Variable Annuity Hardship Withdrawal 2024 presents a complex financial scenario for annuity holders facing unforeseen circumstances. This guide explores the regulations, implications, and alternative options surrounding hardship withdrawals from variable annuities. Understanding these aspects is crucial for making informed decisions about accessing your retirement savings during a financial emergency.

If you’re based in Nigeria, you might want to explore local annuity options. A Annuity Calculator Nigeria 2024 could help you compare different annuity products available in your region.

Variable annuities are financial products that offer both growth potential and income security. They allow investors to allocate their funds across various investment options, aiming for long-term growth. However, unforeseen events can sometimes necessitate accessing these funds before retirement. This is where hardship withdrawals come into play, offering a way to withdraw funds under specific circumstances.

Before diving into specific annuity options, it’s crucial to understand the basics. A Annuity What Is It Definition 2024 will provide you with a clear explanation of how these financial products work.

Contents List

Variable Annuity Hardship Withdrawals in 2024

Variable annuities are complex financial products that offer growth potential and income guarantees. However, they also come with specific withdrawal rules and potential tax implications. This article will explore the intricacies of variable annuity hardship withdrawals, particularly in the context of 2024 regulations.

To get a more personalized estimate of your potential annuity payments, you can use an online calculator. For example, a Annuity Calculator Compounded Monthly 2024 can help you visualize how your payments might grow over time.

We’ll delve into the basics of variable annuities, the conditions for hardship withdrawals, the potential tax consequences, and alternative solutions to consider.

Understanding how annuities work is essential for making informed financial decisions. You might find it helpful to consult a Compound Value Annuity Factor Table 2024 to get a better grasp of the compounding effect over time.

Variable Annuity Basics

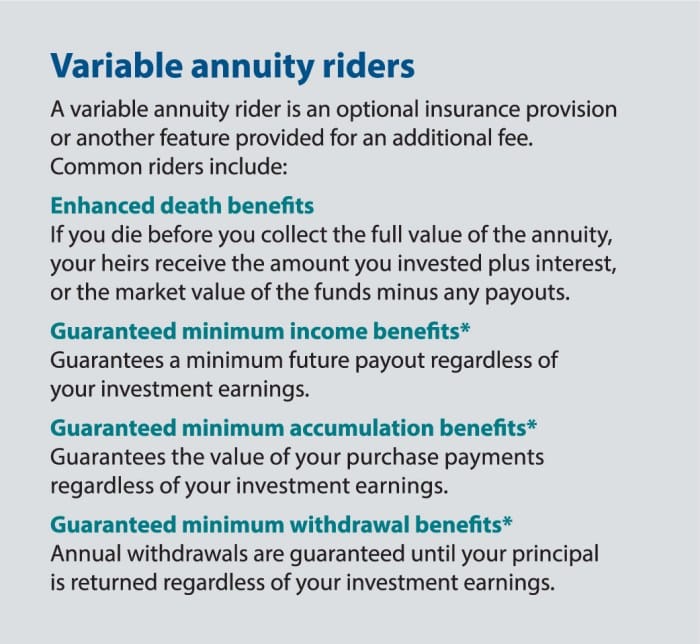

A variable annuity is a type of insurance contract that combines investment features with guaranteed income payments. Essentially, you invest your money in sub-accounts within the annuity, which are similar to mutual funds. The value of these sub-accounts fluctuates based on the performance of the underlying investments.

There are various types of annuities available, each with its own set of features and benefits. You might consider exploring a 9 Annuity 2024 to see if it aligns with your specific needs.

- Investment Options:Variable annuities offer a range of investment options, including stocks, bonds, and money market funds. You have the flexibility to choose a portfolio that aligns with your risk tolerance and financial goals.

- Guaranteed Income:Once you reach a certain age, you can annuitize your variable annuity. This means you’ll receive regular income payments for life, providing a stream of guaranteed income that can’t be outlived.

- Tax-Deferred Growth:Earnings within a variable annuity grow tax-deferred, meaning you won’t pay taxes on investment gains until you withdraw them. This can help your money grow faster over the long term.

- Potential Risks:Variable annuities are subject to market risk. If the underlying investments perform poorly, the value of your annuity could decline. Additionally, early withdrawals can incur penalties and fees.

Hardship Withdrawal Provisions

Hardship withdrawals are designed to provide financial relief in unforeseen circumstances. They allow you to access your annuity funds before you reach the annuitization period, typically with certain restrictions and tax implications.

To determine the appropriate annuity payment, you’ll need to calculate the present value of future payments. A Calculating Annuity Method 2024 guide can provide you with the necessary formulas and steps.

- Purpose:Hardship withdrawals are intended for unexpected events that cause significant financial hardship, such as:

- Medical emergencies

- Loss of employment

- Natural disasters

- Home repairs

- Conditions:To qualify for a hardship withdrawal, you usually need to demonstrate a genuine financial need. This typically involves providing documentation, such as medical bills or unemployment notices.

- Tax Implications:Hardship withdrawals are generally subject to taxes and potentially penalties. The tax treatment can vary depending on the specific provisions of your annuity contract and your individual circumstances.

2024 Regulations and Updates, Variable Annuity Hardship Withdrawal 2024

While the core principles of variable annuity hardship withdrawals remain consistent, there might be changes in regulations and tax treatments. It’s essential to stay informed about any updates that could affect your annuity.

