Timeline of the Capital One Data Breach sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In 2019, Capital One, a prominent financial institution, faced a significant cybersecurity breach, impacting millions of customers.

This incident, a stark reminder of the vulnerabilities inherent in digital systems, sheds light on the intricate workings of cybercrime, the challenges of data security, and the profound impact such events can have on individuals and organizations.

The breach, which compromised sensitive personal information, triggered a wave of concern and prompted investigations into the nature of the attack, the perpetrator’s motives, and the effectiveness of Capital One’s response. This timeline delves into the details of the breach, examining the events leading up to it, the actions taken to contain it, and the lessons learned from this cybersecurity crisis.

It also explores the broader implications of the breach for the financial industry and the growing importance of robust data security measures in today’s digital landscape.

Contents List

Capital One Data Breach Timeline: Timeline Of The Capital One Data Breach

The Capital One data breach, which occurred in 2019, was one of the largest data breaches in history, affecting millions of individuals. This incident highlighted the vulnerabilities of large financial institutions to cyberattacks and the importance of robust cybersecurity measures.

This article will provide a comprehensive timeline of the breach, analyze the motives of the hacker, and discuss the lessons learned from this event.

Background of the Capital One Data Breach

Capital One is a major financial institution that provides a wide range of financial products and services, including credit cards, banking, and auto loans. The company’s vast customer base and sensitive data made it an attractive target for cybercriminals. The breach was attributed to a misconfigured web application firewall (WAF) that allowed the hacker to gain unauthorized access to Capital One’s systems.

The WAF was designed to protect against common web attacks, but it was misconfigured in a way that allowed the hacker to bypass security measures and access sensitive data.

