Variable Annuity Air 2024 takes center stage, offering a unique approach to retirement planning. This innovative investment vehicle combines the traditional benefits of variable annuities with the potential for enhanced growth through a specific air component. Variable annuities, known for their flexibility and tax advantages, allow investors to customize their portfolios with various investment options, including equities, bonds, and other assets.

The value of an annuity depends on several factors, including the initial investment amount, the interest rate, and the duration of the payout. To learn more about the value of an annuity, visit Annuity Is The Value Of 2024.

The integration of air, a strategic element, adds another layer of complexity and opportunity to this already versatile financial tool.

If you’re in Canada and considering an annuity, it’s important to compare quotes from different providers. You can find Annuity Quotes Canada 2024 to make an informed decision.

This guide delves into the intricacies of Variable Annuity Air 2024, providing insights into its features, benefits, risks, and potential applications. We explore the role of air in investment strategies, analyze the current market landscape, and discuss tax implications. By understanding the nuances of this financial instrument, investors can make informed decisions about its suitability for their individual retirement goals.

Contents List

Variable Annuities: An Overview: Variable Annuity Air 2024

Variable annuities are a type of retirement savings product that offers the potential for growth while providing income guarantees. They differ from traditional annuities in that they allow investors to allocate their contributions to a variety of sub-accounts, each investing in a different underlying asset class, such as stocks, bonds, or mutual funds.

This structure provides the opportunity for higher returns but also introduces greater investment risk.

For programmers, understanding how to calculate annuities in Java can be beneficial. You can find resources on Calculate Annuity Java 2024 to learn about the programming techniques involved.

Benefits of Variable Annuities

Variable annuities can offer several potential benefits, including:

- Growth Potential:By investing in a variety of asset classes, variable annuities have the potential to generate higher returns than traditional annuities, which typically offer fixed interest rates. This growth potential can be particularly beneficial in a period of rising inflation or market volatility.

The Knights of Columbus offers various financial products, including annuities. You can find information about K Of C Annuity 2024 to explore their offerings.

- Tax Advantages:Variable annuities offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn. This can help investors accumulate wealth more quickly over time. Additionally, withdrawals from variable annuities are typically taxed as ordinary income, but they may be eligible for favorable tax treatment if taken after age 59 1/2.

An annuity certain is a type of annuity that guarantees payments for a specific period, regardless of the annuitant’s lifespan. You can find a detailed breakdown of the Formula Annuity Certain 2024 to understand its workings.

Risks of Variable Annuities

It’s important to be aware of the risks associated with variable annuities, which include:

- Market Volatility:The value of the sub-accounts in a variable annuity can fluctuate based on the performance of the underlying investments. This means that investors could lose money if the market declines.

- Loss of Principal:Unlike traditional annuities, variable annuities do not guarantee a return of principal. If the investments in the sub-accounts perform poorly, investors could lose some or all of their initial investment.

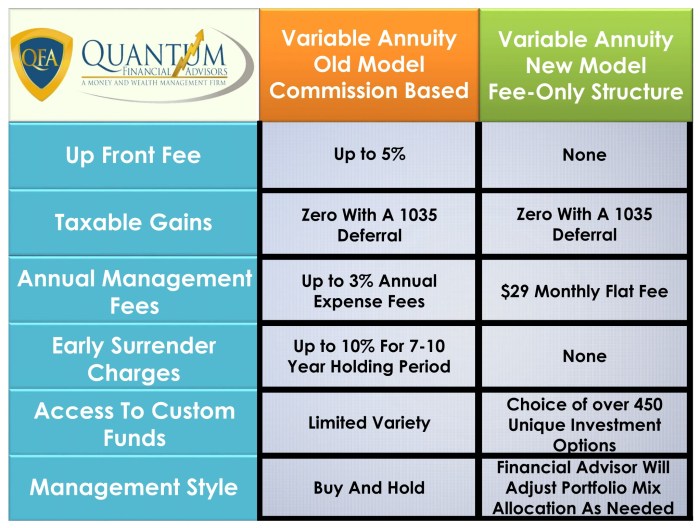

- Fees and Expenses:Variable annuities typically have higher fees and expenses than traditional annuities. These fees can erode returns and reduce the overall value of the investment.

