Variable Annuity B Shares 2024 are a type of annuity that allows investors to grow their retirement savings through a variety of investment options. Unlike traditional annuities, which offer a fixed rate of return, variable annuities provide the potential for higher returns but also carry greater risk.

Annuity is a financial product that offers a stream of regular payments for a set period. Our article on Annuity Is Defined As Mcq 2024 explores this concept in more detail.

B sh

Finding the right annuity can be overwhelming. Our guide on Annuity Quotes Online 2024 provides tips on how to compare quotes and find the best deal.

Annuity 3 is a type of annuity that offers a guaranteed minimum return. Learn more about Annuity 3 2024 and its features.

Variable annuities offer potential for growth but also carry some risk. Our article on Variable Annuity 2024 provides a comprehensive overview of this investment product.

ares are a specific class of variable annuities characterized by their fee structure and investment options, making them an attractive choice for certain investors.

This guide will delve into the intricacies of Variable Annuity B Shares, exploring their features, fees, investment options, tax implications, and suitability for various investor profiles. We’ll also compare them to other annuity products and discuss current market trends and future outlook.

If you’re planning for retirement in Kenya, you might want to explore annuities. You can use an Annuity Calculator Kenya 2024 to get a better understanding of how annuities work and how they could fit into your financial plan.

Contents List

- 1 Variable Annuity B Shares: An Overview

- 2 Fee Structure and Expenses

- 3 Investment Options and Performance

- 4 Tax Implications and Considerations

- 5 Suitability and Considerations for Investors: Variable Annuity B Shares 2024

- 6 Comparison with Other Annuity Products

- 7 Current Market Trends and Outlook

- 8 Closing Notes

- 9 Essential FAQs

Variable annuity B shares are a type of annuity contract that offers investors a way to grow their savings through a variety of investment options. These shares are designed to appeal to investors who are looking for a balance between potential growth and long-term stability.

Key Features and Characteristics

Variable annuity B shares are characterized by their unique fee structure, which typically involves a front-end sales charge and ongoing annual fees. These fees are designed to cover the costs of marketing, distribution, and administrative expenses associated with the product.

Annuity units represent the value of your investment in a variable annuity. Learn more about Annuity Units and how they work.

B shares also offer a range of investment options, allowing investors to customize their portfolio according to their risk tolerance and investment goals.

Role in the Annuity Investment Landscape

Variable annuity B shares play a significant role in the annuity investment landscape, providing investors with a diverse and flexible option for retirement planning. They are particularly attractive to investors who are seeking potential growth and are willing to accept a higher level of risk.

If you have a 401k and are considering rolling it over into an annuity, you might want to read our article on Annuity 401k Rollover 2024.

B shares are also a popular choice for investors who are looking for a tax-advantaged way to save for retirement.

For those who prefer using spreadsheets, you can easily calculate annuity values in Excel. Check out our article on Calculate Annuity Value In Excel 2024 to learn how.

Fee Structure and Expenses

The fee structure associated with variable annuity B shares can be complex and may vary depending on the specific contract. However, some common fees include:

Annual Fees

Annual fees are charged on a regular basis to cover the ongoing costs of managing the annuity contract. These fees may include charges for administrative services, investment management, and mortality and expense risk.

If you’re planning to use your National Pension Scheme (NPS) funds for an annuity, you might be interested in learning how to Calculate Annuity Nps 2024.

Surrender Charges

Surrender charges are fees that are assessed when an investor withdraws money from the annuity contract before a certain period. These charges are designed to discourage investors from withdrawing their money prematurely and to protect the insurance company from losses.

Variable annuity B shares are often compared to other share classes, such as A shares and C shares. A shares typically have a lower front-end sales charge but higher annual fees, while C shares have a higher front-end sales charge but lower annual fees.

The best share class for a particular investor will depend on their individual investment goals, time horizon, and risk tolerance.

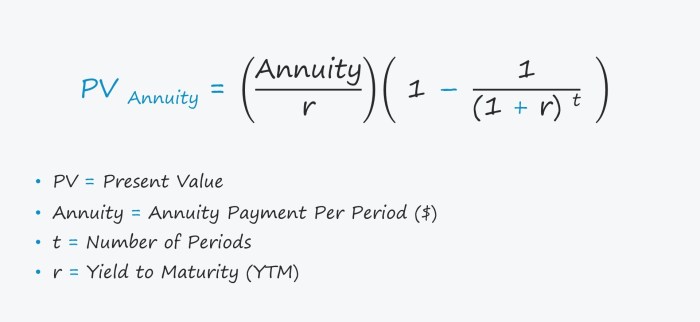

Calculating annuities can seem complicated, but it’s actually quite straightforward. Our guide on How To Calculate Annuities 2024 provides step-by-step instructions and helpful tips.

Investment Options and Performance

Variable annuity B shares offer a wide range of investment options, typically including mutual funds, exchange-traded funds (ETFs), and separate accounts. These options allow investors to diversify their portfolio and tailor their investment strategy to their specific needs.

Performance History and Potential Risks

The performance of variable annuity B shares can fluctuate significantly depending on the performance of the underlying investment options. Investors should be aware of the potential risks associated with these investments, including market volatility, inflation, and interest rate changes.

While annuities are typically associated with retirement planning, they can also play a role in healthcare. Our article on Annuity Health Careers 2024 explores this connection.

