homes, land, and commercial buildings. These taxes are typically collected by local governments and are used to fund services like schools, fire departments, and police departments. The property tax rate can vary depending on the location, the assessed value of the property, and the local government’s budget needs.

For example, property taxes in New Jersey are significantly higher than property taxes in Texas.

Local Taxes

Local taxes can include a variety of taxes levied by cities, counties, and other local governments. These taxes can include property taxes, sales taxes, income taxes, and other taxes. The specific types of local taxes and the rates can vary significantly from one locality to another.

For example, some cities impose a local income tax, while others do not. Some counties may have a higher sales tax rate than others within the same state.

Key Differences in Tax Regulations

The following table summarizes some key differences in tax regulations across states and localities:

| Tax Type | Federal | State | Local |

|---|---|---|---|

| Income Tax | Progressive tax system with various deductions and credits | Varies by state, some states have no income tax, others have progressive systems | Some cities have local income taxes |

| Sales Tax | Federal excise taxes on specific goods and services | Varies by state, some states have no sales tax, others have rates ranging from 4% to 10% | Varies by locality, some cities and counties impose additional local sales taxes |

| Property Tax | Not a federal tax | Varies by state, some states have no property tax, others have rates ranging from 0.5% to 2% | Varies by locality, rates can be significantly higher than state rates |

Tax Deductions and Credits

As we head into October, it’s a good time to start thinking about tax deductions and credits that can help reduce your tax liability. These are valuable tools that can save you money on your taxes, but you need to know what you qualify for and how to claim them.

Common Tax Deductions and Credits

Here are some common tax deductions and credits that you may be able to claim in October:

| Deduction/Credit Name | Eligibility Criteria | Example and Tax Savings |

|---|---|---|

| Charitable Contributions | You must have made a donation to a qualified charitable organization. | You donated $1,000 to a local food bank. If you are in the 22% tax bracket, this deduction could save you $220 in taxes. |

| Homeownership (Mortgage Interest and Property Taxes) | You must be a homeowner with a mortgage and pay property taxes. | You paid $10,000 in mortgage interest and $2,000 in property taxes. This deduction could save you $3,000 in taxes (assuming a 30% tax bracket). |

| Education Expenses (Tuition and Fees) | You must have paid tuition and fees for yourself or a dependent for higher education. | You paid $10,000 in tuition and fees for your child’s college education. You could claim the American Opportunity Tax Credit, which could save you up to $2,500 in taxes. |

| Child Tax Credit | You must have a qualifying child under the age of 17. | You have a child under the age of 17. You could claim the Child Tax Credit, which could save you up to $2,000 in taxes. |

| Retirement Contributions (IRA and 401(k)) | You must have made contributions to a traditional IRA or 401(k). | You contributed $6,500 to your traditional IRA. This deduction could save you $1,300 in taxes (assuming a 20% tax bracket). |

Remember, it’s important to consult with a tax professional to determine which deductions and credits you qualify for and how to maximize your tax savings.

Tax Audit and Investigations

While most taxpayers won’t face an audit, it’s important to understand the potential for tax audits and investigations in October. This is a crucial period for tax authorities to scrutinize returns and assess compliance.

Tax Audit Procedures

The IRS may select taxpayers for audit based on various factors, including inconsistencies in their returns, high-income levels, and unusual deductions.

It’s the end of the tax year, and you might be wondering about the Tax Deadline 2023. Don’t worry, there’s still time to file! The IRS has extended the deadline for many taxpayers, but it’s important to check if you qualify.

You can find out more about the IRS October Deadline 2023 and the October Extension Tax Deadline 2023 online.

- Correspondence Audit:This is the most common type of audit, conducted through mail. The IRS requests specific documentation or information to verify the accuracy of your return.

- Office Audit:You’ll be required to visit an IRS office to discuss your return with an auditor.

- Field Audit:The most extensive type, involving an IRS agent visiting your home or business to examine your records and financial information.

Preparing for a Tax Audit

It’s crucial to be prepared if you receive an audit notification.

