USAA Car Loan Rates offer a competitive option for military members and their families seeking auto financing. USAA, a financial institution dedicated to serving the military community, provides a range of car loan products designed to meet the unique needs of its members.

Thinking about buying a home with a VA loan? Check out the VA Loan Rates Today to see if it’s a good fit for you. VA loans offer unique benefits to eligible veterans and active-duty military personnel.

From understanding the factors influencing loan rates to exploring the application process, this guide delves into the intricacies of USAA car loans. We’ll examine the advantages and disadvantages of choosing USAA for your next car purchase, compare rates to other lenders, and explore customer feedback to provide a comprehensive overview.

Contents List

USAA Car Loan Overview

USAA is a financial institution that provides a range of services, including insurance, banking, and investment products, exclusively for members of the U.S. military, their families, and former members. USAA has a long history of serving military personnel and their families, dating back to 1922.

The company is known for its commitment to providing high-quality financial services at competitive rates, and its car loan products are no exception.

USAA car loans are designed specifically for military members, their families, and former members. The target audience is individuals who have served or are currently serving in the U.S. military, as well as their spouses and children. USAA offers a range of car loan products to meet the needs of this diverse group, including new and used car loans, as well as refinancing options.

Are you considering a mortgage with BMO? BMO Mortgage Rates can vary, so it’s important to compare them with other lenders to get the best deal.

Benefits of Choosing USAA for Car Financing

- Competitive interest rates: USAA car loans are known for their competitive interest rates, which can help you save money on your monthly payments.

- Flexible loan terms: USAA offers a variety of loan terms to suit your individual needs and financial situation.

- Convenient online application process: You can apply for a USAA car loan online, making it easy and convenient to get pre-approved.

- Excellent customer service: USAA is renowned for its excellent customer service, which is available 24/7.

- Exclusive discounts and perks: USAA members may be eligible for exclusive discounts and perks, such as reduced interest rates or cash back offers.

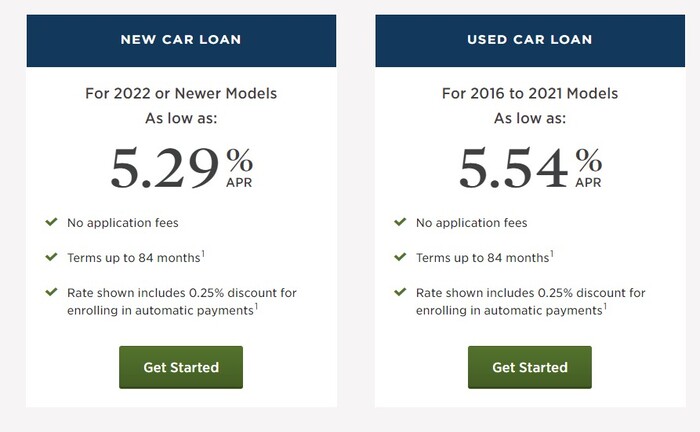

USAA Car Loan Rates

USAA car loan rates are determined by a variety of factors, including your credit score, the loan term, the type of vehicle you are financing, and the current market interest rates. In general, borrowers with higher credit scores and shorter loan terms will qualify for lower interest rates.

A Variable Rate Mortgage can be a good option if you anticipate interest rates dropping in the future. However, it’s important to understand the risks associated with a variable rate, as your payments could increase if interest rates rise.

Factors Influencing USAA Car Loan Rates

- Credit score: Your credit score is a major factor in determining your interest rate. Borrowers with excellent credit scores (740 or higher) typically qualify for the lowest interest rates.

- Loan term: The length of your loan term also impacts your interest rate. Longer loan terms generally come with higher interest rates, but they also result in lower monthly payments.

- Vehicle type: The type of vehicle you are financing can also affect your interest rate. New cars may have higher interest rates than used cars, as they are considered a higher risk for lenders.

- Market interest rates: The current market interest rates also play a role in determining your car loan rate. When interest rates are high, lenders typically charge higher interest rates on loans.

Comparing USAA Car Loan Rates to Other Lenders

USAA car loan rates are generally competitive with those offered by other lenders. However, it is always a good idea to shop around and compare rates from multiple lenders before making a decision. You can use online tools or contact lenders directly to get quotes and compare their rates and terms.

