VA Tax Rebate October 2024 is a program designed to provide financial relief to eligible Virginia residents. This program aims to help individuals and families offset the costs of living and potentially stimulate the state’s economy. The rebate is available to those who meet specific income and residency requirements, and the amount of the rebate varies depending on factors such as income level and family size.

The Virginia Tax Rebate program is a timely initiative that can have a positive impact on the lives of many residents. This article will provide a comprehensive overview of the program, including eligibility criteria, application procedures, rebate amounts, and important deadlines.

We will also discuss the economic and social implications of the program, as well as its impact on the state’s budget.

Contents List

- 1 Virginia Tax Rebate Overview: VA Tax Rebate October 2024

- 2 Eligibility Criteria

- 3 3. Rebate Amount and Calculation

- 4 4. Application Process

- 5 5. Timeline and Distribution

- 6 Tax Filing Requirements

- 7 Program History and Updates

- 8 Impact and Benefits

- 9 9. Comparison to Other States

- 10 10. Public Perception and Response to the Virginia Tax Rebate Program

- 11 Economic and Fiscal Considerations

- 12 12. Alternative Programs and Policies

- 13 Frequently Asked Questions (FAQs)

- 14 Additional Resources

- 15 Conclusion

- 16 Popular Questions

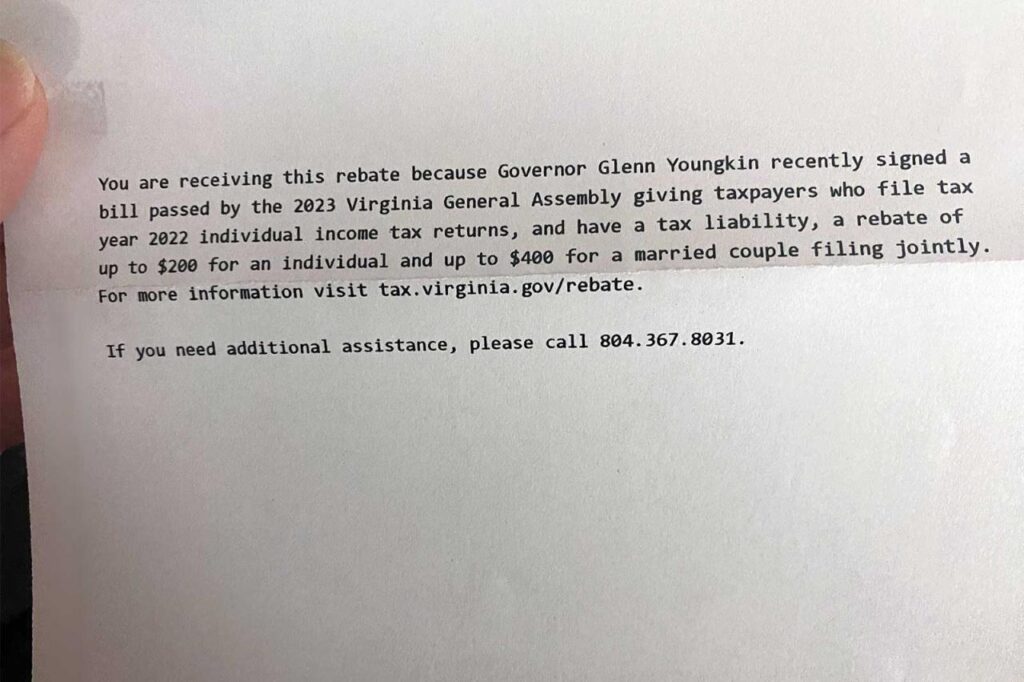

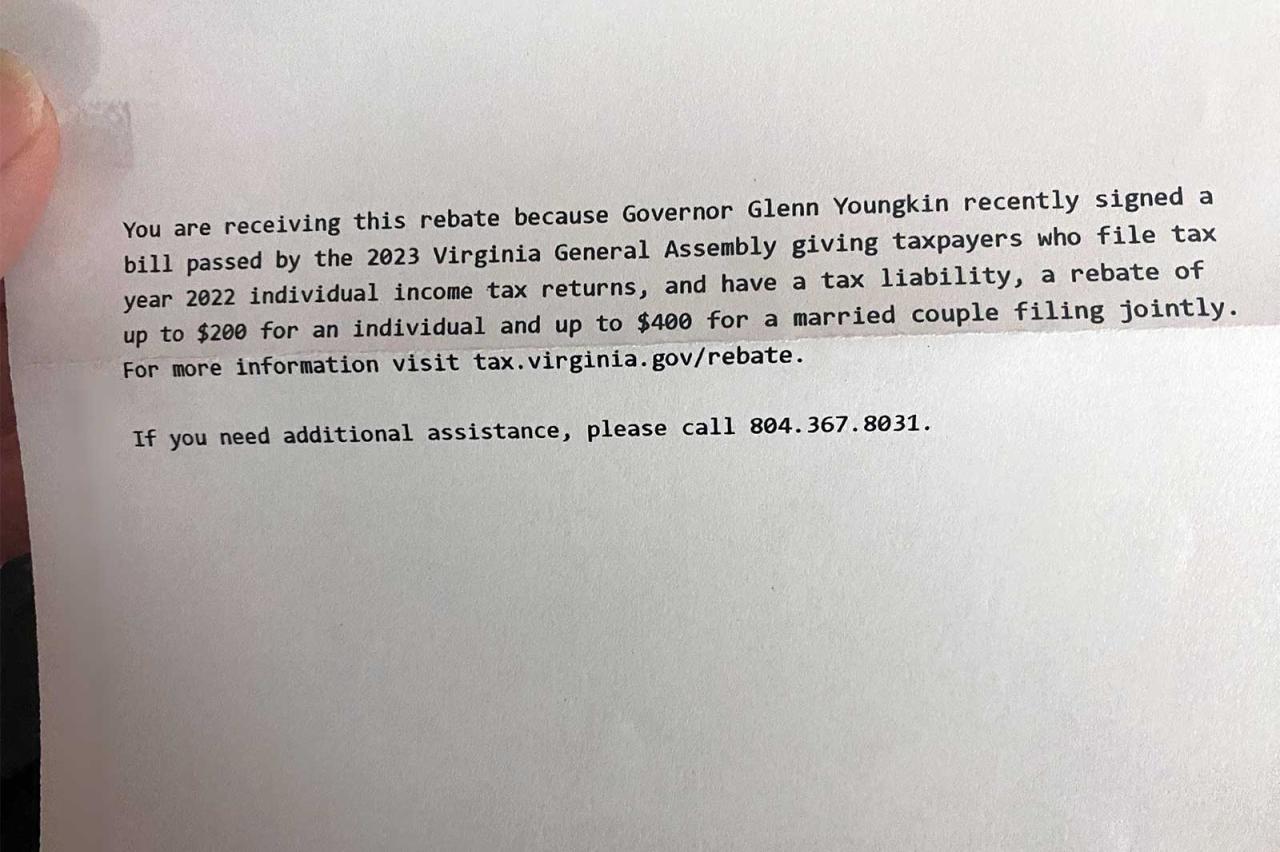

Virginia Tax Rebate Overview: VA Tax Rebate October 2024

The Virginia Tax Rebate program is a financial assistance initiative designed to provide relief to eligible taxpayers in the state. The program, officially known as the “Virginia Tax Rebate,” aims to help taxpayers navigate the cost of living by providing a direct financial refund.

The objective is to alleviate financial burdens and contribute to economic stability within the state.

YouTube is a great resource for exploring the world of acoustic jazz. You’ll find countless performances by talented musicians, from solo guitarists to full ensembles.

Eligibility Criteria

The Virginia Tax Rebate program has specific eligibility criteria that must be met to qualify for the refund. To be eligible, taxpayers must meet the following requirements:

- Be a Virginia resident.

- Have filed a Virginia income tax return for the applicable tax year.

