Variable Annuity Insurance 2024 offers a unique blend of growth potential and guaranteed protection, making it a compelling option for those seeking a secure retirement. Unlike traditional annuities, which offer fixed payments, variable annuities allow you to invest in a variety of market-linked sub-accounts, potentially increasing your returns over time.

CNN is a reputable source for financial news, and they offer a user-friendly annuity calculator. Use this calculator to get a quick estimate of your potential annuity payments in 2024: Annuity Calculator Cnn 2024.

However, this flexibility also comes with the inherent risk of market fluctuations, making it crucial to understand the nuances of this investment vehicle.

Variable annuities are designed to provide a stream of income during retirement, while also offering the potential for growth through market participation. The key to success lies in understanding the different investment options, managing fees effectively, and navigating the ever-evolving regulatory landscape.

Excel is a powerful tool for financial calculations, including annuity rates. Learn how to use Excel to calculate annuity rates accurately and efficiently in 2024 with this guide: Calculate Annuity Rate In Excel 2024.

This guide aims to demystify variable annuities, equipping you with the knowledge to make informed decisions.

Annuity payments received from LIC can have tax implications. Find out whether annuities received from LIC are taxable in 2024 with this information: Is Annuity Received From Lic Taxable 2024.

Contents List

- 1 Variable Annuity Insurance: An Overview

- 2 Understanding the Investment Options

- 3 Fees and Expenses Associated with Variable Annuities

- 4 Tax Implications of Variable Annuities: Variable Annuity Insurance 2024

- 5 Variable Annuities in 2024: Current Trends and Considerations

- 6 Variable Annuities: A Comprehensive Comparison

- 7 Case Studies: Real-World Examples of Variable Annuity Usage

- 8 Variable Annuity Insurance: Who Is It Right For?

- 9 Concluding Remarks

- 10 Quick FAQs

Variable Annuity Insurance: An Overview

Variable annuity insurance is a type of annuity contract that offers the potential for growth based on the performance of underlying investments. Unlike traditional fixed annuities, which provide a guaranteed rate of return, variable annuities allow you to invest in a variety of sub-accounts that track the performance of different asset classes, such as stocks, bonds, or mutual funds.

This means that the value of your annuity can fluctuate depending on the market performance of the investments you choose.

How Variable Annuities Work

Variable annuities function by allowing you to allocate your premium payments to different sub-accounts. These sub-accounts are similar to mutual funds, each investing in a specific asset class. The value of your annuity is determined by the performance of the sub-accounts you select.

Annuity options in Hong Kong offer unique benefits and considerations for residents. To stay informed about the latest developments in annuity products in HK for 2024, explore this guide: Annuity Hk 2024.

For example, if you invest in a sub-account that tracks the S&P 500 index, the value of your annuity will rise and fall in line with the performance of the S&P 500.

Annuity payments can start at different ages, with age 65 being a common starting point. Explore the specifics of annuities starting at age 65 in 2024 with this resource: Annuity 65 2024.

Key Features and Benefits

- Potential for Growth:Variable annuities offer the potential for higher returns than traditional fixed annuities, as the value of your annuity is tied to the performance of the underlying investments.

- Tax Deferral:Investment earnings within a variable annuity are tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money in retirement. This can help you accumulate a larger nest egg over time.