The Role of Air in Variable Annuities

Air, in the context of variable annuities, refers to an allocation of funds to a sub-account that invests in a risk-free asset, such as a money market account or a short-term bond fund. This allocation serves as a buffer against market volatility and helps to preserve principal.

In essence, an annuity is a financial product that provides a steady stream of income over time. To understand the basic concept, you can refer to Annuity What Is It Definition 2024.

Examples of Variable Annuities with Air

Several variable annuity products incorporate air into their investment strategies. For example, some annuities offer a “guaranteed minimum withdrawal benefit” (GMWB), which allows investors to withdraw a certain percentage of their principal each year, regardless of the performance of the underlying investments.

One of the attractive features of an annuity is its flexibility. You can tailor it to your specific needs, such as adjusting the payment frequency or the duration of the payout. Learn more about the flexibility of annuities in Is Annuity Flexible 2024.

These products typically allocate a portion of the investment to a risk-free asset to ensure that the GMWB is met.

If you’re studying finance, understanding the formulas related to annuities is crucial. The Annuity Formula Jaiib 2024 provides a comprehensive explanation of the formulas used in annuity calculations.

Performance Comparison

Variable annuities with air components generally exhibit lower volatility than those without air. This is because the air allocation acts as a cushion during market downturns, helping to mitigate losses. However, the inclusion of air can also lead to lower returns, as the risk-free allocation typically generates lower returns than other asset classes.

Calculating the payments for a growing annuity can be a bit complex, but it’s essential to understand the growth potential of your investment. Explore the process of Calculating Growing Annuity Payment 2024 to get a better grasp of how your annuity can grow over time.

Variable Annuities in 2024

The market for variable annuities is expected to remain competitive in 2024, with insurers continuing to introduce new products and features. However, the popularity of variable annuities may be impacted by several factors, including:

Market Trends and Factors, Variable Annuity Air 2024

- Interest Rates:Rising interest rates can make traditional annuities more attractive, as they offer higher fixed interest rates. This could lead to a decline in demand for variable annuities.

- Market Volatility:Increased market volatility can make investors more risk-averse, leading them to favor lower-risk investments, such as traditional annuities. However, the potential for higher returns may still attract some investors to variable annuities.

- Regulatory Changes:The Department of Labor (DOL) has proposed new regulations that could impact the sale and distribution of variable annuities. These regulations are aimed at protecting investors and ensuring that they are receiving appropriate advice. The impact of these regulations on the variable annuity market remains to be seen.

Looking for a way to secure your future income? An annuity might be the solution you’re looking for. You can find out more about a Annuity 500k 2024 to see if it’s the right fit for you.

Economic Conditions

Recent economic conditions, including high inflation and rising interest rates, have created a challenging environment for investors. The performance of variable annuities will depend on the performance of the underlying investments, which are susceptible to these economic factors.

Often referred to as a “fixed income stream,” an annuity can be a reliable source of income during retirement. Understanding the various types of annuities is crucial, and you can learn more about what they’re known as in Annuity Is Also Known As 2024.

Investment Strategies with Variable Annuities

Variable annuities offer a range of investment strategies, allowing investors to tailor their portfolio to their risk tolerance and financial goals.

Calculating the number of periods for an annuity can help you determine the duration of your income stream. You can use an Annuity Number Of Periods Calculator 2024 to make this calculation.

Investment Strategies and Risk Profiles

| Strategy | Risk Profile | Potential Return |

|---|---|---|

| Conservative | Low | Low |

| Moderate | Medium | Medium |

| Aggressive | High | High |

Diversification within Variable Annuities

Diversification is crucial for managing risk and maximizing returns. Within a variable annuity, investors can achieve diversification by allocating their contributions to a variety of sub-accounts that invest in different asset classes, such as:

- Stocks:Stocks offer the potential for high returns but also carry higher risk. Investors can diversify their stock holdings by investing in different sectors, industries, and market capitalizations.

- Bonds:Bonds are generally considered less risky than stocks and provide income. Investors can diversify their bond holdings by investing in different maturities, credit ratings, and types of bonds.

- Real Estate:Real estate can provide diversification and potential for appreciation. Investors can invest in real estate through real estate investment trusts (REITs) or other real estate-related securities.

