Variable Annuities Have 2024: Navigating the complex world of retirement planning can be daunting, but variable annuities offer a unique approach to building wealth and securing your future. These financial instruments provide a blend of investment potential and guaranteed income streams, making them an intriguing option for those seeking to maximize their retirement savings.

Depending on your location, you might find specific annuity calculators useful. For example, Annuity Calculator Singapore 2024 provides tools for individuals in Singapore. When using calculators, it’s essential to understand how annuity due calculations work, which you can explore in Calculating Annuity Due On Ba Ii Plus 2024.

This guide delves into the key features of variable annuities, exploring their investment options, potential growth, and associated risks. We’ll also examine recent market trends and regulatory changes impacting the variable annuity landscape, providing you with the information needed to make informed decisions.

Contents List

- 1 Understanding Variable Annuities in 2024: Variable Annuities Have 2024

- 1.1 Key Features of Variable Annuities

- 1.2 Risks Associated with Variable Annuities, Variable Annuities Have 2024

- 1.3 Recent Developments in the Variable Annuity Market

- 1.4 Considerations for Choosing a Variable Annuity

- 1.5 Tax Implications of Variable Annuities

- 1.6 Variable Annuities and Retirement Planning

- 2 Last Word

- 3 Query Resolution

Understanding Variable Annuities in 2024: Variable Annuities Have 2024

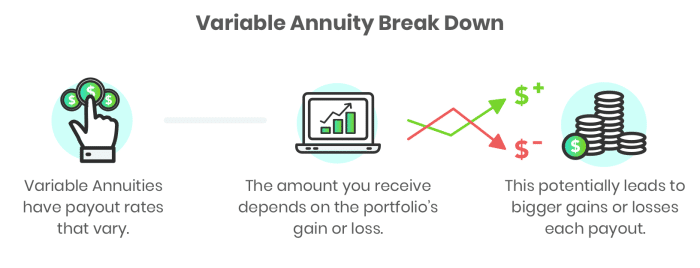

Variable annuities are complex financial products that offer both growth potential and guaranteed income streams. In 2024, they continue to be a popular choice for retirement planning, though it’s crucial to understand their features, risks, and potential benefits before making an investment decision.

If you’re using a financial calculator, you may want to explore how to calculate annuity factors. Calculate Annuity Factor On Ba Ii Plus 2024 offers helpful information on this topic. For specific retirement products, you can research options like Prudential Premier Retirement B Variable Annuity 2024.

Key Features of Variable Annuities

Variable annuities offer a combination of investment growth potential and guaranteed income features. They function similarly to mutual funds, allowing investors to choose from a variety of investment options, such as stocks, bonds, and money market funds. The value of the annuity is directly tied to the performance of the underlying investments.

When researching annuities, understanding the features and potential costs is crucial. For example, you might want to explore the details of Guaranteed Variable Annuity 2024 or learn more about Variable Annuity Charges 2024.

- Investment Options:Variable annuities provide access to a diverse range of investment options, enabling investors to tailor their portfolios based on their risk tolerance and investment goals.

- Potential for Growth:The potential for growth is directly linked to the performance of the chosen investment options. As the value of the investments rises, so does the value of the annuity.

- Guaranteed Income Options:Many variable annuities offer guaranteed income riders, which provide a minimum level of income payments during retirement. These riders typically involve additional fees and can be complex, so careful consideration is required.

Risks Associated with Variable Annuities, Variable Annuities Have 2024

While variable annuities offer potential for growth, they also carry significant risks. Investors need to be aware of these risks before making an investment decision.

- Market Volatility:The value of variable annuities fluctuates with the performance of the underlying investments. This means that investors can lose money if the market declines.

- Potential for Loss of Principal:In a severe market downturn, it’s possible to lose a portion or all of the principal invested in a variable annuity. This risk is greater with investments that have higher growth potential, such as stocks.

- Fees and Expenses:Variable annuities often carry high fees, including mortality and expense charges, which can erode investment returns over time.

Recent Developments in the Variable Annuity Market

The variable annuity market is constantly evolving, with new product offerings and investment strategies emerging. Here are some key trends to consider in 2024.