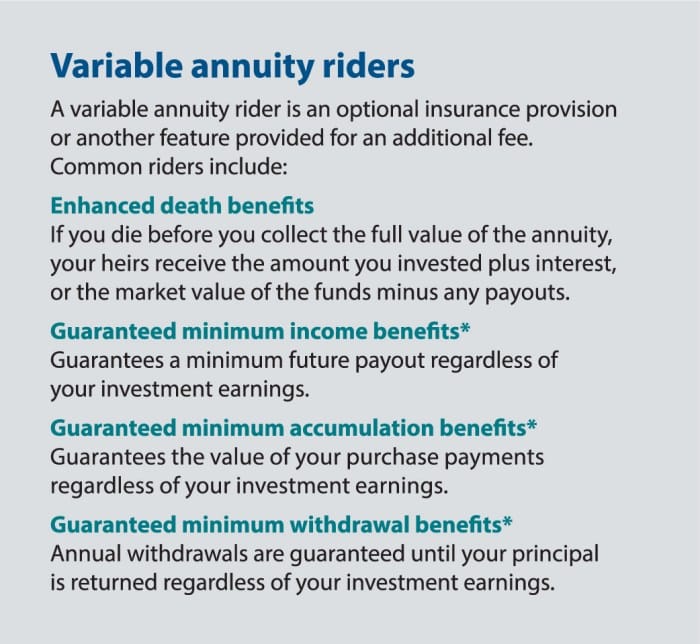

- Guaranteed Death Benefit Options:Many variable annuities offer guaranteed death benefit options, which ensure that your beneficiaries will receive a minimum payout even if the value of your annuity declines.

Understanding the Investment Options

Variable annuities offer a wide range of investment options, allowing you to customize your portfolio based on your risk tolerance and investment goals. Here are some common options:

Mutual Funds

Mutual funds are a popular choice for variable annuity investors, offering diversification and professional management. They pool money from multiple investors to invest in a basket of securities, such as stocks, bonds, or a combination of both.

The TI-84 calculator is a popular tool for students and professionals alike. Learn how to calculate annuities on a TI-84 calculator in 2024 with this guide: How To Calculate Annuities On Ti 84 2024.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they are traded on stock exchanges like individual stocks. They offer diversification and lower expense ratios compared to some mutual funds.

Separate Accounts

Separate accounts offer a higher level of customization and control over your investments. They allow you to invest in individual stocks, bonds, or other securities, giving you more flexibility to tailor your portfolio to your specific needs.

The annuity factor is a key component of annuity calculations. This guide provides a clear explanation of how to calculate the annuity factor in 2024: Calculating An Annuity Factor 2024.

Risk and Diversification

The risk associated with each investment option varies. For example, investing in a stock-heavy sub-account carries a higher risk of loss than investing in a bond-heavy sub-account. It’s important to diversify your portfolio by investing in a mix of different asset classes to mitigate risk and potentially enhance returns.

Managing Risk

To manage risk effectively, consider the following strategies:

- Diversify:Spread your investments across different asset classes, sectors, and geographies to reduce the impact of any single investment’s performance on your overall portfolio.

- Rebalance Regularly:Periodically adjust your portfolio to maintain your desired asset allocation. This helps ensure that you don’t become overly concentrated in any particular asset class.

- Monitor Your Investments:Regularly review your investments and make adjustments as needed to stay on track with your financial goals.

Fees and Expenses Associated with Variable Annuities

Variable annuities come with various fees and expenses that can impact your overall returns. Understanding these fees is crucial for making informed investment decisions.

NSDL is a leading provider of financial services in India. Explore their annuity calculator and learn how to use it in 2024: Annuity Calculator Nsdl 2024.

Types of Fees

- Mortality and Expense Charges:These fees cover the insurance company’s costs of providing the death benefit and other administrative expenses. They are typically expressed as a percentage of your account value.

- Administrative Fees:These fees cover the costs of managing and administering your annuity contract. They may include charges for account maintenance, recordkeeping, and other services.

- Surrender Charges:These fees are assessed if you withdraw money from your annuity before a certain period, typically 5-10 years. They are designed to discourage early withdrawals and help offset the insurance company’s costs of managing the contract.

- Investment Fees:In addition to the annuity contract fees, you may also incur investment fees associated with the underlying sub-accounts, such as mutual fund expense ratios or ETF trading fees.

Impact on Performance

Fees and expenses can significantly impact the overall performance of a variable annuity. They reduce your investment returns and can eat into your potential growth over time. It’s essential to carefully consider the fee structure of any variable annuity contract before investing.

Federal employees who participate in the FERS program have access to a federal annuity. Understanding how to calculate this annuity is crucial for retirement planning. Learn more about calculating a federal annuity under FERS in 2024: Calculating A Federal Annuity – Fers 2024.

