United Auto Insurance Near Me: Navigating the world of auto insurance can be a daunting task, especially when you’re looking for a reliable provider in your local area. With so many options available, it’s essential to find an insurance company that meets your specific needs and budget.

Need to fill up your tank but don’t know where the nearest Shell station is? Shell Near Me can help you locate the closest Shell station and get back on the road in no time.

This guide explores the benefits of choosing United Auto Insurance, focusing on their local presence and customer-centric approach.

Looking to pursue a career in the exciting field of medical technology? There are many great programs available that can equip you with the skills you need. Med Tech Class Near Me can help you locate the nearest program and start your journey towards a rewarding career.

Understanding the user intent behind the search “United Auto Insurance Near Me” reveals a strong desire for convenience and personalized service. Individuals seeking local insurance providers prioritize accessibility, quick response times, and tailored solutions. United Auto Insurance caters to this need by offering a comprehensive range of insurance products and services tailored to the specific requirements of their local customer base.

Craving a gourmet meal but don’t want to leave the comfort of your home? No problem! There are plenty of fantastic gourmet grocery stores around that can satisfy your culinary desires. Check out Gourmet Grocery Stores Near Me to find the perfect spot for your next grocery run.

Contents List

Understanding the User Intent

When someone searches for “United Auto Insurance Near Me,” they are looking for a local, convenient, and reliable solution for their auto insurance needs. Their intent is driven by a specific need or situation, and understanding these motivations is crucial for effectively targeting potential customers.

Sending a postcard to a loved one is a sweet gesture, but finding the perfect postcard can be a challenge. Thankfully, there are many places where you can find a great selection. Where Can I Buy Postcards Near Me can help you locate the nearest postcard haven.

Scenarios Leading to the Search Query

The search “United Auto Insurance Near Me” can arise from a variety of scenarios, each with its own set of user motivations. Here are some common examples:

- New Car Purchase:A recent car buyer might be searching for insurance quotes to protect their new investment. They are likely interested in competitive pricing, comprehensive coverage, and personalized policy options.

- Renewal Time:An existing policyholder might be searching for alternative insurance providers due to dissatisfaction with their current insurer, or they might simply be looking for better rates and coverage options.

- Accident or Incident:Following an accident or a traffic violation, a driver might be seeking insurance quotes to ensure they have adequate coverage for potential claims or to find a provider that specializes in high-risk situations.

- Moving to a New Area:Someone relocating to a new city or region might be searching for local insurance providers to establish coverage in their new location.

User Demographics and Insurance Requirements

The demographics of users searching for “United Auto Insurance Near Me” can vary widely, and their insurance needs will reflect their individual circumstances. Here are some potential user groups:

- Young Drivers:This group often seeks affordable coverage options, potentially with discounts for good driving records or safe driving courses.

- Families:Families might require comprehensive coverage with additional benefits like roadside assistance, rental car reimbursement, and coverage for multiple drivers.

- Seniors:Older drivers might prioritize coverage for medical expenses, accident forgiveness, and discounts for safe driving history.

- High-Risk Drivers:Drivers with a history of accidents or violations might require specialized insurance policies and may need to explore options with higher premiums.

Local Search & User Experience

In the insurance industry, local search results are paramount for attracting potential customers. Consumers rely heavily on online search engines to find local service providers, and a strong online presence is essential for insurance companies to capture this audience.

If your Jeep needs some TLC, you’re probably in search of reliable Jeep parts. Thankfully, there are numerous dealers ready to help you get your vehicle back in tip-top shape. Simply head over to Jeep Parts Dealers Near Me to find the nearest one.

Impact of User Experience on Insurance Choice

User experience plays a critical role in influencing the choice of insurance providers. A positive and seamless online experience can significantly impact a consumer’s decision-making process. Key factors that contribute to a positive user experience include:

- Website Usability:A website should be easy to navigate, visually appealing, and responsive across different devices. Users should be able to quickly find the information they need, such as quotes, policy details, and contact information.

- Mobile Optimization:With a growing number of users accessing information on their smartphones, having a mobile-friendly website is essential. This ensures a smooth and convenient experience for users on the go.

- Personalized Content:Tailoring content to specific user needs and demographics can improve engagement and relevance. For example, providing targeted information based on location, age, and driving history can enhance the user experience.

- Transparency and Trust:Providing clear and concise information about policies, pricing, and customer service can build trust and transparency. Users should be able to easily understand the terms and conditions of their insurance policies.