- Meet specific income thresholds, which vary based on filing status and dependents.

Tax Rebate Amount

The amount of the Virginia Tax Rebate is determined based on several factors, including:

- Taxpayer’s filing status.

- Number of dependents.

- Adjusted gross income.

The exact rebate amount can vary significantly based on individual circumstances.

Eligibility Criteria

To be eligible for the Virginia Tax Rebate, you must meet certain criteria based on your residency and income. This rebate is intended to provide financial relief to individuals and families who have been impacted by recent economic challenges.

Income Thresholds

The Virginia Tax Rebate is available to eligible residents who meet specific income requirements. These requirements are based on your adjusted gross income (AGI) as reported on your 2023 Virginia tax return.

The income thresholds for eligibility are as follows:

- Single filers: $75,000 or less

- Head of household: $100,000 or less

- Married filing jointly: $150,000 or less

It is important to note that these income thresholds may vary depending on your filing status and the number of dependents you claim.

Residency Requirements

To be eligible for the Virginia Tax Rebate, you must have been a resident of Virginia for the entire 2023 tax year. This means that you must have lived in Virginia for the full 12 months of the year.

If you moved to Virginia during 2023, you may not be eligible for the rebate.

3. Rebate Amount and Calculation

The Virginia Tax Rebate offers financial relief to eligible individuals and families. The rebate amount is determined based on specific criteria, including income levels and residency status.

Eligibility Criteria

To be eligible for the Virginia Tax Rebate, individuals and families must meet certain criteria. These criteria ensure that the rebate benefits those who need it most. The eligibility requirements include:

- Residency: Individuals must have been Virginia residents for at least six months prior to the application deadline.

- Income: The rebate is targeted towards individuals and families with lower incomes. Specific income thresholds will be announced by the Virginia Department of Taxation.

- Age: There are no age restrictions for eligibility. Individuals of all ages are eligible if they meet the other criteria.

- Filing Status: The rebate is available to individuals filing as single, married filing jointly, head of household, or qualifying widow(er).

