Variable Annuity 101 2024: A Guide for Investors, is a comprehensive resource designed to demystify the world of variable annuities. This guide provides an insightful look into the complexities of variable annuities, empowering individuals to make informed investment decisions.

Variable annuities offer the potential for higher returns, but they also carry more risk. Variable Annuity Fidelity 2024 discusses how Fidelity offers variable annuity products and what you need to know before investing.

Variable annuities are a unique type of retirement savings product that offers the potential for growth alongside protection against market fluctuations. This guide will delve into the core concepts, key features, and considerations associated with variable annuities, equipping investors with the knowledge they need to navigate this investment landscape effectively.

Contents List

- 1 What is a Variable Annuity?

- 1.1 How Variable Annuities Work

- 1.2 Variable Annuities vs. Other Retirement Savings Options

- 1.3 Living Benefit Riders

- 1.4 Tax-Deferred Growth

- 1.5 Investment Options

- 1.6 Risks and Downsides

- 1.7 Minimizing the Impact of Fees

- 1.8 Variable Annuity Fee Comparison

- 1.9 Tax Advantages

- 1.10 Tax Implications, Variable Annuity 101 2024

- 1.11 Benefits and Drawbacks

- 1.12 Recent Changes and Updates

- 2 Last Point: Variable Annuity 101 2024

- 3 Questions and Answers

What is a Variable Annuity?

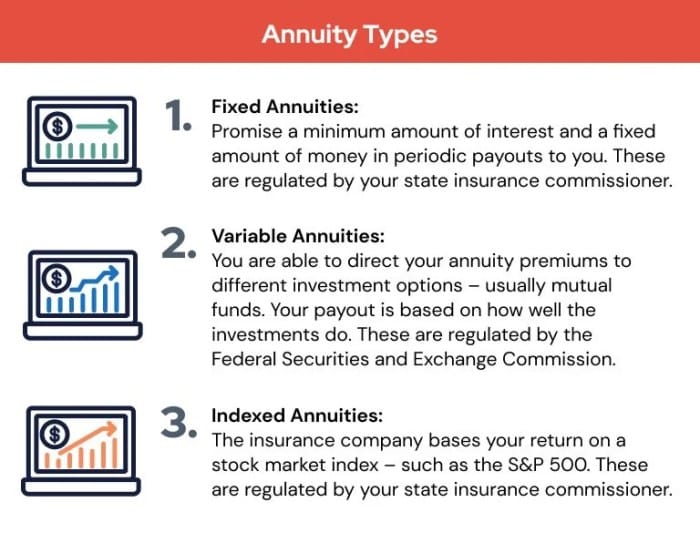

A variable annuity is a type of retirement savings product that offers the potential for growth based on the performance of underlying investments. Unlike traditional fixed annuities, which provide a guaranteed rate of return, variable annuities link your investment returns to the performance of a portfolio of mutual funds or sub-accounts.

This means that your returns can fluctuate based on market conditions.

How Variable Annuities Work

Variable annuities work by allowing you to allocate your contributions to different investment options, typically mutual funds or sub-accounts. These investment options may include stocks, bonds, or a mix of both. The value of your annuity will fluctuate based on the performance of the underlying investments you choose. For example, if you invest in a stock-based sub-account and the stock market performs well, the value of your annuity will likely increase. Conversely, if the stock market experiences a downturn, the value of your annuity may decrease.

Variable Annuities vs. Other Retirement Savings Options

Variable annuities can be compared to other retirement savings options, such as traditional IRAs and 401(k)s. While all of these options offer tax-deferred growth, there are some key differences.

For federal employees, Calculating A Federal Annuity – Fers 2024 outlines the process for determining your annuity payments based on your years of service and salary history.

- Traditional IRAs and 401(k)sare typically more straightforward and offer a wider range of investment options, including individual stocks and bonds. However, they do not offer the same level of downside protection as variable annuities.

- Variable annuitiesoffer the potential for higher returns, but they also come with higher risks.

When you retire, you might want to convert your pension pot into an annuity. Calculate Annuity From Pension Pot 2024 guides you through the process of calculating your annuity payments from your pension pot.

They may also have higher fees than traditional IRAs and 401(k)s.

The best retirement savings option for you will depend on your individual circumstances, risk tolerance, and investment goals.Many variable annuities include a death benefit guarantee, which ensures that your beneficiaries will receive a minimum payout, even if the value of your annuity declines.

An annuity is a financial product that provides a stream of income for a specific period. Annuity Is What 2024 explains the basics of annuities, including their different types and how they work.

This can provide peace of mind, knowing that your loved ones will be protected in the event of your death.

If you’re wondering how much income you can expect from an annuity, the How Much Will An Annuity Pay Calculator 2024 can provide estimates based on your specific circumstances.

Living Benefit Riders

Living benefit riders are optional features that can provide additional downside protection. These riders can guarantee a minimum return on your investment, or they can protect you from losses during market downturns. However, these riders typically come with an additional fee.

If you’re looking for annuity options in Hong Kong, Annuity Hk 2024 provides information on the different annuity products available in the Hong Kong market.

Tax-Deferred Growth

Like traditional IRAs and 401(k)s, variable annuities offer tax-deferred growth. This means that you will not have to pay taxes on your investment earnings until you withdraw them in retirement.

Understanding the tax implications of variable annuities is crucial. Qualified Variable Annuity Taxation 2024 explains how qualified variable annuities are taxed and how it can impact your overall income.

