Variable Annuity High Water Mark 2024 presents a compelling opportunity for investors seeking to navigate market volatility while protecting their accumulated wealth. This strategy, commonly found in variable annuity contracts, aims to ensure that your investment growth is never eroded by market downturns.

By s

India has specific tax rules for annuity income. Discover the taxability of Is Annuity Income Taxable In India 2024 to ensure compliance with Indian tax laws.

Inherited annuities are subject to tax rules. Understand the tax implications of How Is Inherited Annuity Taxed 2024 to manage your financial obligations.

Deciding whether an annuity is worth it is a personal choice. Consider factors like your financial goals and risk tolerance when exploring Is Getting An Annuity Worth It 2024.

etting a high water mark, your investment’s value is locked in, allowing any subsequent growth to accumulate on top of that secured level. This feature provides a unique shield against market fluctuations, making it particularly attractive in today’s uncertain economic environment.

Variable annuities, in general, offer a combination of investment growth potential and guaranteed income streams, making them a popular choice for retirement planning. However, understanding the intricacies of high water marks and their impact on investment decisions is crucial for maximizing the benefits of this feature.

Variable annuities are offered by various life insurance companies. Explore the options available in Variable Annuity Life Insurance Company 2024 to find the right fit for your needs.

This article delves into the concept of high water marks, their application in variable annuities, and the implications for your investment strategy in 2024.

Contents List

- 1 Variable Annuities: A Primer

- 2 High Water Mark: Understanding the Concept

- 3 High Water Mark in 2024: Market Outlook

- 4 Variable Annuity Contracts: Key Considerations

- 5 High Water Mark: Impact on Investment Decisions

- 6 Variable Annuities and Retirement Planning: Variable Annuity High Water Mark 2024

- 7 Summary

- 8 Clarifying Questions

Variable Annuities: A Primer

Variable annuities are investment vehicles that offer a combination of growth potential and downside protection. They are designed to help investors accumulate wealth over the long term, while also providing a guaranteed minimum death benefit (GMDB) to their beneficiaries.

Receiving a large annuity payout can be a significant financial event. Explore the implications of a 3 Million Annuity Payout 2024 and how to manage such a substantial sum.

Defining Variable Annuities

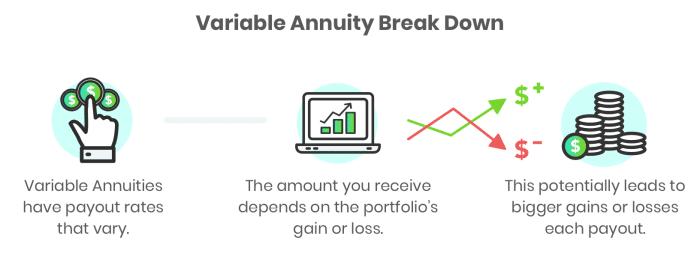

A variable annuity is a type of insurance contract that allows you to invest in a variety of sub-accounts, typically mutual funds or exchange-traded funds (ETFs). The value of your annuity fluctuates based on the performance of your chosen investments.

Unlike traditional fixed annuities, which offer a guaranteed rate of return, variable annuities have no guaranteed return.

Investment Options within Variable Annuities

Variable annuities provide a range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals. These options typically include:

- Equity Funds:These funds invest in stocks, offering the potential for higher returns but also greater risk.

- Bond Funds:Bond funds invest in fixed-income securities, generally considered less risky than equity funds.

- Money Market Funds:These funds invest in short-term, low-risk securities, providing stability and liquidity.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as you approach retirement.

Edward Jones is a well-known financial services firm. If you’re considering an annuity through Edward Jones, you can use their Annuity Calculator Edward Jones 2024 to get a personalized estimate of your potential payments.

Guaranteed Minimum Death Benefits (GMDBs)

GMDBs are a feature of many variable annuities that guarantee a minimum payout to your beneficiaries upon your death. This provides a safety net for your loved ones, ensuring they receive a certain amount even if your investments have declined in value.

The amount of the GMDB is typically based on the initial investment or a percentage of the account value.

Risks Associated with Variable Annuities

While variable annuities offer growth potential and downside protection, they also come with certain risks:

- Market Risk:The value of your investments can fluctuate with market conditions, potentially leading to losses.

- Expense Risk:Variable annuities typically have higher fees than traditional annuities, which can eat into your returns.

- Liquidity Risk:You may face penalties for withdrawing your funds early, limiting your access to your money.