- Organize Your Records:Keep all relevant documents, including receipts, bank statements, and tax forms, organized and readily accessible.

- Respond Promptly:Don’t ignore the audit notice. Respond within the designated timeframe with the requested information.

- Seek Professional Advice:If you’re unsure about the audit process or how to respond, consult with a tax professional for guidance.

Handling a Tax Audit

Remain calm and cooperative during the audit process.

- Be Honest and Accurate:Provide truthful information and documentation to the auditor.

- Don’t Guess:If you’re unsure about a specific question, politely inform the auditor and request clarification.

- Keep a Record:Document all communications and interactions with the IRS, including dates, times, and the names of individuals involved.

Tax Relief Programs and Assistance

October is a crucial month for tax obligations, and navigating these responsibilities can be overwhelming for some individuals. Fortunately, numerous tax relief programs and assistance options are available to ease the burden. This section will delve into some of these programs, outlining their eligibility criteria, benefits, and application processes.

Federal Tax Relief Programs, Taxes Due October

- Earned Income Tax Credit (EITC): This program provides a refundable tax credit to low-to-moderate-income working individuals and families. The EITC can significantly reduce your tax liability or even result in a refund.

- Eligibility Criteria: To qualify, you must meet specific income and filing status requirements.

The amount of the credit depends on your income, number of qualifying children, and filing status.

- Program Benefits: The EITC can reduce your tax liability by up to $6,935 for the 2023 tax year.

- Application Process: The EITC is claimed on your federal income tax return using Form 1040. You must provide information about your income, dependents, and other relevant details.

- Eligibility Criteria: To qualify, you must meet specific income and filing status requirements.

- Child Tax Credit (CTC): This credit offers financial assistance to families with qualifying children.

- Eligibility Criteria: You must meet certain income requirements and have a qualifying child under the age of 17.

- Program Benefits: The CTC can provide up to $2,000 per qualifying child.

- Application Process: The CTC is claimed on your federal income tax return using Form 1040. You must provide information about your qualifying children and other relevant details.

- Premium Tax Credit (PTC): This credit helps individuals and families afford health insurance through the Marketplace.

- Eligibility Criteria: You must meet specific income and residency requirements. The amount of the credit depends on your income, family size, and the cost of health insurance plans available in your area.

- Program Benefits: The PTC can reduce the cost of your monthly health insurance premiums.

- Application Process: You can apply for the PTC through the Health Insurance Marketplace website or by contacting a Marketplace call center.

State Tax Relief Programs

- Property Tax Relief Programs: Many states offer property tax relief programs for homeowners, especially seniors and those with disabilities. These programs may provide tax credits, deductions, or exemptions.

- Eligibility Criteria: Eligibility criteria vary by state but often include age, income, disability status, and property value.

- Program Benefits: The benefits can vary, but they typically reduce your property tax liability.

- Application Process: You can apply for these programs through your state’s tax agency or revenue department.

- Sales Tax Relief Programs: Some states offer sales tax relief programs for specific goods or services, such as groceries, prescription drugs, or energy bills.

- Eligibility Criteria: Eligibility criteria vary by state and program.

- Program Benefits: These programs can reduce the amount of sales tax you pay on eligible items.

- Application Process: The application process may involve claiming a credit on your state income tax return or obtaining a sales tax exemption certificate.

Local Tax Relief Programs

- Property Tax Exemptions: Many cities and counties offer property tax exemptions for specific groups, such as veterans, seniors, or individuals with disabilities.

- Eligibility Criteria: Eligibility criteria vary by jurisdiction and program.

- Program Benefits: These exemptions can significantly reduce your property tax liability.

- Application Process: You can apply for these exemptions through your local assessor’s office or tax collector’s office.

Accessing Tax Relief Programs

- Government Websites: The IRS website, state tax agency websites, and local government websites provide comprehensive information about tax relief programs.

- Non-Profit Organizations: Non-profit organizations like the United Way, Legal Aid, and AARP can provide guidance and assistance with accessing tax relief programs.

- Tax Preparation Services: Reputable tax preparation services can help you identify and claim tax relief programs for which you are eligible.