Depending on your financial goals, you might be interested in exploring higher annuity amounts. For example, an Annuity 3 Million 2024 could provide a significant source of income during retirement.

- New Restrictions:Some states or insurance companies may introduce new restrictions or limitations on hardship withdrawals in 2024. These might include:

- Higher withdrawal thresholds

- More stringent documentation requirements

- Limited withdrawal frequencies

- Tax Changes:Changes in tax laws could affect the tax treatment of hardship withdrawals. For example, there might be modifications to the penalty for early withdrawals or changes in the tax brackets for income. It’s important to consult with a tax professional to understand the current tax implications.

Many annuity contracts offer a “free look” period, which allows you to cancel the contract within a certain timeframe. For instance, a Annuity 30 Day Free Look 2024 gives you 30 days to review the contract and make an informed decision.

Impact on Annuity Holders

Hardship withdrawals can have both short-term and long-term consequences for annuity holders. It’s crucial to consider the potential impact before making a withdrawal.

If you’re looking for a government-backed annuity, you might want to check out a Annuity Calculator Gov 2024. This type of annuity offers greater security and stability.

- Long-Term Growth:Withdrawing funds from your annuity before annuitization can negatively impact the long-term growth of your investment. You’ll miss out on potential earnings, and the withdrawn amount will be permanently removed from the account.

- Penalties and Fees:Many variable annuity contracts impose penalties or fees for early withdrawals. These fees can significantly reduce the amount you receive from the withdrawal.

- Future Investment Strategies:A hardship withdrawal can disrupt your long-term investment strategy. It may require you to re-evaluate your financial goals and adjust your investment portfolio to compensate for the lost funds.

Alternatives to Hardship Withdrawals

Before resorting to a hardship withdrawal, it’s prudent to explore alternative solutions to address your financial emergency. These options might help you avoid the negative consequences of withdrawing from your annuity.

Annuity payments can be a valuable source of income, especially in retirement. If you’re considering an annuity, you might be curious about the potential payout. For instance, you might be interested in exploring an Annuity 60000 2024 to see how it could fit into your financial plan.

- Loans:Consider obtaining a personal loan or a loan secured by your home. This can provide you with the necessary funds without impacting your annuity.

- Borrowing Against the Annuity:Some annuity contracts allow you to borrow against your annuity. This can provide access to funds without triggering a withdrawal. However, it’s important to understand the interest rates and repayment terms associated with such loans.

- Credit Cards:If you have a good credit score, a credit card can offer short-term financing. However, it’s essential to use credit cards responsibly and avoid accumulating high balances that could lead to excessive interest charges.

Case Studies

Let’s examine a few hypothetical scenarios to illustrate the complexities of variable annuity hardship withdrawals:

- Scenario 1:A 60-year-old retiree experiences a medical emergency that requires expensive surgery. The retiree has a variable annuity with a significant balance. The annuity contract allows for hardship withdrawals with a 10% penalty. The retiree needs to decide whether the immediate financial relief outweighs the potential long-term consequences of the penalty.

Understanding how annuities work can feel like navigating a complex financial maze. But, with the right resources, it becomes clearer. A Annuity How It Works 2024 guide can demystify the process and help you make informed decisions.

- Scenario 2:A 55-year-old individual loses their job due to unexpected layoffs. They have a variable annuity with a substantial balance but are hesitant to withdraw funds due to potential tax implications. They explore alternative solutions like a personal loan or borrowing against the annuity to avoid impacting their retirement savings.

Epilogue: Variable Annuity Hardship Withdrawal 2024

Navigating the complexities of variable annuity hardship withdrawals requires careful consideration. While they offer a lifeline during financial emergencies, it’s essential to weigh the short-term benefits against the long-term consequences. Understanding the regulations, potential penalties, and available alternatives is crucial for making informed decisions that protect your financial well-being.

Consulting with a financial advisor can provide personalized guidance and help you develop a plan that aligns with your individual needs and goals.

There are various online platforms that offer annuity calculators. You might find it useful to explore a Annuity Calculator Groww 2024 to see how different factors impact your potential returns.

Key Questions Answered

Can I withdraw any amount during a hardship withdrawal?

The amount you can withdraw depends on your specific situation and the terms of your annuity contract. You may be limited to a certain percentage of your account value or a specific dollar amount.

Are there any tax implications for a hardship withdrawal?

Yes, hardship withdrawals are generally taxed as ordinary income. You may also face additional penalties, depending on your age and the specific regulations in place.

What are some alternative options to a hardship withdrawal?

Alternative options include taking out a loan, borrowing against your annuity contract, or exploring other financial resources like credit cards or personal loans.

While annuities are often associated with retirement planning, they can also be used for other purposes. For example, an Annuity Jackpot 2024 could provide a lump sum payment for a significant life event.

Annuity contracts come with various terms and conditions. You might be interested in exploring a Annuity 20 Year Certain 2024 , which guarantees payments for a minimum of 20 years.

Calculating annuity payments can be a bit tricky, especially if you’re not familiar with financial formulas. A How To Calculate Annuity On Casio Calculator 2024 guide can help you navigate the process using a simple calculator.