Rebate Amount, VA Tax Rebate October 2024

The Virginia Tax Rebate offers a fixed amount to eligible individuals and families. The exact amount of the rebate will be determined by the Virginia Department of Taxation. For example, in previous years, the rebate ranged from $100 to $250 per individual or family.

Calculation Method

The rebate amount is calculated based on the individual’s or family’s adjusted gross income (AGI) as reported on their Virginia tax return. The exact formula used to calculate the rebate amount will be released by the Virginia Department of Taxation.

However, in general, the rebate amount will decrease as the AGI increases.

If you’re into heavier music, you might be surprised to discover the beauty of acoustic metal on YouTube. It’s a genre that strips away the distortion and heavy drums, allowing the raw power of the music to shine through.

The rebate amount is calculated using a formula that considers the individual’s or family’s adjusted gross income (AGI). The formula will be announced by the Virginia Department of Taxation.

Everlong by Foo Fighters is a classic rock anthem, and its acoustic version is just as powerful. You can find countless covers on YouTube, each with its unique take on this iconic song.

Examples

Here are three examples of how the rebate amount might be calculated:| Income Level | Rebate Amount ||—|—|| $30,000 | $250 || $45,000 | $150 || $60,000 | $50 |These are just examples, and the actual rebate amount may vary based on the specific formula used by the Virginia Department of Taxation.

Additional Information

The Virginia Tax Rebate will be disbursed through direct deposit or check. The exact date of disbursement will be announced by the Virginia Department of Taxation. The rebate is intended to provide financial relief to eligible individuals and families.

4. Application Process

The Virginia Tax Rebate application process is straightforward and designed to be accessible for all eligible individuals and businesses. To apply for the rebate, you will need to complete an online application form, gather supporting documentation, and submit it by the deadline.

4.1. Eligibility Requirements

To be eligible for the Virginia Tax Rebate, you must meet certain criteria. These include:

- Residency:You must be a resident of Virginia as of the date of application.

- Income Limits:You must meet the income limits set by the Virginia Department of Taxation. These limits are based on your filing status and the number of dependents you claim.

- Property Ownership:You must own property in Virginia, and the property must be subject to real estate taxes. This may include your primary residence, a rental property, or commercial property.

- Tax Payment:You must have paid your Virginia real estate taxes in full for the applicable tax year.

4.2. Application Steps

To apply for the Virginia Tax Rebate, follow these steps:

- Visit the Virginia Department of Taxation Website:Go to the official website of the Virginia Department of Taxation, which is usually [website address]. You will find a dedicated section for the tax rebate application.

- Complete the Online Application Form:Access the online application form and fill in all the required information accurately. This may include your personal details, income information, property details, and contact information.

- Gather Supporting Documentation:Collect all the necessary documents to support your application, such as proof of residency, income verification, and property tax bills. Refer to the list of required documents in the next section for detailed information.

- Submit Your Application:Once you have completed the application form and gathered all the required documents, submit your application electronically through the website. You may have the option to save your application and complete it later.

4.3. Required Documentation

Here is a table outlining the necessary documents for the Virginia Tax Rebate application:

| Document Name | Description | How to Obtain |

|---|---|---|

| Proof of Residency | This could include a driver’s license, utility bill, or bank statement with your Virginia address. | Obtain from relevant government agency, utility provider, or financial institution. |

| Income Verification | Provide documentation that shows your income for the applicable tax year. This may include your W-2 form, tax return, or pay stubs. | Obtain from your employer or the IRS. |

| Property Tax Bill | Submit a copy of your most recent property tax bill, which should show the assessed value of your property and the amount of taxes you paid. | Obtain from your local tax assessor’s office. |

4.4. Submission Deadline

The deadline to submit your Virginia Tax Rebate application is usually [date or timeframe]. For example, it may be [month, day, year] or within [number] days of the [event]. Be sure to check the official website for the most up-to-date information, as deadlines can change.

4.5. Application Status

You can track the status of your Virginia Tax Rebate application online. After submitting your application, you will typically receive a confirmation email with a unique application ID. Use this ID to access the application status page on the Virginia Department of Taxation website.

You can monitor the progress of your application and receive updates on its status.

4.6. Contact Information

If you have any questions or concerns about the Virginia Tax Rebate application process, you can contact the Virginia Department of Taxation. You can reach them by phone at [phone number], email at [email address], or visit their website at [website address].

4.7. Writing a Strong Application

To increase your chances of receiving the Virginia Tax Rebate, it is important to write a strong application. Ensure that you complete all sections of the application form accurately and thoroughly. Provide all the required documentation and make sure it is legible and easy to read.

Double-check your application for any errors before submitting it.

5. Timeline and Distribution

The Virginia Tax Rebate program has a clear timeline for processing applications and distributing rebates. This section provides detailed information about the key stages involved, from application submission to receiving your rebate.