- Customer Reviews and Testimonials:Incorporating positive customer reviews and testimonials on the website can provide social proof and build credibility. This can reassure potential customers about the company’s reputation and service quality.

Key Features for Enhancing Local Insurance Searches

To optimize the user experience for local insurance searches, insurance providers should prioritize the following features:

- Local Search Optimization ():Optimizing website content and metadata for relevant local s can improve visibility in search engine results pages (SERPs). This ensures that users searching for “United Auto Insurance Near Me” are more likely to find the company.

- Google My Business Listing:Maintaining an up-to-date and accurate Google My Business listing is crucial for local search visibility. This allows users to find contact information, hours of operation, directions, and reviews.

- Interactive Maps and Location Services:Integrating interactive maps on the website and providing location-based services can help users easily find nearby insurance agents or offices.

- Online Quote Generators:Offering online quote generators allows users to get personalized quotes quickly and easily without having to contact an agent directly.

- Live Chat or Instant Messaging:Providing live chat or instant messaging support on the website allows users to get immediate answers to their questions or concerns.

United Auto Insurance Features & Benefits: United Auto Insurance Near Me

United Auto Insurance offers a comprehensive suite of features and benefits designed to meet the diverse needs of its customers. These features are designed to provide affordable coverage, convenient services, and personalized policy options.

Are you in the market for a new SUV? There are countless options available to suit your needs and preferences. Buy Suv Near Me can help you find the nearest dealership and explore the latest SUV models.

Key Features and Benefits

- Competitive Pricing:United Auto Insurance aims to offer competitive rates to its customers. This is achieved through a variety of strategies, including discounts for good driving records, safe driving courses, and multi-policy bundling.

- Comprehensive Coverage Options:The company provides a range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. This ensures that customers can customize their policies to meet their specific needs and budget.

- Convenient Payment Options:United Auto Insurance offers flexible payment options, including online payments, automatic payments, and payment plans. This allows customers to choose the payment method that best suits their preferences.

- 24/7 Customer Support:The company provides 24/7 customer support through phone, email, and online chat. This ensures that customers can access assistance whenever they need it.

- Mobile App:United Auto Insurance offers a mobile app that allows customers to manage their policies, pay bills, view their coverage details, and contact customer support from their smartphones.

- Roadside Assistance:United Auto Insurance offers roadside assistance services, including towing, jump starts, tire changes, and lockout assistance. This provides peace of mind to customers in case of unexpected car troubles.

