Variable Annuity Guaranteed Minimum Income Benefit 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This financial product, designed to provide a secure stream of income during retirement, is a fascinating blend of investment potential and guaranteed protection.

Annuity rates fluctuate based on various factors, including the duration of the contract. Explore the current trends and potential changes in Annuity 3 Year Rates 2024 to make informed decisions.

The variable annuity aspect allows for potential growth through market participation, while the guaranteed minimum income benefit provides a safety net, ensuring a minimum level of income regardless of market fluctuations.

Variable annuities offer a unique investment approach, combining guaranteed income with potential growth. Learn more about the latest trends and strategies for variable annuity ETFs in 2024 by exploring Variable Annuity Etf 2024.

This article delves into the intricate workings of variable annuities with guaranteed minimum income benefits, exploring their advantages, considerations, and potential impact on retirement planning. We will dissect the key features, benefits, and considerations involved in choosing this financial product, shedding light on how it can help individuals achieve their retirement income goals.

Annuity products can be tailored to meet various needs, including the provision of a steady income stream for a specific period. Explore the different types of 3-year annuities and their suitability in 3 Annuity 2024.

Contents List

Variable Annuity Guaranteed Minimum Income Benefit (GMIB) Overview

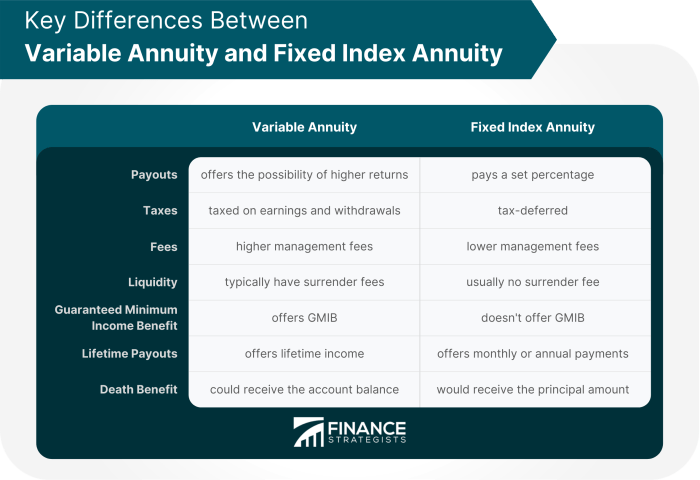

A variable annuity with a Guaranteed Minimum Income Benefit (GMIB) is a type of retirement savings product that provides guaranteed income payments, potential for growth, and downside protection. In simple terms, it combines the growth potential of a variable annuity with the security of a guaranteed income stream.

Annuity planning can be complex, especially when considering beneficiary options. If you’re unsure about how to proceed with an annuity without a designated beneficiary, consider the insights provided in Annuity No Beneficiary 2024.

This type of annuity is designed to help individuals ensure they have a steady income stream in retirement, regardless of market fluctuations.

Key Features of a GMIB

A GMIB offers several key features that make it attractive to retirement savers. Here’s a breakdown:

- Guaranteed Minimum Income Payments:This is the core feature of a GMIB. It guarantees a certain level of income payments for life, regardless of how the underlying investments perform. This provides peace of mind, knowing that you will receive a steady stream of income in retirement.

- Potential for Growth:The investment portion of a variable annuity with a GMIB is typically invested in a variety of mutual funds or sub-accounts, which allows for potential growth. This means your income stream could grow over time if the investments perform well.

For those familiar with financial calculators, the TI-84 can be a valuable tool for annuity calculations. Explore the specific steps and functions involved in Calculate Annuity On Ti 84 2024.

- Downside Protection:GMIBs offer downside protection, meaning your income payments are protected from market losses. Even if your investments lose value, your guaranteed income stream remains intact.

Calculating the internal rate of return (IRR) for an annuity is crucial for evaluating its profitability. The Irr Calculator Annuity 2024 provides a valuable tool for determining the IRR of your annuity.

