Variable Annuity Contracts Contain Which Of The Following Guarantees 2024? This question is crucial for anyone considering variable annuities as a retirement savings strategy. These contracts offer a unique blend of growth potential and guaranteed protection, but understanding the specific guarantees is essential to making informed decisions.

Annuity due payments are made at the beginning of each period, making them slightly different from regular annuities. To learn more about how to calculate annuity due payments, check out How To Calculate An Annuity Due 2024.

Variable annuities are a type of insurance contract that allows you to invest in a variety of sub-accounts, similar to mutual funds. Unlike traditional fixed annuities, variable annuities offer the potential for higher returns but also come with the risk of losing principal.

If you’re in the UK, you can use the government’s annuity calculator to estimate your potential income. Find more information at Annuity Calculator Uk Gov 2024.

However, they typically include certain guarantees designed to protect your investment from market volatility and ensure a minimum level of income during retirement.

Understanding the potential returns on your annuity is crucial. Read Calculate Annuity Return 2024 to learn how to calculate your expected income.

Contents List

Introduction to Variable Annuity Contracts

Variable annuity contracts are a type of investment product that offers a combination of growth potential and guaranteed income. They are designed to provide investors with the opportunity to earn higher returns than traditional fixed annuities, while also offering some protection against market downturns.

Looking for an annuity with a guaranteed interest rate? You might be interested in Annuity 4 Percent 2024 , which offers a fixed rate of return for a set period.

Variable annuities are complex financial instruments, and it is crucial to understand their features, benefits, and risks before investing.

Annuity contingent payments, where the payout depends on certain events, are gaining popularity. If you’re curious about the specifics of this type of annuity, check out this article on Annuity Contingent Is 2024.

Key Features and Benefits of Variable Annuities

Variable annuities have several key features that distinguish them from other types of annuities:

- Investment Growth Potential:Variable annuities allow investors to choose from a variety of investment options, such as mutual funds, stocks, and bonds. This provides the potential for higher returns than fixed annuities, which typically offer a guaranteed interest rate.

- Tax-Deferred Growth:Earnings on variable annuities are not taxed until they are withdrawn, which can provide tax advantages for long-term investors.

- Guaranteed Income Options:Variable annuities often offer guaranteed income options, such as guaranteed minimum income benefits or guaranteed lifetime withdrawal benefits. These options can provide a level of security and income certainty in retirement.

Comparison with Other Types of Annuities

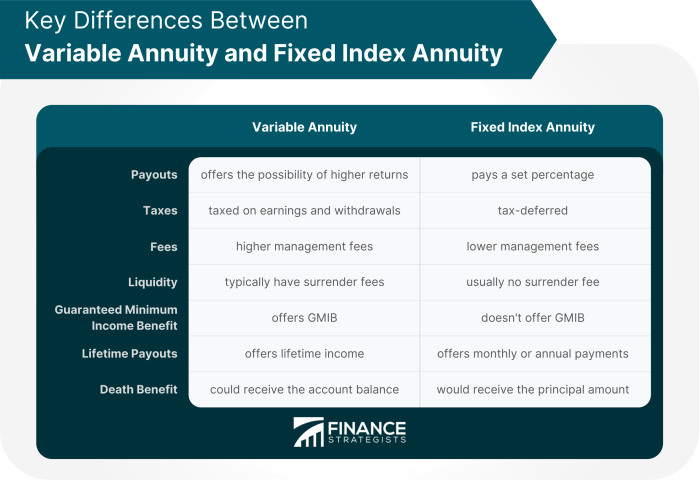

Variable annuities differ from other types of annuities in several ways:

- Fixed Annuities:Fixed annuities provide a guaranteed interest rate, which means that your returns are predictable. However, fixed annuities typically offer lower returns than variable annuities.

- Indexed Annuities:Indexed annuities offer returns that are linked to the performance of a specific market index, such as the S&P 500. Indexed annuities provide some protection against market downturns, but they typically have lower growth potential than variable annuities.

Guarantees Offered by Variable Annuity Contracts: Variable Annuity Contracts Contain Which Of The Following Guarantees 2024

Variable annuity contracts typically offer a variety of guarantees to protect investors from market risk and ensure income security.

Annuity payments can be fixed or variable, depending on the contract terms. You can learn more about variable annuities by reading Annuity Is Variable 2024.