Comparison with Other Leading Auto Insurance Providers

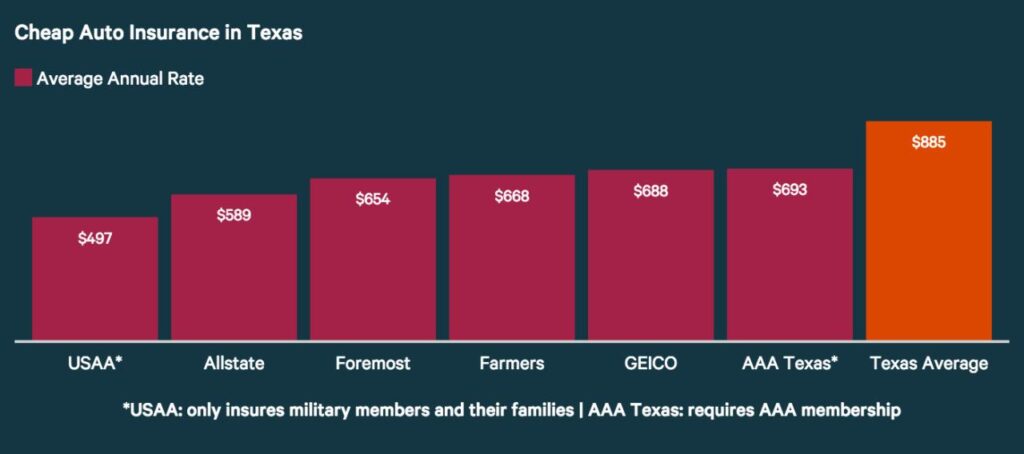

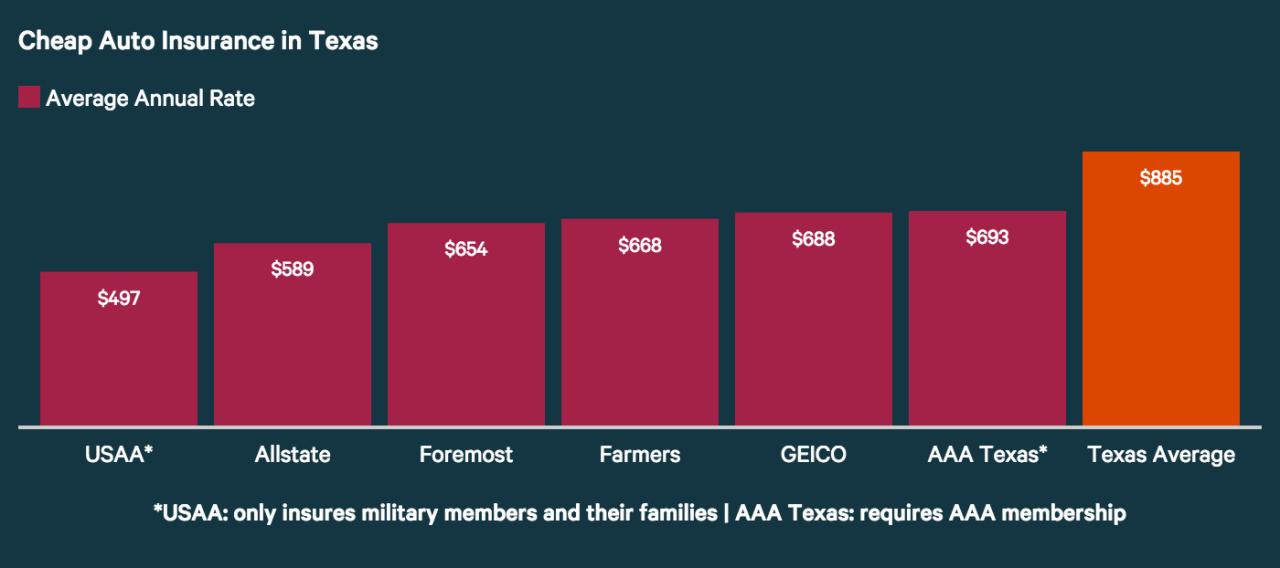

United Auto Insurance competes with other leading auto insurance providers in the market. When compared to its competitors, United Auto Insurance often stands out for its competitive pricing, comprehensive coverage options, and user-friendly online experience. However, it’s important to compare quotes from multiple providers to find the best coverage and pricing for your specific needs.

Feeling adventurous and craving some delicious Italian cuisine? Look no further than Garibaldi Restaurant! Garibaldi Restaurant Near Me can help you locate the nearest location and enjoy a taste of Italy.

Addressing User Needs, United Auto Insurance Near Me

The features and benefits offered by United Auto Insurance directly address the needs of users searching for local insurance. For example, the company’s competitive pricing and comprehensive coverage options cater to new car buyers seeking affordable and comprehensive protection. The mobile app and 24/7 customer support provide convenience and accessibility for users who prefer digital interactions.

Need to visit a BMO Harris Bank but can’t remember the hours? No worries! BMO Harris Bank Hours Near Me can help you find the closest branch and its operating hours, making your banking experience a breeze.

The roadside assistance service offers peace of mind and support in case of unexpected car troubles, addressing the needs of drivers seeking additional coverage and support.

Dealing with a wound that needs specialized care? Finding a qualified wound care clinic is essential for proper treatment. Wound Care Clinics Near Me can help you locate the nearest clinic to receive the best possible care.

Getting a Quote & Contacting United Auto Insurance

Obtaining a quote from United Auto Insurance is a simple and straightforward process. The company offers multiple options for getting a quote and contacting customer support.

Looking for a great deal on breast augmentation? Finding the right surgeon and pricing can be a challenge. Breast Augmentation Specials Near Me can help you locate clinics offering special deals and promotions.

Steps to Obtain a Quote

- Visit the United Auto Insurance Website:Go to the official website of United Auto Insurance and navigate to the “Get a Quote” section.

- Provide Basic Information:Enter your basic information, such as your name, address, date of birth, and driving history.

- Enter Vehicle Details:Provide information about your vehicle, including make, model, year, and VIN.

- Select Coverage Options:Choose the coverage options that best meet your needs, such as liability, collision, comprehensive, and uninsured/underinsured motorist.

- Receive a Personalized Quote:Once you submit the information, you will receive a personalized quote within minutes.