USAA Car Loan Rates by Credit Score

| Credit Score Range | APR (Approximate) |

|---|---|

| 740+ (Excellent) | 3.50%

|

| 670-739 (Good) | 4.00%

An Interest Only Mortgage can be a good option if you want lower monthly payments in the early years of your mortgage. However, you’ll need to make a large lump sum payment at the end of the term to repay the principal balance.

|

| 620-669 (Fair) | 5.00%

Need financing for a home renovation project? A Renovation Loan can help you get the funds you need to upgrade your home. These loans are specifically designed for home improvement projects and can be a good option if you need to finance a large project.

|

| 580-619 (Poor) | 6.50%

|

| Below 580 (Very Poor) | 8.00%

|

Please note that these are just approximate APRs and may vary based on the specific factors mentioned earlier. It is always recommended to contact USAA directly for the most up-to-date rates and terms.

Need a quick loan until your next payday? Payday Loan Direct Lender can help you get the funds you need, but it’s important to be aware of the high interest rates and fees associated with payday loans.

Applying for a USAA Car Loan

Applying for a USAA car loan is a straightforward process that can be completed online or by phone. Here are the steps involved:

Steps Involved in Applying for a USAA Car Loan

- Gather your necessary documents: This includes your driver’s license, Social Security number, proof of income, and recent bank statements.

- Complete the online application: You can apply for a car loan online through USAA’s website. The application process is simple and requires you to provide basic information about yourself and the vehicle you are financing.

- Receive pre-approval: Once you submit your application, USAA will review it and provide you with a pre-approval decision. This pre-approval will give you an idea of the interest rate and loan terms you may qualify for.

- Shop for a car: Once you are pre-approved, you can start shopping for a car. USAA offers a variety of resources to help you find the right vehicle, including a car buying guide and a vehicle history report service.

- Finalize your loan: Once you have chosen a car, you can finalize your loan with USAA. This involves signing the loan documents and providing any additional information required.

Required Documentation for Loan Approval

- Driver’s license

- Social Security number

- Proof of income (pay stubs, tax returns, etc.)

- Recent bank statements

- Vehicle identification number (VIN)

- Vehicle purchase agreement

Loan Approval Process and Timeframe

The loan approval process typically takes a few days. Once you submit your application, USAA will review your information and make a decision. If you are approved, you will receive a loan agreement that Artikels the terms of your loan.

You can then use this agreement to finalize the purchase of your car.

USAA Car Loan Features

USAA car loans offer a variety of features designed to make the financing process easier and more convenient for borrowers. Here are some of the key features to consider:

USAA Car Loan Features

- Prepayment options: USAA allows you to make prepayments on your car loan without any penalties. This can help you save money on interest and pay off your loan sooner.

- Flexible loan terms: USAA offers a variety of loan terms, ranging from 24 to 84 months. This allows you to choose a term that fits your budget and financial goals.

- Loan protection options: USAA offers a variety of loan protection options, such as GAP insurance and credit life insurance. These options can help protect you from financial hardship in the event of an accident or unexpected job loss.

- Online account management: You can manage your USAA car loan online, including making payments, viewing your loan balance, and accessing your loan documents.

- Excellent customer service: USAA is known for its excellent customer service, which is available 24/7.

Comparison with Other Lenders

USAA car loan features are generally comparable to those offered by other lenders. However, some lenders may offer additional features, such as loan forgiveness programs or cash back rewards. It is important to compare features and terms from multiple lenders before making a decision.

Advantages and Disadvantages of Each Feature

The advantages and disadvantages of each feature will vary depending on your individual needs and circumstances. For example, prepayment options can help you save money on interest, but they may not be necessary if you are already on track to pay off your loan on time.

Looking for a personal loan with flexible terms and a fast approval process? Withu Loans could be a good option for you. They offer loans for a variety of purposes, and their online application process is quick and easy.

Loan protection options can provide peace of mind, but they can also add to the overall cost of your loan.

If you need money fast, an Insta Loan could be the solution. These loans are designed to provide quick access to funds, often with minimal paperwork. It’s important to consider the terms and conditions before taking out an Insta Loan, as they can come with higher interest rates.

USAA Car Loan Reviews and Customer Feedback

USAA car loans have generally received positive reviews from customers. Many borrowers praise the company’s competitive interest rates, flexible loan terms, and excellent customer service. However, some customers have reported issues with the loan approval process or with accessing customer service representatives.

If you’re looking to finance a new car, consider a Chase Auto Loan. They offer competitive rates and a variety of loan terms to fit your needs.

