Variable Annuity Disclosure Is Required To Contain 2024, a significant change impacting both investors and financial institutions. This new regulation mandates enhanced disclosure requirements for variable annuities, aiming to increase transparency and investor understanding. The 2024 rules aim to provide investors with a clearer picture of the risks and potential rewards associated with variable annuities, ultimately empowering them to make more informed investment decisions.

Understanding the different types of annuities is crucial. You can explore the concept of an “ordinary” annuity in 2024 by visiting Annuity Is Ordinary 2024 , which explains its characteristics and how it differs from other annuity types.

The 2024 disclosure requirements are a response to evolving investor needs and the increasing complexity of the variable annuity market. They aim to address concerns about potential investor confusion and ensure that all relevant information is readily available to those considering variable annuity investments.

Contents List

- 1 Variable Annuity Disclosure Requirements in 2024

- 2 Key Elements of the 2024 Disclosure

- 3 Impact of the 2024 Disclosure on Investors: Variable Annuity Disclosure Is Required To Contain 2024

- 3.1 Potential Benefits of the 2024 Disclosure Requirements for Investors

- 3.2 How the Enhanced Disclosures Can Improve Investor Understanding of Variable Annuities

- 3.3 Potential Challenges Investors May Face in Navigating the New Disclosure Requirements

- 3.4 Benefits and Challenges of the 2024 Disclosure Rules for Investors

- 4 Final Thoughts

- 5 FAQ Summary

Variable Annuity Disclosure Requirements in 2024

The 2024 variable annuity disclosure requirements are a significant development in the financial services industry, aimed at enhancing transparency and investor protection. These new rules impose stricter disclosure obligations on financial institutions, impacting how they present information about variable annuities to investors.

Are you curious about how to calculate the annual annuity for 2024? You can find detailed information on How To Calculate Annual Annuity 2024 which explains the process step-by-step.

The 2024 disclosure requirements build upon previous regulations, introducing new elements and emphasizing clarity and comprehensiveness. This article delves into the key aspects of the 2024 disclosure rules, exploring their implications for investors and the financial industry.

Understanding HVAC calculations is crucial for efficient system design. J Calculation Hvac 2024 can provide you with valuable information on “J” calculations and their role in HVAC design.

Significance of the 2024 Variable Annuity Disclosure Requirements

The 2024 variable annuity disclosure requirements are crucial for several reasons. They aim to address concerns about the complexity of variable annuities and ensure investors have the necessary information to make informed decisions. The enhanced disclosure rules are designed to improve investor understanding of the risks, fees, and potential benefits associated with these products.

By providing clearer and more comprehensive information, the 2024 regulations aim to empower investors to make more informed choices about their investments.

Specific Changes Implemented in the 2024 Disclosure Rules

The 2024 disclosure rules introduce several significant changes compared to previous regulations. These changes focus on enhancing clarity, comprehensiveness, and investor understanding. Some key changes include:

- Expanded Risk Disclosure:The 2024 rules require a more detailed and comprehensive disclosure of the risks associated with variable annuities, including market risk, interest rate risk, and mortality risk. This expanded risk disclosure aims to provide investors with a more thorough understanding of the potential downsides of investing in variable annuities.

- Clearer Fee Presentation:The new rules require a more transparent presentation of fees, including both explicit and implicit fees. This includes fees associated with the underlying investment options, as well as fees charged by the insurance company for the annuity contract. The goal is to make it easier for investors to compare the costs of different variable annuity products.

- Enhanced Performance Disclosure:The 2024 rules require a more detailed disclosure of the historical performance of variable annuities. This includes both the performance of the underlying investment options and the overall performance of the annuity contract. The enhanced performance disclosure aims to provide investors with a better understanding of the potential returns they can expect from variable annuities.

Not all annuities are paid out immediately. Learn about deferred annuities, which involve a delay in receiving payments, by visiting Annuity Is Deferred 2024 , where you can explore their characteristics and potential benefits.