- Insurance Company Risk:The financial stability of the insurance company issuing the annuity can impact your investment.

High Water Mark: Understanding the Concept

The high water mark (HWM) is a feature found in some variable annuity contracts that aims to protect investors from losing ground on their investment gains.

Annuity payments can be deferred, meaning they don’t start immediately. Find out more about Annuity Is Deferred 2024 and how it might affect your financial planning.

How the High Water Mark Works

The high water mark is the highest value your annuity account has reached. When the HWM is activated, it prevents your account value from falling below this peak level. For example, if your account reaches a high water mark of $100,000 and subsequently declines to $90,000, the insurance company will make up the difference, bringing your account back to $100,000.

Purpose of the High Water Mark

The HWM is designed to provide a level of downside protection, encouraging investors to take on more risk in pursuit of higher returns. Knowing that their losses will be capped at the HWM level can give investors more confidence to ride out market fluctuations.

Advantages and Disadvantages of the High Water Mark

Advantages

- Downside Protection:The HWM prevents investors from losing their hard-earned gains.

- Increased Risk Tolerance:The HWM can encourage investors to take on more risk, potentially leading to higher returns.

- Enhanced Investment Confidence:The HWM can provide investors with a sense of security and peace of mind.

Disadvantages

- Higher Fees:Contracts with HWM provisions often have higher fees than those without.

- Limited Growth Potential:The HWM can limit the potential for growth, as it prevents your account from falling below the peak value.

- Complexity:Understanding the HWM and its implications can be complex for some investors.

High Water Mark in 2024: Market Outlook

The performance of variable annuities with HWM provisions in 2024 will be influenced by a number of factors, including interest rates, inflation, and overall market conditions.

Variable annuities offer the potential for growth, but they also come with risks. Learn more about the features and potential benefits of Variable Annuity Gmib 2024 before making any investment decisions.

Impact of Market Conditions

In a rising interest rate environment, bond yields tend to increase, which can negatively impact the performance of fixed-income investments. This could lead to lower returns for variable annuities with HWM provisions, as the HWM may be less effective in protecting against losses.

Looking to calculate your monthly annuity payments? There are many online calculators available, such as the Annuity Calculator Compounded Monthly 2024 , which can help you estimate your future income stream.

Influence of Interest Rates and Inflation

Inflation can erode the purchasing power of your investment returns, making it harder to keep pace with rising costs. If inflation remains high in 2024, it could put downward pressure on the performance of variable annuities, even those with HWM provisions.

Investment Strategies for 2024

Given the potential challenges of the market in 2024, investors may consider the following strategies:

- Diversify Your Portfolio:Allocate your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

- Adjust Your Risk Tolerance:If you are concerned about market volatility, consider shifting your portfolio towards more conservative investments.

- Review Your HWM Provisions:Understand the specific terms of your HWM and how it might impact your investment strategy.

Variable Annuity Contracts: Key Considerations

Variable annuity contracts come in a variety of forms, each with its own set of features and benefits.

While both annuities and life insurance offer financial protection, they have distinct features and purposes. Understand the differences between Is Annuity The Same As Life Insurance 2024 to make informed decisions.

Comparing Variable Annuity Contracts

When comparing variable annuity contracts, it is important to consider the following factors:

- Fees:Variable annuities typically have a range of fees, including administrative fees, investment management fees, and mortality and expense risk charges. Look for contracts with lower fees to maximize your returns.

- Investment Options:Ensure the contract offers a diverse range of investment options that align with your risk tolerance and financial goals.

- HWM Provisions:Understand the specific terms of the HWM, including the trigger point, the reset frequency, and any limitations.

- Guaranteed Minimum Death Benefits (GMDBs):Compare the GMDB levels offered by different contracts and choose one that provides adequate protection for your beneficiaries.

- Withdrawal Penalties:Pay attention to any early withdrawal penalties, as they can impact your access to your funds.

Table Comparing Contract Options

| Feature | Contract A | Contract B | Contract C ||—|—|—|—|| Fees | 1.5% | 2.0% | 1.0% || Investment Options | Equity, Bond, Money Market | Equity, Bond, Target-Date | Equity, Bond, Money Market, Real Estate || HWM Provisions | Yes, annual reset | Yes, quarterly reset | No HWM || GMDB | 100% of initial investment | 110% of initial investment | 80% of account value |

High Water Mark: Impact on Investment Decisions

The HWM feature can significantly influence investment decisions within a variable annuity.

