Today’s Rate 2024: A Guide to Understanding and Managing, explores the ever-changing landscape of rates in 2024. This guide delves into the factors influencing key rates across various sectors, analyzing their impact on individuals, businesses, and the global economy.

Buying your first home is a major milestone. Buying Your First Home 2024 can be a complex process, so it’s wise to get pre-approved for a mortgage and work with a real estate agent.

From understanding the historical context to forecasting future trends, this comprehensive resource equips you with the knowledge and strategies to navigate the dynamic world of rates.

If you’re looking to purchase a home in 2024, understanding subprime mortgages can be helpful, especially if you have less-than-perfect credit. These loans can offer a path to homeownership, but it’s crucial to weigh the risks and benefits carefully.

This guide examines the intricate interplay of factors that contribute to the fluctuations in rates, providing insights into the forces shaping the financial landscape. We will explore how these rates affect different sectors, from the financial markets to the energy industry, and analyze the potential consequences for consumers and businesses alike.

A chattel mortgage is a loan secured against movable assets, like equipment or machinery. Chattel mortgage 2024 options can be helpful for businesses or individuals needing to finance specific assets.

Contents List

Understanding “Today’s Rate” in 2024

In the dynamic landscape of 2024, the term “Today’s Rate” encompasses a wide range of economic indicators that influence financial decisions, investment strategies, and overall economic activity. This concept refers to the current prevailing rates across various sectors, reflecting the state of the market and influencing future expectations.

Keep an eye on the current market to see how home loan interest rates today are trending. These rates can change frequently, so it’s good to be aware of any fluctuations.

Understanding the nuances of “Today’s Rate” is crucial for individuals, businesses, and investors to navigate the complexities of the global economy.

Rocket Mortgage is a popular online lender. Rocket Mortgage Com 2024 offers a convenient way to apply for a mortgage from the comfort of your home, with potentially faster processing times.

Defining “Today’s Rate” in 2024, Today’s Rate 2024

In 2024, “Today’s Rate” encompasses a variety of key rates that fluctuate based on market forces and global events. These rates serve as a barometer for economic health, providing insights into the cost of borrowing, the return on investments, and the value of currencies.

When it comes to financing a home, understanding home mortgages is essential. There are different types of mortgages available, each with its own terms and interest rates.

“Today’s Rate” is a dynamic concept that evolves constantly, reflecting the interplay of supply and demand in financial markets, the impact of government policies, and global economic trends.

Fidelity Mortgage is another lender worth exploring. Fidelity Mortgage 2024 offers a range of mortgage products and services, so it’s worth checking out their rates and terms.

Factors Influencing “Today’s Rate”

Several factors influence “Today’s Rate” across different sectors. In finance, interest rates set by central banks play a crucial role. The Federal Reserve in the United States, for instance, adjusts interest rates to manage inflation and stimulate economic growth. These adjustments directly impact the cost of borrowing for individuals and businesses, influencing investment decisions and consumer spending.

Curious about the current rates for 30-year fixed mortgages? Interest Rates Today 30 Year Fixed 2024 can fluctuate daily, so it’s important to stay informed about the market.

In the energy sector, oil prices are a major driver of “Today’s Rate.” Global supply and demand dynamics, geopolitical events, and technological advancements all contribute to oil price fluctuations. These fluctuations directly impact the cost of transportation, manufacturing, and energy production, influencing consumer prices and business costs.

Looking for stability in your mortgage payments? Fixed rate home loans provide predictable monthly payments, which can be helpful for budgeting.

Exchange rates also play a significant role in “Today’s Rate.” The value of a currency relative to other currencies is determined by factors such as economic growth, inflation, and interest rate differentials. Fluctuations in exchange rates impact international trade, investment flows, and the cost of imports and exports, influencing the global economy.

If you’re already a homeowner, you might consider a second charge mortgage to access additional funds. This type of loan is secured against your property, but it comes with its own set of terms and conditions.

Historical Context of “Today’s Rate”

“Today’s Rate” has evolved significantly throughout history, reflecting changes in economic policies, technological advancements, and global events. For instance, the Bretton Woods Agreement established a fixed exchange rate system after World War II, but this system collapsed in the 1970s, leading to the current floating exchange rate system.

Thinking about a shorter-term mortgage? 15-year mortgage rates are often lower than 30-year rates, leading to faster debt repayment and lower overall interest costs. However, monthly payments will be higher.

Similarly, the emergence of new financial instruments and markets has reshaped the landscape of “Today’s Rate,” introducing new complexities and opportunities.

Before you apply for a mortgage, it’s wise to know what credit score to buy a house is generally required. A higher credit score often leads to better mortgage rates and terms.

Understanding the historical context of “Today’s Rate” is essential for interpreting current trends and anticipating future developments. By examining past patterns and analyzing the factors that have shaped “Today’s Rate” over time, we can gain valuable insights into the forces that drive the global economy.

Want to know what the current landscape looks like for long-term mortgages? 30-year mortgage rates today fluctuate daily, so it’s wise to check regularly to see how they’re trending.