Customer Reviews and Feedback on USAA Car Loans

| Source | Rating | Pros | Cons |

|---|---|---|---|

| Trustpilot | 4.5 out of 5 stars | Competitive rates, excellent customer service, convenient online application process | Some customers reported issues with the loan approval process or with accessing customer service representatives |

| ConsumerAffairs | 4 out of 5 stars | Low interest rates, flexible loan terms, helpful customer service | Some customers reported long wait times for loan approval or for customer service assistance |

| Bankrate | 4.2 out of 5 stars | Excellent customer service, competitive rates, user-friendly online platform | Some customers reported limited loan options or high fees for certain features |

Insights from Customer Experiences

Many customers have shared positive experiences with USAA car loans, highlighting the company’s competitive rates, flexible terms, and responsive customer service. However, some customers have expressed frustration with the loan approval process, particularly the wait times for a decision. Others have reported challenges accessing customer service representatives or navigating the company’s online platform.

Pros and Cons of USAA Car Loans Based on Customer Feedback

Based on customer feedback, the pros of USAA car loans include competitive interest rates, flexible loan terms, excellent customer service, and a convenient online application process. However, some cons include potential delays in the loan approval process, limited loan options, and high fees for certain features.

A Subsidized Loan can be a great option for students, as the government pays the interest while you’re in school. This can help you save money on interest payments in the long run.

It is important to weigh the pros and cons carefully before making a decision.

Alternatives to USAA Car Loans: Usaa Car Loan Rates

While USAA offers competitive car loan rates and features, it is always a good idea to explore alternative lenders to ensure you are getting the best possible deal. Here are some of the top car loan providers to consider:

Alternative Car Loan Providers

- Capital One Auto Finance

- LightStream

- Navy Federal Credit Union

- Bank of America

- Wells Fargo

Comparing USAA Car Loan Rates and Features with Competitors

When comparing USAA car loans to alternatives, consider factors such as interest rates, loan terms, fees, and customer service. It is also important to compare the eligibility requirements and loan features offered by each lender.

Table Comparing USAA Car Loans to Alternatives, Usaa Car Loan Rates

| Lender | APR (Approximate) | Loan Terms | Fees | Customer Service |

|---|---|---|---|---|

| USAA | 3.50%

Want to get a loan quickly and easily? Fast Loans Online are becoming increasingly popular, as they allow you to apply for a loan and receive funds within a short period of time. However, be sure to compare the terms and conditions carefully before applying for a fast loan online.

|

24-84 months | Varying fees | Excellent |

| Capital One Auto Finance | 2.99%

Looking for the Best Loan Rates ? Compare offers from different lenders to find the lowest interest rates and the best terms for your situation. Remember, the best rate for one person may not be the best for another.

|

12-84 months | Varying fees | Good |

| LightStream | 2.49%

|

12-84 months | No origination fees | Excellent |

| Navy Federal Credit Union | 2.99%

Looking for a personal loan with competitive rates? Avant Loans might be a good option for you. They offer personal loans with flexible terms and a user-friendly online application process.

|

12-84 months | Varying fees | Excellent |

| Bank of America | 3.49%

|

12-84 months | Varying fees | Good |

| Wells Fargo | 3.99%

|

12-84 months | Varying fees | Good |

Please note that these are just approximate APRs and may vary based on individual creditworthiness and other factors. It is always recommended to contact lenders directly for the most up-to-date rates and terms.

Conclusion

Whether you’re a seasoned military member or a new member of the USAA family, understanding the ins and outs of USAA car loans is essential for making informed financial decisions. By exploring the features, rates, and customer experiences, you can determine if a USAA car loan aligns with your individual needs and financial goals.

Need money for a personal expense? Apply For Personal Loan and get the funds you need quickly. There are many lenders offering personal loans with different terms and conditions, so shop around to find the best deal.

Remember to carefully consider all your options and compare rates and features to find the best loan for your situation.

FAQ Insights

What are the eligibility requirements for a USAA car loan?

To be eligible for a USAA car loan, you must be a current or former member of the U.S. military, a member’s family member, or a USAA member. You’ll also need to meet specific credit score and income requirements.

What are the typical loan terms for USAA car loans?

USAA car loan terms can vary, but they generally range from 12 to 84 months. The specific term offered will depend on factors such as your credit score, loan amount, and vehicle type.

Can I prepay my USAA car loan?

Yes, USAA allows prepayment of car loans without any penalties. This can help you save on interest charges and pay off your loan faster.

How can I contact USAA for more information about their car loans?

You can reach USAA by phone, email, or through their website. Their contact information is readily available on their website.

Need a loan quickly? Simple Fast Loans can help you get the funds you need in a hurry. They offer a variety of loan options to fit your needs, and their application process is simple and straightforward.