Trade-offs Between Growth and Preservation, Variable Annuity High Water Mark 2024

Investors with HWM provisions may be more inclined to take on more risk, as they are protected from substantial losses. However, this increased risk-taking may also limit their potential for growth, as the HWM prevents their account value from falling below the peak level.

Annuity payments are often considered income, but it’s essential to understand the tax implications. Explore the details of Is Annuity Income 2024 to ensure you’re prepared for tax season.

Investment Strategies for Maximizing HWM Benefits

To maximize the benefits of the HWM, investors can consider the following strategies:

- Invest in Growth-Oriented Assets:Allocate a larger portion of your portfolio to equity funds or other growth-oriented investments, as the HWM provides a safety net for potential losses.

- Rebalance Regularly:Periodically rebalance your portfolio to maintain your desired asset allocation and ensure that you are not taking on too much risk.

- Monitor Your HWM:Keep track of your HWM level and adjust your investment strategy accordingly.

Annuity 95-1 is a specific type of annuity with unique characteristics. Learn more about Annuity 95-1 2024 and how it might benefit your financial planning.

Investment Strategies for Different Risk Tolerance Levels

| Risk Tolerance | Investment Strategy ||—|—|| High | Allocate a larger portion of your portfolio to equity funds and other growth-oriented investments, as the HWM provides a safety net for potential losses.

| Moderate | Maintain a balanced portfolio with a mix of stocks and bonds, adjusting your asset allocation based on market conditions.

| Low | Allocate a larger portion of your portfolio to fixed-income investments, such as bond funds, to minimize risk.

Excel is a powerful tool for financial calculations, including annuities. Learn how to Calculate Growing Annuity In Excel 2024 to gain greater control over your financial planning.

Variable Annuities and Retirement Planning: Variable Annuity High Water Mark 2024

Variable annuities with HWM provisions can play a valuable role in retirement planning.

Contribution to Retirement Planning

Variable annuities can help investors accumulate wealth for retirement, while the HWM feature provides a level of downside protection for their accumulated savings.

Fixed variable annuities offer a blend of guaranteed income and potential growth. Discover the intricacies of Fixed Variable Annuity 2024 to make an informed decision.

Protecting Accumulated Wealth

The HWM can help to protect investors’ retirement savings from market downturns, ensuring that they have a sufficient nest egg to support their lifestyle in retirement.

Integration with Other Retirement Planning Tools

Variable annuities can be integrated with other retirement planning tools, such as 401(k) plans and IRAs, to create a comprehensive retirement strategy.

Benefits and Drawbacks of Using Variable Annuities in Retirement Planning

| Benefit | Drawback ||—|—|| Potential for growth | Higher fees || Downside protection | Complexity || Tax-deferred growth | Liquidity risk || Flexibility | Insurance company risk |

Summary

Variable annuities with high water marks can be powerful tools for managing risk and maximizing growth potential. However, choosing the right contract, understanding the intricacies of the high water mark feature, and employing appropriate investment strategies are critical for success.

By carefully considering the advantages and disadvantages, you can make informed decisions that align with your financial goals and risk tolerance. As you navigate the complexities of variable annuities in 2024, remember that a comprehensive understanding of high water marks can pave the way for a more secure and prosperous financial future.

An annuitant is someone who receives annuity payments. Learn more about K Is An Annuitant Currently Receiving Payments 2024 and the different types of annuities available.

Clarifying Questions

What are the potential drawbacks of high water mark provisions?

While high water marks offer protection against market downturns, they can also limit potential upside gains. If your investment experiences a significant dip and then recovers to a level above the high water mark, the growth beyond that point may not be fully captured.

Additionally, some contracts may impose fees associated with high water mark provisions.

How do high water marks affect investment decisions?

High water marks encourage investors to take a more conservative approach to investment selection. They may opt for investments with lower volatility, prioritizing capital preservation over aggressive growth. However, it’s important to remember that long-term growth is often achieved through calculated risk-taking.

Balancing risk and reward is key to maximizing the benefits of high water marks.

Are high water marks suitable for all investors?

High water marks are most beneficial for investors with a moderate to high risk tolerance and a long-term investment horizon. If you are seeking significant growth potential and are comfortable with market fluctuations, high water marks may not be the optimal strategy.

It’s essential to consider your individual financial goals, risk tolerance, and investment timeframe when evaluating the suitability of high water marks.