- Improved Language and Format:The 2024 disclosure rules emphasize the use of clear and concise language that is easy for investors to understand. The rules also require that disclosures be presented in a user-friendly format, such as bullet points, tables, and charts.

Comparison with Previous Regulations

The 2024 disclosure requirements represent a significant evolution from previous regulations. While previous regulations required certain disclosures about variable annuities, the 2024 rules are more comprehensive and detailed. For instance, the 2024 rules expand the scope of risk disclosure, require a more transparent presentation of fees, and emphasize the use of clear and concise language.

Key Aspects of the 2024 Disclosure Rules that Are Most Impactful for Investors

The most impactful aspects of the 2024 disclosure rules for investors include:

- Expanded Risk Disclosure:The enhanced risk disclosure provides investors with a more comprehensive understanding of the potential downsides of investing in variable annuities, enabling them to make more informed decisions about whether these products are appropriate for their investment goals and risk tolerance.

- Clearer Fee Presentation:The more transparent presentation of fees allows investors to easily compare the costs of different variable annuity products, making it easier to choose the option that best meets their needs.

- Enhanced Performance Disclosure:The detailed disclosure of historical performance provides investors with a better understanding of the potential returns they can expect from variable annuities, allowing them to assess whether these products are likely to meet their investment goals.

Key Elements of the 2024 Disclosure

The 2024 disclosure requirements encompass a wide range of information that must be provided to investors. These disclosures are designed to ensure investors have a thorough understanding of the features, risks, and potential benefits of variable annuities. The following is a comprehensive list of the required disclosures in the 2024 regulations:

- Product Description:A clear and concise description of the variable annuity product, including its features, benefits, and risks. This description should be tailored to the specific product being offered and should be easy for investors to understand.

- Investment Options:A detailed description of the investment options available within the variable annuity, including their investment objectives, strategies, and risk profiles. This information should be presented in a clear and concise manner, making it easy for investors to compare the different investment options.

- Fees and Expenses:A transparent presentation of all fees and expenses associated with the variable annuity, including both explicit and implicit fees. This should include fees charged by the insurance company for the annuity contract, as well as fees associated with the underlying investment options.

The disclosure should clearly explain the impact of these fees on the investor’s returns.

- Risk Disclosure:A comprehensive disclosure of the risks associated with variable annuities, including market risk, interest rate risk, mortality risk, and other relevant risks. The disclosure should be written in plain language and should provide investors with a clear understanding of the potential downsides of investing in variable annuities.

- Performance Disclosure:A detailed disclosure of the historical performance of the variable annuity, including both the performance of the underlying investment options and the overall performance of the annuity contract. The disclosure should be presented in a clear and user-friendly format, such as tables and charts, and should provide investors with a realistic understanding of the potential returns they can expect from variable annuities.

Curious about the different payment modes associated with annuities? You can learn more about how annuities are structured as a sequence of payments on Annuity Is Sequence Of Mode Of Payment 2024 , which delves into the different payment options available.

- Tax Implications:A clear explanation of the tax implications of investing in a variable annuity, including the tax treatment of distributions, withdrawals, and death benefits. The disclosure should be written in plain language and should provide investors with a clear understanding of the potential tax consequences of their investment.

