Variable Annuity Annuitization 2024: A Guide to Guaranteed Income is a topic that’s often overlooked in retirement planning, but it can be a powerful tool for securing a steady stream of income in your golden years. Variable annuities offer a unique blend of growth potential and guaranteed payments, making them an attractive option for those seeking a balance between risk and reward.

This

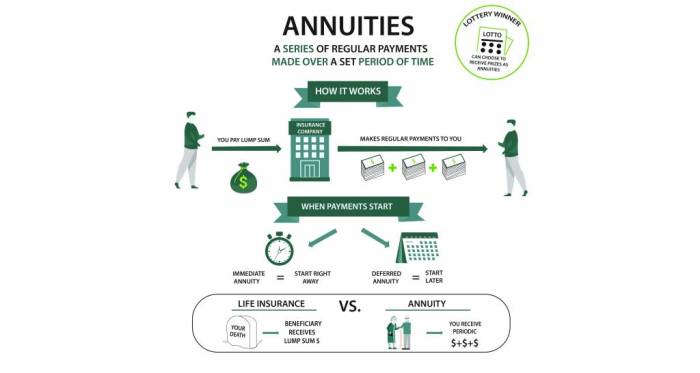

An annuity is a financial product that provides regular payments over a set period. To understand the basic definition and concepts of annuities, visit Annuity Is Meaning 2024 and gain a foundation for financial planning.

Many individuals have questions about annuity calculations, and you’re not alone. Find answers to common questions about annuity calculations in Annuity Calculation Questions And Answers 2024 , making it easier to understand the process.

guide delves into the intricacies of variable annuity annuitization, exploring its benefits, risks, and how it can be integrated into your overall retirement strategy.

The core of variable annuities lies in their sub-accounts, which allow investors to choose from a variety of investment options, including stocks, bonds, and mutual funds. This flexibility allows you to tailor your investment strategy to your risk tolerance and financial goals.

However, it’s important to understand that the value of your variable annuity can fluctuate based on market performance, so there’s always an element of risk involved. Annuitization is the process of converting your variable annuity into a guaranteed stream of income payments for life.

It’s important to understand the tax implications of annuity payments. For information on whether annuity payments are taxable, visit Is Annuity Payments Taxable 2024 and make informed decisions about your finances.

By choosing to annuitize, you trade the potential for growth in your annuity for the certainty of regular payments, regardless of market fluctuations.

One of the key features of annuities is the guarantee of income. To understand the guarantees associated with annuity income, explore Is Annuity Income Guaranteed 2024 and make informed decisions about your financial security.

Contents List

- 1 Variable Annuities: An Overview

- 2 Annuitization in 2024: Current Trends

- 3 Understanding Variable Annuity Annuitization

- 4 Tax Implications of Annuitization: Variable Annuity Annuitization 2024

- 5 Annuitization Strategies and Considerations

- 6 Variable Annuity Annuitization in Retirement Planning

- 7 Case Studies: Variable Annuity Annuitization in Action

- 8 Outcome Summary

- 9 General Inquiries

Variable Annuities: An Overview

Variable annuities are a type of retirement savings product that offers the potential for growth, but also comes with a level of risk. They differ from traditional annuities in that they offer the opportunity to invest in a range of sub-accounts, allowing for the potential for higher returns, but also exposing investors to greater volatility.

Key Features of Variable Annuities

Variable annuities provide investors with a flexible way to save for retirement. They offer a combination of growth potential and tax-deferred accumulation, making them an attractive option for individuals seeking to diversify their retirement portfolio. However, it’s crucial to understand the inherent risks associated with variable annuities before making an investment decision.

Understanding how to calculate an annuity due on your BA II Plus 2024 calculator is essential for financial planning. You can find a detailed guide on Calculating Annuity Due On Ba Ii Plus 2024 to walk you through the steps and formulas.

Benefits of Variable Annuities

- Potential for Growth:Variable annuities allow investors to participate in the growth of the stock market through their investment in sub-accounts. This potential for growth can be significant over the long term.

- Tax-Deferred Accumulation:Earnings on variable annuities are not taxed until they are withdrawn in retirement. This tax deferral allows for compound growth, potentially increasing the overall value of the investment.

- Guaranteed Death Benefit:Many variable annuities offer a guaranteed death benefit, which ensures that a beneficiary will receive a minimum payout, even if the investment value has declined.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income riders or protection against market downturns. These benefits can provide a level of security and peace of mind during retirement.

Drawbacks of Variable Annuities

- Risk of Loss:As variable annuities are linked to the stock market, they are subject to market fluctuations and potential losses. Investors could lose a portion or all of their investment.

- Fees and Expenses:Variable annuities typically have higher fees and expenses compared to traditional annuities. These fees can eat into investment returns, impacting the overall profitability of the investment.

- Complexity:Variable annuities are complex financial products that require a thorough understanding of investment options, fees, and potential risks. They may not be suitable for all investors, especially those seeking a low-risk, guaranteed income stream.

Annuity rates can fluctuate over time. For an overview of annuity rates in 2021 and 2024, visit Annuity Rates 2021 2024 and gain insights into current market trends.