Tips for Utilizing Tax Relief Programs

- Gather All Necessary Documentation: Before applying for any tax relief program, ensure you have all required documents, such as income statements, proof of residency, and identification.

- Meet Eligibility Requirements: Carefully review the eligibility criteria for each program to ensure you qualify.

- File on Time: Most tax relief programs have deadlines, so it’s essential to file your applications or claims by the designated date.

- Seek Professional Advice: If you have questions about tax relief programs or need assistance with the application process, consult a tax professional or a non-profit organization specializing in tax assistance.

Tax Scams and Fraud

Tax scams and fraud are unfortunately common, and October is no exception. Scammers often target taxpayers during this time, as they may be feeling stressed about meeting deadlines or may be more susceptible to phishing attempts. Understanding common scams and how to protect yourself is essential.

Identifying and Avoiding Tax Scams

It is crucial to be aware of common tax scams to avoid falling victim. Here are some tips to help you identify and avoid tax scams:

- Beware of unsolicited calls, emails, or texts.Legitimate government agencies will not contact you by phone, email, or text to request personal information or threaten legal action. If you receive such a communication, do not respond and report it to the authorities.

- Be cautious of emails claiming to be from the IRS or other government agencies.Always verify the sender’s email address and look for red flags like misspellings, grammatical errors, or suspicious links. The IRS will never ask for personal information over email.

- Never give out your Social Security number or other sensitive information over the phone or online unless you initiated the contact and are confident about the legitimacy of the request.

- Be wary of offers that seem too good to be true.Scammers often promise unrealistic tax refunds or deductions to lure unsuspecting victims.

- Check the IRS website for official information and resources.The IRS website is a reliable source of information about taxes, deadlines, and scams.

Reporting Tax Fraud and Seeking Assistance

If you believe you have been a victim of tax fraud, report it to the IRS immediately. You can report tax fraud online, by phone, or by mail.

- Online:Report tax fraud online through the IRS website’s “Report Phishing, Scam, or Fraud” page.

- Phone:Call the IRS at 1-800-829-1040.

- Mail:Send a written report to the IRS at the following address:

Internal Revenue ServiceCriminal Investigation Division 1111 Constitution Avenue NW Washington, DC 20224

You can also contact the Federal Trade Commission (FTC) to report tax fraud. The FTC has a dedicated website for reporting scams, including tax scams.

Examples of Common Tax Scams

Tax scams can take many forms. Here are some examples of common scams that you should be aware of:

- Phishing scams:Scammers send emails or texts that appear to be from the IRS or other government agencies. These emails or texts often contain links that lead to fake websites designed to steal your personal information.

- Phone scams:Scammers call taxpayers pretending to be IRS agents. They may threaten legal action or demand immediate payment.

- Identity theft scams:Scammers steal your identity and file fraudulent tax returns in your name to claim your refund.

- Tax refund scams:Scammers promise to get you a larger tax refund than you are entitled to. They may ask for your personal information or a fee for their services.

- Tax preparation scams:Scammers offer to prepare your taxes for a low fee, but they may not be qualified to do so. They may also inflate your deductions or claim false credits to increase your refund.

Concluding Remarks

Staying informed about your tax obligations and adhering to deadlines is essential for maintaining financial stability and avoiding penalties. This guide has provided a comprehensive overview of taxes due in October, offering insights into key deadlines, payment options, and important considerations.

Remember to consult with a tax professional if you have specific questions or require personalized advice.

Query Resolution

What are the most common types of taxes due in October?

Some common types of taxes due in October include property taxes, quarterly estimated taxes for individuals and businesses, and certain state and local taxes.

What happens if I miss a tax deadline in October?

Missing a tax deadline can result in penalties, including interest charges, late filing fees, and potential legal actions. The severity of penalties can vary depending on the specific tax type and the amount of time you are late.

Are there any tax relief programs available in October?

Yes, there are various tax relief programs available for individuals and businesses facing financial hardship. These programs may offer extensions, payment plans, or other forms of assistance. You can find more information about these programs on government websites or by consulting with a tax professional.