Variable Annuity Income 2024 takes center stage as investors seek ways to navigate a dynamic market landscape. This guide delves into the complexities of variable annuities, exploring how they work, the factors that influence their performance, and strategies for maximizing income potential.

Annuity due payments are slightly different from ordinary annuity payments. If you need to calculate these, Calculating Annuity Due Payment 2024 can help. This article outlines the key differences and provides a practical example of how to calculate annuity due payments using Excel 2024.

We’ll examine the unique features of variable annuities, comparing them to traditional retirement accounts and pensions, and discuss the inherent risks associated with these investments.

A 9 Annuity is another type of annuity with its own set of features. 9 Annuity 2024 provides an overview of this annuity, including its potential benefits and risks. This article can help you assess whether a 9 Annuity aligns with your retirement planning objectives.

Variable annuities offer a potential path to grow retirement savings and generate income, but understanding their intricacies is crucial. This guide aims to provide a comprehensive overview, empowering readers to make informed decisions about whether variable annuities align with their financial goals.

Annuity health insurance can be a valuable addition to your overall health plan. Annuity Health Insurance 2024 explains how this type of insurance works and the benefits it can offer. It also discusses key considerations when choosing an annuity health insurance plan.

Contents List

- 1 Variable Annuity Income: An Overview

- 2 Variable Annuity Income in 2024

- 3 Strategies for Maximizing Variable Annuity Income: Variable Annuity Income 2024

- 4 Tax Considerations for Variable Annuity Income

- 5 Variable Annuity Income vs. Other Income Sources

- 6 Risks Associated with Variable Annuity Income

- 7 Variable Annuity Income: A Case Study

- 8 Resources and Further Information

- 9 Conclusive Thoughts

- 10 Common Queries

Variable Annuity Income: An Overview

Variable annuities are a type of retirement savings product that offers the potential for growth and income generation. They differ from fixed annuities in that the value of your investment is tied to the performance of a specific portfolio of underlying assets, typically mutual funds.

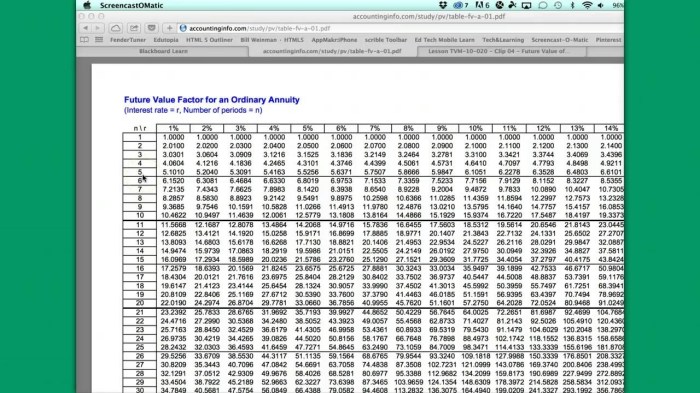

If you’re considering an annuity that includes growth potential, Fv Annuity With Growth 2024 explains how to calculate the future value of such an annuity. This article covers the FV function in Excel 2024 and its application to annuities that incorporate growth factors.

This means that the amount of income you receive in retirement can fluctuate depending on how those assets perform.

Excel 2024 makes it easy to calculate the rate of return on an annuity. Calculate Annuity Rate In Excel 2024 offers a comprehensive explanation of the RATE function, including its syntax and how to apply it to different annuity scenarios.

This can help you compare different annuity options and make informed financial decisions.

Key Features of Variable Annuities

- Potential for Growth:Variable annuities offer the potential for higher returns than fixed annuities, as the value of your investment is tied to the market.

- Income Generation:You can choose to receive income from your variable annuity in retirement, either through withdrawals or annuitization.

- Tax-Deferred Growth:Earnings on your investment grow tax-deferred, meaning you won’t pay taxes on them until you withdraw the money.

- Guaranteed Death Benefit:Some variable annuities offer a guaranteed death benefit, which ensures that your beneficiaries will receive a certain amount of money, even if your investment loses value.

Variable Annuity Income in 2024

The performance of variable annuities in 2024 will depend on a variety of factors, including overall market conditions, interest rates, and the specific investment options you choose.

Annuity 3 is a specific type of annuity with unique characteristics. Annuity 3 2024 explains the key features of this annuity, including its potential advantages and drawbacks. Understanding the details of Annuity 3 can help you decide if it’s a suitable option for your financial needs.

Factors Influencing Variable Annuity Income in 2024

- Market Volatility:The stock market is expected to remain volatile in 2024, which could impact the performance of variable annuities. If the market declines, the value of your investment may decrease, and your income potential could be reduced.

- Interest Rate Fluctuations:Interest rate increases can also impact variable annuity income. Higher interest rates can make it more expensive to borrow money, which can lead to lower returns on investments. Conversely, lower interest rates can boost investment returns.