Investment Options

Variable annuities offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and investment goals. You can choose from a range of mutual funds or sub-accounts, which may invest in stocks, bonds, or a mix of both.

If you’re in the UK, the Annuity Calculator Uk Gov 2024 can help you estimate the annuity payments you might receive based on your pension pot.

Risks and Downsides

Variable annuities also come with some risks and downsides:

- Market Volatility: Because variable annuities are linked to the performance of underlying investments, their value can fluctuate significantly based on market conditions. This means that you could lose money if the market performs poorly.

- Potential for Loss of Principal: Unlike fixed annuities, which guarantee a return of principal, variable annuities do not guarantee that you will get back all of your investment.

A deferred variable annuity is a type of annuity that starts paying out at a later date. Deferred Variable Annuity Definition 2024 explains the key features of this type of annuity.

You could lose some or all of your principal if the market performs poorly.

- Fees: Variable annuities typically have higher fees than traditional IRAs and 401(k)s. These fees can eat into your returns over time.

Here are some of the most common types of fees associated with variable annuities:

- Mortality and Expense Charges: These charges cover the cost of providing the death benefit guarantee.

- Administrative Fees: These fees cover the cost of managing the annuity contract.

- Investment Management Fees: These fees cover the cost of managing the underlying investments in the annuity.

- Surrender Charges: These charges are imposed if you withdraw your money from the annuity before a certain period of time.

Minimizing the Impact of Fees

You can minimize the impact of fees on the overall return of your variable annuity by:

- Choosing a product with lower fees: Compare the fee structures of different variable annuity products to find one with lower charges.

- Investing in low-cost investment options: Look for investment options within the annuity that have lower expense ratios.

- Keeping your money invested for a longer period: Surrender charges can be significant, so it is important to keep your money invested for a longer period to avoid these charges.

Variable Annuity Fee Comparison

Annuity payments can be fixed or variable, depending on the type of annuity you choose. Annuity Is Variable 2024 discusses the potential benefits and drawbacks of variable annuities, which offer the potential for higher returns but also carry more risk.

| Annuity Product | Mortality and Expense Charges | Administrative Fees | Investment Management Fees | Surrender Charges |

|---|---|---|---|---|

| Product A | 1.25% | 0.50% | 0.75% | 7 years |

| Product B | 1.00% | 0.25% | 1.00% | 5 years |

| Product C | 1.50% | 0.75% | 0.50% | 10 years |

This table shows a simplified comparison of fee structures for different variable annuity products. As you can see, the fees can vary significantly, so it is important to compare products carefully before making a decision.When you withdraw money from a variable annuity, you will be taxed on the earnings portion of the withdrawal.

Vanguard offers various financial products, including annuities. Annuity Calculator Vanguard 2024 provides a tool for calculating potential annuity payments based on Vanguard’s offerings.

The principal portion of your investment is typically considered to be tax-free.

Tax Advantages

Variable annuities offer several potential tax advantages:

- Tax-Deferred Growth: You will not have to pay taxes on your investment earnings until you withdraw them in retirement.

- Tax-Free Withdrawals: You may be able to withdraw your earnings tax-free if you meet certain requirements, such as being at least 59 1/2 years old and taking withdrawals as an annuity.

Annuity rates can fluctuate over time, and it’s helpful to compare rates from different providers. Annuity Rates 2021 2024 provides insight into how annuity rates have changed in recent years, which can help you make informed decisions.

Tax Implications, Variable Annuity 101 2024

Here are some potential tax implications to consider when investing in a variable annuity:

- 10% Early Withdrawal Penalty: If you withdraw money from your variable annuity before age 59 1/2, you may be subject to a 10% early withdrawal penalty.

- Taxable Income: When you withdraw money from your variable annuity, the earnings portion of the withdrawal will be considered taxable income.

Understanding the Annuity Basis Is 2024 is essential when evaluating annuity options. This refers to the interest rate used to calculate the annuity payments, which can impact the overall amount you receive.

The current market is experiencing a period of high inflation and rising interest rates. This can impact the performance of variable annuities, as the value of underlying investments may fluctuate.

Looking to receive a large payout in 2024? You might be interested in learning about 3 Million Annuity Payout 2024. This type of annuity can provide a substantial stream of income for many years, but it’s crucial to understand how it works and what the potential risks are.

Benefits and Drawbacks

Variable annuities can offer potential benefits, such as tax-deferred growth and downside protection. However, they also come with risks, such as market volatility and high fees.

Recent Changes and Updates

There have been some recent changes and updates to variable annuity regulations and product offerings. It is important to stay informed about these changes to ensure that you are making informed investment decisions.

Last Point: Variable Annuity 101 2024

In conclusion, variable annuities offer a unique blend of growth potential and protection, making them a valuable addition to a diversified retirement portfolio. Understanding the nuances of variable annuities, including their features, fees, and tax implications, is crucial for investors seeking to maximize their returns while mitigating risk.

When considering an annuity, a helpful tool is the Annuity Loan Calculator 2024. This calculator can help you estimate the monthly payments you can expect to receive, as well as the total amount you’ll receive over the life of the annuity.

By carefully considering their investment goals, risk tolerance, and financial circumstances, individuals can determine if a variable annuity aligns with their overall financial strategy.

Questions and Answers

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

Are variable annuities suitable for all investors?

Variable annuities are generally suitable for investors with a long-term investment horizon and a moderate to high risk tolerance.

What are the potential downsides of variable annuities?

Potential downsides include the risk of losing principal, high fees, and complex investment options.