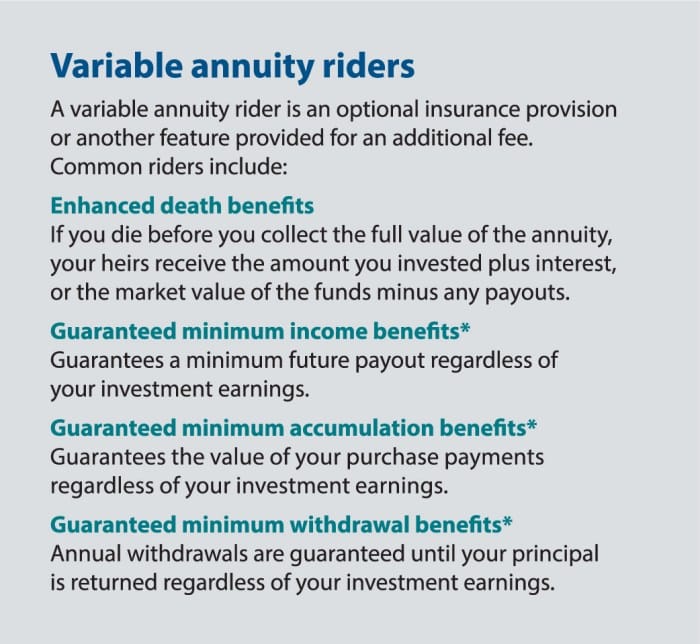

- Guarantees and Limitations:A clear explanation of any guarantees and limitations associated with the variable annuity, including any guarantees on principal or interest, as well as any limitations on withdrawals or death benefits. The disclosure should be written in plain language and should provide investors with a clear understanding of the scope and limitations of any guarantees.

If you’re interested in a 750k annuity in 2024, Annuity 750k 2024 can provide insights into the potential benefits, factors to consider, and how it might fit into your financial plan.

- Withdrawal Provisions:A clear explanation of the withdrawal provisions associated with the variable annuity, including any surrender charges, penalties, or restrictions on withdrawals. The disclosure should be written in plain language and should provide investors with a clear understanding of the conditions under which they can access their funds.

Are annuities a good investment? Annuity Is Good 2024 provides insights into the potential advantages and disadvantages of annuities, helping you determine if they’re right for your financial goals.

- Death Benefits:A clear explanation of the death benefit provisions associated with the variable annuity, including the type of death benefit, the payout amount, and any limitations on the death benefit. The disclosure should be written in plain language and should provide investors with a clear understanding of the benefits they will receive in the event of their death.

- Other Relevant Information:Any other information that is relevant to investors’ understanding of the variable annuity, such as information about the insurance company, the product’s regulatory status, and the investor’s rights and responsibilities. This information should be presented in a clear and concise manner, making it easy for investors to access the information they need.

Purpose and Importance of Each Required Disclosure

Each of the required disclosures serves a specific purpose and is important for ensuring investors have the information they need to make informed decisions about variable annuities. The purpose and importance of each disclosure are Artikeld below:

- Product Description:This disclosure provides investors with a basic understanding of the variable annuity product, including its features, benefits, and risks. This information is essential for investors to determine whether the product is appropriate for their investment goals and risk tolerance.

Annuity “3” might sound cryptic, but it refers to a specific type of annuity. Annuity 3 2024 can provide clarity on what this type of annuity entails and its potential applications.

- Investment Options:This disclosure provides investors with detailed information about the investment options available within the variable annuity, allowing them to choose the options that best align with their investment objectives and risk profiles.

- Fees and Expenses:This disclosure provides investors with a transparent presentation of all fees and expenses associated with the variable annuity, allowing them to compare the costs of different products and make informed decisions about which product is most cost-effective.

- Risk Disclosure:This disclosure provides investors with a comprehensive understanding of the risks associated with variable annuities, enabling them to make informed decisions about whether these products are appropriate for their investment goals and risk tolerance.

- Performance Disclosure:This disclosure provides investors with a realistic understanding of the potential returns they can expect from variable annuities, allowing them to assess whether these products are likely to meet their investment goals.

- Tax Implications:This disclosure provides investors with a clear understanding of the potential tax consequences of their investment in a variable annuity, enabling them to make informed decisions about how to manage their tax liability.

- Guarantees and Limitations:This disclosure provides investors with a clear understanding of the scope and limitations of any guarantees associated with the variable annuity, allowing them to make informed decisions about the level of protection they are seeking.

- Withdrawal Provisions:This disclosure provides investors with a clear understanding of the conditions under which they can access their funds from the variable annuity, enabling them to make informed decisions about their liquidity needs.

- Death Benefits:This disclosure provides investors with a clear understanding of the benefits they will receive in the event of their death, allowing them to make informed decisions about how to provide for their beneficiaries.

- Other Relevant Information:This disclosure provides investors with access to other relevant information about the variable annuity, such as information about the insurance company, the product’s regulatory status, and the investor’s rights and responsibilities.

