Understanding tax brackets for 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complexities of the US tax system can be a daunting task, especially when it comes to understanding how tax brackets work and how they impact your personal finances.

This comprehensive guide will demystify the concept of tax brackets for 2024, providing insights into the different brackets, factors affecting your tax liability, and strategies to optimize your tax situation.

The 2024 tax brackets, like in previous years, are designed to ensure a progressive tax system, where higher earners contribute a larger percentage of their income in taxes. By understanding how these brackets work, you can gain valuable insights into your tax obligations and make informed decisions regarding your financial planning and investment strategies.

Contents List

2024 Tax Brackets

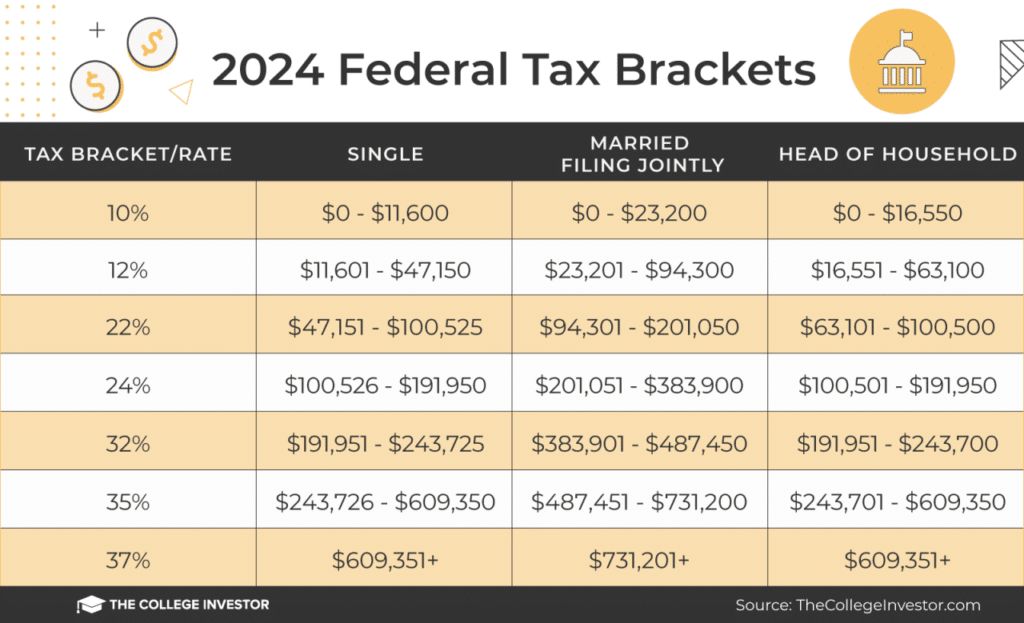

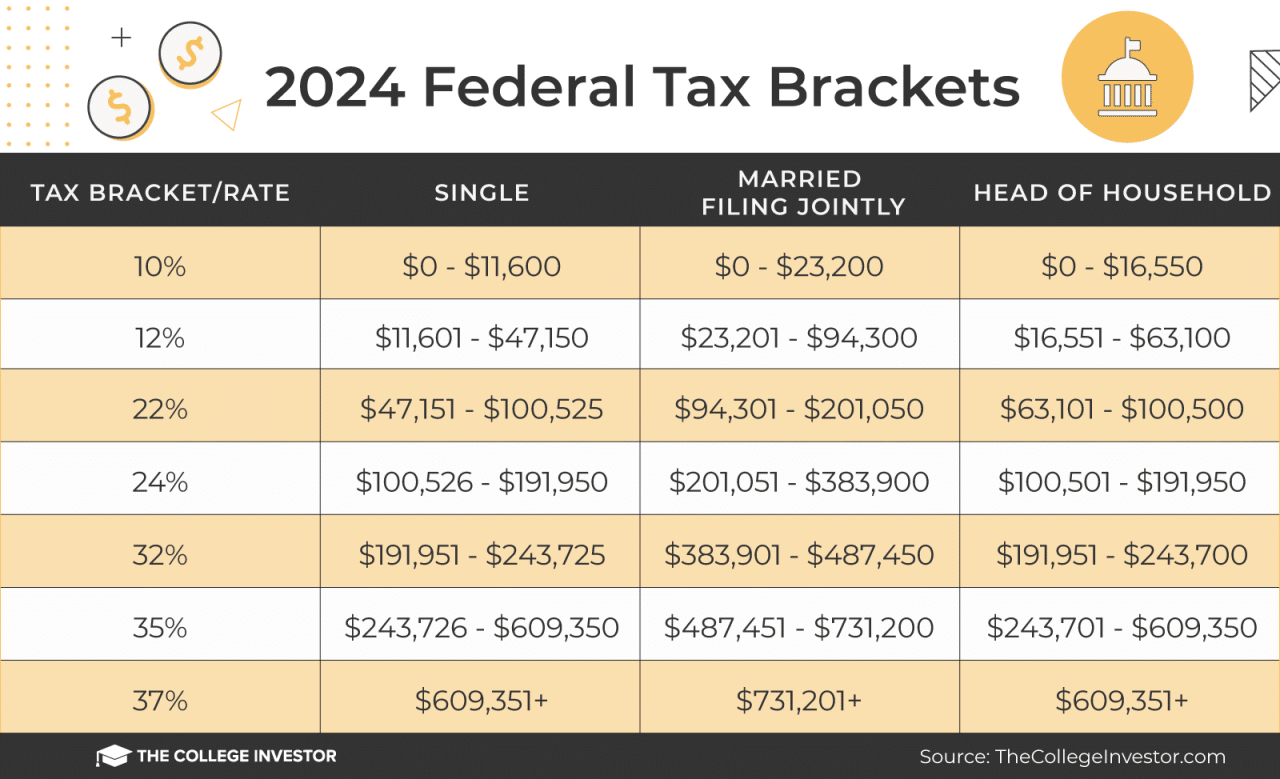

Understanding the 2024 tax brackets is crucial for accurately calculating your tax liability and making informed financial decisions. The tax brackets determine the percentage of your income that is taxed at each level. This guide will break down the 2024 tax brackets for different filing statuses, helping you understand how your income will be taxed.

The TikTok community is mourning the loss of Taylor Rousseau Grigg, a popular creator who passed away at the young age of 25. Read more about her life and legacy in this article: TikTok star Taylor Rousseau Grigg dead at 25.

2024 Tax Brackets for Different Filing Statuses

The 2024 tax brackets vary depending on your filing status. Here’s a table summarizing the tax brackets and corresponding tax rates for each filing status:

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single Filers | $0

|

10% |

| $10,951

The latest College Football Rankings have seen some major shifts, with Alabama dropping down and Big Ten teams climbing to the top. See the complete rankings and analysis here: College Football Rankings: Alabama falls, Big Ten teams stack top.