How GMIBs Work

GMIBs work by combining investment options with guaranteed income features. Here’s a closer look:

- Investment Options:Variable annuities with GMIBs typically offer a range of investment options, including mutual funds, sub-accounts, and other investment vehicles. You can choose the investment options that align with your risk tolerance and investment goals.

- Guaranteed Minimum Income Payment Calculation:The guaranteed income payments are calculated based on factors such as the amount of your initial investment, the age at which you start receiving payments, and the chosen payout option. The insurer will typically provide a table or calculator to help you estimate your guaranteed income payments.

- Potential for Growth and Downside Protection:The potential for growth and downside protection offered by a GMIB depends on the investment options you choose and the performance of the underlying investments. While the guaranteed income payments are protected from market losses, the value of your investment portion may fluctuate.

Chapter 9 of many financial textbooks often delves into the intricacies of annuities. Gain a deeper understanding of annuity concepts and calculations by exploring the relevant content in Chapter 9 Annuities 2024.

When planning for retirement, it’s essential to have a clear understanding of your future income stream. Utilize the comprehensive Annuity Calculator Nz 2024 to project your potential annuity payments.

Benefits of a GMIB, Variable Annuity Guaranteed Minimum Income Benefit 2024

GMIBs offer a number of benefits for retirement savers:

- Guaranteed Income:The most significant benefit of a GMIB is the guaranteed income stream. This provides financial security and peace of mind, knowing that you will have a steady income source in retirement.

- Potential for Growth:GMIBs allow for potential growth through the investment portion of the annuity. This means your income stream could grow over time if the investments perform well.

- Downside Protection:GMIBs provide downside protection, meaning your income payments are protected from market losses. This helps to mitigate the risk of outliving your savings.

- Retirement Income Goals:GMIBs can help individuals achieve their retirement income goals by providing a guaranteed income stream and potential for growth. They can be particularly beneficial for individuals who are concerned about market volatility or who want to ensure they have a steady income source in retirement.

The tax implications of annuity death benefits can be complex. Find out if the death benefit from your annuity is taxable and how to manage potential tax liabilities in Is Annuity Death Benefit Taxable 2024.

- Diversified Retirement Portfolio:GMIBs can be a valuable addition to a diversified retirement portfolio. They can help to reduce risk and provide a stable income stream in retirement.

Annuity calculations involve a specific formula that considers factors like interest rates, payment frequency, and the duration of the contract. Discover the step-by-step process for calculating annuities in How Annuity Is Calculated 2024.

Considerations for Choosing a GMIB

When choosing a variable annuity with a GMIB, it’s essential to consider the following factors:

- Guaranteed Income Payment Levels:Compare the guaranteed income payment levels offered by different insurance companies. Consider the factors that affect these payments, such as the initial investment amount, the age at which you start receiving payments, and the payout option.

- Investment Options:Evaluate the investment options available within the variable annuity. Consider the range of mutual funds or sub-accounts offered and the investment strategies that align with your risk tolerance and investment goals.

- Fees and Charges:Understand the fees and charges associated with the GMIB. These can include administrative fees, mortality and expense charges, and surrender charges. Compare the fees of different insurance companies to find the most competitive option.

- Insurance Company Strength:Choose an insurance company with a strong financial rating. This ensures that the insurer will be able to meet its obligations to pay your guaranteed income payments in the future.

Simplifying annuity calculations can be achieved with the help of an Excel template. Discover the benefits and functionalities of Annuity Calculator Excel Template 2024 to streamline your annuity planning.

GMIBs in 2024: Variable Annuity Guaranteed Minimum Income Benefit 2024

The current market conditions are impacting the variable annuity market, and GMIBs are no exception. Here’s a look at the trends and insights for 2024:

- Interest Rate Environment:Rising interest rates are affecting the performance of fixed-income investments, which can impact the guaranteed income payments offered by GMIBs. Insurers are adjusting their pricing and product offerings to reflect the current interest rate environment.