Strategies for Minimizing Fees

- Shop Around:Compare fees and expenses across different variable annuity contracts to find the most competitive options.

- Consider Lower-Cost Investment Options:Choose sub-accounts with lower expense ratios, such as index funds or ETFs.

- Avoid Surrender Charges:If possible, avoid withdrawing money from your annuity before the surrender charge period expires to minimize fees.

Tax Implications of Variable Annuities: Variable Annuity Insurance 2024

Variable annuities offer tax advantages that can make them an attractive retirement savings option. Understanding the tax implications of variable annuities is essential for maximizing their benefits.

Tax Deferral

Investment earnings within a variable annuity are tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money. This allows your investments to grow tax-free for a longer period, potentially leading to larger returns.

Withdrawals, Variable Annuity Insurance 2024

When you withdraw money from a variable annuity, the withdrawals are generally taxed as ordinary income. However, if you take qualified withdrawals after age 59 1/2, they may be taxed at a lower rate as long-term capital gains.

Tax-Free Withdrawals

Some variable annuities offer tax-free withdrawal options, such as the “death benefit” or “living benefit” riders. These riders can help you access your funds without incurring any tax liability.

The BA II Plus calculator is a favorite among financial professionals. This guide explains how to calculate the annuity factor on a BA II Plus calculator in 2024: Calculate Annuity Factor On Ba Ii Plus 2024.

Strategies for Optimizing Tax Efficiency

- Consider Roth IRAs:If you’re in a lower tax bracket now than you expect to be in retirement, consider contributing to a Roth IRA instead of a variable annuity. Roth IRA withdrawals in retirement are tax-free.

- Maximize Tax-Deferred Growth:Take advantage of the tax-deferred growth potential of variable annuities by keeping your money invested for as long as possible.

- Use Tax-Free Withdrawal Options:If available, consider using tax-free withdrawal options to minimize your tax liability in retirement.

Variable Annuities in 2024: Current Trends and Considerations

The variable annuity market is constantly evolving, influenced by factors such as interest rates, market volatility, and regulatory changes. Understanding the current trends and considerations can help you make informed decisions about variable annuity investments in 2024.

Variable annuities offer a way to potentially grow your retirement savings. Use this variable annuity calculator to explore different scenarios and make informed decisions in 2024: Variable Annuity Calculator 2024.

Market Environment

The current market environment is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors can impact the performance of variable annuities, as they affect the underlying investments.

Regulatory Changes

The insurance industry is subject to ongoing regulatory changes, which can affect variable annuity products. For example, new regulations may be introduced to address issues such as fee transparency and consumer protection.

Want to understand the steps involved in calculating an annuity? This guide provides a step-by-step approach to using an annuity calculator in 2024: Annuity Calculator With Steps 2024.

In this dynamic market, it’s essential to:

- Stay Informed:Keep up-to-date on market trends, regulatory changes, and any developments affecting variable annuity products.

- Diversify:Spread your investments across different asset classes to mitigate risk and potentially enhance returns.

- Seek Professional Advice:Consult with a qualified financial advisor to discuss your investment goals, risk tolerance, and whether variable annuities are a suitable option for you.

Variable Annuities: A Comprehensive Comparison

Variable annuities can be a valuable retirement savings option, but it’s important to compare them to other available choices to determine if they’re right for you. Here’s a table comparing variable annuities to other retirement savings options:

| Feature | Variable Annuity | Traditional IRA | Roth IRA | 401(k) Plan |

|---|---|---|---|---|

| Investment Options | Sub-accounts tracking various asset classes | Broad range of investments | Broad range of investments | Employer-sponsored plan with limited investment options |

| Tax Treatment | Tax-deferred growth, withdrawals taxed as ordinary income | Tax-deductible contributions, withdrawals taxed as ordinary income | Non-deductible contributions, tax-free withdrawals in retirement | Tax-deferred growth, withdrawals taxed as ordinary income |

| Fees and Expenses | Mortality and expense charges, administrative fees, surrender charges | May have administrative fees | May have administrative fees | May have administrative fees, employer-specific fees |

| Guaranteed Death Benefit | Available in many contracts | Not typically offered | Not typically offered | May offer a death benefit |

| Risk | Higher risk than fixed annuities, subject to market fluctuations | Risk associated with underlying investments | Risk associated with underlying investments | Risk associated with underlying investments |