Death Benefit Guarantee

A death benefit guarantee ensures that a beneficiary will receive a minimum payout upon the death of the annuitant. This guarantee protects the beneficiary from losing the principal investment if the market value of the annuity falls below a certain level.

Planning for retirement? You might find it helpful to use an annuity calculator. Check out this resource on Annuity Calculator Excel Template 2024 to get started.

Death benefit guarantees can be structured in various ways, such as:

- Guaranteed Principal Protection:This type of guarantee ensures that the beneficiary will receive at least the original principal amount invested, regardless of market performance.

- Guaranteed Minimum Death Benefit:This type of guarantee ensures that the beneficiary will receive a minimum death benefit, which may be higher than the principal amount invested. The minimum death benefit may be fixed or may increase over time.

Minimum Interest Rate Guarantee

A minimum interest rate guarantee ensures that the annuity will earn a minimum interest rate, even if the market value of the annuity falls below a certain level. This guarantee provides some protection against market downturns and ensures that the annuitant will receive a minimum return on their investment.

Wondering what a $75,000 annuity might look like? You can explore the details of Annuity 75000 2024 to see how this type of annuity could work for you.

Living Benefit Guarantees

Living benefit guarantees provide income protection and longevity protection for the annuitant during their lifetime. These guarantees can take various forms, including:

- Guaranteed Minimum Income Benefit (GMIB):A GMIB guarantees a minimum income stream for the annuitant, regardless of market performance. The income stream may be fixed or may increase over time.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):A GLWB guarantees that the annuitant can withdraw a certain percentage of their account value each year, for life, without running out of money. This guarantee can provide peace of mind and income security in retirement.

- Guaranteed Minimum Accumulation Benefit (GMAB):A GMAB guarantees that the account value will never fall below a certain level, even if the market value of the annuity falls below that level. This guarantee can provide some protection against market downturns and ensure that the annuitant will not lose their principal investment.

Annuity rates can vary depending on the term length. For example, you might be interested in Annuity 3 Year Rates 2024 to see the current interest rates for a three-year annuity.

Other Potential Guarantees, Variable Annuity Contracts Contain Which Of The Following Guarantees 2024

In addition to the guarantees mentioned above, variable annuity contracts may offer other potential guarantees, such as:

- Guaranteed Surrender Value:This guarantee ensures that the annuitant will receive a minimum payout if they surrender the annuity before it matures.

- Guaranteed Annuity Payment:This guarantee ensures that the annuitant will receive a minimum annuity payment, even if the market value of the annuity falls below a certain level.

Outcome Summary

Choosing a variable annuity is a significant financial decision that requires careful consideration. By understanding the guarantees offered and how they align with your individual needs and risk tolerance, you can make an informed choice that supports your long-term financial goals.

If you’re planning for retirement with a spouse, a joint and survivor annuity might be a good option. You can learn more about these types of annuities in Annuity Joint And Survivor 2024.

Remember, the guarantees are a key component of variable annuities, providing protection and peace of mind for your retirement savings.

Key Questions Answered

How do variable annuity guarantees work?

Variable annuity guarantees are designed to protect your investment against certain risks, such as market downturns or longevity. These guarantees typically come with specific conditions and limitations, so it’s important to read the contract carefully.

Are variable annuities right for everyone?

Variable annuities are not suitable for everyone. They are generally more appropriate for investors with a long-term investment horizon who are comfortable with some level of market risk. If you are seeking guaranteed returns or have a short-term investment timeframe, a fixed annuity might be a better option.

What are the potential downsides of variable annuities?

Annuity contracts can offer guaranteed payments for a specified duration, known as the “certain period.” For example, you might be interested in Annuity 20 Year Certain 2024 if you want to ensure a steady stream of income for two decades.

Variable annuities can have high fees and complex terms. They also offer no guarantees of principal protection, and the investment performance is tied to the performance of the underlying sub-accounts.

Canadians can use an annuity calculator to estimate their potential income. Check out this resource on Annuity Calculator Canada 2024 to get started.

Annuity payments can be a source of income during retirement. If you’re curious about the tax implications of annuity income, you can read more at Is Annuity Income 2024.

Joint life annuities provide income for two individuals. If you’re interested in learning more about these types of annuities, you can find information at Annuity Calculator Joint Life 2024.

An annuity is a financial product that provides a stream of payments over time. To learn more about the definition of an annuity, you can read this article on Annuity Is Defined As Mcq 2024.