- Market Volatility:Market volatility can impact the value of the investment portion of a GMIB. While the guaranteed income payments are protected from market losses, the value of your investment portion may fluctuate. Individuals considering a GMIB should be prepared for potential market volatility.

- Innovation in Product Design:Insurance companies are constantly innovating with new product designs and features. Some GMIBs are now offering enhanced features, such as increased downside protection or flexible payout options. It’s essential to stay informed about the latest product offerings and features.

GMIBs and Retirement Planning

GMIBs can be a valuable tool for retirement planning. Here’s how they can be incorporated:

- Retirement Income Risk Management:GMIBs can help manage retirement income risk by providing a guaranteed income stream. This helps to ensure that you have a steady source of income in retirement, regardless of market fluctuations.

- Retirement Portfolio Diversification:GMIBs can contribute to a diversified retirement portfolio by providing a source of guaranteed income. This can help to reduce overall portfolio risk and provide a balance between growth and stability.

- Hypothetical Retirement Portfolio:A hypothetical retirement portfolio could include a GMIB as part of its fixed-income allocation. The GMIB would provide a guaranteed income stream, while the remaining portion of the portfolio could be invested in growth-oriented assets, such as stocks and real estate.

The tax implications of variable annuities can vary depending on several factors. Explore the latest guidelines and strategies for managing variable annuity taxation in Variable Annuity Taxation 2024.

Final Conclusion

As we conclude our exploration of variable annuities with guaranteed minimum income benefits, the landscape of retirement planning emerges with renewed clarity. The ability to potentially grow wealth while simultaneously securing a guaranteed income stream makes these products a compelling option for individuals seeking to navigate the complexities of retirement finances.

When planning for an annuity, it’s essential to determine the appropriate deposit amount to achieve your desired income stream. Learn about the factors influencing annuity deposits and how to calculate them in Calculate Annuity Deposit 2024.

Understanding the nuances of these products, including their benefits, considerations, and market trends, empowers individuals to make informed decisions about their retirement future.

Understanding mortality tables is crucial for accurate annuity calculations. The 2000 Basic Mortality Table remains a significant benchmark, and you can find detailed information on its application in Annuity 2000 Basic Mortality Table 2024.

Frequently Asked Questions

What are the potential risks associated with variable annuities with a GMIB?

While GMIBs provide guaranteed income, the underlying investment component is still subject to market risk. This means that the value of your investment could fluctuate, and you may not earn the same rate of return as you would with a fixed annuity.

It’s important to understand the risks involved and choose a GMIB that aligns with your risk tolerance.

How long does the guaranteed minimum income last?

The duration of the guaranteed minimum income period varies depending on the specific GMIB product. Some products offer a lifetime guarantee, while others have a set period, such as 10 or 20 years. It’s crucial to review the terms and conditions of the product to understand the duration of the guaranteed income.

Formula annuity bonds offer a structured approach to income generation. Learn about the intricacies of formula annuity bonds and their potential benefits in Formula Annuity Bond 2024.

Are there any fees associated with GMIBs?

Yes, there are typically fees associated with variable annuities with GMIBs. These fees can include administrative fees, mortality and expense charges, and investment management fees. It’s important to compare the fees of different GMIB products to find one that fits your budget.

Can I withdraw my investment from a variable annuity with a GMIB?

Yes, you can typically withdraw your investment from a variable annuity with a GMIB. However, withdrawals may be subject to surrender charges or penalties, especially if you withdraw before a certain period. Review the product’s terms and conditions to understand the withdrawal rules.

How do I choose the right variable annuity with a GMIB for me?

Choosing the right variable annuity with a GMIB involves considering your risk tolerance, retirement income goals, and financial situation. It’s advisable to consult with a financial advisor to get personalized guidance and explore the various options available.