How Variable Annuities Function

Variable annuities work by allowing investors to allocate their contributions to different sub-accounts, each with its own investment strategy and associated risk level. These sub-accounts typically offer a range of investment options, including stocks, bonds, and mutual funds. Investors can customize their portfolio by allocating their funds according to their risk tolerance and investment goals.

Annuitization in 2024: Current Trends

The annuitization rate for variable annuities has been steadily declining in recent years, reflecting a shift in investor preferences towards other retirement income strategies. This trend is influenced by several factors, including low interest rates, market volatility, and the increasing popularity of other retirement income options.

If you’re looking to purchase an annuity in the UK, you’ll want to use a dedicated annuity calculator. For a comprehensive look at UK annuity calculators, visit Annuity Calculator Uk 2020 2024 and compare rates and options.

Factors Driving Annuitization Trends

- Low Interest Rates:Historically, annuitization has been more attractive when interest rates are higher, as it provides a guaranteed income stream based on prevailing rates. However, in an environment of low interest rates, the appeal of annuitization has diminished, as the guaranteed income stream may not be as substantial.

- Market Volatility:The recent market volatility has made some investors hesitant to lock in their investment gains through annuitization, fearing that they may miss out on future growth potential. They prefer to maintain control over their investment decisions, rather than committing to a fixed income stream.

- Alternative Retirement Income Options:The emergence of other retirement income options, such as Roth IRAs, 401(k)s, and Social Security, has provided investors with more diverse choices for generating retirement income. These alternatives offer greater flexibility and control, which has contributed to the decline in annuitization rates.

When considering annuities, you may wonder if they are considered earned income. For a comprehensive understanding of whether annuities are earned income, visit Is Annuity Earned Income 2024 and clarify any questions.

Implications of Annuitization Trends

The decline in annuitization rates has implications for both individuals considering annuitization and the broader annuity market. For individuals, it means that they may need to explore alternative strategies for generating retirement income. For the annuity market, it represents a potential shift in demand, as fewer investors are choosing to annuitize their variable annuities.

Understanding Variable Annuity Annuitization

Annuitization is the process of converting a variable annuity contract into a guaranteed income stream for life. This process involves exchanging the accumulated value of the annuity for a series of regular payments, which are typically guaranteed for life.

Process of Annuitization

The process of annuitization for variable annuities differs from traditional annuity annuitization in that it involves the conversion of a variable investment portfolio into a fixed income stream. The payout amount is determined based on the accumulated value of the annuity at the time of annuitization, as well as the chosen annuitization option.

Are you wondering if an annuity is a good retirement option? Explore the details and potential benefits of annuities for retirement planning at Is Annuity Retirement 2024 and make an informed decision.

Annuitization Options

Variable annuity contracts offer various annuitization options, each with its own payout structure and guarantees. Some common options include:

- Straight Life Annuity:This option provides a guaranteed income stream for life, with payments continuing as long as the annuitant is alive.

- Joint Life Annuity:This option provides a guaranteed income stream for two individuals, typically a couple. Payments continue as long as at least one of the annuitants is alive.

- Period Certain Annuity:This option provides a guaranteed income stream for a specified period of time, regardless of the annuitant’s lifespan. If the annuitant dies before the period ends, payments continue to a beneficiary.

Factors to Consider

When deciding whether and how to annuitize a variable annuity, individuals should consider several factors, including:

- Age and Health:The annuitant’s age and health can influence the amount of guaranteed income they receive. Younger and healthier annuitants typically receive higher payouts, as they are expected to live longer.

- Investment Goals:Annuitization can be a suitable strategy for individuals seeking a guaranteed income stream in retirement. However, it may not be appropriate for those seeking to maintain investment growth potential.

- Financial Circumstances:Individuals should assess their overall financial situation, including their income, expenses, and other assets, before making an annuitization decision.

Tax Implications of Annuitization: Variable Annuity Annuitization 2024

Annuitization can have significant tax implications, as the payments received from a variable annuity are typically taxed as ordinary income. It’s crucial to understand the tax treatment of annuity payments before making an annuitization decision.

Tax Treatment of Annuity Payments

The portion of each annuity payment that represents a return of principal is not taxed. However, the remaining portion, which represents earnings, is taxed as ordinary income. The IRS uses a specific method to determine the taxable portion of each payment, known as the “annuitization method.”

The BA II Plus 2024 calculator is a valuable tool for annuity calculations. Learn how to calculate annuities with this calculator and gain valuable insights into financial planning at Calculate Annuity With Ba Ii Plus 2024.

Tax Liability, Variable Annuity Annuitization 2024

Annuitization can impact an individual’s overall tax liability, especially in relation to other retirement income sources. The tax burden on annuity payments may be higher than other retirement income sources, such as Social Security or pensions.

Annuitization Strategies and Considerations

There are various annuitization strategies that individuals can consider, each with its own pros and cons. The most suitable strategy depends on individual goals, financial circumstances, and risk tolerance.

