Variable Annuity IRA 2024 offers a unique path to retirement savings, combining the tax advantages of an IRA with the potential for growth through market-linked investments. This guide delves into the intricacies of variable annuity IRAs, exploring their benefits, risks, and investment options in the context of the evolving financial landscape of 2024.

Excel is a versatile tool for financial calculations, including annuity payments. Learn how to calculate annuity payments using Excel in this guide: Calculating Annuity Payments In Excel 2024.

Variable annuities differ from traditional fixed annuities by allowing your investment to grow based on the performance of a chosen portfolio of mutual funds or sub-accounts. This exposure to market fluctuations introduces both the possibility of higher returns and the risk of losses, making it crucial to understand your risk tolerance and investment goals before making any decisions.

Variable annuities offer a different approach to retirement planning. You can learn more about the process of exchanging variable annuities in this article: Variable Annuity Exchange 2024.

Contents List

Introduction to Variable Annuities

Variable annuities are a type of insurance contract that combines investment growth potential with guaranteed income payments. They are a popular choice for individuals seeking to build a retirement nest egg and protect themselves from market volatility. Unlike traditional fixed annuities, which offer a guaranteed rate of return, variable annuities allow investors to participate in the growth of the stock market.

Annuity is a financial product that provides a steady stream of income for a specific period of time. To understand the basics of annuities, check out this helpful resource: Annuity What Is It Definition 2024.

How Variable Annuities Work

Variable annuities function by investing premiums in a sub-account portfolio of mutual funds or other investment vehicles. The value of the sub-account fluctuates based on the performance of the underlying investments. This means that the payout from a variable annuity is not guaranteed and can vary depending on the investment performance.

Life expectancy plays a significant role in annuity calculations. This article provides insights into annuity calculators that consider life expectancy: Annuity Calculator Based On Life Expectancy 2024.

Benefits and Risks of Variable Annuities, Variable Annuity Ira 2024

- Potential for Growth:Variable annuities offer the potential for higher returns than fixed annuities, as they are linked to the stock market.

- Tax Deferral:Earnings on variable annuities are not taxed until they are withdrawn, providing tax deferral benefits.

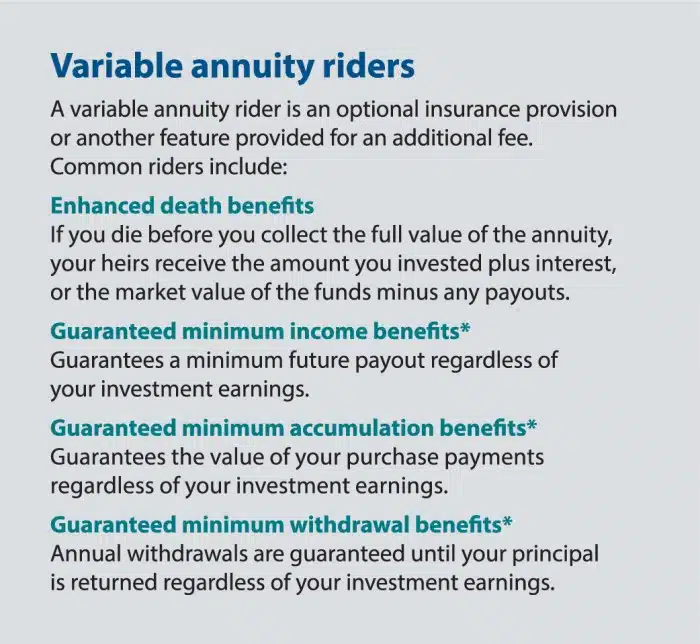

- Guaranteed Minimum Death Benefit:Many variable annuities include a guaranteed minimum death benefit, which ensures that a beneficiary will receive a certain amount of money, even if the sub-account value declines.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income payments or protection against market downturns.

- Risk of Loss:The value of the sub-account can decline, potentially resulting in a loss of principal.

- High Fees:Variable annuities typically have higher fees than fixed annuities, which can impact investment returns.

- Complexity:Variable annuities can be complex financial products, and it is important to understand the risks and fees involved before investing.

Variable Annuity IRAs

A variable annuity IRA is a type of Individual Retirement Account (IRA) that allows investors to hold variable annuities. This type of IRA offers the same tax advantages as traditional IRAs, but with the added potential for investment growth offered by variable annuities.

Need a quick and easy way to estimate your annuity payments? This online calculator can help: Annuity Calculator Quick 2024.

Tax Advantages of Variable Annuity IRAs

Contributions to a variable annuity IRA are tax-deductible, which means that you can reduce your taxable income and potentially lower your tax liability. Earnings on the variable annuity are also tax-deferred, meaning that you will not have to pay taxes on them until you withdraw the money in retirement.

The annuity exclusion ratio is a key factor in determining how much of your annuity payments are taxable. Learn more about this ratio in this article: Annuity Exclusion Ratio 2024.

Tax Implications of Withdrawals

Withdrawals from a variable annuity IRA are generally taxed as ordinary income. However, if you are over age 59 1/2 and have held the IRA for at least five years, you may be eligible for a tax-free withdrawal.

Charles Schwab offers a helpful annuity calculator that can help you estimate your potential payments. You can access this calculator through this link: Annuity Calculator Charles Schwab 2024.

Understanding the Investment Options

Variable annuity IRAs offer a wide range of investment options, allowing investors to tailor their portfolios to their individual risk tolerances and investment goals. These options may include:

- Mutual Funds:Variable annuities typically offer access to a variety of mutual funds, which invest in different asset classes, such as stocks, bonds, and real estate.

