VA Loan Rates Today are a vital resource for veterans seeking homeownership. These government-backed loans offer unique advantages, including no down payment requirement and competitive interest rates. Understanding the factors that influence VA loan rates, such as current market conditions and your credit score, is crucial to securing the best possible terms.

If you’re looking to tap into your home equity for a larger purchase, Second Mortgage Rates can vary depending on your credit score and the current market conditions. It’s important to compare rates and terms from different lenders to find the best option for your situation.

This guide will delve into the current VA loan rates, exploring the factors that impact them and offering tips for securing favorable terms. We’ll also discuss the advantages of VA loans compared to conventional mortgages, helping you make an informed decision about your home financing.

Contents List

Understanding VA Loan Rates: Va Loan Rates Today

VA loans are a fantastic benefit for veterans, offering favorable terms and lower interest rates than conventional mortgages. But understanding VA loan rates is crucial for making informed decisions about your home financing.

When you need cash quickly, Fast Cash Loans can be a convenient solution. These loans often offer fast approval and disbursement, making them a good option for urgent financial needs.

Defining VA Loan Rates

VA loan rates represent the interest rate you pay on your VA mortgage loan. They are determined by various factors, including current market conditions, your credit score, and the type of VA loan you choose.

Thinking about expanding your real estate portfolio? Investment Property Loans can help you finance your next purchase. These loans are designed specifically for acquiring properties for rental income or future resale, offering specialized terms and financing options.

Factors Influencing VA Loan Rates

Several factors play a role in determining VA loan rates:

- Current Market Conditions:Like other mortgage rates, VA loan rates fluctuate based on economic factors, including inflation, interest rates set by the Federal Reserve, and investor demand.

- Credit Score:Your credit score is a significant factor in determining your VA loan rate. A higher credit score generally leads to lower interest rates.

- Loan Type:Different VA loan programs, such as VA purchase loans, VA refinance loans, and VA cash-out refinance loans, may have slightly varying interest rates.