|

12% | |

| $46,276

Don’t miss the exciting matchup between the Las Vegas Raiders and the Denver Broncos! Find out how to watch this NFL game live on TV or streaming services by checking out this guide: How to watch the Las Vegas Raiders vs. Denver Broncos NFL game.

|

22% | |

| $101,751

If you’re filing as head of household in 2024, you’ll need to know the specific tax brackets that apply to your filing status. You can find a comprehensive breakdown of these brackets here: Tax brackets for head of household in 2024.

|

24% | |

$192,151

|

32% | |

$578,126

|

35% | |

| $1,016,001+ | 37% | |

| Married Filing Jointly | $0

|

10% |

$21,901

|

12% | |

$82,551

|

22% | |

$172,751

|

24% | |

| $344,301

The IRS has announced some changes to the tax brackets for 2024. These changes could affect your tax liability, so it’s important to stay informed. Check out this article to learn more about the specific changes: Tax bracket changes for 2024.

|

32% | |

| $696,251

Qualifying widow(er)s have their own unique set of tax brackets in 2024. You can find a complete list of these brackets and their corresponding income ranges here: Tax brackets for qualifying widow(er)s in 2024.

|

35% | |

| $1,232,001+ | 37% | |

| Married Filing Separately | $0

Stay up-to-date on the latest Arkansas football recruiting news with Otis Kirk’s insightful report. Watch the full video here: WATCH: Arkansas Football Recruiting Report with Otis Kirk (10-6-24).

|

10% |

$10,951

|

12% | |

$41,276

|

22% | |

$86,376

|

24% | |

$172,151

|

32% | |

$348,126

|

35% | |

| $616,001+ | 37% | |

| Head of Household | $0

|

10% |

$18,551

|

12% | |

$82,551

|

22% | |

$172,751

|

24% | |

$344,301

|

32% | |

$696,251

|

35% | |

| $1,232,001+ | 37% |

Impact of Changes in Tax Brackets on Individual Tax Liabilities

Changes in tax brackets can significantly impact individual tax liabilities. If your income increases and you move into a higher tax bracket, you’ll pay a higher percentage of your income in taxes.

