Variable Annuity Basics 2024: In a world where retirement planning is more crucial than ever, understanding different investment strategies is paramount. Variable annuities, with their potential for growth and guaranteed income features, offer a unique approach to securing your future.

Calculating annuity values can seem complex, but real-world examples can make it easier to understand. Calculate Annuity Example 2024 provides practical examples to illustrate how annuity calculations work, helping you grasp the concepts.

This guide delves into the intricacies of variable annuities, explaining how they work, their benefits and drawbacks, and how they can fit into your overall financial plan.

For those in the UK, specific annuity calculators are available to cater to local regulations. Annuity Calculator Uk 2024 provides a dedicated calculator for UK residents, helping them estimate their annuity payments based on UK-specific factors.

Variable annuities differ from fixed annuities by offering the potential for higher returns through investments in sub-accounts that can fluctuate with the market. While this potential for growth comes with risk, it also presents opportunities for long-term wealth accumulation. This guide will help you navigate the complexities of variable annuities, equipping you with the knowledge to make informed decisions about your financial future.

The timing of annuity payments is crucial for financial planning. Annuity Date Is 2024 provides information on the date annuity payments are typically made, helping you understand the payment schedule and incorporate it into your budget.

Contents List

- 1 Variable Annuities: An Introduction

- 2 Understanding Variable Annuity Components: Variable Annuity Basics 2024

- 3 Variable Annuity Benefits and Drawbacks

- 4 Variable Annuity Contract Features

- 5 Choosing the Right Variable Annuity

- 6 Variable Annuities and Retirement Planning

- 7 Closing Summary

- 8 Common Queries

Variable Annuities: An Introduction

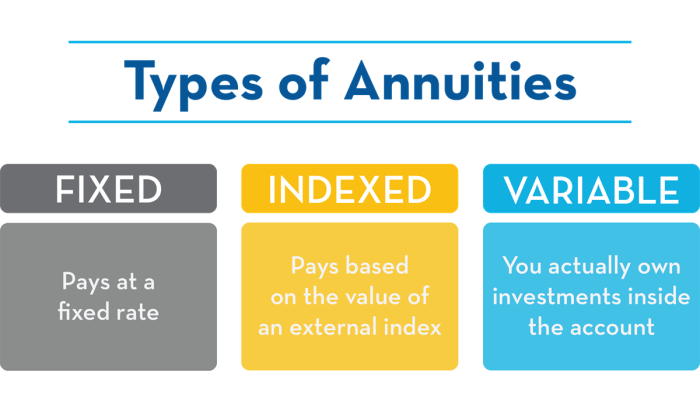

Variable annuities are a type of insurance product that offers the potential for growth while providing tax deferral and death benefit options. They differ from fixed annuities in that the value of the investment is not guaranteed and can fluctuate based on the performance of the underlying investment options.

Understanding how to calculate annuity payments is crucial for planning your retirement. How To Calculate An Annuity Payment 2024 provides step-by-step instructions and formulas to help you calculate your expected annuity payments.

Variable annuities are designed to help individuals accumulate and protect their wealth for retirement. They are particularly well-suited for investors with a longer time horizon and a higher risk tolerance. These individuals are comfortable with the potential for fluctuations in their investment value and are willing to accept some risk in exchange for the possibility of higher returns.

Annuity payments can be structured in various ways, including as a stream of regular payments. Is Annuity Stream 2024 delves into the concept of an annuity stream, explaining how it works and its potential advantages.

Key Features of Variable Annuities

- Potential for Growth:Variable annuities allow investors to participate in the growth of the stock market or other asset classes through sub-accounts that invest in mutual funds or exchange-traded funds (ETFs).

- Tax Deferral:Earnings on the investment within a variable annuity are not taxed until they are withdrawn, providing tax deferral benefits.

- Death Benefit Options:Variable annuities typically offer death benefit options that guarantee a minimum payout to beneficiaries in the event of the policyholder’s death.

- Risk:The value of a variable annuity is not guaranteed and can fluctuate based on the performance of the underlying investments. This means that investors could lose money if the market declines.

Understanding Variable Annuity Components: Variable Annuity Basics 2024

Variable annuities are structured with sub-accounts that serve as separate investment compartments. These sub-accounts offer various investment options, allowing investors to customize their portfolio based on their risk tolerance and investment goals. The insurance company managing the variable annuity oversees the sub-accounts and charges fees for its services.

Annuity interest rates can vary depending on market conditions. Annuity 8.5 Percent 2024 delves into the implications of an 8.5% interest rate on an annuity, exploring how it can impact your overall returns.

