Variable Annuity Advantages 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Variable annuities are financial products that offer the potential for growth and protection against inflation, making them a popular choice for investors seeking to build a secure retirement future.

They are distinct from traditional fixed annuities, offering a wider range of investment options and the potential for higher returns, but also carrying greater risk. This comprehensive guide will explore the advantages and considerations associated with variable annuities, providing valuable insights for individuals seeking to make informed financial decisions.

Understanding what type of account an annuity falls under is crucial. This article: Annuity Is Which Account 2024 can help you determine the right classification for your specific annuity.

Variable annuities are essentially investment contracts that combine the benefits of an annuity with the flexibility of a mutual fund. They allow individuals to allocate their funds across a variety of investment options, such as stocks, bonds, and money market instruments, seeking to achieve higher returns than fixed annuities.

However, the value of these investments is subject to market fluctuations, meaning that investors could experience losses as well as gains.

Looking for information on annuities with a value of $750,000? This article: Annuity 750k 2024 can provide you with insights into this type of annuity and its potential benefits and risks.

Contents List

Variable Annuity Basics

A variable annuity is a type of annuity contract that provides a stream of income payments, but unlike traditional fixed annuities, the amount of income you receive is not guaranteed. Instead, the payments are tied to the performance of a portfolio of investments you choose within the annuity contract.

This means that your income payments can fluctuate based on the ups and downs of the market.

Interested in exploring the details of a 4-annuity? This resource: 4 Annuity 2024 can help you understand the specifics of this type of annuity.

Key Features of Variable Annuities

- Investment Choice:Variable annuities offer a wide range of investment options, including mutual funds, ETFs, and other investment vehicles. You have the flexibility to customize your portfolio based on your risk tolerance and investment goals.

- Tax-Deferred Growth:Earnings within a variable annuity grow tax-deferred, meaning you won’t owe taxes on your investment gains until you begin taking withdrawals in retirement.

- Potential for Higher Returns:While there’s no guarantee of returns, variable annuities have the potential to generate higher returns than fixed annuities, which can be beneficial for long-term growth.

- Death Benefit:Some variable annuities include death benefit riders that guarantee a minimum payout to your beneficiaries if you pass away before the annuity begins paying out.

Differences from Fixed Annuities

The main difference between variable annuities and fixed annuities lies in the way income payments are determined. Fixed annuities offer a guaranteed rate of return, meaning your income payments will be fixed for the life of the contract. Variable annuities, on the other hand, have no guaranteed rate of return.

Understanding how to calculate the annuity factor is crucial for making informed financial decisions. This article: Calculating Annuity Factor 2024 will provide you with the necessary information and formulas to calculate this important factor.

Your income payments will vary depending on the performance of your chosen investments.

If you’re new to annuities, this article: How To Calculate Annuities 2024 will guide you through the process of calculating annuity payments and understanding the key concepts involved.

Investment Options Within Variable Annuities

Variable annuities typically offer a range of investment options within the contract. These options can include:

- Mutual Funds:A diversified investment vehicle that pools money from multiple investors to purchase a variety of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs):Similar to mutual funds, but traded on stock exchanges, providing greater flexibility and potential for intraday trading.

- Separate Accounts:These are individual investment accounts within the annuity contract that offer a wider range of investment options, such as individual stocks or bonds.

Advantages of Variable Annuities in 2024: Variable Annuity Advantages 2024

Variable annuities offer several advantages that can make them an attractive option for retirement planning, especially in today’s economic climate.

Calculating the present value of an annuity can be a bit tricky, but this article: Calculating Annuity Present Values 2024 can provide you with the necessary steps and formulas.

Potential for Growth and Higher Returns

Variable annuities have the potential to generate higher returns than fixed annuities, which can be especially beneficial in an environment of rising inflation and interest rates. By investing in a diversified portfolio of assets, you can potentially outpace inflation and grow your savings over time.

Want to know how to calculate the present value of an annuity? This helpful article: Calculating Annuity Present Value 2024 will walk you through the process step-by-step.

Protection Against Inflation

Inflation erodes the purchasing power of your savings over time. Variable annuities can help protect against inflation by allowing you to invest in assets that have the potential to grow faster than inflation. For example, investing in stocks, which have historically outpaced inflation, can help preserve your savings’ real value.

Tax-Deferred Growth

Earnings within a variable annuity grow tax-deferred, meaning you won’t owe taxes on your investment gains until you begin taking withdrawals in retirement. This can be a significant advantage, as it allows your savings to compound faster and potentially grow to a larger amount over time.

Curious about the specifics of an annuity contract? This article: Annuity Contract Is 2024 will provide you with valuable information about the key elements and terms of an annuity contract.

Key Considerations for Variable Annuities

While variable annuities offer potential advantages, it’s crucial to understand the risks and considerations involved before investing.

Potential Risks, Variable Annuity Advantages 2024

- Market Volatility:The value of your investments within a variable annuity can fluctuate with the market, potentially leading to losses. If the market declines, your income payments could be reduced.

- Investment Losses:There’s no guarantee of returns with variable annuities, and you could lose some or all of your investment if the market performs poorly.