Conversely, if your income decreases and you move into a lower tax bracket, you’ll pay a lower percentage of your income in taxes. For example, let’s say your income was $100,000 in 2023 and you were in the 22% tax bracket.

Tax season is just around the corner, and it’s important to know how much you’ll be paying. The IRS has released the tax brackets for 2024, which you can find here: Tax brackets for 2024 in the United States.

This information will help you plan your finances and prepare for filing your taxes.

If your income increases to $120,000 in 2024 and you move into the 24% tax bracket, you’ll pay a higher percentage of your income in taxes on the portion of your income that falls within the 24% tax bracket. This means that even though your income increased by $20,000, you won’t see a $20,000 increase in your after-tax income because the additional income will be taxed at a higher rate.Understanding how tax brackets work is crucial for making financial decisions, such as budgeting, saving, and investing.

By knowing how your income will be taxed, you can make informed decisions that align with your financial goals.

If you’re filing taxes as married filing separately in 2024, you’ll need to be aware of the specific tax brackets that apply to your filing status. You can find a breakdown of these brackets here: Tax brackets for married filing separately in 2024.

Understanding Marginal Tax Rates

The concept of marginal tax rates is crucial for understanding how your income is taxed. It’s not about the total tax you pay, but rather the rate applied to each additional dollar you earn. This system, used in most countries, is designed to ensure fairness and progressivity in taxation.

How Marginal Tax Rates Work Within Tax Brackets

Marginal tax rates are applied within specific income brackets. Each bracket has a different rate, and the rate increases as your income goes up. For instance, if you earn $50,000 and fall within the 12% tax bracket, only the portion of your income exceeding the previous bracket’s upper limit is taxed at 12%.

The new tax brackets for 2024 could have a significant impact on your income. Learn how these changes might affect your tax liability and what you can do to prepare: How will tax brackets affect my 2024 income?.

For example, let’s say you earn $75,000 in

2024. The tax brackets for single filers are as follows

| Income Range | Tax Rate ||—|—|| $0

$11,000 | 10% |

| $11,001

$44,725 | 12% |

| $44,726

$101,750 | 22% |

| $101,751

The New York Giants secured a victory against the Seattle Seahawks with a score of 29-20. You can read a detailed analysis of the game, including key plays and player performance, in this article: Instant Analysis: Giants defeat Seahawks, 29-20.

$192,150 | 24% |

| $192,151

Want to estimate your tax liability for 2024? Use this handy tax bracket calculator to get a quick estimate based on your income and filing status: Tax bracket calculator for 2024.

$578,125 | 32% |

| $578,126

$1,017,500 | 35% |

| $1,017,501+ | 37% |Here’s how the marginal tax rate applies:* $0

$11,000

You pay 10% tax on the entire amount. $11,001

The Green Bay Packers emerged victorious against the Los Angeles Rams with a score of 24-19, thanks in part to crucial turnovers. Read a full recap of the game, including highlights and key moments: Recap: Turnovers help Packers defeat Rams, 24-19.

-

$44,725

Barcelona secured a dominant victory in their latest match, thanks to a hat trick from Robert Lewandowski in the first half. Read more about this impressive performance and the team’s current standing: First-half hat trick for Lewandowski as Barcelona top ahead of.

You pay 12% on the income between $11,001 and $44,725.

- $44,726

$75,000

You pay 22% on the income between $44,726 and $75,000.

You don’t pay 22% on your entire $75,000 income. You only pay 22% on the portion of your income that falls within the 22% tax bracket.

Impact of Marginal Tax Rates on Financial Planning and Investment Decisions

Marginal tax rates play a significant role in financial planning and investment decisions. Understanding how they work allows individuals to:* Optimize tax liability:By strategically planning income and expenses, individuals can minimize their tax burden. For instance, they can utilize tax deductions and credits to reduce their taxable income and, consequently, their overall tax liability.