Sub-Accounts and Investment Options

Within a variable annuity, investors can choose from a range of sub-accounts that invest in different asset classes, such as:

- Stock Funds:These sub-accounts invest in a variety of stocks, aiming for capital appreciation.

- Bond Funds:These sub-accounts invest in bonds, providing income and potentially some capital appreciation.

- Money Market Funds:These sub-accounts invest in short-term debt securities, offering a relatively safe and liquid investment option.

- Target-Date Funds:These sub-accounts automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

Insurance Company Role and Fees

The insurance company managing the variable annuity plays a crucial role in:

- Selecting and monitoring investment options:The insurer carefully chooses the sub-accounts available to policyholders, ensuring a diverse range of investment choices.

- Providing administrative services:The insurer manages the sub-accounts, handles transactions, and provides statements to policyholders.

- Charging fees:The insurer charges fees for its services, which are typically deducted from the sub-account balances. These fees can include mortality and expense charges, as well as administrative fees.

Variable Annuity Benefits and Drawbacks

Variable annuities offer several potential benefits, but they also come with inherent risks. Understanding both sides is essential for making informed investment decisions.

To make informed financial decisions, it’s important to understand how to calculate annuity values. Calculating Annuity Values 2024 offers a detailed guide to calculating annuity values, covering different types of annuities and their respective formulas.

Benefits of Variable Annuities

- Potential for Growth:Variable annuities allow investors to participate in the growth of the stock market or other asset classes.

- Tax Deferral:Earnings on the investment within a variable annuity are not taxed until they are withdrawn.

- Death Benefit Options:Variable annuities typically offer death benefit options that guarantee a minimum payout to beneficiaries in the event of the policyholder’s death.

- Living Benefit Riders:Some variable annuities offer living benefit riders, which provide guarantees for income or principal protection.

Risks of Variable Annuities

- Market Volatility:The value of a variable annuity is not guaranteed and can fluctuate based on the performance of the underlying investments. This means that investors could lose money if the market declines.

- Investment Losses:The investment options within a variable annuity are subject to market risk, and investors could lose money if the investments underperform.

- Surrender Charges:Many variable annuities have surrender charges that are imposed if the policy is withdrawn within a certain period. These charges can be significant, particularly in the early years of the contract.

- High Fees:Variable annuities typically have higher fees than other investment products, which can erode returns over time.

Variable Annuities vs. Other Investment Options

| Feature | Variable Annuity | Mutual Funds | Exchange-Traded Funds (ETFs) |

|---|---|---|---|

| Tax Deferral | Yes | No | No |

| Death Benefit Options | Yes | No | No |

| Fees | Higher | Lower | Lower |

| Risk | Higher | Moderate | Moderate |

Variable Annuity Contract Features

Variable annuity contracts include various features that can significantly impact the policyholder’s benefits and obligations. Understanding these features is essential for making informed decisions about a variable annuity.

The BA II Plus calculator is a popular tool for financial calculations, including annuities. Calculating Annuity Ba Ii Plus 2024 explains how to utilize the BA II Plus calculator to calculate annuity values, making it easier to understand your potential returns.

Key Contract Features

- Death Benefit:The death benefit is a guaranteed payment to beneficiaries in the event of the policyholder’s death. The death benefit can be a fixed amount or a percentage of the account value.

- Living Benefit Riders:These riders provide additional guarantees for income or principal protection during the policyholder’s lifetime. Common living benefit riders include guaranteed income for life and guaranteed minimum death benefit (GMDB).

- Surrender Charges:These charges are imposed if the policy is withdrawn within a certain period. Surrender charges are typically highest in the early years of the contract and gradually decrease over time.

Guaranteed Minimum Death Benefit (GMDB), Variable Annuity Basics 2024

A GMDB guarantees that the beneficiary will receive at least a certain minimum amount, even if the account value has declined. The GMDB is typically a percentage of the initial investment amount or a fixed amount.

If you’re looking to calculate annuity payments, there are various tools available, including Visual Basic. Annuity Calculator Visual Basic 2024 offers a comprehensive guide to creating an annuity calculator using Visual Basic, allowing you to easily estimate your potential future payments.

Living Benefit Riders

Living benefit riders can provide valuable protection against market volatility and longevity risk. Some common types of living benefit riders include:

- Guaranteed Income for Life:This rider provides a guaranteed stream of income for life, regardless of the account value.

- Guaranteed Minimum Withdrawal Benefit (GMWB):This rider guarantees that the policyholder can withdraw a certain minimum amount each year, even if the account value has declined.

- Guaranteed Principal Protection:This rider guarantees that the policyholder will not lose their principal investment, even if the account value declines.

Choosing the Right Variable Annuity

Selecting the right variable annuity requires careful consideration of individual investment goals, risk tolerance, and financial situation. It is important to compare different products and understand the associated fees and features before making a decision.

