VA Loan Interest Rates play a crucial role in the homeownership journey for eligible veterans and active-duty military personnel. These government-backed loans offer unique advantages, including no down payment requirement and competitive interest rates. Understanding the factors that influence these rates is essential for securing the best possible financing for your dream home.

An unsecured personal loan can be a convenient way to borrow money without putting up any collateral. However, it’s important to be aware that these loans typically come with higher interest rates than secured loans.

The VA loan program, administered by the Department of Veterans Affairs, aims to provide affordable homeownership opportunities for those who have served our country. VA loans are known for their flexible terms and lower interest rates compared to conventional mortgages.

Best Egg offers a variety of personal loans, including those for debt consolidation, home improvement, and other purposes. Best Egg loans are known for their competitive rates and flexible repayment options.

The current interest rate environment for VA loans, like all mortgage rates, is influenced by various economic factors, including inflation, Federal Reserve policies, and overall market conditions.

Need quick access to funds but don’t want to deal with the hassle of applying for a credit card? Personal loans near me can offer a convenient solution. Just be sure to compare interest rates and terms from different lenders.

Contents List

Introduction to VA Loan Interest Rates

A VA loan is a mortgage specifically designed for eligible veterans, active-duty military personnel, and surviving spouses. These loans offer unique advantages that can make homeownership more accessible for those who have served our country. The Department of Veterans Affairs (VA) guarantees a portion of the loan, which helps lenders feel more secure about providing loans to veterans.

Choosing the right mortgage company is crucial when making such a large financial commitment. Mortgage companies offer a wide range of loan options, so it’s essential to research and compare their offerings before making a decision.

This guarantee, in turn, often leads to more favorable terms, such as lower interest rates and down payment requirements.

Securing a mortgage is a significant financial decision, so it’s crucial to get the best possible rates. Best home loan rates can vary greatly depending on your credit score, loan amount, and other factors. Do your research and compare offers to find the most advantageous deal.

In the current market, VA loan interest rates are generally competitive with conventional mortgage rates, and sometimes even lower. However, the exact interest rate you qualify for will depend on a variety of factors, including your credit score, the loan amount, and the prevailing economic conditions.

If you’re thinking about buying a new home, it’s crucial to shop around for the best rates. Rocket Mortgage rates are known for their competitive offerings, but it’s always a good idea to compare options from multiple lenders.

Factors Influencing VA Loan Interest Rates

Several key factors influence VA loan interest rates. Understanding these factors can help you make informed decisions about your mortgage options.

A home equity line of credit (HELOC) can provide access to funds as needed, but it’s crucial to understand the interest rates and potential risks associated with this type of loan.

- Current Economic Climate:Interest rates are closely tied to the overall health of the economy. When the economy is strong, interest rates tend to rise as lenders become more confident in lending money. Conversely, during economic downturns, interest rates may fall as lenders try to encourage borrowing.

When it comes to personal loans, finding the best rates is crucial. Best personal loan rates can vary significantly depending on your credit score, loan amount, and other factors. It’s always wise to compare offers from multiple lenders before making a decision.

- Credit Score:Your credit score is a crucial factor in determining your VA loan interest rate. Borrowers with higher credit scores are typically considered less risky by lenders, which can lead to lower interest rates. Aim for a credit score of 740 or higher to secure the most favorable terms.

Looking to tap into your home’s equity for a major project or a financial boost? Best home equity loans can provide a convenient way to access funds, but it’s essential to understand the risks and potential downsides before proceeding.

- Loan-to-Value (LTV) Ratio:The LTV ratio is the percentage of the home’s value that you are borrowing. A lower LTV ratio, which means a larger down payment, generally results in a lower interest rate. VA loans typically allow for a 0% down payment, but a larger down payment can still lead to a better rate.

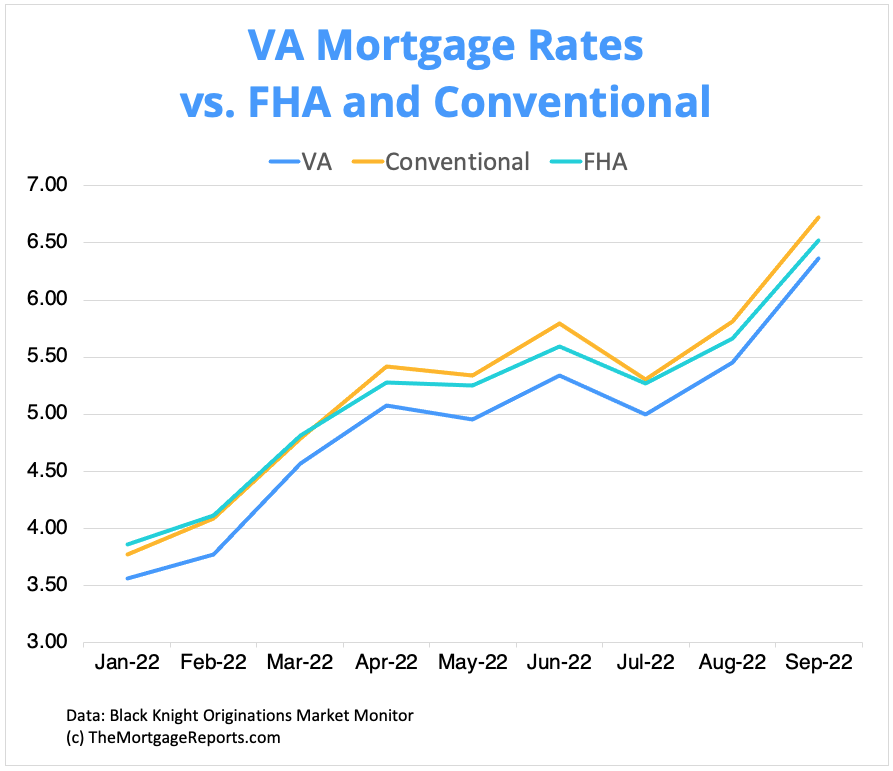

VA Loan Interest Rate Comparison

VA loan interest rates are often more favorable than conventional mortgage rates. This is because the VA guarantee reduces the risk for lenders, allowing them to offer lower rates. However, it’s essential to compare rates from multiple lenders to find the best deal.