Before investing in an annuity, you should be aware of the potential fees involved. Variable Annuity Fees 2024 provides insights into these costs. If you’re comfortable with Excel, you can explore Calculating Annuity Excel 2024 for spreadsheet-based calculations.

- New Features and Investment Strategies:Variable annuity providers are introducing innovative features, such as guaranteed lifetime withdrawal benefits and enhanced investment options. These new features can offer greater flexibility and protection for investors.

- Impact of Market Conditions:Interest rate changes and inflation can significantly impact the performance of variable annuities. Rising interest rates can lead to lower returns on fixed income investments, while inflation can erode the purchasing power of income payments.

- Regulatory Changes:The regulatory landscape for variable annuities is constantly evolving. New regulations can impact product offerings, fees, and investor protections.

Considerations for Choosing a Variable Annuity

When evaluating variable annuity options, it’s essential to consider several factors that can impact your investment decision.

- Investment Performance:Examine the historical performance of the investment options offered by the annuity provider. Consider the track record of the fund managers and the fees associated with each investment option.

- Fees and Expenses:Carefully review the fees and expenses associated with the variable annuity, including mortality charges, expense charges, and surrender charges. Compare these fees with other investment options.

- Guarantees:If a guaranteed income rider is included, understand the terms and conditions of the guarantee, including any limitations or restrictions.

Tax Implications of Variable Annuities

Variable annuities have unique tax implications that can affect the overall return on your investment. Understanding these tax considerations is essential for making informed investment decisions.

Variable annuities can offer different types of guarantees. To understand these guarantees, you might find Variable Annuity Contracts Contain Which Of The Following Guarantees 2024 informative.

- Tax Treatment of Withdrawals:Withdrawals from variable annuities are typically taxed as ordinary income, except for the portion representing the cost basis, which is tax-free.

- Death Benefits:Death benefits from variable annuities may be subject to income tax, depending on the beneficiary’s relationship to the annuitant and the specific terms of the contract.

- Potential Tax Advantages:Variable annuities can offer tax deferral, allowing earnings to grow tax-free until they are withdrawn. This can be beneficial for long-term investments.

- Potential Tax Disadvantages:The tax treatment of withdrawals and death benefits can be complex and may result in higher taxes compared to other retirement savings options.

Variable Annuities and Retirement Planning

Variable annuities can be a valuable component of a comprehensive retirement plan, offering both growth potential and guaranteed income options.

Calculating annuity values can be complex, and resources are available to assist you. For example, you might find Problem 6-24 Calculating Annuity Future Values 2024 helpful. Before making a decision, it’s also wise to consider the safety and security of annuity products, which you can learn more about in Is Annuity Safe 2024.

- Managing Longevity Risk:Variable annuities with guaranteed income riders can help manage longevity risk, providing a stream of income that can last throughout retirement.

- Retirement Income:Variable annuities can be used to supplement other retirement income sources, such as Social Security and pensions.

- Maximizing Benefits:Carefully consider the investment options, fees, and guarantees offered by different variable annuity products to maximize their benefits for your retirement planning needs.

Last Word

As you embark on your retirement planning journey, understanding the intricacies of variable annuities is crucial. By carefully considering your investment goals, risk tolerance, and financial situation, you can determine if variable annuities are a suitable component of your overall retirement strategy.

Remember, seeking professional financial advice can help you navigate the complexities of this investment option and make decisions that align with your individual needs and aspirations.

Query Resolution

What are the main benefits of variable annuities?

To make informed decisions about annuities, consider factors like monthly payments and potential returns. You might be interested in articles like Annuity 2000 Per Month 2024 or research the details of Is Annuity Lic 2024.

Variable annuities offer potential for growth through investment options, tax-deferred growth, and the possibility of guaranteed income streams.

What are the risks associated with variable annuities?

Risks include market volatility, potential for loss of principal, and fees associated with the annuity.

How do variable annuities compare to traditional IRAs and 401(k)s?

Variable annuities offer potential for higher returns but also carry higher risk compared to traditional IRAs and 401(k)s. The choice depends on your individual risk tolerance and investment goals.

Annuity products are gaining popularity in 2024. If you’re considering an annuity, you might be interested in learning about the different types available, such as Annuity Is 2024. You may also want to explore options in the UK, like Annuity Uk 2024.