Examples of How These Disclosures Can Be Presented in a Clear and Understandable Format

The 2024 disclosure requirements emphasize the use of clear and concise language and user-friendly formats. Here are some examples of how these disclosures can be presented in a clear and understandable format:

- Bullet Points:Bullet points can be used to present key information in a concise and easy-to-read format. For example, a disclosure about fees and expenses could be presented using bullet points to list each fee and its corresponding description.

- Tables:Tables can be used to present complex information in an organized and easy-to-understand format.

For example, a disclosure about the performance of different investment options could be presented in a table showing the historical returns of each option.

- Charts:Charts can be used to visually represent data and trends, making it easier for investors to understand complex information.

For example, a chart could be used to illustrate the growth of an investment over time or to compare the performance of different investment options.

- Plain Language:The 2024 disclosure rules emphasize the use of plain language that is easy for investors to understand.

This means avoiding technical jargon and using clear and concise language that is accessible to a wide range of investors.

Sample Disclosure Document Incorporating the 2024 Requirements, Variable Annuity Disclosure Is Required To Contain 2024

A sample disclosure document incorporating the 2024 requirements would include the following sections:

- Product Description:This section would provide a clear and concise description of the variable annuity product, including its features, benefits, and risks.

- Investment Options:This section would provide a detailed description of the investment options available within the variable annuity, including their investment objectives, strategies, and risk profiles.

An “X share annuity” might sound confusing, but it’s a specific type of annuity with unique features. You can learn more about these annuities on X Share Annuity 2024 , which provides detailed information about their workings.

- Fees and Expenses:This section would present a transparent disclosure of all fees and expenses associated with the variable annuity, including both explicit and implicit fees.

- Risk Disclosure:This section would provide a comprehensive disclosure of the risks associated with variable annuities, including market risk, interest rate risk, mortality risk, and other relevant risks.

- Performance Disclosure:This section would provide a detailed disclosure of the historical performance of the variable annuity, including both the performance of the underlying investment options and the overall performance of the annuity contract.

- Tax Implications:This section would provide a clear explanation of the tax implications of investing in a variable annuity, including the tax treatment of distributions, withdrawals, and death benefits.

If you’ve won the lottery, you might be faced with a choice: take a lump sum or an annuity. Annuity Or Lump Sum Lottery 2024 explores the pros and cons of each option to help you make an informed decision.

- Guarantees and Limitations:This section would provide a clear explanation of any guarantees and limitations associated with the variable annuity, including any guarantees on principal or interest, as well as any limitations on withdrawals or death benefits.

- Withdrawal Provisions:This section would provide a clear explanation of the withdrawal provisions associated with the variable annuity, including any surrender charges, penalties, or restrictions on withdrawals.

- Death Benefits:This section would provide a clear explanation of the death benefit provisions associated with the variable annuity, including the type of death benefit, the payout amount, and any limitations on the death benefit.

- Other Relevant Information:This section would include any other information that is relevant to investors’ understanding of the variable annuity, such as information about the insurance company, the product’s regulatory status, and the investor’s rights and responsibilities.

Excel is a powerful tool for financial calculations, including annuities. If you’re interested in learning how to calculate annuity due in Excel, check out Calculating Annuity Due In Excel 2024 , which offers a comprehensive guide.

Impact of the 2024 Disclosure on Investors: Variable Annuity Disclosure Is Required To Contain 2024

The 2024 disclosure requirements are designed to benefit investors by providing them with the information they need to make informed decisions about variable annuities. The enhanced disclosures can improve investor understanding of these complex products, leading to better investment outcomes.

Potential Benefits of the 2024 Disclosure Requirements for Investors

The potential benefits of the 2024 disclosure requirements for investors include:

- Improved Understanding:The enhanced disclosures can help investors better understand the features, risks, and potential benefits of variable annuities, enabling them to make more informed decisions about whether these products are appropriate for their investment goals and risk tolerance.