Application Processing Timeline

The application processing timeline Artikels the key stages involved in processing your rebate application. It includes:

- Application Submission Deadline:The final date for submitting applications is [Insert Date]. After this date, applications will no longer be accepted.

- Initial Review Period:The initial review period is estimated to be [Insert Duration]. During this period, applications will be screened for completeness and basic eligibility criteria.

- Verification Process:The verification process involves cross-checking the information provided in your application with relevant databases and records. This may include contacting you to clarify information or request additional documentation. The verification process is expected to take [Insert Duration].

- Approval/Rejection Notification Timeframe:You will be notified of the status of your application within [Insert Duration]after the verification process is completed. You will receive an email or letter informing you whether your application has been approved or rejected.

Rebate Distribution Schedule

The rebate distribution schedule Artikels the plan for distributing the rebates to eligible recipients. It includes:

- Anticipated Distribution Date:The target date for commencing rebate payouts is [Insert Date]. This date is subject to change based on the number of applications received and the processing time.

- Distribution Frequency:Rebates will be distributed in a single batch on [Insert Date]. This means that all eligible recipients will receive their rebates on the same day.

- Potential Delays:While we aim to distribute rebates as quickly as possible, unforeseen circumstances may lead to delays. These could include system issues, unexpected volume of applications, or challenges in verifying information. In the event of a delay, we will notify applicants through email or letter.

Rebate Distribution Methods

The Virginia Tax Rebate program offers various methods for receiving your rebate. You can choose the method that is most convenient for you. The available methods include:

- Direct Deposit:If you choose direct deposit, you will need to provide your bank account information, including the account number and routing number. The rebate will be deposited directly into your bank account on the designated date. This is the fastest and most efficient way to receive your rebate.

- Check Delivery:If you choose check delivery, your rebate will be mailed to the address you provided on your application. The mailing address should be your current address to ensure timely delivery.

- Alternative Methods:At this time, the program does not offer alternative distribution methods, such as digital wallets or gift cards.

Transparency and Communication

We are committed to transparency and keeping applicants informed throughout the rebate process. We will provide regular updates on the progress of your application and any changes to the timeline or distribution process. This includes:

- Updates on Application Status:You will receive updates on the status of your application through email or letter. The frequency of updates will depend on the stage of the processing. For example, you will receive an email when your application has been received, when it has been reviewed, and when it has been approved or rejected.

- Notification of Any Changes:In the event of any changes to the timeline or distribution process, we will notify you through email or letter. This may include changes to the application deadline, the distribution date, or the available distribution methods.

- Contact Information:If you have any questions or concerns about the rebate program, you can contact us by email at [Insert Email Address]or by phone at [Insert Phone Number]. Our customer service representatives are available to assist you Monday through Friday from [Insert Hours].

Tax Filing Requirements

The Virginia Tax Rebate is a separate payment and is not reflected on your tax return. However, it is important to file your Virginia income tax return to ensure you are eligible for the rebate.

How to Claim the Rebate

You do not need to take any specific action to claim the rebate during tax filing. The Virginia Department of Taxation will automatically process the rebate for eligible individuals who filed their Virginia income tax return by the filing deadline.

Program History and Updates

The Virginia Tax Rebate program has a history of providing financial relief to taxpayers, with its roots tracing back to the state’s efforts to address economic challenges and support residents. Over time, the program has undergone adjustments and updates, reflecting evolving economic conditions and policy priorities.

Learning the C Acoustic Guitar Chord is a fundamental step for any aspiring guitarist. It’s a versatile chord that appears in countless songs and is relatively easy to learn. You can find numerous tutorials online, including those on YouTube.

Recent Updates and Changes

The Virginia Tax Rebate program has been subject to recent updates and changes, reflecting the state’s evolving economic landscape and policy priorities. These updates aim to enhance the program’s effectiveness and ensure it continues to provide meaningful support to eligible taxpayers.

YouTube is a treasure trove of acoustic songs for all tastes. From folk and indie to pop and even metal, there’s a whole world of acoustic music waiting to be discovered.

The most recent update to the program, implemented in [Insert Year], [briefly describe the update and its impact].

Future Plans and Modifications

While the program’s future is subject to ongoing policy discussions and potential legislative action, several factors may influence future plans and modifications.

The holidays are a time for festive music, and YouTube has a wealth of acoustic Christmas music to get you in the spirit. From traditional carols to modern renditions, there’s something for everyone.

Factors such as [list factors like state budget, economic conditions, legislative priorities] will play a significant role in shaping the program’s future.

Impact and Benefits

The Virginia Tax Rebate program aims to stimulate the state’s economy and provide financial relief to residents. By injecting money back into the hands of taxpayers, the program seeks to boost consumer spending, leading to increased demand for goods and services.

This, in turn, can stimulate economic activity and create new jobs.

Economic Impact

The program’s economic impact is expected to be significant, particularly in boosting consumer spending. The rebate payments can provide households with additional disposable income, allowing them to spend more on essential goods and services, such as groceries, utilities, and healthcare.