Step-by-Step Guide for Investors

Here is a step-by-step guide for investors considering incorporating variable annuities into their investment plans:

- Determine your financial goals and risk tolerance:Before investing in a variable annuity, it’s essential to understand your financial goals and how much risk you’re willing to take. Consider your investment time horizon and your need for income in retirement.

- Research different variable annuity products:Compare the features, fees, and expenses of different variable annuity products to find one that aligns with your investment goals and risk tolerance. Consider factors such as the investment options available, the guaranteed minimum withdrawal benefit (GMWB), and the death benefit.

- Seek professional financial advice:It’s highly recommended to consult with a qualified financial advisor before investing in a variable annuity. An advisor can help you understand the risks and benefits of these products and develop an investment strategy that meets your specific needs.

- Monitor your investment:After investing in a variable annuity, it’s important to monitor your investment regularly. Review the performance of the sub-accounts and make adjustments to your investment strategy as needed. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Tax Implications of Variable Annuities

Variable annuities offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn. This can help investors accumulate wealth more quickly over time. However, it’s important to understand the tax implications of variable annuities, particularly when it comes to withdrawals and early withdrawals.

An annuity is a financial product that can be a valuable tool for retirement planning and other financial goals. Learn more about what an annuity is known for in An Annuity Is Known 2024.

Tax Treatment of Withdrawals

Withdrawals from variable annuities are typically taxed as ordinary income. This means that the earnings portion of the withdrawal is taxed at your ordinary income tax rate. However, withdrawals taken after age 59 1/2 may be eligible for favorable tax treatment, such as the 10% early withdrawal penalty.

To understand the concept of an annuity, it’s helpful to see it in action. You can find a clear explanation and examples in Annuity Meaning With Example 2024.

Tax Advantages vs. Other Retirement Savings Options

Variable annuities offer tax advantages similar to other retirement savings options, such as traditional IRAs and 401(k) plans. However, there are some key differences:

- Traditional IRAs and 401(k) plans:Contributions to these plans are typically tax-deductible, but withdrawals are taxed as ordinary income. Variable annuities offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn. This can be advantageous if you expect to be in a lower tax bracket in retirement.

- Roth IRAs:Contributions to Roth IRAs are not tax-deductible, but withdrawals in retirement are tax-free. Variable annuities do not offer tax-free withdrawals in retirement.

Tax Consequences of Early Withdrawals

Early withdrawals from variable annuities may be subject to a 10% early withdrawal penalty, in addition to ordinary income tax. This penalty applies to withdrawals taken before age 59 1/2, unless you qualify for an exception. It’s essential to consult with a financial advisor to understand the potential tax consequences of early withdrawals and to develop a withdrawal strategy that minimizes your tax liability.

Wrap-Up

Variable Annuity Air 2024 represents a compelling option for those seeking a diversified and potentially high-growth approach to retirement planning. While it’s crucial to carefully consider the associated risks and potential downsides, the unique combination of variable annuity features and air integration could offer a distinct advantage for investors seeking to maximize their returns and achieve their financial aspirations.

As the market continues to evolve, it’s essential to stay informed about the latest trends and regulatory changes impacting variable annuities. By understanding the intricacies of this complex financial instrument, investors can make well-informed decisions that align with their individual financial goals and risk tolerance.

Question & Answer Hub

What are the key differences between traditional annuities and variable annuities?

An annuity can provide a consistent stream of income for a set period of time, which can be beneficial for retirement planning. Consider exploring the details of a Annuity 75000 2024 to see if it aligns with your financial goals.

Traditional annuities offer a fixed rate of return, while variable annuities provide the potential for growth but also carry the risk of principal loss. Variable annuities are more flexible, allowing investors to customize their investment portfolios.

How does air impact the performance of variable annuities?

The air component, typically a derivative or structured product, can enhance returns by providing leverage or downside protection. However, it also introduces additional complexity and potential risks.

What are the potential tax consequences of early withdrawals from variable annuities?

Early withdrawals from variable annuities may be subject to taxes and penalties, depending on the individual’s circumstances and the type of annuity. It’s essential to consult with a financial advisor to understand the tax implications.