While annuities and pensions share similarities, they are distinct financial products. Is Annuity Same As Pension 2024 clarifies the key differences between annuities and pensions, helping you understand their unique features and benefits.

Steps to Choose a Variable Annuity

- Define Your Investment Goals:Determine your financial objectives and the time horizon for your investment. Are you saving for retirement, seeking income during retirement, or protecting your principal?

- Assess Your Risk Tolerance:Evaluate your comfort level with market volatility. How much risk are you willing to take to achieve your investment goals?

- Research Variable Annuity Products:Explore different variable annuity products available in the market, considering their features, fees, and investment options.

- Compare Key Features and Fees:Create a table comparing the key features and fees of different variable annuity products. Consider factors such as death benefit options, living benefit riders, surrender charges, and investment options.

- Evaluate the Insurer’s Financial Strength:Ensure that the insurance company issuing the variable annuity is financially sound and has a strong track record.

- Consult with a Financial Advisor:Seek advice from a qualified financial advisor who can help you choose a variable annuity that aligns with your individual circumstances and investment goals.

Factors to Consider

- Insurer’s Financial Strength:Choose an insurer with a strong financial rating and a history of stability.

- Investment Options:Ensure that the variable annuity offers a wide range of investment options that align with your risk tolerance and investment goals.

- Fees:Compare the fees associated with different variable annuity products, including mortality and expense charges, administrative fees, and surrender charges.

- Death Benefit Options:Evaluate the death benefit options available, including the guaranteed minimum death benefit (GMDB) and the potential for a payout based on the account value.

- Living Benefit Riders:Consider the availability and cost of living benefit riders, such as guaranteed income for life, guaranteed minimum withdrawal benefit (GMWB), and guaranteed principal protection.

Variable Annuities and Retirement Planning

Variable annuities can play a significant role in retirement planning, offering potential for growth, tax deferral, and income generation during retirement. However, it is important to understand their limitations and consider them within a comprehensive retirement planning strategy.

Annuity payments can provide a sense of financial security, but it’s important to understand their certainty. Is Annuity Certain 2024 examines the level of certainty associated with annuity payments, addressing potential risks and factors that can affect their consistency.

Variable Annuities for Retirement Income

Variable annuities can provide a stream of income during retirement through withdrawals from the accumulated account value. The amount of income received will depend on the investment performance and the withdrawal strategy chosen.

An annuity is a financial product that provides regular payments for a specific period. An Annuity Is Known 2024 explores the key characteristics and features of annuities, offering insights into how they work and their potential benefits.

Longevity Risk Protection

Variable annuities with living benefit riders can help protect against longevity risk, ensuring a guaranteed income stream for life, even if the account value declines. These riders can provide peace of mind for individuals concerned about outliving their savings.

Tax Implications

Withdrawals from a variable annuity are taxed as ordinary income. However, qualified withdrawals made after age 59 1/2 may be eligible for favorable tax treatment under the rules for qualified retirement plans.

Closing Summary

Understanding variable annuities is a crucial step in crafting a comprehensive retirement strategy. By carefully evaluating your risk tolerance, investment goals, and long-term financial needs, you can determine if variable annuities are a suitable fit for your portfolio. Remember, seeking professional advice from a qualified financial advisor can provide valuable insights and guidance as you navigate this complex world of investments.

It’s important to understand the tax implications of annuities, especially in 2024. Annuity Is Taxable 2024 provides a detailed explanation of how annuities are taxed, helping you make informed financial decisions.

Common Queries

Are variable annuities suitable for everyone?

Variable annuities are best suited for individuals with a longer time horizon and a moderate to high risk tolerance. They are generally not recommended for those nearing retirement or who need guaranteed income streams.

For those seeking a shorter-term annuity, a 3-year annuity calculator can be a helpful tool. 3 Year Annuity Calculator 2024 provides a specialized calculator designed to help you estimate payments for a 3-year annuity period.

How do I choose the right variable annuity?

Consider factors such as the insurance company’s financial strength, the available investment options, fees, and the features offered by the contract, including death benefits and living benefit riders.

What are the tax implications of variable annuities?

Withdrawals from variable annuities are generally taxed as ordinary income. However, there are specific tax rules governing withdrawals before age 59 1/2 and during retirement.

Are there any penalties for withdrawing from a variable annuity?

Yes, variable annuity contracts typically have surrender charges that can apply to withdrawals within a certain period. These charges can vary depending on the contract terms.

If you’re considering an annuity from LIC, it’s important to understand its tax implications. Is Annuity From Lic Taxable 2024 explores the taxability of annuities from LIC, providing insights into how these payments are treated for tax purposes.