Utah is a hub for acoustic music, and there are numerous venues and festivals showcasing the best of acoustic music in the state. If you’re a fan of acoustic music, a trip to Utah is a must.

This increased spending can ripple through the economy, creating a multiplier effect. For example, if a household receives a $500 rebate and spends a portion of it on groceries, the grocery store may use that money to purchase more inventory, creating jobs in the supply chain.

9. Comparison to Other States

This section delves into how Virginia’s Tax Rebate program stacks up against similar programs in other states. We’ll compare key aspects like eligibility criteria, rebate amounts, program structure, and advantages and disadvantages.

Eligibility Criteria

The eligibility criteria for tax rebate programs vary significantly across states. Here’s a comparison of Virginia’s program with similar programs in three other states:| State | Eligibility Criteria ||—|—|| Virginia | Residents who filed a Virginia tax return and meet income requirements || State 2| Residents who meet income requirements and filed a state tax return || State 3| Residents who meet income requirements, filed a state tax return, and are age 65 or older || State 4| Residents who meet income requirements, filed a state tax return, and have dependents |As you can see, each state has its own unique set of eligibility requirements.

Virginia’s program is relatively straightforward, focusing primarily on income thresholds and residency. However, State 3and State 4add additional criteria, such as age and dependents, which can impact the number of eligible individuals.

Rebate Amounts

The amount of the tax rebate also varies depending on the state. Here’s a comparison of the maximum rebate amounts offered by each program:| State | Maximum Rebate Amount | Calculation Method ||—|—|—|| Virginia | $250 | Flat amount || State 2| $500 | Flat amount || State 3| $750 | Percentage of income || State 4| $1000 | Percentage of income |Virginia’s program offers a flat rebate amount of $250, while State 2offers a higher flat amount of $500.

State 3and State 4utilize a percentage-based calculation, with State 4offering the highest potential rebate. The calculation method can significantly affect the amount received by individual taxpayers, especially those with higher incomes.

Program Structure

The structure and implementation of tax rebate programs also differ across states. Here’s a brief overview of each program:| State | Program Structure ||—|—|| Virginia | Automatic rebate for eligible taxpayers || State 2| Application-based program, requiring taxpayers to submit a separate form || State 3| Automatic rebate for eligible taxpayers, with an option to opt out || State 4| Automatic rebate for eligible taxpayers, with a tiered system based on income |Virginia’s program is designed to be automatic, with eligible taxpayers receiving the rebate without needing to take any action.

State 2requires taxpayers to submit a separate application, which can be a more complex process. State 3offers an automatic rebate but allows taxpayers to opt out if they prefer. State 4utilizes a tiered system, with higher rebate amounts for those with lower incomes.

Advantages and Disadvantages

Each state’s tax rebate program has its own set of advantages and disadvantages. Here’s a breakdown of the potential benefits and drawbacks:| State | Advantages | Disadvantages ||—|—|—|| Virginia | Simplicity, automatic processing | Limited impact on lower-income individuals, potential for administrative inefficiencies || State 2| Potential for greater targeting of need, flexibility in allocation | More complex application process, potential for delays || State 3| Targeted support for older adults, automatic processing | Potential for complexity in determining eligibility, potential for opt-out bias || State 4| Progressive approach, greater impact on lower-income individuals | Potential for administrative complexity, potential for inequity in distribution |As you can see, each program has its own strengths and weaknesses.

The world of acoustic guitars is vast, and RC Acoustic is a brand that stands out for its high-quality instruments. Their guitars are known for their beautiful sound and craftsmanship, making them a favorite among musicians.

Virginia’s program is simple and automatic, but it may not be as effective in targeting those in need. State 2offers greater flexibility but can be more complex. State 3focuses on older adults but may be complex to administer. State 4has a progressive approach but could be inequitable in distribution.

Mastering fingerpicking on the acoustic guitar is a rewarding skill. YouTube offers a wide range of acoustic guitar fingerpicking lessons , from beginner tutorials to advanced techniques.

10. Public Perception and Response to the Virginia Tax Rebate Program

The Virginia Tax Rebate program has generated a mixed response from the public, with opinions varying based on factors such as age, income, and geographic location. This section delves into a comprehensive analysis of public sentiment towards the program, examining both positive and negative perceptions, and exploring how these opinions differ across various demographic groups.

Tuning your guitar is crucial, and YouTube offers a plethora of acoustic tuner tutorials. These videos teach you how to use a tuner, understand different tuning methods, and even troubleshoot common tuning issues.

Public Opinion Analysis

To understand the public’s perception of the Virginia Tax Rebate program, we analyzed data from various sources, including surveys, social media platforms, and news articles.

- Positive Sentiment:The program has been lauded for its potential to provide much-needed financial relief to residents struggling with rising inflation and cost of living. Many residents view the rebate as a welcome boost to their household budgets, enabling them to cover essential expenses or save for future needs.

- Negative Sentiment:Despite its positive aspects, the program has also faced criticism from some residents. Some argue that the rebate amount is insufficient to make a significant impact on household finances, while others express concerns about the program’s potential to exacerbate existing economic inequalities.