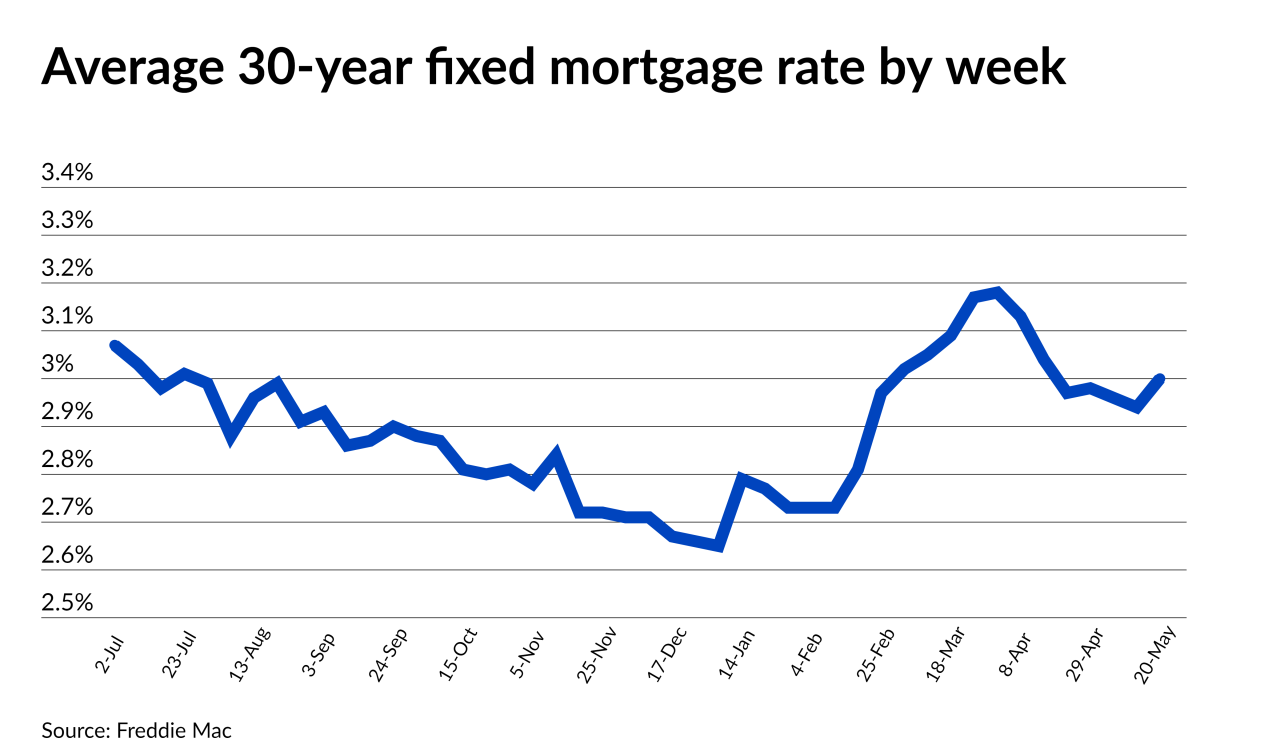

Historical Overview of VA Loan Rate Trends

VA loan rates have historically followed a similar trend to conventional mortgage rates. Over the past few decades, VA loan rates have generally fluctuated between 4% and 7%, depending on market conditions.

Wells Fargo offers a range of financial products and services, including loans. Wells Fargo Loans can be a good option for personal, home, or business financing, depending on your specific needs.

Current VA Loan Rates

VA loan rates are constantly changing, so it’s essential to check with a lender for the most up-to-date information. However, here’s a general overview of current average VA loan rates for various loan terms:

| Loan Term | Interest Rate |

|---|---|

| 15-Year Fixed-Rate | 5.50%

Need a quick cash infusion? Quick Cash Loans can provide you with the funds you need, often with fast approval and disbursement. These loans are a convenient solution for unexpected expenses or emergencies, allowing you to access the cash you need quickly.

|

| 30-Year Fixed-Rate | 6.00%

|

It’s crucial to note that these rates are estimates and can vary based on individual circumstances, such as your credit score and loan-to-value ratio.

Need a quick cash infusion? Cash Loans can provide you with the funds you need, often with fast approval and disbursement. These loans can be a convenient solution for unexpected expenses or emergencies.

VA Loan Fees and Closing Costs

In addition to the interest rate, VA loans have certain fees and closing costs associated with them. These fees can include:

- Funding Fee:A fee charged by the VA to help fund the loan program. The funding fee can vary depending on your loan type and down payment.

- Closing Costs:These costs cover expenses related to the closing process, such as appraisal fees, title insurance, and recording fees.

Factors Affecting VA Loan Rates

Credit Score’s Impact on VA Loan Rates

Your credit score is a significant factor in determining your VA loan rate. Lenders consider your creditworthiness when assessing your risk, and a higher credit score generally indicates lower risk and therefore lower interest rates.

Chase is a major lender in the mortgage market. Chase Mortgage Rates can vary depending on the type of loan, your credit score, and the current market conditions. It’s important to shop around and compare rates from different lenders to find the best deal for your needs.

Loan-to-Value Ratio (LTV) and VA Loan Rates

The loan-to-value ratio (LTV) represents the percentage of the home’s value that you’re borrowing. A lower LTV typically leads to lower interest rates because it signifies a lower risk for the lender. VA loans often allow for 100% financing, meaning you can borrow the entire purchase price without a down payment.

Mortgage interest rates can fluctuate, so it’s important to stay up-to-date. Current Mortgage Interest Rates can help you make informed decisions about buying or refinancing your home, potentially saving you money on your mortgage payments.

However, a higher LTV may result in a slightly higher interest rate.

VA Loan Rates and Current Mortgage Rates

VA loan rates generally track closely with current mortgage rates. When overall mortgage rates rise, VA loan rates typically follow suit. Conversely, when mortgage rates fall, VA loan rates tend to decrease as well.

VA Loan Rate Comparison

VA Loan Rates vs. Conventional Mortgage Rates

VA loans often offer lower interest rates compared to conventional mortgages. This is because the VA guarantees a portion of the loan, reducing the lender’s risk. However, it’s essential to compare rates from multiple lenders to ensure you’re getting the best deal.

Advantages and Disadvantages of VA Loans

Advantages:

- Lower Interest Rates:VA loans often have lower interest rates than conventional mortgages.

- No Down Payment:VA loans allow for 100% financing, eliminating the need for a down payment.

- Lower Closing Costs:VA loans generally have lower closing costs compared to conventional mortgages.

- No Private Mortgage Insurance (PMI):VA loans don’t require PMI, saving you money on monthly payments.

Disadvantages:

- Funding Fee:VA loans have a funding fee that is charged at closing.

- Limited Loan Amounts:VA loans have a maximum loan amount, which varies by county.

- Strict Eligibility Requirements:You must meet specific eligibility requirements to qualify for a VA loan.