- Exchange-Traded Funds (ETFs):Some variable annuities allow investors to invest in ETFs, which are similar to mutual funds but trade on stock exchanges.

- Annuities within Annuities:Some variable annuities offer the option to invest in sub-accounts that are themselves annuities, providing additional income guarantees.

Diversification

It is important to diversify your investments within a variable annuity IRA to reduce risk. Diversification involves spreading your investments across different asset classes and investment strategies. This helps to mitigate the impact of any one investment performing poorly.

Wondering if an annuity can provide you with income for life? You can explore the specifics of annuities for life in this article: Is Annuity For Life 2024.

Fees and Expenses

Variable annuity IRAs are subject to a variety of fees and expenses, which can impact investment returns over time. These fees may include:

- Mortality and Expense (M&E) Charges:These charges cover the cost of the insurance guarantees offered by the variable annuity.

- Administrative Fees:These fees cover the costs of managing the variable annuity, such as recordkeeping and customer service.

- Investment Fees:These fees are charged by the underlying investment options, such as mutual funds or ETFs.

- Surrender Charges:These charges are imposed if you withdraw money from the variable annuity before a certain period of time.

Comparing Fees

It is important to compare the fees associated with different variable annuity products before making an investment. Look for products with low fees and transparent fee structures.

Annuity returns can vary depending on the specific product and market conditions. Learn more about annuities with an 8% return in this article: Annuity 8 Percent 2024.

Considerations for 2024: Variable Annuity Ira 2024

The variable annuity landscape is constantly evolving, and there are a number of factors to consider in 2024. These include:

- Economic Conditions:Economic conditions can have a significant impact on the performance of variable annuity investments. In a strong economy, stocks tend to perform well, while in a weak economy, they may decline.

- Interest Rates:Interest rates can also impact variable annuity investments. Higher interest rates can make it more expensive to borrow money, which can lead to lower stock prices.

- Regulatory Changes:The government may make changes to regulations governing variable annuities, which could impact the availability or cost of these products.

To navigate the variable annuity landscape in 2024, it is important to consult with a financial advisor who is knowledgeable about these products. They can help you assess your risk tolerance, investment goals, and financial situation and recommend a variable annuity product that is right for you.

The tax implications of immediate annuities can be a bit complex. You can find answers to your questions about immediate annuity income taxes here: Is Immediate Annuity Income Taxable 2024.

Case Studies

Case Study 1: Successful Investment

John is a 55-year-old investor who is looking to supplement his retirement income. He invests $100,000 in a variable annuity IRA, choosing a diversified portfolio of mutual funds that track the S&P 500 index. Over the next 10 years, the stock market experiences strong growth, and John’s investment grows to $250,000.

For those with programming skills, you can use Java to calculate annuity values. Explore the details of calculating annuities in Java in this article: Calculate Annuity Java 2024.

He is able to withdraw a significant portion of his investment in retirement without incurring any tax penalties.

The Knights of Columbus offers annuity products that can be a valuable part of retirement planning. Learn more about the K of C annuity offerings here: K Of C Annuity 2024.

Case Study 2: Less Favorable Returns

Sarah is a 60-year-old investor who invests $50,000 in a variable annuity IRA. She chooses a portfolio of high-growth stocks, hoping to maximize her returns. However, the stock market experiences a downturn in the following years, and Sarah’s investment declines to $35,000.

Variable annuities have unique characteristics that set them apart from other types of annuities. Discover the key features of variable annuities in this resource: Variable Annuity Characteristics 2024.

She is disappointed with the performance of her investment, but she is able to continue to hold the variable annuity and hope for a recovery in the market.

Final Conclusion

Variable annuity IRAs can be a powerful tool for retirement planning, offering the potential for growth and tax advantages. However, they are not without their complexities and risks. Careful consideration of your investment goals, risk tolerance, and the fees associated with specific products is essential.

By understanding the nuances of variable annuity IRAs, you can make informed decisions that align with your long-term financial objectives.

Detailed FAQs

What are the main advantages of a variable annuity IRA?

Variable annuity IRAs offer tax-deferred growth on your investments, meaning you won’t pay taxes on earnings until you withdraw them in retirement. They also provide potential for higher returns through market-linked investments.

What are the risks associated with variable annuities?

Variable annuities are subject to market risk, meaning your investment can lose value. The value of your investment is tied to the performance of the underlying investments, which can fluctuate significantly.

Are there any fees associated with variable annuity IRAs?

Yes, variable annuity IRAs typically have various fees, including mortality and expense charges, which can impact your investment returns. It’s crucial to compare fees across different products before making a decision.

How do I choose the right investment options within a variable annuity IRA?

The best investment options for you will depend on your risk tolerance, investment goals, and time horizon. It’s essential to carefully consider your individual circumstances and seek professional advice if needed.

Are there any specific considerations for variable annuity IRAs in 2024?

In 2024, it’s important to stay informed about any changes to tax laws or regulations that might affect variable annuity IRAs. You should also consider the potential impact of economic conditions on your investment decisions.

Understanding annuity returns is crucial for making informed financial decisions. This article provides information on annuities with a 7% return: 7 Annuity Return 2024.

For those who prefer a more hands-on approach, you can use mathematical formulas to calculate annuity values. This resource explores the mathematical calculations involved in annuities: Annuity Calculator Math 2024.