Make informed investment decisions

Marginal tax rates can influence the attractiveness of different investment options. For example, investors may prefer investments that generate tax-advantaged returns, such as municipal bonds, which are exempt from federal income tax.

Plan for retirement

The IRS has released the new tax brackets for 2024, and they’re likely to impact your tax bill. Get a clear understanding of these new brackets and their implications by reading this article: What are the new tax brackets for 2024?

.

Understanding marginal tax rates helps individuals plan for retirement effectively. They can consider strategies like contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs, to reduce their current tax burden and potentially lower their tax liability in retirement.

It’s important to note that marginal tax rates can change over time, so it’s essential to stay informed about any updates to the tax code.

Tax Reform and Future Trends

The tax landscape is constantly evolving, with ongoing discussions and proposals for tax reform shaping the future of how individuals and businesses are taxed. These reforms, driven by economic conditions, political agendas, and evolving societal priorities, can significantly impact tax brackets and overall tax obligations.

Impact of Economic Climate on Tax Policy, Understanding tax brackets for 2024

The current economic climate significantly influences tax policy decisions. In times of economic growth, policymakers may consider lowering taxes to stimulate further investment and spending. Conversely, during economic downturns, tax increases may be implemented to address budget deficits or fund social programs.

For instance, during the 2008 financial crisis, the United States implemented the American Recovery and Reinvestment Act, which included tax cuts to stimulate the economy. Conversely, in times of economic prosperity, such as the late 1990s, tax increases were considered to address budget deficits and fund social programs.

Emerging Trends in Taxation

The tax system is evolving to adapt to the changing nature of the economy and technological advancements.

- Increased Focus on Digital Economy:With the rise of the digital economy, governments are exploring ways to tax digital businesses that operate across borders. This includes proposals for digital service taxes and changes to international tax rules to ensure that multinational companies pay their fair share of taxes.

- Growing Importance of Sustainability:Tax incentives are being used to encourage environmentally friendly behavior and promote sustainable practices. This includes tax breaks for renewable energy investments, carbon taxes, and green bonds.

- Data Privacy and Security:Data is becoming an increasingly valuable asset, and governments are considering how to tax the collection, use, and monetization of data. This includes exploring data privacy regulations and the potential for data taxes.

Potential Tax Reforms and Their Impact

Tax reform proposals often involve adjustments to tax brackets, deductions, and credits.

- Flat Tax System:A flat tax system proposes a single tax rate for all income levels, eliminating the current progressive system with multiple tax brackets. This could potentially simplify the tax system but could also lead to greater inequality, as higher earners would pay a lower percentage of their income in taxes.

- Expanded Tax Credits:Tax credits can be used to offset tax liability and provide financial assistance to specific groups or for particular activities. Expanding tax credits for education, childcare, or renewable energy investments could potentially benefit low- and middle-income households and encourage desired behaviors.

- Changes to Deductions:Tax deductions can reduce taxable income, potentially lowering tax obligations. Reforms could involve limiting or eliminating certain deductions, such as those for state and local taxes, to generate revenue or simplify the tax code.

It is crucial to stay informed about potential tax reforms and their implications for individual tax obligations. Taxpayers should consult with qualified tax professionals to understand the latest changes and plan accordingly.

Closure: Understanding Tax Brackets For 2024

As you navigate the intricacies of the 2024 tax brackets, remember that staying informed is crucial. Keep an eye on potential tax reforms and their implications for the future. By utilizing tax planning strategies, maximizing deductions and credits, and seeking professional advice when necessary, you can effectively manage your tax liability and optimize your financial well-being.

The knowledge you gain from this guide empowers you to make informed decisions and confidently navigate the complexities of the US tax system.

Answers to Common Questions

What are the main differences between tax brackets in 2024 compared to previous years?

While the basic structure of tax brackets remains similar, there may be adjustments to income thresholds and tax rates. It’s essential to consult official IRS resources for the most up-to-date information.

How do I determine which tax bracket I fall into?

Your tax bracket is determined by your taxable income, which is your gross income minus deductions and exemptions. You can use tax calculators or consult a tax professional to determine your specific tax bracket.

Is it possible to avoid paying taxes altogether?

While it’s not possible to avoid paying taxes entirely, you can minimize your tax liability through effective tax planning strategies, such as maximizing deductions and credits.