- Inflation:Inflation can erode the purchasing power of your income. If inflation rises faster than your investment returns, your income may not keep pace with the rising cost of living.

Strategies for Maximizing Variable Annuity Income: Variable Annuity Income 2024

There are a number of strategies you can use to maximize your variable annuity income. These strategies focus on selecting the right investment options and optimizing your withdrawal strategy.

If you have an HP12c calculator, you can use it to calculate annuity payments. Calculate Annuity Hp12c 2024 offers a guide on how to use the HP12c calculator to perform annuity calculations. This article provides step-by-step instructions and examples to help you master this useful financial tool.

Selecting Investment Options

- Diversify Your Portfolio:Don’t put all your eggs in one basket. Diversify your investment portfolio across different asset classes, such as stocks, bonds, and real estate, to reduce risk and potentially enhance returns.

- Consider Your Risk Tolerance:Choose investments that align with your risk tolerance. If you’re risk-averse, you may want to invest in more conservative options, such as bonds. If you’re willing to take on more risk, you may want to invest in stocks or other growth-oriented investments.

Choosing between an annuity and a pension can be a tough decision. Annuity Vs Pension 2024 provides a detailed comparison of these retirement income options. It outlines the advantages and disadvantages of each, helping you make an informed choice that aligns with your financial goals.

- Rebalance Regularly:Periodically rebalance your portfolio to ensure that your asset allocation remains in line with your investment goals and risk tolerance. This can help you manage risk and potentially improve returns.

Optimizing Withdrawal Strategies

- Consider Annuities:An annuity can provide you with a guaranteed stream of income for life. This can be a good option if you want to ensure a steady income in retirement.

- Withdrawals:If you choose to withdraw money from your variable annuity, you can do so in a variety of ways. You can take a lump sum, a series of payments, or a combination of both.

- Minimize Taxes:Take advantage of tax-advantaged withdrawal options to minimize your tax liability. This can help you maximize your after-tax income.

Tax Considerations for Variable Annuity Income

Variable annuities offer tax-deferred growth, which means you won’t pay taxes on your earnings until you withdraw them. However, you will need to pay taxes on your withdrawals, which are generally taxed as ordinary income.

Choosing the right annuity can be challenging, but 5 Annuity 2024 highlights five popular types of annuities that may be suitable for different financial goals. Learn about fixed annuities, variable annuities, immediate annuities, deferred annuities, and indexed annuities to find the one that best fits your needs.

Tax Implications of Variable Annuity Income

- Tax-Deferred Growth:Earnings on your investment grow tax-deferred, meaning you won’t pay taxes on them until you withdraw the money.

- Taxable Withdrawals:When you withdraw money from your variable annuity, it is generally taxed as ordinary income. This can be a significant tax liability, especially if you have a large amount of money in your annuity.

- Potential for Tax Penalties:If you withdraw money from your variable annuity before age 59 1/2, you may be subject to a 10% early withdrawal penalty, in addition to ordinary income taxes.

Variable Annuity Income vs. Other Income Sources

Variable annuities can be a valuable part of a diversified retirement income strategy, but it’s important to compare them to other income sources to determine if they are the right fit for you.

Variable annuities offer a combination of features. A Variable Annuity Is Both An Annuity And A 2024 explains how variable annuities function as both an annuity and an investment. This article explores the benefits and risks associated with this type of annuity, helping you decide if it’s right for you.

Variable Annuities vs. Traditional Retirement Accounts

- Traditional IRAs and 401(k)s:Traditional retirement accounts offer tax-deferred growth similar to variable annuities. However, withdrawals from traditional retirement accounts are taxed as ordinary income, just like variable annuity withdrawals.

- Roth IRAs and 401(k)s:Roth retirement accounts offer tax-free withdrawals in retirement, making them a more tax-efficient option than variable annuities.

Variable Annuities vs. Pensions

- Pensions:Pensions provide a guaranteed stream of income in retirement, which can be a valuable source of income. However, pensions are becoming less common, and they are often subject to limits and restrictions.

- Variable Annuities:Variable annuities offer the potential for growth, but they also carry the risk of market losses. They can be a good option for individuals who are comfortable with risk and who are looking for the potential for higher returns.

Risks Associated with Variable Annuity Income

Variable annuities are subject to a number of risks, including market risk, interest rate risk, and inflation risk.

The word “annuity” has nine letters, which can be a helpful reminder when trying to recall the concept. Annuity 9 Letters 2024 explains the basic principles of annuities, including how they work and their potential benefits. It’s a good starting point for anyone interested in learning more about this financial tool.

Market Risk, Variable Annuity Income 2024

- Potential for Market Losses:The value of your investment in a variable annuity is tied to the performance of the underlying assets. If the market declines, the value of your investment may decrease, and your income potential could be reduced.