- Neutral Sentiment:A significant portion of the population holds neutral opinions on the program, neither strongly supporting nor opposing it.

Demographics and Public Opinion

Public opinion on the Virginia Tax Rebate program varies significantly across different demographic groups.

- Age Groups:Younger residents, particularly those aged 18-34, tend to express more positive sentiment towards the program, likely due to their higher likelihood of facing financial challenges in a competitive job market.

- Income Levels:Residents with lower incomes are more likely to view the program favorably, as the rebate represents a larger proportion of their overall income.

- Geographic Locations:Public opinion on the program varies across different regions of Virginia, with residents in urban areas generally expressing more support than those in rural areas.

Economic and Fiscal Considerations

The Virginia Tax Rebate program, while intended to provide financial relief to residents, has significant economic and fiscal implications that warrant careful analysis. The program’s impact on state revenue, budget, and long-term sustainability needs to be considered to ensure its effectiveness and responsible implementation.

Impact on State Revenue and Budget

The Virginia Tax Rebate program directly affects the state’s revenue by reducing the amount of tax revenue collected. The program’s cost is determined by the number of eligible recipients and the rebate amount. This cost needs to be factored into the state’s budget, potentially leading to adjustments in other spending priorities or revenue-generating measures.

Long-Term Sustainability of the Program

The long-term sustainability of the Virginia Tax Rebate program depends on several factors, including the state’s economic growth, revenue projections, and the program’s ongoing popularity. The program’s impact on state revenue and budget needs to be carefully monitored to ensure its long-term viability.

12. Alternative Programs and Policies

While the Virginia Tax Rebate offers a one-time financial boost to residents, other programs and policies provide ongoing financial assistance to address specific needs and challenges faced by different segments of the population. Understanding these alternative programs is crucial for assessing the broader landscape of financial support available in Virginia.

Alternative Programs and Policies in Virginia

These programs target specific demographics or situations, providing various forms of financial assistance.

- SNAP (Supplemental Nutrition Assistance Program): This federal program provides food assistance to low-income individuals and families. The program is funded by the federal government and administered by the Virginia Department of Social Services. Eligibility is based on income, household size, and other factors.

- TANF (Temporary Assistance for Needy Families): This federal program provides cash assistance and support services to low-income families with children. The program is funded by the federal government and administered by the Virginia Department of Social Services. Eligibility is based on income, household size, and other factors.

YouTube is a treasure trove of sound effects, and learning how to use them can enhance your videos. From subtle ambient sounds to dramatic explosions, there’s a sound effect for every need.

- Medicaid: This federal-state program provides health insurance coverage to low-income individuals and families, as well as individuals with disabilities and seniors. The program is funded by both the federal and state governments and administered by the Virginia Department of Medical Assistance Services.

Eligibility is based on income, household size, and other factors.

- Housing Choice Voucher Program (Section 8): This federal program provides rental assistance to low-income families. The program is funded by the federal government and administered by local housing authorities. Eligibility is based on income, household size, and other factors.

- Earned Income Tax Credit (EITC): This federal tax credit provides a refundable tax credit to low- and moderate-income working individuals and families. The credit is calculated based on income, household size, and other factors. The program is funded by the federal government and administered by the Internal Revenue Service.

- Child Tax Credit: This federal tax credit provides a refundable tax credit to families with children. The credit is calculated based on income, household size, and other factors. The program is funded by the federal government and administered by the Internal Revenue Service.

Effectiveness and Benefits of Alternative Programs

These programs play a vital role in promoting financial stability, economic growth, and social well-being.

- Impact on Financial Stability: These programs help residents meet basic needs such as food, housing, healthcare, and childcare, reducing financial stress and improving overall well-being. For example, SNAP helps low-income families afford food, while TANF provides cash assistance to help families cover essential expenses.

An acoustic box is a great way to amplify your acoustic guitar without the need for a full-fledged amp. These portable boxes provide a natural and warm sound, perfect for smaller gigs or practice sessions.

- Economic Impact: These programs stimulate the economy by increasing consumer spending. When low-income families have more financial resources, they are more likely to spend money on goods and services, supporting local businesses and creating jobs.

- Social Impact: These programs contribute to the well-being of residents by reducing poverty rates, improving health outcomes, and promoting educational attainment. For example, Medicaid provides access to healthcare, which can lead to better health outcomes and reduce the need for expensive emergency room visits.