Market fluctuations can have a significant impact on the value of variable annuity B shares. When markets are rising, the value of the shares may increase, but when markets are falling, the value of the shares may decrease. Investors should be prepared for potential fluctuations in the value of their investments.

If you’re using a financial calculator like the BA II Plus, you’ll need to know how to calculate annuity due. Our article on Calculating Annuity Due On Ba Ii Plus 2024 provides detailed instructions.

Tax Implications and Considerations

Variable annuity B shares offer certain tax advantages, but investors should be aware of the tax implications associated with these investments.

Understanding the tax implications of annuities is crucial. While it’s important to note that annuity income is not always considered capital gains, you can find out more about the specifics by reading our article on Is Annuity Income Capital Gains 2024.

Tax Treatment of Withdrawals and Distributions

Withdrawals from a variable annuity B share contract are generally taxed as ordinary income. However, distributions from the contract after the investor reaches age 59 1/2 may qualify for favorable tax treatment as qualified retirement income.

Tax Considerations for Investment Decisions

Investors should consider the tax implications of investing in variable annuity B shares when making investment decisions. For example, investors in a high tax bracket may want to consider the tax implications of withdrawals before making a significant investment in B shares.

Variable annuity B shares may be suitable for certain investors, but they are not appropriate for everyone.

Suitability for Different Investor Profiles

B shares may be suitable for investors who are seeking potential growth, have a long time horizon, and are comfortable with a higher level of risk. However, they may not be suitable for investors who are risk-averse or have a short time horizon.

Factors to Consider

Investors should carefully consider the following factors when evaluating variable annuity B shares:

- Fee structure

- Investment options

- Performance history

- Tax implications

- Risk tolerance

- Time horizon

Potential Benefits and Drawbacks

Variable annuity B shares offer several potential benefits, including:

- Potential for growth

- Tax advantages

- Flexibility

However, they also have some drawbacks, such as:

- High fees

- Potential for losses

- Complexity

Comparison with Other Annuity Products

Variable annuity B shares can be compared to other annuity products, such as traditional annuities, indexed annuities, and variable life insurance.

Advantages and Disadvantages

Each annuity product type has its own advantages and disadvantages.

- Traditional annuities offer guaranteed income payments but may have lower growth potential.

- Indexed annuities offer protection against market losses but may have limited growth potential.

- Variable life insurance provides death benefits and investment options but may have higher fees and complexity.

Table Summarizing Key Features

| Annuity Product Type | Key Features | Advantages | Disadvantages ||—|—|—|—|| Variable Annuity B Shares | Investment options, potential growth, tax advantages | Potential for growth, flexibility | High fees, potential for losses || Traditional Annuities | Guaranteed income payments, low risk | Guaranteed income, low risk | Limited growth potential || Indexed Annuities | Protection against market losses, guaranteed minimum return | Protection against losses, guaranteed return | Limited growth potential || Variable Life Insurance | Death benefits, investment options | Death benefits, investment options | High fees, complexity |

Current Market Trends and Outlook

The variable annuity market is constantly evolving, with new products and features being introduced regularly.

Current Market Trends

Some current market trends affecting the variable annuity market include:

- Low interest rates

- Increased demand for guaranteed income products

- Growing popularity of alternative investments

Winning the lottery can be a life-changing event, and you might want to consider using an Annuity Calculator Lottery 2024 to explore your options.

These trends may have a significant impact on the value and performance of variable annuity B shares. For example, low interest rates may make it more difficult for B shares to achieve high returns, while the increased demand for guaranteed income products may lead to the development of new products that compete with B shares.

Future Outlook

The future outlook for variable annuity B shares is uncertain. However, they are likely to remain a popular investment option for investors who are seeking potential growth and are willing to accept a higher level of risk. The performance of B shares will continue to be influenced by market conditions and the overall economy.

Closing Notes

Variable Annuity B Shares 2024 offer a unique approach to retirement planning, combining the potential for growth with the security of an annuity. Understanding their features, fees, and risks is crucial for investors seeking to make informed decisions. While B shares may not be suitable for all investors, they can be a valuable tool for those seeking to diversify their portfolios and potentially enhance their retirement income.

As you explore this investment option, consider your risk tolerance, investment goals, and financial situation to determine if B shares align with your overall financial strategy.

Essential FAQs

What is the difference between variable annuity B shares and other share classes (A, C, etc.)?

When considering a variable annuity, it’s important to understand the disclosures required. Learn more about what information must be included in a Variable Annuity Disclosure.

The main difference lies in their fee structures. B shares typically have higher initial fees but lower ongoing expenses compared to A shares, which have lower initial fees but higher ongoing expenses. C shares, on the other hand, have front-end loads and may have higher ongoing expenses as well.

The best choice depends on your investment horizon and risk tolerance.

What are the potential risks associated with variable annuity B shares?

Variable annuities are subject to market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments. Additionally, there is a risk of losing your principal investment, especially if the market experiences a downturn.

It’s important to carefully consider your risk tolerance and investment goals before investing in variable annuities.

Are there any tax advantages to investing in variable annuity B shares?

The tax treatment of variable annuities can be complex and depends on factors such as the type of withdrawal, the age of the annuitant, and the investment strategy. It’s essential to consult with a tax professional to understand the tax implications of investing in variable annuities.