Annuitization Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Straight Life Annuity | Provides a guaranteed income stream for life, offering longevity protection. | No guarantee of payments beyond the annuitant’s lifespan. |

| Joint Life Annuity | Provides a guaranteed income stream for two individuals, ensuring a continuous income stream for the surviving spouse. | Payments may cease upon the death of the first annuitant. |

| Period Certain Annuity | Guarantees payments for a specified period of time, providing income certainty for a set duration. | May not provide lifelong income, especially if the annuitant lives beyond the period certain. |

Reversionary annuities are a type of annuity that provides payments to a beneficiary after the original annuitant’s death. For a detailed explanation of reversionary annuities, visit Annuity Is Reversionary 2024 and learn how they can benefit your estate planning.

Tailoring Annuitization Strategies

Annuitization strategies can be tailored to meet specific individual goals and financial circumstances. For example, individuals seeking a guaranteed income stream for life may choose a straight life annuity, while those with a spouse may prefer a joint life annuity to ensure continued income for the surviving spouse.

Understanding the concept of an “annuity unit” is crucial when dealing with annuities. For a clear explanation of annuity units, visit Annuity Unit Is 2024 and learn how they affect your financial planning.

Best Practices

When choosing an annuitization strategy, individuals should consult with a qualified financial advisor to ensure they are making an informed decision. It’s important to consider all factors, including age, health, investment goals, and financial circumstances, before making a decision.

Variable Annuity Annuitization in Retirement Planning

Variable annuity annuitization can be an integral part of a comprehensive retirement planning strategy, providing a guaranteed income stream and mitigating longevity risk.

Guaranteed Income Streams

Annuitization provides a guaranteed income stream for life, which can be a valuable component of a retirement plan. This guaranteed income can help ensure financial security during retirement, regardless of market fluctuations.

Longevity Risk Mitigation

Annuitization helps mitigate longevity risk, the risk of outliving one’s retirement savings. By providing a guaranteed income stream for life, annuitization ensures that individuals will have a steady source of income, even if they live longer than expected.

Integration with Other Income Sources

Variable annuity annuitization can be integrated with other retirement income sources, such as Social Security and pensions, to create a diversified and sustainable income stream in retirement.

Case Studies: Variable Annuity Annuitization in Action

To illustrate the practical application of variable annuity annuitization, here are a few case studies:

Case Study 1: John and Mary, a Retired Couple

John and Mary, a retired couple in their late 60s, decided to annuitize their variable annuity to provide a guaranteed income stream for life. They chose a joint life annuity, ensuring that payments would continue as long as either John or Mary was alive.

The annuitization provided them with a steady source of income, allowing them to enjoy their retirement without worrying about outliving their savings.

If you’re studying finance or economics, you’ll likely encounter multiple-choice questions about annuities. For a comprehensive overview of annuity concepts in a multiple-choice format, visit Annuity Is Mcq 2024 and test your knowledge.

Case Study 2: Sarah, a Single Woman in Her 70s

Sarah, a single woman in her 70s, was concerned about longevity risk and wanted to ensure she had a guaranteed income stream for life. She decided to annuitize her variable annuity, choosing a straight life annuity to provide a guaranteed income stream for as long as she lived.

The annuitization gave her peace of mind, knowing that she would have a steady source of income during her retirement years.

Case Study 3: David, a Retiree Seeking Income Certainty

David, a retiree in his early 60s, was seeking income certainty and wanted to protect his retirement savings from market fluctuations. He decided to annuitize a portion of his variable annuity, choosing a period certain annuity to provide a guaranteed income stream for a specific period of time.

The annuitization provided him with a predictable income stream, allowing him to budget for his expenses and enjoy his retirement with confidence.

If you’re a Federal Employee Retirement System (FERS) participant, you may be eligible for an annuity. Learn how to calculate your FERS annuity at Calculate Annuity Fers 2024 and plan for your retirement.

Outcome Summary

Variable annuity annuitization can be a complex topic, but understanding its nuances is essential for making informed decisions about your retirement income. By carefully considering your individual financial situation, goals, and risk tolerance, you can determine if variable annuity annuitization is the right strategy for you.

With the right approach, annuitization can provide you with the financial security and peace of mind you need to enjoy a comfortable and fulfilling retirement.

General Inquiries

What are the key benefits of variable annuity annuitization?

Annuitization offers several key benefits, including guaranteed income for life, protection against market volatility, and the potential for tax advantages.

What are the potential drawbacks of variable annuity annuitization?

The primary drawback of annuitization is that you give up the potential for growth in your annuity. Additionally, you may have limited access to your funds once you annuitize, and there may be surrender charges if you choose to withdraw funds early.

How does annuitization impact my tax liability?

The tax treatment of annuity payments can be complex and depends on various factors, including the type of annuity and your individual tax situation. It’s crucial to consult with a tax advisor to understand the tax implications of annuitization.

If you’re looking to calculate the present value of an annuity with growth, you’ll need to consider the future cash flows and the discount rate. Check out this helpful guide on Pv Annuity With Growth 2024 for a breakdown of the process and how to use a financial calculator.

How can I find a qualified financial advisor to help me with variable annuity annuitization?

You can seek recommendations from trusted sources like family, friends, or professional organizations. You can also use online resources like the Financial Industry Regulatory Authority (FINRA) website to find advisors in your area.