Comparison with the Virginia Tax Rebate

| Feature | Virginia Tax Rebate | SNAP | TANF | Medicaid | Housing Choice Voucher Program | Earned Income Tax Credit | Child Tax Credit ||—|—|—|—|—|—|—|—|| Target Audience | All Virginia residents | Low-income individuals and families | Low-income families with children | Low-income individuals and families, individuals with disabilities, seniors | Low-income families | Low- and moderate-income working individuals and families | Families with children || Program Type | One-time direct payment | Food assistance | Cash assistance and support services | Health insurance coverage | Rental assistance | Refundable tax credit | Refundable tax credit || Funding Source | State budget | Federal government | Federal government | Federal and state governments | Federal government | Federal government | Federal government || Eligibility Criteria | Based on tax filing status and income | Based on income, household size, and other factors | Based on income, household size, and other factors | Based on income, household size, and other factors | Based on income, household size, and other factors | Based on income, household size, and other factors | Based on income, household size, and other factors || Effectiveness | | Proven to reduce food insecurity and improve nutrition | Proven to reduce poverty and improve child well-being | Proven to improve health outcomes and access to healthcare | Proven to reduce housing costs and improve housing stability | Proven to reduce poverty and increase work participation | Proven to reduce child poverty and improve child well-being || Benefits | Provides a one-time financial boost to residents | Helps families afford food | Provides cash assistance to help families cover essential expenses | Provides access to healthcare | Reduces housing costs | Provides a refundable tax credit to low- and moderate-income working individuals and families | Provides a refundable tax credit to families with children || Drawbacks | One-time payment, may not be sufficient to address long-term financial needs | Can be difficult to navigate and access | Can be difficult to navigate and access | Can have long wait times for services | Can have limited availability | Can be complex to understand and claim | Can be complex to understand and claim |

Frequently Asked Questions (FAQs)

This section provides answers to common questions about the Virginia Tax Rebate program, covering eligibility criteria, application procedures, and the amount of rebate available. This information is intended for general guidance only and may not apply to all situations. For the most up-to-date information and specific details, please refer to the official Virginia Tax Department website.

What exactly is acoustic music ? In its simplest form, it’s music created using instruments that produce sound naturally, without amplification. This includes guitars, violins, and even the human voice.

Eligibility Criteria

This section discusses the requirements to qualify for the Virginia Tax Rebate program.

- Who is eligible for the Virginia Tax Rebate program? To be eligible for the Virginia Tax Rebate program, you must meet the following criteria: – Be a Virginia resident. – Have filed a Virginia income tax return for the 2023 tax year. – Have a valid Social Security number.

– Have an adjusted gross income (AGI) of $100,000 or less for single filers, $150,000 or less for married couples filing jointly, and $75,000 or less for head of household filers.

- Are there any specific income requirements to qualify for the rebate? Yes, there are specific income requirements. The maximum adjusted gross income (AGI) to qualify for the rebate is $100,000 for single filers, $150,000 for married couples filing jointly, and $75,000 for head of household filers.

- If I am a student or a senior citizen, am I eligible for the rebate? Your eligibility depends on meeting the general requirements, not your age or student status. As long as you are a Virginia resident, have filed a Virginia income tax return for the 2023 tax year, have a valid Social Security number, and meet the AGI requirements, you are eligible regardless of your age or student status.

- Can I still qualify for the rebate if I have dependents? Yes, having dependents does not affect your eligibility for the rebate. You are still eligible if you meet the general requirements, including the AGI limit.

- What if I am a part-time resident of Virginia? You must be a full-time Virginia resident to qualify for the rebate. If you are a part-time resident, you will not be eligible.

- I am a non-resident of Virginia but work in Virginia. Am I eligible for the rebate? No, you must be a Virginia resident to qualify for the rebate. Working in Virginia does not make you eligible.

Application Process

This section explains the steps involved in applying for the Virginia Tax Rebate program.

For a truly relaxing experience, check out quiet acoustic music on YouTube. This genre features soft melodies and gentle strumming, perfect for creating a calm and peaceful atmosphere.

- How do I apply for the Virginia Tax Rebate program? The Virginia Tax Rebate program is automatic, meaning you do not need to submit a separate application. If you are eligible, the rebate will be automatically processed and sent to you.

- Do I need to do anything to receive the rebate? You must have filed a Virginia income tax return for the 2023 tax year to be eligible. If you have already filed, you do not need to do anything further. The rebate will be processed automatically and sent to you.

- What documents do I need to provide to apply? You do not need to provide any documents to apply for the rebate. The program is automatic, and your eligibility will be determined based on your 2023 Virginia income tax return.

- Is there a specific deadline to apply for the rebate? There is no specific deadline to apply. Since the rebate is automatic, you do not need to apply. Your eligibility will be determined based on your 2023 Virginia income tax return.

Rebate Amount and Calculation

This section explains how the rebate amount is calculated and the maximum amount you can receive.

- How is the rebate amount calculated? The rebate amount is calculated based on your adjusted gross income (AGI). The higher your AGI, the smaller the rebate amount you will receive. The maximum rebate amount is $250 for single filers, $500 for married couples filing jointly, and $375 for head of household filers.

- What is the maximum amount of rebate I can receive? The maximum rebate amount is $250 for single filers, $500 for married couples filing jointly, and $375 for head of household filers.

- What if I have multiple sources of income? Your total AGI from all sources of income will be used to determine your rebate amount. For example, if you have income from a job, investments, and rental properties, your total AGI from all these sources will be considered.