Fees and Expenses

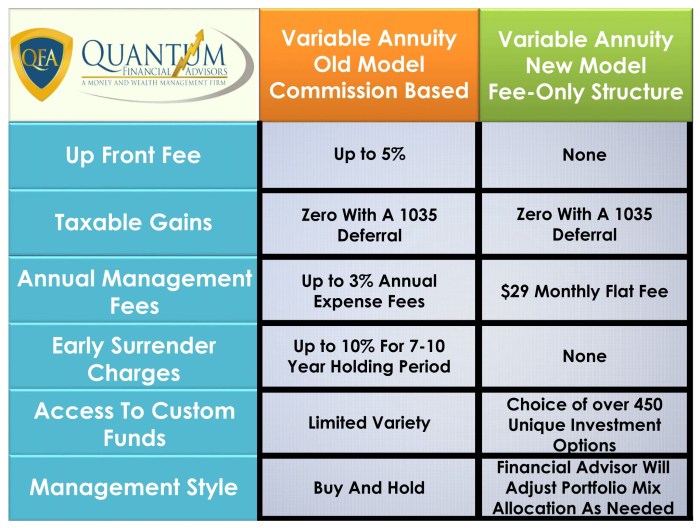

Variable annuities typically come with fees and expenses, which can eat into your returns. It’s essential to carefully review the fees associated with any variable annuity contract before investing. These fees can include:

- Mortality and Expense Risk Charges:These charges cover the insurance company’s costs of providing the annuity’s death benefit and administrative expenses.

- Investment Management Fees:These fees are charged by the mutual funds or other investment vehicles within the annuity contract.

- Surrender Charges:These charges may be applied if you withdraw your money from the annuity before a certain period.

Choosing a Reputable Insurance Company

It’s crucial to select a reputable and financially sound insurance company when purchasing a variable annuity. Look for a company with a strong track record, good financial ratings, and a history of providing excellent customer service. You can research insurance companies using resources like A.M.

Best, Standard & Poor’s, and Moody’s.

Annuity payments can be complex, but with the right tools, you can easily calculate their net present value. Check out this handy Annuity Npv Calculator 2024 to help you understand the present value of your future payments.

Variable Annuity Features and Options

Variable annuities offer a range of features and options that can enhance their flexibility and benefits.

Riders

Variable annuities often include riders that provide additional features and protection. Some common riders include:

- Death Benefit Riders:These riders guarantee a minimum payout to your beneficiaries if you pass away before the annuity begins paying out. They can help ensure your loved ones receive a lump sum payment, even if your investments haven’t performed well.

- Living Benefit Riders:These riders provide a minimum guaranteed income stream, regardless of the performance of your investments. They can help protect you from market downturns and ensure you receive a steady income in retirement.

Sub-Accounts

Variable annuities typically use sub-accounts to hold your investments. Each sub-account represents a separate investment, such as a mutual fund or ETF. You can allocate your money across different sub-accounts to create a diversified portfolio.

Withdrawals

You can typically withdraw money from a variable annuity, but withdrawals may be subject to fees and penalties, especially if you withdraw before a certain age. It’s important to understand the withdrawal rules and any associated fees before making any withdrawals.

Are you wondering if your annuity is considered a stream of income? This helpful article: Is Annuity Stream 2024 can shed light on the nature of your annuity payments.

Variable Annuities in Retirement Planning

Variable annuities can be a valuable component of a diversified retirement portfolio, providing potential for growth and income generation.

Diversified Retirement Portfolio

Variable annuities can help diversify your retirement portfolio by providing exposure to different asset classes, such as stocks, bonds, and real estate. This diversification can help reduce risk and potentially enhance returns.

Need to calculate the loan payments for an annuity in Excel? This guide: Calculate Annuity Loan Excel 2024 will provide you with the formulas and steps you need to use Excel for annuity calculations.

Income Stream Options

Variable annuities can provide income stream options during retirement. You can choose to receive a guaranteed income stream for life or a lump sum payment. The specific income options available will depend on the terms of your annuity contract.

Tax Implications

Withdrawals from variable annuities are generally taxed as ordinary income. However, the tax treatment of withdrawals can vary depending on the specific features of your annuity contract. It’s important to consult with a financial advisor to understand the tax implications of variable annuities in retirement.

Are you wondering if your annuity offers flexibility? This article: Is Annuity Flexible 2024 can help you determine if your annuity allows for adjustments or changes to your payment schedule.

Last Word

In conclusion, variable annuities can be a valuable tool for individuals seeking to grow their retirement savings and protect against inflation. However, it’s crucial to carefully weigh the potential risks and benefits before making an investment decision. Understanding the key features, potential risks, and considerations associated with variable annuities will empower you to make informed choices that align with your financial goals and risk tolerance.

If you’re looking to set up an annuity with a $400,000 investment, you can find helpful information here: Annuity $400 000 2024. This article will provide you with insights into the potential benefits and risks of this type of annuity.

By consulting with a qualified financial advisor and conducting thorough research, you can harness the advantages of variable annuities to build a secure and prosperous future.

Need to calculate the value of an annuity with BMO? You can find the right tool for the job by visiting this link: Annuity Calculator Bmo 2024. This calculator will help you understand the value of your annuity payments.

Frequently Asked Questions

What are the tax implications of withdrawals from a variable annuity?

Withdrawals from a variable annuity before age 59 1/2 are generally subject to a 10% penalty, in addition to ordinary income tax. However, withdrawals after age 59 1/2 are taxed as ordinary income.

If you’re wondering if you qualify as an annuitant receiving payments in 2024, you can find out by visiting this helpful resource: K Is An Annuitant Currently Receiving Payments 2024. This article will provide you with the necessary information to understand your status and make informed decisions about your financial future.

How do variable annuities compare to other retirement savings options, such as 401(k)s and IRAs?

Variable annuities offer tax-deferred growth, similar to 401(k)s and IRAs. However, they also come with additional fees and expenses that should be considered. It’s essential to compare the costs and features of different retirement savings options to determine the best fit for your individual needs.

Are variable annuities right for everyone?

Variable annuities are not suitable for everyone. They are best suited for individuals with a long-term investment horizon and a higher risk tolerance. If you are seeking a guaranteed return or are averse to market volatility, a fixed annuity or other investment options might be more appropriate.