- Investment Volatility:The stock market is inherently volatile, and the value of your investment can fluctuate significantly in the short term. This can be unsettling for investors who are not comfortable with risk.

Interest Rate Risk

- Higher Interest Rates:Higher interest rates can make it more expensive to borrow money, which can lead to lower returns on investments. This can impact the performance of your variable annuity and reduce your income potential.

- Lower Interest Rates:Lower interest rates can boost investment returns, but they can also lead to lower income from annuities. This is because annuities are often based on a fixed interest rate, and lower interest rates can reduce the amount of income you receive.

Need to figure out the present value of an annuity? You can easily do this in Excel 2024. Calculating Annuity Present Value 2024 provides a step-by-step guide to using the PV function and understanding the inputs needed for accurate calculations.

Whether you’re planning for retirement or evaluating investment options, knowing how to calculate present value is essential.

Inflation Risk

- Eroding Purchasing Power:Inflation can erode the purchasing power of your income. If inflation rises faster than your investment returns, your income may not keep pace with the rising cost of living.

- Importance of Planning:It’s important to factor inflation into your retirement planning. This will help you ensure that your income will keep pace with the rising cost of living.

Variable Annuity Income: A Case Study

Imagine a 55-year-old individual named Sarah who is starting to plan for retirement. She has a significant amount of savings and is looking for a way to grow her money and generate income in retirement. Sarah decides to invest in a variable annuity, choosing a portfolio of mutual funds that are diversified across different asset classes, including stocks, bonds, and real estate.Sarah’s variable annuity grows steadily over the next 10 years, as the stock market performs well.

Understanding the tax implications of annuity income is crucial for financial planning. Is Annuity Income Capital Gains 2024 addresses the question of whether annuity income is considered capital gains. This article provides insights into the tax treatment of annuity payments and how it can affect your overall tax liability.

When she reaches retirement age, she decides to start receiving income from her annuity. She chooses to receive a monthly payment, which is based on the current value of her investment and the interest rate that is being paid on the annuity.Over the next few years, Sarah’s variable annuity income fluctuates slightly, as the stock market experiences some ups and downs.

However, overall, her income is consistent and provides her with a comfortable retirement.

Factors Influencing Income in the Case Study

- Investment Performance:The performance of Sarah’s investment portfolio directly impacts the amount of income she receives from her variable annuity. A strong market performance leads to higher income, while a weak market performance leads to lower income.

- Withdrawal Strategy:Sarah’s decision to receive a monthly payment from her annuity, rather than taking a lump sum, ensures a steady stream of income in retirement. This can be a good strategy for individuals who want to minimize risk and ensure a predictable income.

- Interest Rates:The interest rate being paid on Sarah’s annuity also impacts her income. Higher interest rates lead to higher income, while lower interest rates lead to lower income.

Resources and Further Information

For more information on variable annuities and income generation, you can consult the following resources:

Reputable Resources

- Financial Industry Regulatory Authority (FINRA):FINRA is a non-profit organization that regulates the securities industry. It provides a wealth of information on variable annuities, including investor alerts and educational materials.

- Securities and Exchange Commission (SEC):The SEC is the federal agency that oversees the securities industry. It provides information on variable annuities, including investor protection tips and enforcement actions.

- National Association of Insurance Commissioners (NAIC):The NAIC is an organization that represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. It provides information on variable annuities, including state regulations and consumer protection resources.

Conclusive Thoughts

As you consider variable annuities as part of your retirement income strategy, remember that careful planning and diversification are essential. While variable annuities offer potential for growth and income generation, they also come with risks. Consulting with a qualified financial advisor can help you assess your individual needs and determine if variable annuities are a suitable investment option.

Common Queries

What is the minimum investment required for a variable annuity?

The minimum investment for a variable annuity varies depending on the specific product and insurance company. It’s best to consult with an advisor or the insurance company’s website for the most up-to-date information.

Are there any fees associated with variable annuities?

Yes, variable annuities typically come with fees, including administrative fees, mortality and expense charges, and investment management fees. These fees can impact the overall returns of the annuity. It’s important to understand the fee structure before investing.

What are the tax implications of withdrawals from a variable annuity?

Withdrawals from a variable annuity are generally taxed as ordinary income. However, if you withdraw the earnings from your investment before age 59 1/2, you may also face a 10% penalty.

How do I know if a variable annuity is right for me?

It’s important to carefully consider your individual financial situation, risk tolerance, and time horizon before investing in a variable annuity. Consulting with a financial advisor can help you determine if this investment aligns with your financial goals.

Variable annuities come with certain charges that can impact your returns. Variable Annuity Charges 2024 explains the different types of charges associated with variable annuities, including mortality and expense charges. Understanding these charges can help you make informed decisions about investing in a variable annuity.