Navigating the mortgage process can be overwhelming, but a mortgage broker can provide invaluable assistance. They act as your intermediary, helping you find the best loan options and guiding you through the entire process.

- Conventional Mortgage Rates:Conventional mortgages are the most common type of home loan, and they are typically available to borrowers with good credit scores. However, they often require a larger down payment than VA loans.

- VA Loan Interest Rates:VA loans offer several advantages, including lower interest rates, no down payment requirement, and more lenient credit score requirements. These benefits can make homeownership more accessible for veterans and their families.

VA Loan Interest Rate Trends

VA loan interest rates have fluctuated over time, influenced by factors such as economic conditions, government policies, and the overall mortgage market. Understanding historical trends can help you anticipate future changes in interest rates.

An equity loan can provide a way to access funds using the equity in your home. However, it’s essential to carefully consider the risks and potential consequences before taking out such a loan.

- Historical Fluctuations:VA loan interest rates have generally mirrored the trends in the broader mortgage market. During periods of economic growth, rates have tended to rise, while during recessions, they have fallen.

- Current Trends:Current interest rates are influenced by various factors, including inflation, the Federal Reserve’s monetary policy, and global economic events. It’s important to stay informed about these factors to make informed decisions about your mortgage.

- Government Policies:The VA’s lending guidelines and policies can impact VA loan interest rates. For example, changes to the VA’s guarantee fee can affect the cost of borrowing.

Obtaining the Best VA Loan Interest Rate

To qualify for the lowest possible VA loan interest rate, it’s essential to take steps to improve your credit score and ensure you meet all lender requirements.

Planning a home improvement project? Home improvement loans can provide the financial resources you need to upgrade your space. Just be sure to shop around for competitive rates and terms.

- Improve Your Credit Score:Aim for a credit score of 740 or higher. This can be achieved by paying bills on time, keeping credit utilization low, and avoiding unnecessary credit inquiries.

- Shop Around for Lenders:Compare rates from multiple lenders to find the best deal. Use online mortgage calculators to estimate monthly payments and compare different loan options.

- Consider a Larger Down Payment:A larger down payment can result in a lower interest rate. Even though VA loans allow for a 0% down payment, a larger down payment can still be beneficial.

VA Loan Interest Rate Calculator

A VA loan interest rate calculator is a helpful tool for estimating your monthly mortgage payments and comparing different loan options. These calculators allow you to input information such as the loan amount, interest rate, and loan term to calculate your estimated monthly payment.

If you’re considering taking out a second mortgage, it’s essential to understand the associated costs and risks. Second mortgage rates tend to be higher than first mortgages, so it’s important to carefully weigh the potential benefits against the potential drawbacks.

- Input Relevant Information:Enter the loan amount, interest rate, and loan term into the calculator to get an estimated monthly payment.

- Interpret the Results:The calculator will display your estimated monthly payment, as well as the total amount of interest you will pay over the life of the loan.

- Use Accurate Data:To ensure accurate calculations, it’s essential to use the most up-to-date information about your loan amount, interest rate, and loan term.

VA Loan Interest Rate FAQs

Here are some frequently asked questions about VA loan interest rates:

- What are the eligibility requirements for a VA loan?To be eligible for a VA loan, you must be a veteran, active-duty military personnel, or a surviving spouse of a service member who died in the line of duty. You must also meet certain credit score and income requirements.

If you’re considering refinancing your existing mortgage, it’s worth exploring your options. Refinancing a mortgage can potentially lower your monthly payments, shorten your loan term, or switch to a different loan type. However, it’s important to weigh the costs and benefits carefully.

- Are there any closing costs associated with a VA loan?Yes, there are closing costs associated with VA loans. These costs can include appraisal fees, origination fees, and title insurance.

- What are the loan terms for a VA loan?VA loans typically have a fixed interest rate and a term of 15 or 30 years. However, there are also adjustable-rate mortgages (ARMs) available.

Ultimate Conclusion

Navigating the world of VA loan interest rates can be daunting, but with careful planning and research, you can find the most advantageous loan option. By understanding the factors that influence these rates, comparing offers from different lenders, and leveraging your creditworthiness, you can secure a competitive rate and achieve your homeownership goals.

Remember, taking advantage of the resources available to you, such as VA loan calculators and financial advisors, can significantly streamline the process and ensure a smooth and successful home purchase experience.

Questions and Answers: Va Loan Interest Rate

What is the average VA loan interest rate?

The average VA loan interest rate fluctuates based on market conditions. It’s best to check with lenders for current rates.

How do I improve my chances of getting a lower VA loan interest rate?

Maintaining a good credit score, having a low debt-to-income ratio, and making a larger down payment can help you qualify for a lower rate.

Are there closing costs associated with VA loans?

Need some extra cash in a hurry? Quick cash loans can be a lifesaver in a pinch, offering fast access to funds when you need them most. Just be sure to carefully consider the terms and interest rates before taking out any loan.

Yes, VA loans have closing costs, but they are often lower than conventional mortgages.

Can I refinance my existing VA loan to get a lower interest rate?

Yes, you can refinance your VA loan to take advantage of lower rates if they are available.