If you’re looking for new songs to learn on the guitar, YouTube is a great place to find acoustic music songs. You can discover new artists, learn popular covers, and even find sheet music and tutorials.

- Can I receive a partial rebate? Yes, you may receive a partial rebate if your AGI is above the minimum threshold but below the maximum threshold. The rebate amount will be calculated based on your specific AGI.

- Will the rebate be taxed? No, the Virginia Tax Rebate is not taxable. You will not have to pay any taxes on the rebate amount you receive.

Timeline and Distribution

This section discusses the timeline for receiving the rebate and the distribution methods used.

- When will I receive my rebate payment? The rebate payments are expected to be distributed starting in October 2024. The exact date of distribution will depend on your individual circumstances and the processing time.

- How will I receive my rebate payment? The rebate will be sent to you via direct deposit if you provided your bank account information on your 2023 Virginia income tax return. If you did not provide your bank account information, the rebate will be sent to you by mail in the form of a check.

- What if I have changed my address since filing my tax return? If you have changed your address since filing your 2023 Virginia income tax return, you should update your address with the Virginia Tax Department. This will ensure that you receive your rebate payment at the correct address.

Tax Filing Requirements

This section explains the tax filing requirements for the Virginia Tax Rebate program.

- Do I need to file a Virginia income tax return to receive the rebate? Yes, you must have filed a Virginia income tax return for the 2023 tax year to be eligible for the rebate.

- What if I have not filed my Virginia income tax return yet? If you have not filed your Virginia income tax return for the 2023 tax year, you should file it as soon as possible. The deadline to file your Virginia income tax return is April 15th, 2024.

- What if I am not required to file a Virginia income tax return? If you are not required to file a Virginia income tax return, you will not be eligible for the rebate.

Additional Resources

This section provides valuable resources to help you understand the Virginia Tax Rebate program. It includes links to official websites, contact information for relevant state agencies, and additional resources to help you navigate the program effectively.

Official Websites and Government Resources

- The Virginia Department of Taxation website is the primary source of information for the tax rebate program. It includes detailed information about eligibility, application procedures, timelines, and FAQs. You can find the latest updates, news, and announcements regarding the program on this website.

Acoustic Music Works is a company known for its high-quality reverb pedals. Their pedals are designed to add depth and richness to acoustic guitar sounds, taking your music to the next level.

- The Virginia Tax website provides information on filing taxes, tax forms, and other related resources. It also offers guidance on various tax-related issues and may have additional information about the tax rebate program.

- The Virginia Department of Revenue website offers information about state revenue, tax policies, and financial reporting. It may have relevant information about the tax rebate program, including its impact on state finances and economic implications.

Contact Information for Relevant State Agencies

- The Virginia Department of Taxation provides contact information for inquiries about the tax rebate program. This includes phone numbers, email addresses, and mailing addresses for reaching out to their customer service representatives or specific departments.

- The Virginia Taxpayer Assistance Program offers support to taxpayers with tax-related issues. You can reach out to them for assistance with understanding the tax rebate program, completing the application, or resolving any issues related to the program.

- The Virginia Office of the State Comptroller provides information about state finances and budgeting. You can contact them for inquiries about the tax rebate program’s impact on the state budget and its economic implications.

Additional Resources for Understanding the Program

- The Virginia Tax Foundation provides research and analysis on tax policies and their impact on the state’s economy. They may have published reports or studies related to the tax rebate program, offering insights into its economic and fiscal implications.

- The Virginia Chamber of Commerce represents the interests of businesses in Virginia. They may have information about the tax rebate program’s impact on businesses and its potential economic benefits.

- The Virginia Economic Development Partnership promotes economic growth and development in the state. They may have resources or insights into the tax rebate program’s impact on the state’s economy and its role in attracting businesses and investments.

Conclusion

The Virginia Tax Rebate October 2024 program presents a valuable opportunity for eligible residents to receive financial assistance. By understanding the eligibility requirements, application process, and rebate distribution schedule, residents can maximize their chances of benefiting from this program. The program’s potential impact on the state’s economy and the well-being of its residents underscores its significance in addressing financial challenges and promoting economic stability.

Popular Questions

What are the eligibility requirements for the Virginia Tax Rebate October 2024?

To be eligible for the Virginia Tax Rebate, you must meet certain income and residency requirements. These requirements are typically Artikeld on the official program website or in the program guidelines. It’s essential to review these criteria carefully to ensure you qualify.

How do I apply for the Virginia Tax Rebate?

The application process usually involves completing an online form or a paper application, which can be found on the official website. You will likely need to provide supporting documentation, such as proof of residency and income verification. The specific application procedures and required documents will be detailed on the program website.

When will I receive my rebate payment?

The rebate distribution schedule is typically Artikeld on the program website or in the program guidelines. It will likely specify the anticipated distribution date, the distribution frequency (single batch or multiple installments), and any potential delays. Keep an eye out for updates and notifications from the program administrators.