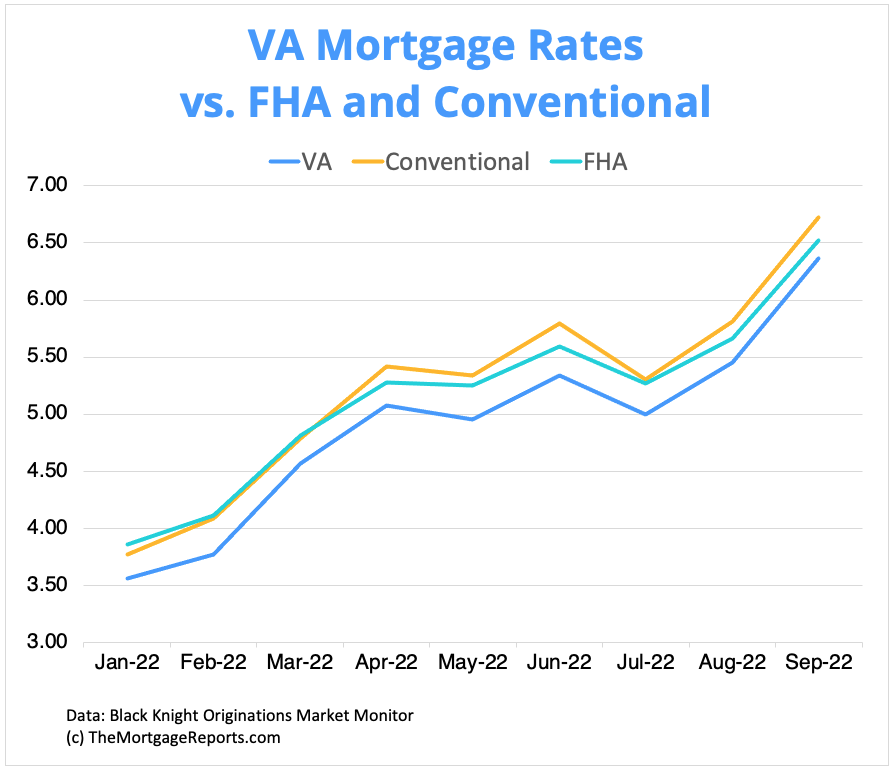

VA Interest Rates Today are a crucial factor for veterans and active-duty military personnel seeking homeownership. These rates, offered by the Department of Veterans Affairs, often provide significant benefits compared to conventional mortgages, but understanding their nuances is essential.

Whether you’re buying a new or used car, an auto loan can help you finance your purchase and get behind the wheel.

This guide explores the current landscape of VA interest rates, delving into their key characteristics, influencing factors, and trends. We’ll examine how VA rates compare to conventional options, discuss the benefits and potential drawbacks of VA loans, and provide valuable tips for securing the most competitive rates.

Need some quick cash? Quick cash loans can provide you with the funds you need, often within a day or two.

Conclusive Thoughts: Va Interest Rates Today

Navigating the world of VA interest rates can seem complex, but with careful research and planning, veterans can find the best financing options to achieve their homeownership goals. By understanding the factors that influence VA rates, comparing different loan options, and seeking professional guidance, borrowers can make informed decisions that benefit their financial well-being.

Curious about current interest rates? See what current Heloc rates are available to you.

Question Bank

What is the difference between VA interest rates and conventional mortgage rates?

Looking to tap into your home equity? A Best Heloc can offer you a flexible line of credit with potentially lower interest rates.

VA interest rates are typically lower than conventional mortgage rates due to the government backing provided by the VA. However, they can fluctuate based on market conditions and individual borrower factors.

If you’re a veteran, you may be eligible for special financing rates. Explore the latest Va mortgage rates.

How do I qualify for a VA loan?

Planning a road trip in an RV? Secure financing with an Rv Loan and hit the open road.

To qualify for a VA loan, you must meet eligibility criteria, including active-duty service, veteran status, or surviving spouse status. You may also need to meet certain credit score and income requirements.

Lower your monthly mortgage payments by refinancing your existing loan. Check out the latest rates and options for refinancing your mortgage.

Are there any fees associated with VA loans?

Looking to buy a new car? A car loan can help you finance your purchase and drive off in your dream vehicle.

Yes, VA loans typically involve funding fees, which vary depending on the loan type and the borrower’s down payment. However, these fees are often lower than those associated with conventional mortgages.

Need a loan with lower interest rates? A secured loan can be a good option, as it uses an asset as collateral.

Simplify your finances by consolidating your debts with a consolidation loan.

Looking to start or grow your business? A Sba 7a loan can provide you with the funding you need.

Buying your first home? An Fha home loan can help you achieve your dream of homeownership.

A Home Equity Line Of Credit can provide you with a flexible line of credit that you can use for a variety of purposes.

Want the security of a fixed interest rate? Explore the benefits of a Fixed Rate Heloc.

Consider Peer To Peer Lending as an alternative to traditional loans. This innovative method connects borrowers and lenders directly.