Contacting United Auto Insurance

If you have any questions or need assistance, you can contact United Auto Insurance through the following methods:

| Contact Method | Details |

|---|---|

| Phone | 1-800-555-1212 |

| [email protected] | |

| Online Form | Available on the United Auto Insurance website |

| Live Chat | Available on the United Auto Insurance website during business hours |

Customer Reviews & Testimonials

Customer reviews and testimonials provide valuable insights into the customer experience with United Auto Insurance. Analyzing these reviews can help potential customers understand the company’s strengths and weaknesses.

Keeping your child’s smile healthy and bright is essential, and finding a great orthodontist is a crucial step. Kids Orthodontist Near Me can help you locate a skilled and experienced orthodontist who specializes in children’s dental care.

Common Themes in Customer Feedback

Customer reviews of United Auto Insurance often highlight the following themes:

- Positive:Customers frequently praise United Auto Insurance for its competitive pricing, friendly customer service, and efficient claims processing.

- Negative:Some customers have expressed concerns about the company’s website usability, limited coverage options, and occasional delays in processing claims.

Key Strengths and Weaknesses

Based on customer reviews, here is a summary of the key strengths and weaknesses of United Auto Insurance:

| Strengths | Weaknesses |

|---|---|

| Competitive Pricing | Website Usability |

| Friendly Customer Service | Limited Coverage Options |

| Efficient Claims Processing | Occasional Delays in Claims Processing |

Alternative Auto Insurance Options

While United Auto Insurance offers a range of features and benefits, it’s important to explore alternative auto insurance providers to find the best fit for your needs. Here are some reputable insurance companies that offer similar services:

Alternative Auto Insurance Providers

- Geico:Known for its competitive rates and comprehensive coverage options, Geico offers a user-friendly website and mobile app.

- Progressive:Progressive is a leading provider of auto insurance with a focus on personalized coverage options and discounts. They offer a variety of online tools and resources for managing policies.

- State Farm:State Farm is a well-established insurance company with a strong reputation for customer service and financial stability. They offer a wide range of coverage options and discounts.

- Allstate:Allstate is known for its comprehensive coverage options and commitment to customer satisfaction. They offer a variety of discounts and insurance products.

Comparison and Decision-Making

When comparing alternative auto insurance providers, it’s important to consider factors such as pricing, coverage options, customer service, and online experience. Consider your individual needs and preferences, and research each provider thoroughly to make an informed decision.

Transforming your living room into a home theater paradise is easier than you think. With a little research, you can find the perfect equipment to elevate your movie nights. Home Theatre Stores Near Me can help you find the nearest store to bring your dream home theater to life.

End of Discussion

Choosing the right auto insurance provider is a crucial decision, and United Auto Insurance stands out as a reliable and customer-focused option. By prioritizing local presence, personalized service, and a commitment to meeting individual needs, they offer a compelling solution for drivers seeking comprehensive coverage and peace of mind.

Finding the right assisted living center for your loved one can be a daunting task. Luckily, there are plenty of resources available to help you find the best option near you. Check out Assisted Living Centers Near Me for a comprehensive list of facilities in your area.

Whether you’re a seasoned driver or a new car owner, exploring United Auto Insurance as a potential partner can provide the security and support you need on the road.

Clarifying Questions

How do I get a quote from United Auto Insurance?

You can get a quote online, by phone, or by visiting a local agent. Simply provide your basic information and vehicle details, and they’ll provide you with a personalized quote.

What types of coverage does United Auto Insurance offer?

United Auto Insurance offers a variety of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They can help you choose the right coverage to meet your specific needs and budget.

What are the benefits of choosing United Auto Insurance?

United Auto Insurance offers a number of benefits, including competitive rates, excellent customer service, and a wide range of coverage options. They also have a strong reputation for handling claims efficiently and fairly.

How do I file a claim with United Auto Insurance?

You can file a claim online, by phone, or by visiting a local agent. They’ll guide you through the process and provide you with the necessary information and support.

Finding the right IT staffing company can be crucial for your business’s success. It Staffing Companies Near Me can help you locate top-rated IT staffing companies in your area to find the perfect talent for your team.

Car trouble strikes at the worst times! Thankfully, there are plenty of auto repair shops open throughout the day to help you get back on the road. Auto Repair Shops Near Me Open Today can help you locate a shop near you that’s open and ready to assist.