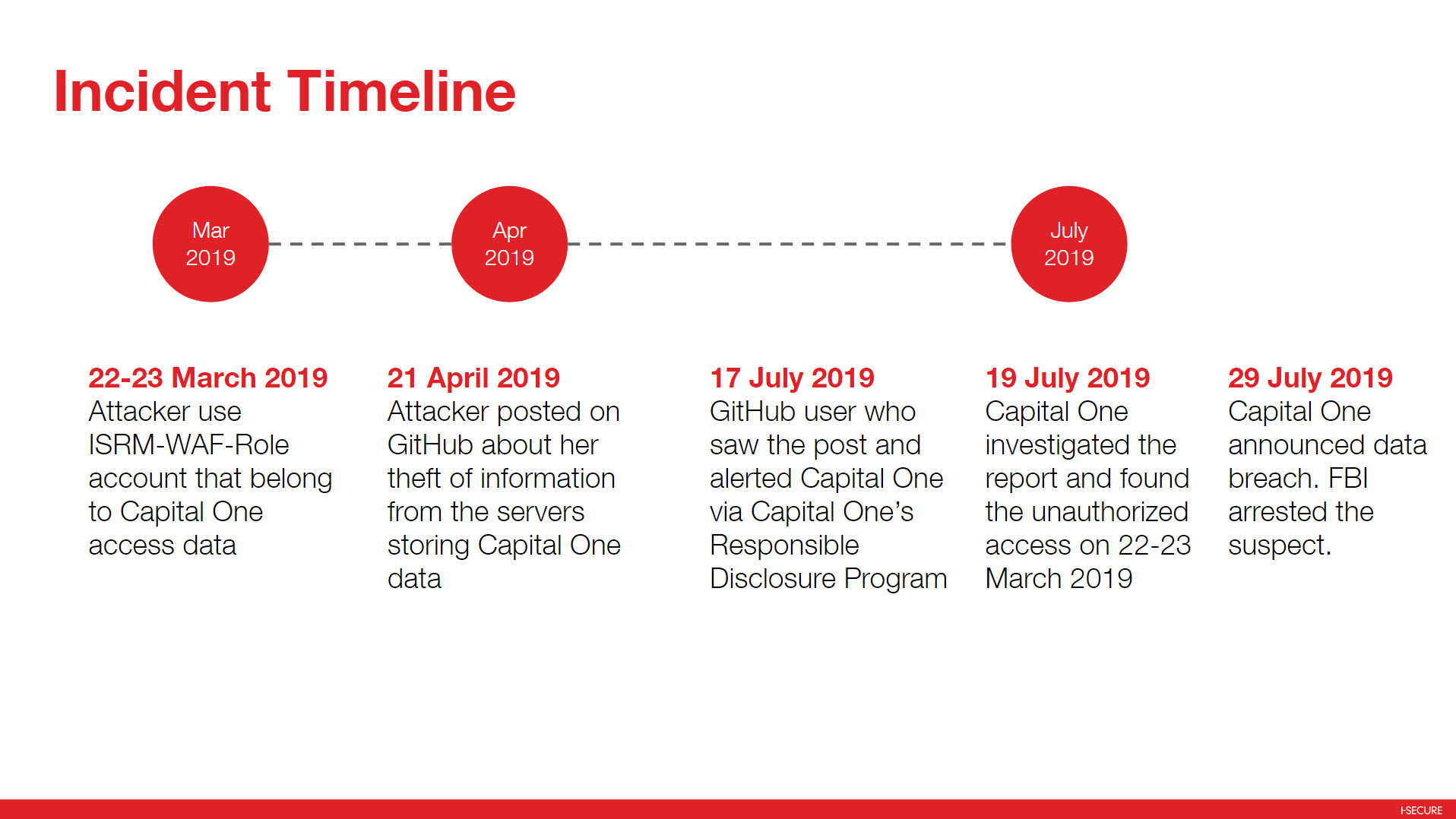

The Breach Timeline

- March 2019:The hacker, Paige Thompson, exploited a misconfigured web application firewall (WAF) on Capital One’s systems, gaining unauthorized access to sensitive data.

- July 17, 2019:Capital One discovered the breach and immediately began investigating the incident.

- July 18, 2019:Capital One notified law enforcement about the breach.

- July 22, 2019:Capital One publicly disclosed the breach and notified affected individuals.

- July 23, 2019:Thompson was arrested by the FBI.

- August 2019:Capital One began offering credit monitoring and identity theft protection services to affected individuals.

- December 2019:Thompson pleaded guilty to charges related to the breach.

- 2020:Thompson was sentenced to five years in prison.

The breach affected approximately 106 million individuals, including 140,000 Social Security numbers, 80,000 bank account numbers, and credit card information for over 1 million people. The financial implications for Capital One were significant, including legal costs, regulatory fines, and reputational damage.

The Hacker and Their Motives

Paige Thompson, the hacker responsible for the breach, was a former Amazon Web Services (AWS) employee. She had a history of hacking and was known for her online persona, “erratic,” where she boasted about her exploits. Thompson’s motives for targeting Capital One remain unclear, but it is believed that she was motivated by a combination of factors, including financial gain, personal vendetta, and a desire to prove her technical skills.

Thompson allegedly stole data from Capital One’s systems and attempted to sell it on the dark web.

Response and Recovery, Timeline of the Capital One Data Breach

Capital One responded quickly to the breach, taking immediate steps to contain the damage and mitigate its impact. The company worked with law enforcement to investigate the breach and identify the hacker. Capital One also notified affected individuals about the breach and offered credit monitoring and identity theft protection services.

In addition, the company implemented new security measures to prevent future breaches, including strengthening its WAF and enhancing its data security practices. The effectiveness of Capital One’s response was mixed. While the company was praised for its prompt notification of affected individuals and its commitment to providing remediation services, it was also criticized for its misconfigured WAF, which allowed the hacker to gain access to sensitive data in the first place.

Lessons Learned and Industry Implications

The Capital One data breach highlighted the importance of robust cybersecurity measures for financial institutions. It also underscored the need for organizations to regularly review and update their security practices to stay ahead of evolving threats. The breach also had significant implications for the financial industry, prompting a renewed focus on data security and privacy.

The industry has since implemented new regulations and best practices to improve cybersecurity, including the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. The breach also raised concerns about consumer privacy and data protection, prompting a greater awareness of the importance of safeguarding personal information.

Last Point

The Capital One data breach serves as a cautionary tale, highlighting the ever-evolving nature of cyber threats and the need for constant vigilance in protecting sensitive information. The incident underscores the critical importance of proactive security measures, robust incident response plans, and ongoing efforts to enhance data protection practices.

By understanding the intricacies of this breach, we can gain valuable insights into the challenges of safeguarding data in a digital age, and develop more effective strategies to mitigate future cyber risks.

FAQ Insights

What was the total number of individuals affected by the Capital One data breach?

Approximately 100 million individuals were affected by the breach.

What types of data were compromised in the Capital One data breach?

The compromised data included names, addresses, Social Security numbers, credit card numbers, and other sensitive personal information.

In this topic, you find that Capital One Settlement Case Timeline is very useful.

What measures did Capital One take to respond to the breach?

Capital One implemented a range of measures, including notifying affected individuals, providing credit monitoring and identity theft protection services, and strengthening their security systems.

What are some of the key lessons learned from the Capital One data breach?

The breach highlighted the importance of robust security measures, proactive threat detection, and effective incident response plans. It also emphasized the need for continuous monitoring and improvement of data security practices.