Case Studies: Real-World Examples of Variable Annuity Usage

Here are two case studies illustrating how variable annuities can be used to achieve different financial goals:

Case Study 1: Retirement Income

John, a 55-year-old retiree, is looking for a way to generate income in retirement while preserving his principal. He chooses a variable annuity with a guaranteed death benefit option, allocating his investments to a mix of stocks and bonds. This allows him to potentially earn higher returns than a traditional fixed annuity while still having a safety net for his beneficiaries.

Case Study 2: Long-Term Growth

Sarah, a 30-year-old professional, is saving for retirement and is willing to take on more risk for potential long-term growth. She invests in a variable annuity with a focus on growth-oriented sub-accounts, such as those tracking the S&P 500 or other broad market indexes.

Excel is a valuable tool for managing personal finances, and it can be used to calculate annuity loan payments. Learn how to calculate annuity loans in Excel in 2024 with this helpful guide: Calculate Annuity Loan Excel 2024.

This allows her to benefit from the potential for higher returns over a longer time horizon.

Variable Annuity Insurance: Who Is It Right For?

Variable annuities can be a suitable option for individuals with specific financial goals and risk tolerance. They may be a good fit for:

- Individuals seeking potential growth:If you’re willing to accept the risk of market fluctuations, variable annuities can offer the potential for higher returns than traditional fixed annuities.

- Individuals with a long-term investment horizon:Variable annuities are best suited for long-term investments, as they allow you to ride out market volatility over time.

- Individuals seeking tax deferral:Variable annuities offer tax-deferred growth, which can help you accumulate a larger nest egg over time.

- Individuals with a high risk tolerance:Variable annuities are best suited for individuals who are comfortable with the potential for losses in their investments.

However, variable annuities may not be right for everyone. They are generally not recommended for:

- Individuals with a low risk tolerance:If you’re risk-averse, you may be better off with a traditional fixed annuity or other low-risk investments.

- Individuals with a short-term investment horizon:Variable annuities are not ideal for short-term investments, as market fluctuations can significantly impact their value.

- Individuals who need guaranteed income:Variable annuities do not provide guaranteed income, unlike traditional fixed annuities.

It’s important to consult with a qualified financial advisor to determine if variable annuities are right for your individual needs and circumstances.

Concluding Remarks

Variable annuities can be a valuable tool in your retirement planning arsenal, offering a balance of growth and protection. While they present a more complex investment strategy than traditional annuities, understanding the fundamentals, choosing the right investment options, and managing fees carefully can help you unlock their potential.

Remember, consulting with a financial advisor is crucial to tailor a variable annuity strategy that aligns with your individual financial goals and risk tolerance.

Quick FAQs

Are variable annuities suitable for everyone?

Variable annuities are not a one-size-fits-all solution. They are best suited for individuals with a long-term investment horizon, a moderate to high risk tolerance, and a desire for potential growth.

How do variable annuities compare to traditional IRAs?

While both offer tax deferral on investment growth, variable annuities provide additional features like guaranteed death benefits and the potential for higher returns through market participation. However, they also carry greater risk and higher fees.

What are the main risks associated with variable annuities?

Annuity calculations can be a bit tricky, but understanding how they work is essential for planning your financial future. If you’re looking to learn more about how annuities are calculated in 2024, check out this comprehensive guide: How Annuity Is Calculated 2024.

The primary risk is market volatility. Your investment returns are tied to the performance of the underlying sub-accounts, which can fluctuate significantly. Additionally, fees and surrender charges can impact your overall returns.

The 72t annuity is a popular choice for those looking to withdraw funds from a retirement account before age 59 1/2. Learn about the rules and regulations surrounding this type of annuity in 2024 with this resource: Annuity 72t 2024.