- Increased Transparency:The more transparent presentation of fees and expenses can help investors compare the costs of different variable annuity products, making it easier to choose the option that best meets their needs.

- Enhanced Protection:The expanded risk disclosure can help investors better understand the potential downsides of investing in variable annuities, enabling them to make more informed decisions and potentially avoid investment losses.

- Empowered Decision-Making:The 2024 disclosure requirements can empower investors to make more informed decisions about their investments, leading to better investment outcomes and potentially increased financial security.

How the Enhanced Disclosures Can Improve Investor Understanding of Variable Annuities

The enhanced disclosures in the 2024 rules can improve investor understanding of variable annuities by:

- Providing More Detailed Information:The 2024 rules require a more detailed and comprehensive disclosure of information about variable annuities, including information about fees, expenses, risks, and performance. This detailed information can help investors better understand the complexities of these products.

- Using Clear and Concise Language:The 2024 rules emphasize the use of clear and concise language that is easy for investors to understand.

Looking to learn more about a specific annuity amount? You can find information about an annuity of 500k in 2024 on Annuity 500k 2024 , including its potential benefits and factors to consider.

This can help investors avoid confusion and make more informed decisions.

- Presenting Information in User-Friendly Formats:The 2024 rules encourage the use of user-friendly formats, such as bullet points, tables, and charts, to present information in a way that is easy for investors to understand.

Looking for information on annuities from 2021 in the context of 2024? Annuity 2021 2024 might provide insights into how past annuity trends might influence current decisions.

While the 2024 disclosure requirements are intended to benefit investors, there are some potential challenges that investors may face in navigating the new rules. These challenges include:

- Increased Complexity:The enhanced disclosures may increase the complexity of the information that investors need to review, making it more challenging for some investors to understand the key aspects of variable annuities.

- Time Commitment:The 2024 rules require a more comprehensive disclosure of information, which may require investors to spend more time reviewing the disclosures before making a decision.

Calculating annuity rates can be complex, but Excel can simplify the process. Calculate Annuity Rate In Excel 2024 provides step-by-step instructions and formulas to help you determine the rate of your annuity.

- Information Overload:The increased volume of information provided in the disclosures may lead to information overload, making it difficult for some investors to identify the most important information.

Benefits and Challenges of the 2024 Disclosure Rules for Investors

The following table summarizes the benefits and challenges of the 2024 disclosure rules for investors:

| Benefits | Challenges |

|---|---|

| Improved understanding of variable annuities | Increased complexity of disclosures |

| Increased transparency about fees and expenses | Time commitment required to review disclosures |

| Enhanced protection from investment losses | Information overload |

| Empowered decision-making | Difficulty understanding complex information |

Final Thoughts

The implementation of the 2024 variable annuity disclosure requirements marks a significant step towards greater transparency and investor protection in the financial market. By providing investors with more comprehensive and easily understandable information, these new regulations are poised to empower investors and enhance their confidence in variable annuities.

As the financial landscape continues to evolve, it is likely that we will see further refinements and adjustments to variable annuity disclosure regulations, ensuring that investors remain informed and protected in the years to come.

FAQ Summary

What are the key benefits of the 2024 variable annuity disclosure requirements for investors?

The 2024 disclosure requirements aim to provide investors with a clearer understanding of the risks and potential rewards associated with variable annuities. This enhanced transparency allows investors to make more informed investment decisions, potentially leading to better outcomes.

How do the 2024 disclosure requirements impact financial institutions?

Financial institutions are required to update their disclosure practices to comply with the 2024 regulations. This may involve revising their existing disclosure documents and implementing new procedures to ensure compliance.

Want to know more about an annuity of 300,000 in 2024? Head over to Annuity 300 000 2024 to learn about its features, potential returns, and how it might fit into your financial plans.

What are some of the potential challenges investors may face in navigating the new disclosure requirements?

Investors may find the new disclosure requirements to be more complex than previous regulations. However, the goal of the enhanced disclosures is to provide a more comprehensive and understandable picture of variable annuities, ultimately making it easier for investors to make informed decisions.