Key Rates in 2024: Today’s Rate 2024

Several key rates are crucial for understanding “Today’s Rate” in 2024. These rates provide insights into the cost of borrowing, the return on investments, and the value of currencies, influencing financial decisions and economic activity.

The USDA offers loans to eligible borrowers in rural areas. Usda Home Loan 2024 programs can provide a more affordable path to homeownership for those who qualify.

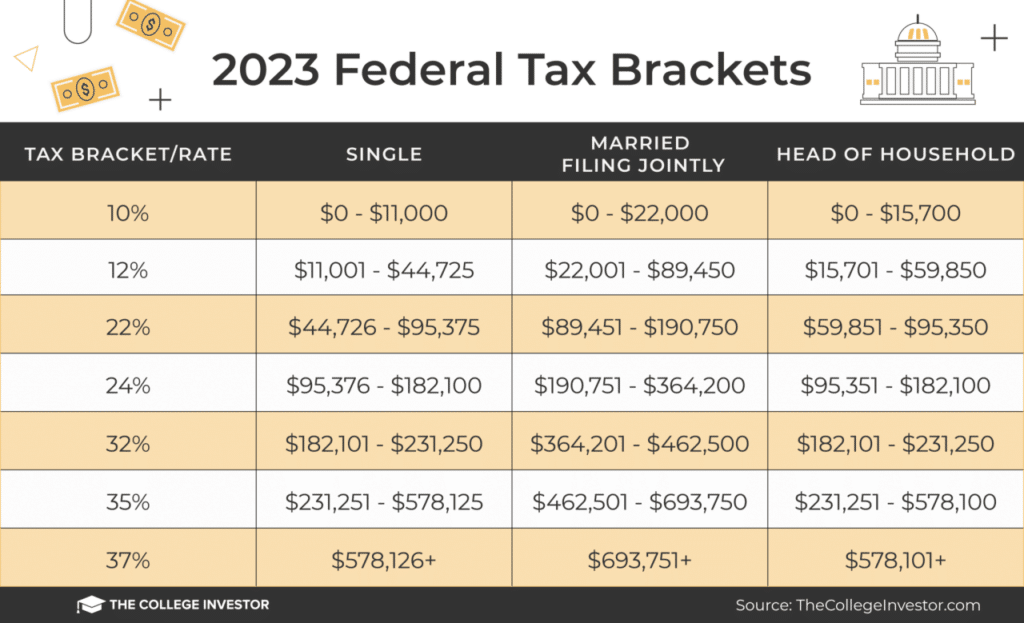

| Rate Name | Description | Current Value | Source |

|---|---|---|---|

| Federal Funds Rate | The target interest rate set by the Federal Reserve for overnight lending between banks. | [Current Value] | [Source] |

| Libor (London Interbank Offered Rate) | A benchmark interest rate that represents the average rate at which banks lend to each other in the London interbank market. | [Current Value] | [Source] |

| Treasury Yield Curve | A graphical representation of interest rates on U.S. Treasury securities with different maturities. | [Current Value] | [Source] |

| Oil Price (Brent Crude) | The price of Brent crude oil, a global benchmark for oil prices. | [Current Value] | [Source] |

| EUR/USD Exchange Rate | The exchange rate between the euro and the U.S. dollar. | [Current Value] | [Source] |

Each key rate plays a significant role in shaping “Today’s Rate” and influencing economic activity. The Federal Funds Rate, for example, influences the cost of borrowing for individuals and businesses, impacting consumer spending and investment decisions. The Treasury Yield Curve provides insights into market expectations for future interest rates, influencing investment strategies and risk appetite.

Oil prices impact the cost of transportation, manufacturing, and energy production, influencing consumer prices and business costs. Exchange rates influence international trade, investment flows, and the cost of imports and exports, impacting the global economy.

Subprime loans are often associated with higher interest rates and riskier lending practices. Subprime loans 2024 are designed for borrowers with less-than-stellar credit history, but they can be more expensive in the long run.

Concluding Remarks

Navigating the complex world of rates requires a deep understanding of the factors at play. This guide provides a comprehensive overview of the key rates influencing our financial landscape, their historical context, and their potential impact on different sectors. By analyzing expert forecasts and exploring strategies for managing these fluctuations, you can gain a strategic advantage in today’s dynamic economic environment.

Whether you are an individual investor, a business owner, or simply seeking a better understanding of the financial landscape, this guide offers valuable insights and practical advice for navigating the complexities of Today’s Rate 2024.

Questions and Answers

What are the key factors influencing Today’s Rate in 2024?

Key factors influencing Today’s Rate in 2024 include inflation, economic growth, monetary policy, and global events.

How do these rates impact consumers?

Fluctuations in rates can impact consumers through changes in borrowing costs, interest earned on savings, and the cost of goods and services.

What strategies can businesses employ to manage rate fluctuations?

Businesses can employ strategies such as hedging, adjusting pricing, and optimizing cash flow management to mitigate the impact of rate fluctuations.

Are there any resources available for further information on Today’s Rate?

Yes, reputable financial institutions, government agencies, and financial news outlets provide valuable information and analysis on rates.