Potential Cost Savings with VA Loans

The lower interest rates and reduced closing costs associated with VA loans can result in significant cost savings over the life of your mortgage. For example, a veteran who secures a VA loan with a 0.5% lower interest rate than a conventional mortgage could save thousands of dollars in interest payments over the course of a 30-year loan.

Bank of America offers a variety of financial products and services, including personal loans. Bank Of America Personal Loan can provide you with the funds you need for a variety of purposes, such as debt consolidation, home improvement, or major purchases.

Tips for Securing Favorable VA Loan Rates

Improving Your Credit Score

A higher credit score can significantly impact your VA loan rate. Here are some strategies to improve your credit score:

- Pay Your Bills On Time:Consistent on-time payments are crucial for a good credit score.

- Reduce Your Credit Utilization:Keep your credit utilization ratio low by avoiding maxing out your credit cards.

- Check Your Credit Report for Errors:Review your credit report for any inaccuracies and dispute them with the credit bureaus.

Negotiating with Lenders

Don’t hesitate to negotiate with lenders for a lower interest rate. Shop around for the best rates and use your credit score and other factors as leverage during negotiations.

Sometimes you need a smaller loan for unexpected expenses or a personal project. Small Personal Loans can provide you with the funds you need without the burden of a large loan. These loans can be a convenient and affordable solution for short-term financial needs.

Choosing the Right Loan Term

The loan term you choose can significantly impact your interest payments. A shorter loan term, such as a 15-year mortgage, will generally have a higher monthly payment but will result in lower overall interest costs. A longer loan term, like a 30-year mortgage, will have a lower monthly payment but will lead to higher interest payments over time.

VA Loan Resources

Reputable Sources for VA Loan Rates, Va Loan Rates Today

Several reputable sources can help you obtain VA loan rates:

- VA.gov:The official website of the U.S. Department of Veterans Affairs provides information on VA loans, including current interest rates.

- Mortgage Lenders:Contact reputable mortgage lenders who specialize in VA loans to get personalized rate quotes.

VA Loan Calculators

VA loan calculators can help you estimate your monthly payments and total interest costs based on different loan terms and interest rates. Here are some resources for VA loan calculators:

- VA.gov:The VA website offers a loan calculator that allows you to estimate your monthly payments.

- Mortgage Lender Websites:Many mortgage lenders provide VA loan calculators on their websites.

Consulting with a Mortgage Lender or Financial Advisor

It’s always wise to consult with a mortgage lender or financial advisor to discuss your VA loan options and determine the best course of action for your financial situation.

Concluding Remarks

Securing a VA loan can be a rewarding experience for veterans. By understanding the current VA loan rates, exploring the factors that influence them, and implementing strategies to improve your credit score, you can navigate the homeownership journey with confidence.

Sometimes you need a short-term financial boost. Short Term Loans can provide you with the funds you need until your next payday. These loans are designed for quick and easy access to cash, making them a convenient solution for unexpected expenses.

Remember, seeking guidance from a reputable mortgage lender or financial advisor can provide valuable insights and support throughout the process.

FAQ Section

What is the difference between a VA loan and a conventional mortgage?

Are you thinking about buying a home? Mortgage Interest Rates can fluctuate, so it’s important to stay informed. Understanding current rates and trends can help you make informed decisions and potentially save money on your mortgage.

VA loans are backed by the U.S. Department of Veterans Affairs, offering benefits like no down payment requirement and lower interest rates. Conventional mortgages are not government-backed and typically require a down payment and may have higher interest rates.

Do I need to be a veteran to qualify for a VA loan?

No, VA loans are also available to active-duty military personnel, surviving spouses of veterans, and certain other eligible individuals.

If you’re looking to tap into your home equity, Chase Heloc offers a line of credit that can be a good option for homeowners. You can borrow against the equity you’ve built up in your home, offering flexibility and potential cost savings.

What is the maximum loan amount for a VA loan?

Need cash fast? $255 Payday Loans Online Same Day can provide you with the funds you need, often deposited directly into your account the same day. It’s a convenient solution for unexpected expenses or short-term financial needs.

The maximum loan amount for a VA loan varies by county and is determined by the VA. It’s best to consult with a lender to determine the maximum amount you qualify for.

How do I find a reputable VA lender?

Managing multiple debts can be overwhelming. Credit Consolidation can help you simplify your finances by combining your debts into one loan with a potentially lower interest rate. This can make managing your payments easier and potentially save you money.

You can find reputable VA lenders through the VA website or by contacting a mortgage broker or financial advisor. It’s important to compare rates and terms from multiple lenders before making a decision.